AsiaVision/E+ via Getty Images

A Quick Take On Waterdrop

Waterdrop (NYSE:WDH) went public in May 2021, raising approximately $360 million in gross proceeds in a U.S. IPO that was priced at $12.00 per share.

The firm offers a platform for Chinese users to obtain various types of health insurance services and medical expense crowdfunding.

Although WDH has produced notable profitability results despite a drop in revenue, I remain cautious on its forward trajectory and wait to see a restart of revenue growth.

I’m on Hold for WDH in the near term.

Waterdrop Overview

Beijing, China-based Waterdrop was founded to create an independent third-party health insurance distribution platform and medical crowdfunding marketplace for Chinese users.

Management is headed by founder, Chairman and CEO Peng Shen, who was previously a founding team member of Meituan Waimai, a food delivery service in China.

The company’s primary offerings include:

-

Insurance Marketplace

-

Medical Crowdfunding

The firm leverages online social networks for user acquisition, with many users first becoming aware of Waterdrop through its Medical Crowdfunding platform.

Market & Competition

According to a 2020 market research report by Insurance Business Asia, the Chinese health insurance market was an estimated $64.7 billion in 2017 and is expected to reach $136.6 billion by 2022, according to GlobalData.

This represents a forecast very strong CAGR of 16.1% from 2017 to 2022.

The main drivers for this expected growth are a continuing demographic shift, ‘with a decline in fertility and a rise in aging,’ which will exert greater pressure on the country’s healthcare system.

Also, it is private insurance carriers who are creating new product offerings, especially in the areas of serious illnesses such as cancer and cardiovascular disease.

The retail/consumer segment will be an area of prime focus, followed by the commercial sector.

Major competitive or other industry participants by type include:

