Gotta be careful here. Management might eat your biscuit.

ZhuravlevaMaria/iStock via Getty Images

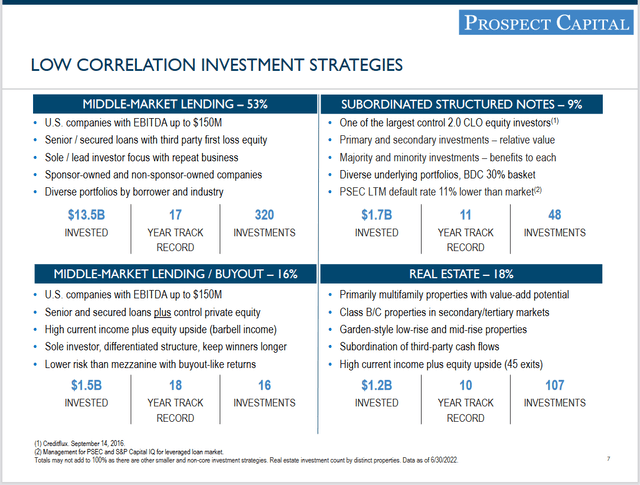

Prospect Capital Corporation (NASDAQ:PSEC) is an externally managed BDC with a multi-strategy approach investing predominantly (49.9%) in first-lien debt of middle market private companies. BDCs are a type of closed-end fund (CEF) and this article builds on a series of pieces I’ve done on CEFs recently.

PSEC is managed by Prospect Capital Management. Broadly we can understand them as a debt-focused fund with 78.7% of the portfolio as secured loans. Assets are diversified across 129 different companies and across 39 industry categories.

A unique and growing feature of the fund is that they 100% own a private REIT, National Property REIT Corp (NPRC), which had a fair value of $1.616 billion as of 6/30/22. With PSEC’s net asset value of $4.119 billion then the REIT represents 39%. When we look at the book overall we can see that at least 18% of it is wrapped up in real estate investments.

Investor Presentation: Investment Strategy

That’s some context for their multi-strategy approach. We can see that the strategy is broadly focused across middle market lending/buyouts with real estate as the secondary anchor. Management highlighted the results of NPRC in their recent call:

NPRC as of June had exited completely 45 properties at an average net realized IRR to NPRC of 25.1% and average realized cash multiple of invested capital of 2.5x with an objective to redeploy capital into new property acquisitions, including with repeat property manager relationships.

With the REIT performing well investors are given an opportunity with PSEC to invest not only in middle market debt of private companies, but also in a basket of real estate. That real estate basket should help in the midst of this inflationary environment and with forty-seven multi-family properties, eight student housing properties, four senior living properties, and three commercial properties these appear to not be at as much risk in a recession.

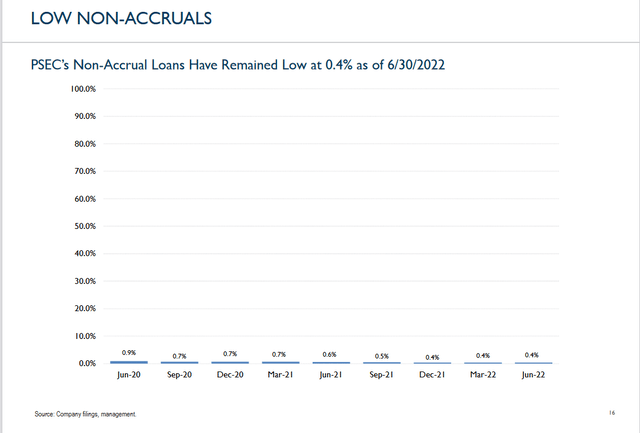

The value of their debt portfolio overall is predominantly secured by assets meaning that even in the case of default there will still be recourse to return full value. But ultimately non-accrual rates for PSEC have been trending lower and most recently reported at 0.4%.

Investor Presentation: Non-Accrual Rates

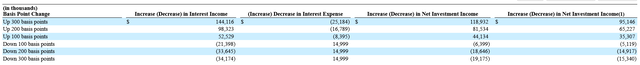

Another feature we can note about their book is that $4.545 billion of their loans are at floating rates. Compared to total assets of $7.663 billion that translates to 59% of their assets benefiting from rising interest rates. This data was provided in their most recent 10-K regarding interest rate sensitivity which shows both their income and expense delta.

2022 10-K: Interest Rate Sensitivity Table

This was when one, three, and six-month LIBOR were 1.79%, 2.29%, 2.94% and respectively. Three-month LIBOR hit 4.36% this week with another hike expected. Based on this we can estimate that net investment income may increase in the 200 basis point range of $65.227 million annually. Last year’s NII totaled $343.9 million which we can add to our floating rate estimate too to get an FY23 NII estimate of $409.127 million.

