Sundry Photography

Why The Stock Nosedived

While Amazon’s (NASDAQ:AMZN) North American sales surged by 20% YoY last quarter, international sales dropped by 5%. Notably, international revenues grew by 12% YoY, excluding volatile foreign exchange. The company’s Q3 revenues came in at $127.1 billion, missing the consensus estimate by 0.24%. These factors anchored Amazon’s stock, but what dropped it was the company’s $140-148 billion Q4 revenue estimate, well below the $155.37 billion expected result. The projected result illustrates only a 2-8% YoY revenue increase for the fourth quarter.

Therefore, Amazon’s stock dropped to its lowest level since the COVID-19 panic meltdown. The market is overreacting, as Amazon’s slowdown and earnings decline phase is likely transitory. The company should provide solid revenue growth and increase profitability in future years, increasing its share price substantially and making Amazon one of the top stocks to own for the next decade.

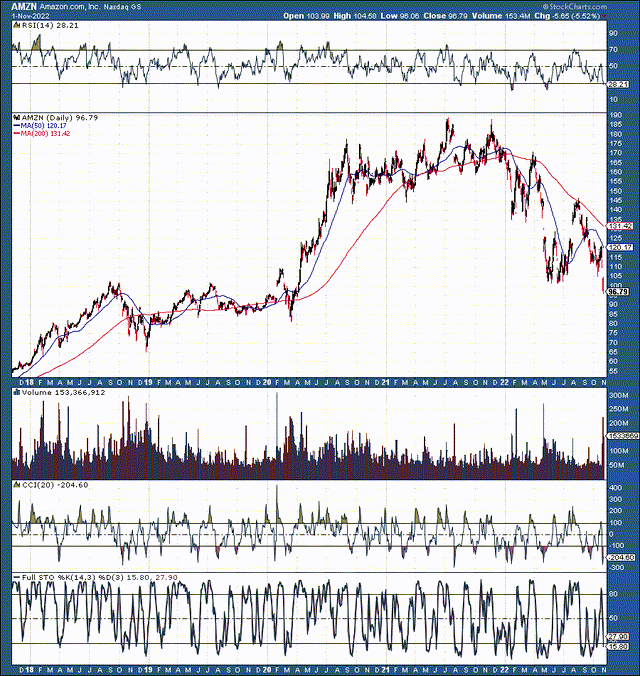

AMZN 5-Year Chart

AMZN (StockCharts.com )

Remarkably, Amazon’s stock dropped by 50% from its all-time high a year ago, filling the long-term unfilled gap at $95 and entering the critical support range at the $90-100 level. The RSI is now below 30, illustrating oversold market conditions for Amazon’s stock. Moreover, the massive sell volume indicates panic selling and even capitulation among market participants. Additionally, technical indicators like the CCI, full stochastic, and others imply that a shift in momentum is near, and the stock should stabilize and rebound soon. More importantly, if you’re a long-term investor, there’s probably little downside risk here. While the stock could fall marginally lower from here, Amazon’s shares shouldn’t stay below $100 for long.

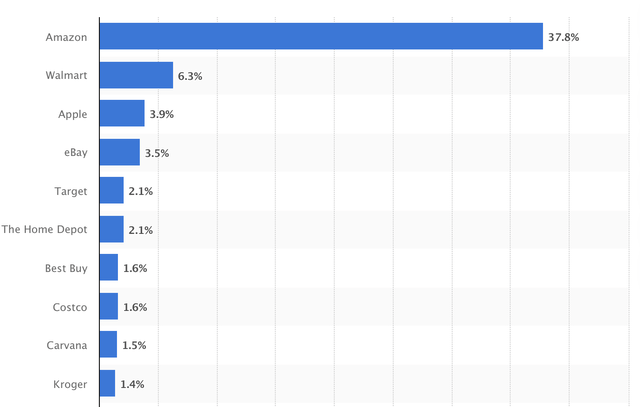

Amazon – The King of Online Retail

US e-commerce market share (Statista.com )

Amazon remains the king of the U.S.’s massive e-commerce market, with nearly 40% market share amongst all leading retailers. Over its last 12 months of operations, the company raked in more than $500 billion in sales. Moreover, revenues should increase substantially as the transitory slowdown effect dissipates in the coming years. While Amazon has competitors, the online giant should keep its dominant, market-leading position. Also, just because the economy is going through a transitory slowdown doesn’t mean online shopping is going away. On the contrary, we should see significant online retail sales growth in the coming years. Amazon is well positioned to capitalize and profit from the dynamic in the e-commerce marketplace.

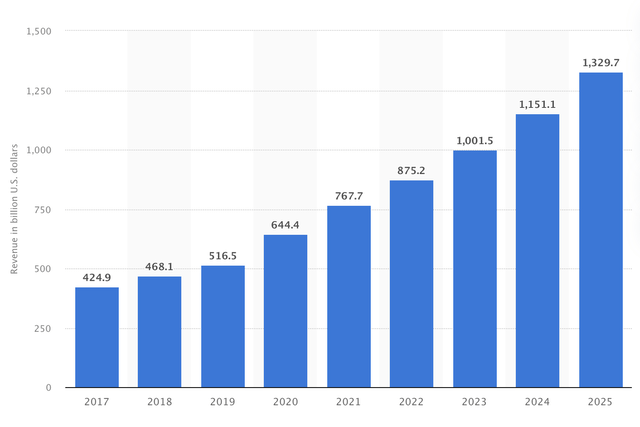

U.S. E-commerce Revenue Growth and Projections (2023-2025)

U.S. e-commerce revenue (Statista.com )

We should see significant online sales growth in the years ahead, and Amazon’s revenues should continue increasing substantially. Amazon should produce 10%-15% YoY revenue growth through 2030, leading to enormous profitability potential and a much higher stock price in future years.

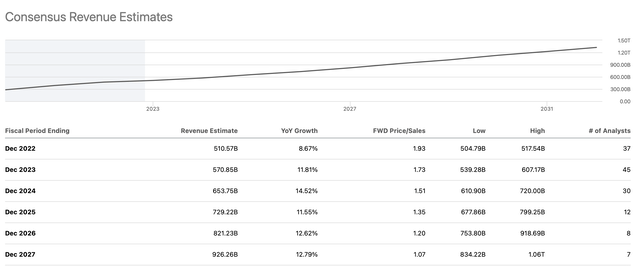

Amazon’s Revenue Estimates

Revenue growth projections (SeekingAlpha.com )

Amazon could double its revenues to approximately $1 trillion by 2027. Additionally, despite the company’s stock price being slashed, sales were robust in the third quarter.

Q3 Sales Look Good

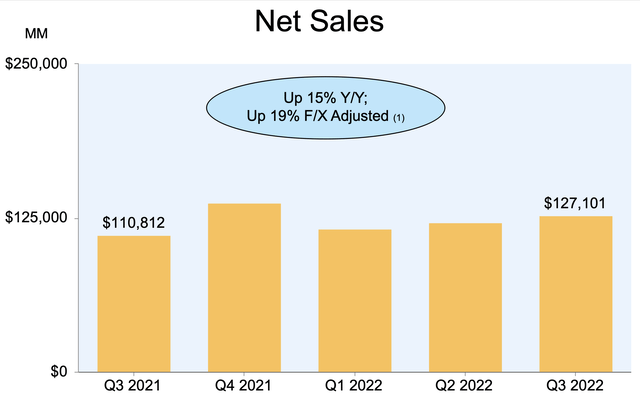

Amazon sales (static.seekingalpha.com )

YoY sales were up by 15% (19% adjusted) to $127.1 billion last quarter. Amazon reported a GAAP EPS of $0.28, a seven-cent beat over what the analysts expected. However, Amazon’s $127.1 billion in sales came in slightly below the consensus figure of $127.4 billion.

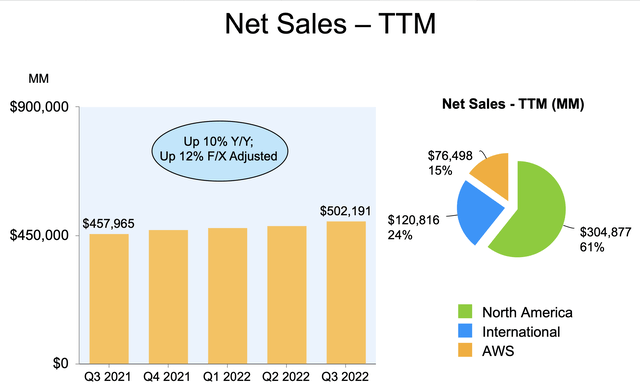

TTM sales (static.seekingalpha.com)

TTM sales were up by 10% YoY (12% adjusted). While we see a slowdown in sales growth, the decline is likely transitory, and the company’s revenue growth should increase closer to 15% in future years.