Valuation Of Prospect Capital Corporation

The stock price sits at $7.27 implying a market cap of $2.870 billion. Net asset value per share as of 6/30/22 was $10.48 which means the stock is trading at a 30.63% discount to NAV. According to data from CEF Advisors the average debt-focused BDC trades at -13.97% discount suggesting a potential relative undervaluation. A caveat here is that the NAV number comes from prior to the market deterioration in September.

For reference, peer BDC Ares Capital Corp had an NAV per share of $18.81 as of 6/30/22. As of 9/30/22 NAV came in at $18.56 which is a ~1% decline. So we may find that NAV remains approximately the same if we just consider things on a relative basis. Yet, we know from above that PSEC is likely to see income and therefore NAV increase in the coming year due to rising rates.

Therefore I think it’s likely that NAV for this coming quarter will be greater than the June number of $10.48. If we take this as a base estimate for the company that would imply a 44% return without considering the 9.90% dividend. A more conservative estimation would be a reversion to peer average of -13.97% of NAV or $9.02. That would imply a return of 24%.

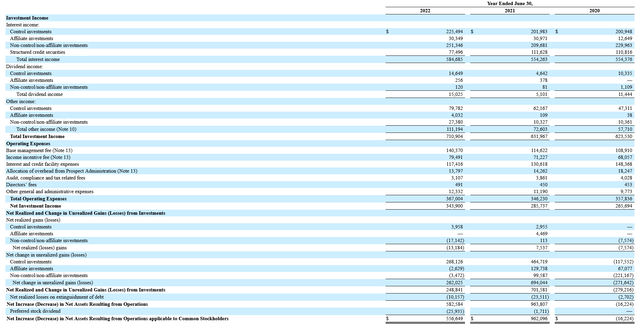

When we factor in our NII estimate from above we can gauge that the P/NII is 7.02x our FY23 estimate. A look at their income statement shows that NII has been growing over the last three years as well.

2022 10-K: Balance Sheet

The question we need to ask ourselves is why is it trading at such a discount to NAV?

Investors Don’t Trust PSEC Management

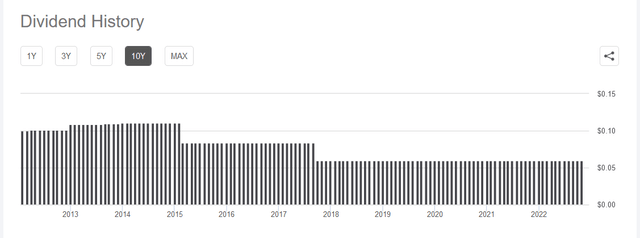

Management of PSEC is the prime suspect. Take a look through any comment stream on a PSEC article here on SA and you’ll find commenters highlighting this. The first major issue is that while the monthly distribution has been paid consistently over the last five years, prior to this the company cut the distribution twice.

Seeking Alpha: 10-year Distribution History

Those that invest for income do not forget distribution cuts as it represents a decrease to their income. An anecdotal reflection gathered here on Seeking Alpha I think is instructive as well. It’s from a comment on another article about PSEC:

I have been to a PSEC annual meeting held in NYC – long time ago. Might have been in year 2011 or 2012 – don’t remember. What you say about the CEO is correct. There were about 9 people (shareholders) in attendance not including the CFO, the CEO’s wife, the COO and the CEO. The CEO was late for the meeting – talk about rudeness – and we were all waiting for him. He looked like he just woke up out of bed, his hair was messy and not combed (granted NYC was cold and windy that day) and he was dressed as if he just finished playing golf. I say all this because it conjures up a sense of arrogance about himself but also disrespect for us ordinary shareholders. I distinctly remember a question that one of the shareholders attending the meeting asked: He asked, “Can the company continue to keep paying the level of dividend you are paying?” The CEO responded, “I don’t know, if we have to cut it, we will cut it.” That answer certainly conveyed to me – at least – that the commitment to the dividend for shareholders was not of high priority to him.

Shareholders are co-owners of the fund with the CEO which he clearly did not seem to respect in this instance. Buying the equity of any company exposes one to shared risk with management, a risk that I like to think is a cooperative one. But if management has no regard for co-owners then who are they working for? In this case, we know who they are working for: Prospect Capital Management who manages PSEC.