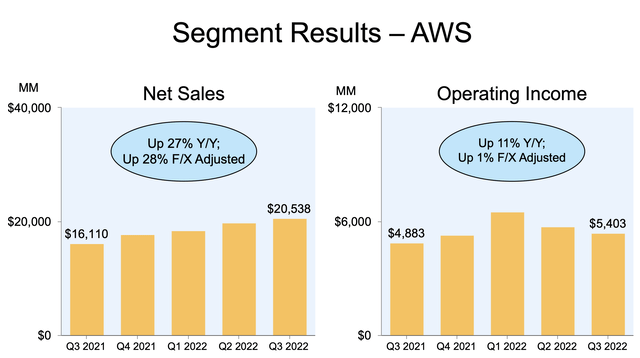

Segment performance (static.seekingalpha.com)

AWS sales surged by 27% YoY, illustrating remarkable sales growth potential for future years. While operating income was only up by 11% YoY, the earnings decline phase is likely transitory. AWS sales should continue expanding, and as operational efficiency normalizes, profits should increase substantially as the company advances.

Investors Are Worried About Profitability

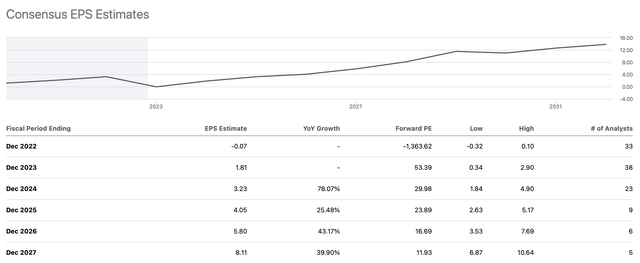

EPS Estimates

EPS estimates (SeekingAlpha.com )

Amazon’s “lack of profitability” didn’t seem to worry investors during the good times, but some are panicking now. It’s expected that Amazon is going through a temporary slowdown and earnings decline phase, given the current challenging market conditions. Consensus estimates imply that Amazon will earn next to nothing this year and may produce only about $1-2 in EPS next year. However, Amazon is a high-growth company with remarkable earning potential and should return to producing high EPS growth in future years.

What Amazon’s financials could look like in the coming years:

| Year | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $511 | $572 | $658 | $750 | $848 | $950 | 1,054 | 1,160 | 1,264 |

| Revenue growth | 9% | 12% | 15% | 14% | 13% | 12% | 11% | 10% | 9% |

| EPS | N/A | $2 | $3.90 | $6 | $8.60 | $11.61 | $15 | $19 | $25 |

| Forward P/E | 47.5 | 45 | 42 | 40 | 38 | 35 | 32 | 30 | 28 |

| Stock price | $95 | $175 | $252 | $344 | $441 | $525 | $608 | $750 | $840 |

Source: The Financial Prophet

While my estimates may appear optimistic, I’m using a relatively standard revenue growth trajectory for Amazon. Also, the company can increase profitability by approximately 20%-40% YoY once the transitory slowdown phase passes. Furthermore, I’m using a declining P/E ratio as the company becomes more profitable in future years. Therefore, Amazon’s stock price will likely appreciate substantially as the company advances through 2030.

Risks to Amazon

Investing in Amazon is not without risk, of course. However, the most significant risk now seems more panic selling due to overall market volatility and another possible leg lower for the economy. Nevertheless, the downside is likely limited now, and there’s substantial upside potential for investors willing to hold Amazon long term. There’s also the risk of increased competition, where other companies could take more market share from the e-commerce giant. There’s also the risk of growth being slower than expected. Furthermore, Amazon may not become as profitable as estimated, and it may take the company longer to achieve significant ($10 or higher) EPS. Please consider these and other risks carefully before investing in Amazon stock.

Be the first to comment