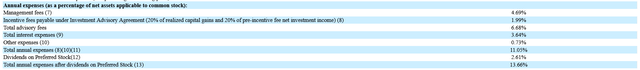

This brings us to another critique of the fund: the high expenses Prospect Capital Management charges. Annual expense on net assets was 13.66% last year. That BDC data we looked at earlier has the debt-focused BDC average expense ratio at 10.84% so we can acknowledge that BDCs are high overall, and PSEC is high among them.

Seeking Alpha: Expense Ratio Table

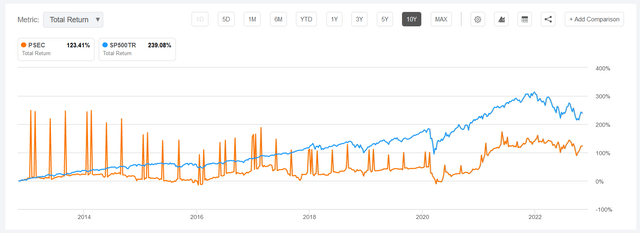

So not only do we have management that does not seem to value their co-owners, we can see they are charging pretty high fees to do business with them. Over the 10-year time frame that partnership’s total return would have underperformed the S&P 500. Yet if we look at the five-year chart it actually beat it.

Seeking Alpha: PSEC & S&P500 10-year Chart

Seeking Alpha: PSEC & S&P500 5-year Chart

You are the ultimate judge of the value of that partnership. For me it doesn’t look particularly appealing. Especially given the high expense ratio combined with management concerns.

A Critical Audit Matter

Another way to underscore all of this is the recent auditor disagreement over the fund’s internal controls over financial reporting. This followed their most recent 10-K being delayed due to this issue. Management attempted to downplay things in their most recent call suggesting that the issue is related to their “design framework” and should have no impact on financial valuations. Chief Financial Officer Kristin Van Dask had this to say in response to questioning:

We are currently evaluating the design framework of our internal controls as it relates to our CLOs, and we have not made any changes to how we value from prior periods. And we anticipate no changes to any number of disclosure in any filing for any period other than as it will be addressed in Item 9A of our current 10-K.

And further:

This is isolated to the design framework of controls and management’s assessment of that. It is not about the substantive numbers. And no changes are anticipated to our valuation process other than to make sure we have this framework designed effectively.

Yet if we review the language from the auditor in their 10-K it reads a bit differently to me than what management is suggesting. Here’s a piece of that language:

We identified the valuation of level 3 investments as a critical audit matter. The principal considerations for our determination are the use of valuation approaches, including complex techniques to value these investments and the use of significant unobservable inputs, which are inherently uncertain and subjective, including revenue and earnings before interest, taxes, depreciation, and amortization (“EBITDA”) multiples, discount rates and market yields for portfolio companies, discount rates for CLOs, and capitalization rates for real estate properties. Performing audit procedures to evaluate the reasonableness of management’s assumptions involved a high degree of auditor judgment and specialized skills and knowledge needed.

All of what’s mentioned there sounds to me like the valuation ultimately is at question. If the framework is what is being changed then the outputs of that framework, chief among them being valuation numbers, are going to change. That’s a logical reality. So it seems to me that management may be obfuscating the reality of this issue a bit. That isn’t to say that the result will be a material difference in their numbers, just that it’s a risk to be conscious of.

A Risk to The Common: Growing Preferred Equity as Leverage

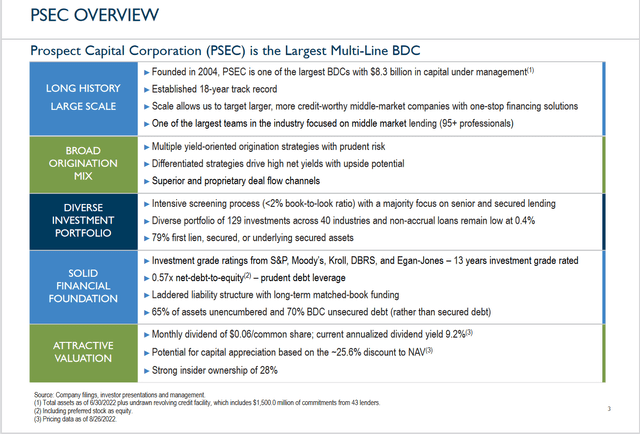

We can find evidence of management obfuscation as well in terms of how they frame their leverage currently. Their most recent investor presentation highlights their “solid financial foundation” with 0.57x net debt-to-equity.

Investor Presentation: PSEC Overview

Catch the footnote though highlighting that preferred stock is being treated as equity. There’s some basis for this as preferred stocks are known to be equity/debt hybrid securities. What makes a preferred feature like equity is that it represents ownership where the principal may never be returned. This is mainly the case for perpetual preferred securities.

Yet these preferreds as debt represent leverage against the common stock to a greater degree than is implied by that 0.57x ratio. There was even some back and forth on this particular issue in the most recent earnings call. The question came from Robert Dodd, an analyst with Raymond James, and seemed to cause some tension. Here’s the initial question:

John, during your prepared remarks, you talked about no plans to change the target leverage of debt to equity with the preferred treated as equity, obviously, 0.7 to 0.85.

With the preferred program potentially increasing to 1.5 now and maybe eventually even more, that would — if you were in the midpoint of that pure debt-to-equity range, that would imply that the total leverage on common equity could get as high as 1.5x or something like that.

So can you give us any color on what’s the comfort level for regulatory leverage? I understand how the rating agencies look at it. I also understand how a common equity shareholder looks at it slightly differently. So can you give us the comfort range on that side as well?

The response was stumbling and prompted a few back-and-forth clarifications but the highlights are here from COO Grier Eliasek:

Yes, yes. I’m having a hard time getting anywhere close to 1.5, Robert. So we have — 1.5 assuming we get to that issuance level, which, given our expanded volumes is may be a reasonable assumption. We have very kind of a small $150 million traded. That’s 1.65. We’re not at even $3 billion of debt. That’s at 4.65 divided by $4.1 billion of common, that’s only 1.13. That’s a far cry from 1.5, nowhere close to it, number one.

Let’s look at the specifics for a second. Debt totaled $2.769 billion as of 6/30/22 and an equity value of $4.119 billion. So that gets us to a debt-to-equity ratio of 0.67x which is already a bit higher than the 0.57x noted in their presentation.

But we still need to add the preferred security value ($692 million) to the debt pile to get a more accurate accounting here. That gets us to total debt of $3.461 billion and a debt-to-equity ratio on the common of 0.84x. That’s nearly 50% greater leverage on the common than is implied.

You can’t even find the value of their preferreds in the investor presentation. Despite having multiple footnotes highlighting that they are treating preferreds as equity for calculations, they don’t actually give you the number to interpret it for yourself. Instead you must go to their filings to get the full picture.

And it’s worse. The bulk of these preferreds are convertible into common at pretty favorable terms. So there’s not only increased leverage due to the preferreds, there’s increased dilution potential.

Jumping Onto The Preferred Bandwagon

Number one in the company’s strategy is expanding shareholder return via their perpetual preferred program raising $1.75 billion in capital, $970 million of which they have already raised since 2020. This program was even highlighted in the call as part of their history of innovation and they’ve even done press releases just on this program.

These are mostly non-trading preferreds they are talking about though. The target is really institutional investors and perhaps gives a window into which owners PSEC may be focused on. But they do have one publicly traded preferred which may be of interest here: NYSE:PSEC.PA. Here are the basics:

|

Ticker |

|

|

Current Price |

$16.13 |

|

Par Value |

$25.00 |

|

Dividend |

$1.34 |

|

Dividend Yield |

8.31% |

|

1st Call Date |

7/12/2026 |

|

Maturity Date |

None |

Dividends are cumulative so even if one is missed then it will be accrued. Although these are quarterly payments, income seekers attracted to PSEC may find that the preferred shares offer better security overall.

Hold Recommendation But Really A Sell Overall

After taking a look at the company I’m giving both the stock and preferred a hold rating. The reason I’m doing that is simply because I think perhaps in the near term the stock price seems undervalued and the distribution appears secure currently. Yet over the long term I don’t want to partner with management that charges me +13% in expenses. Especially management which seems to be deliberately obfuscating key data points like leverage.

Funds like these are designed to survive so it’s unlikely this fund is going anywhere. For the common stock the major risks are a distribution cut if the fund is ever in a liquidity crunch and decline in NAV. The critical audit matter we discussed could cause a swing in NAV, but we simply don’t know yet. And with continuing macroeconomic concerns we may see an increase in defaults which would impact value here as well.

With PSEC management touting their perpetual preferred program to institutional investors it seems they are prioritizing their preferred shareholders. Only one of the preferred securities (PSEC.PA) trades publicly and currently has a similar dividend yield (8.31%) to PSEC (9.90%). For income seekers interested in PSEC, a safer way to play here may be through the preferred. The major risk to the preferreds are rising interest rates which could cause the security price to decline until digestible yields are achieved.

Yet I think a pretty simple rule could eliminate investing in PSEC: choose not to invest in management who unapologetically show up late to their own annual shareholder meeting.

It just doesn’t seem like a winning proposition.

Be the first to comment