-

Affiliated agents

-

Bancassurance

-

Direct sales

-

Online third-party brokers and agents – Ant Group and WeSure

-

Offline brokers and agents – Fanhua, Everpro and Datong

-

Crowdfunding – Qingsong Crowdfunding

Waterdrop’s Recent Financial Performance

-

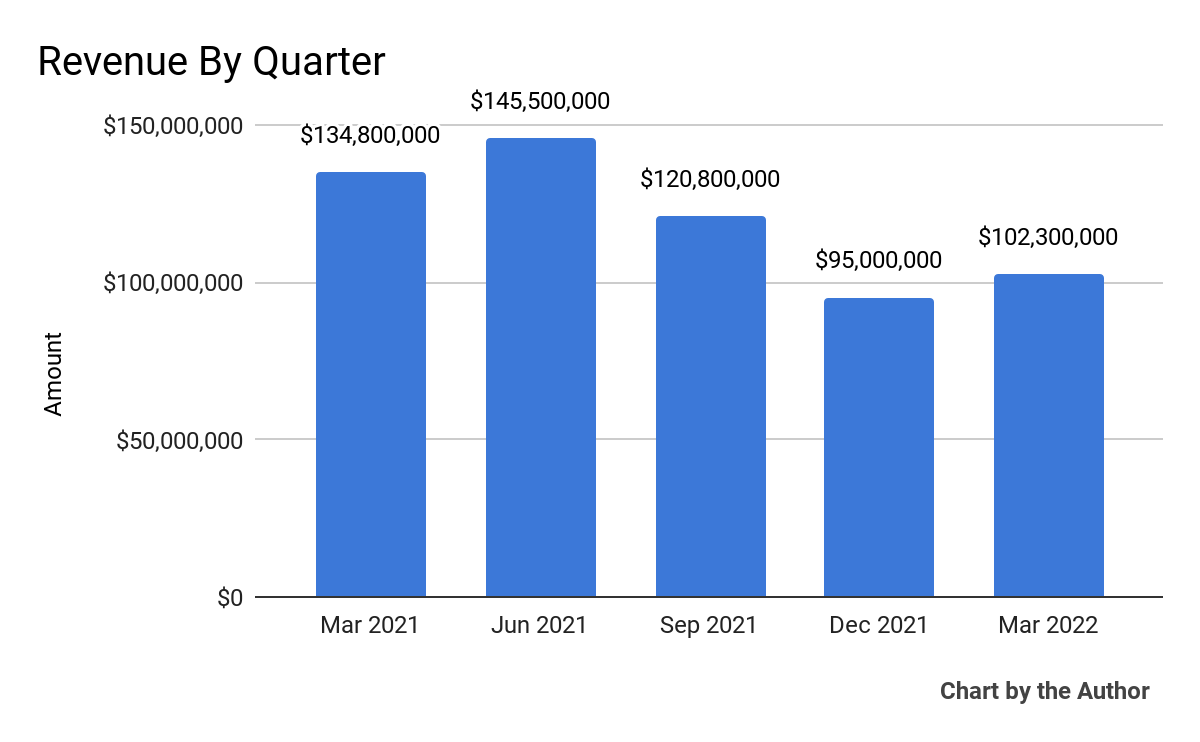

Total revenue by quarter has dropped materially in the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha and The Author)

-

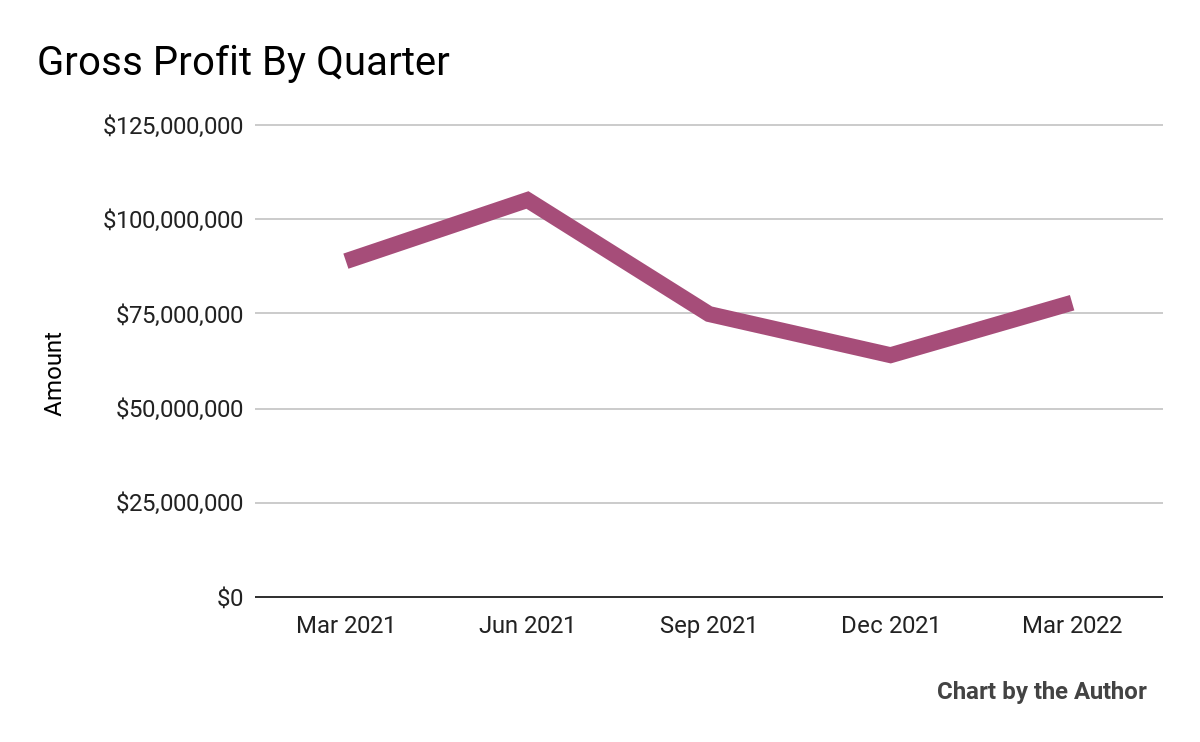

Gross profit by quarter has also fallen:

5 Quarter Gross Profit (Seeking Alpha and The Author)

-

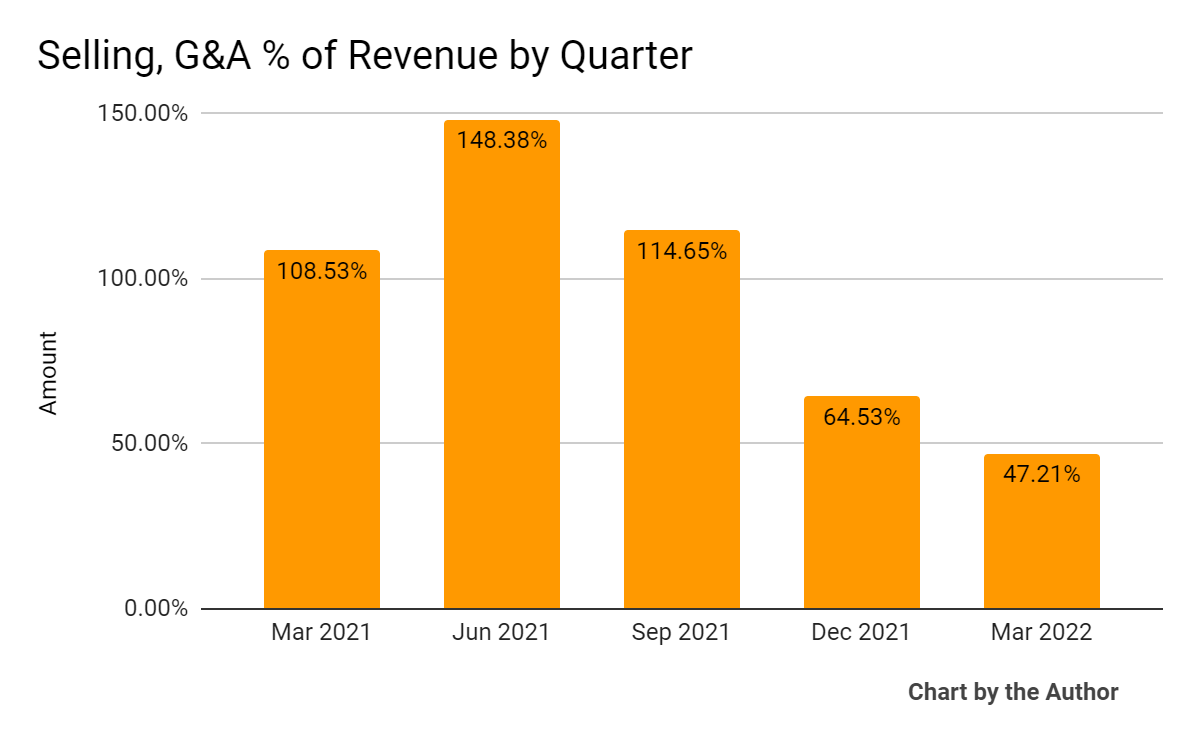

Selling, G&A expenses as a percentage of total revenue by quarter have dropped considerably, a positive sign:

5 Quarter Selling, G&A % of Revenue (Seeking Alpha and The Author)

-

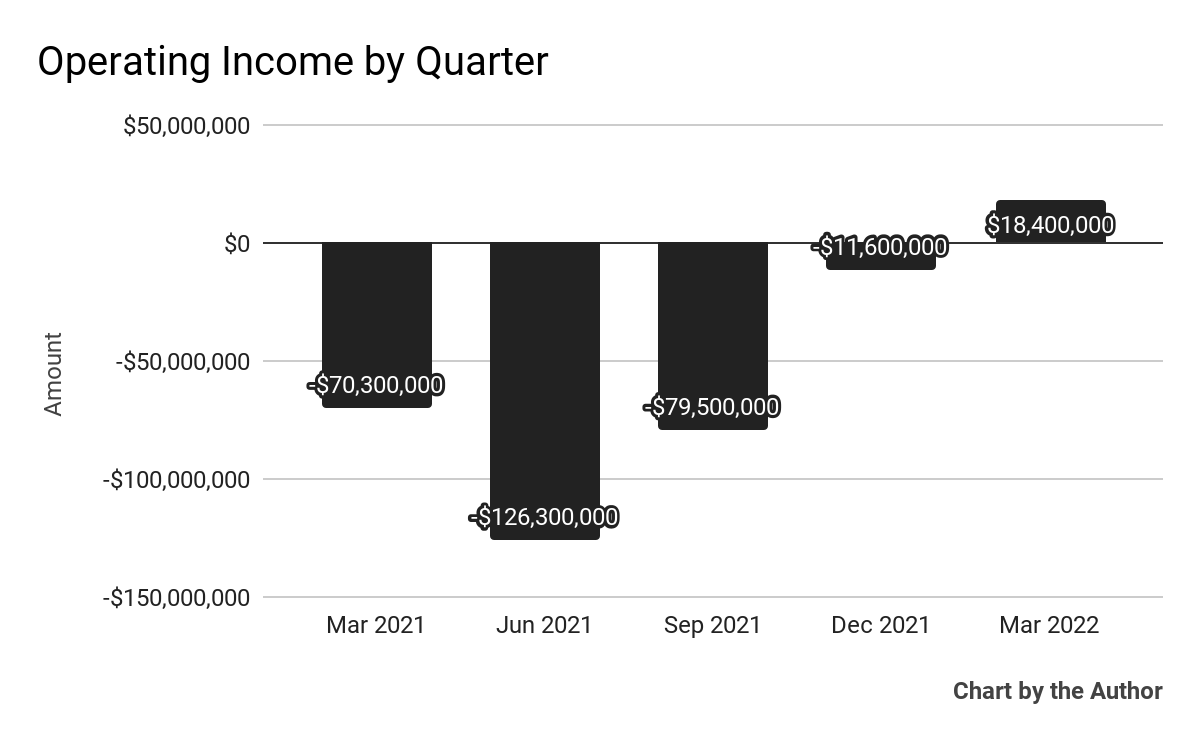

Operating income by quarter has improved markedly and was positive in the most recently reported quarter:

5 Quarter Operating Income (Seeking Alpha and The Author)

-

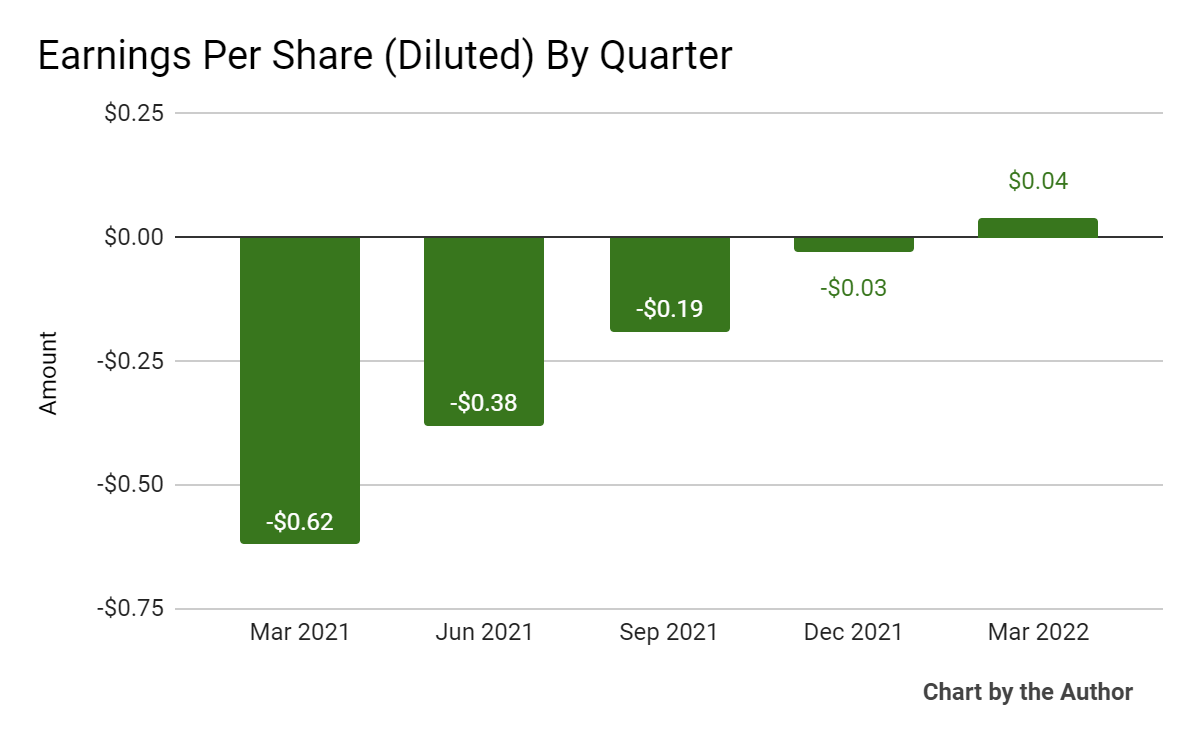

Earnings per share (Diluted) have also turned positive in Q1 2022:

5 Quarter Earnings Per Share (Seeking Alpha and The Author)

(Source data for above GAAP financial charts)

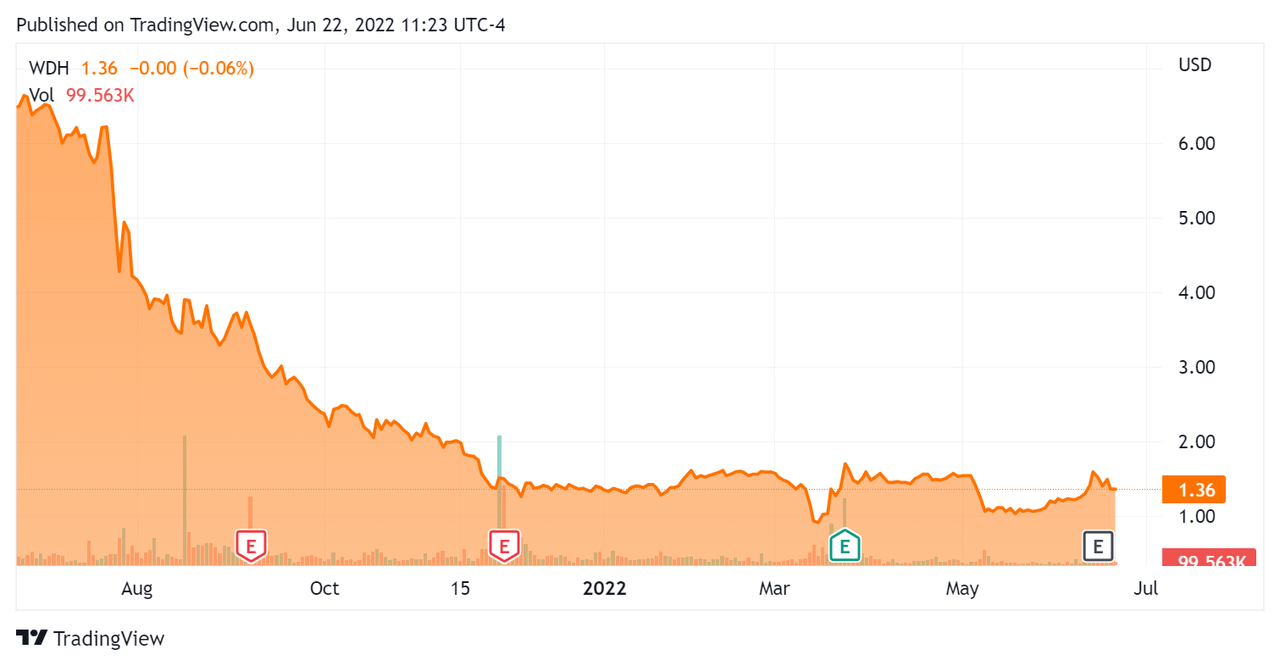

In the past 12 months, WDH’s stock price has fallen 79 percent vs. the U.S. S&P 500 Index’s drop of around 10.9 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For WDH

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$587,480,000 |

|

Enterprise Value |

$82,130,000 |

|

Price/Sales (TTM) |

1.07 |

|

Enterprise Value/Sales (TTM) |

0.18 |

|

Operating Cash Flow (TTM) |

-$172,570,000 |

|

Revenue Growth Rate (TTM) |

-8.79% |

|

CapEx Ratio |

-30.80 |

|

Earnings Per Share |

-$0.56 |

(Source)

Commentary On Waterdrop

In its last earnings call (transcript), covering Q1 2022’s results, management highlighted the resurgence of the pandemic in China that resulted in greater opportunities for online marketplaces like WDH’s.

However, publicly traded insurance firms in China faced problems in recent periods, although management said that the carriers that adopt a more efficient sales model ‘are enjoying a faster recovery.’

Recently, the company has launched a number of new initiatives and products more granularly designed to appeal to different demographics and price-sensitive prospects.

Also, WDH continued to build its online-to-offline (O2O) brokerage business, finishing the quarter with a 400-person sales unit seeking to grow revenue in this channel.

As to its financial results, after years of robust growth, some of which was fueled by the pandemic, the firm saw significant year-over-year revenue contraction.

But, management reported strong growth in user repurchase rate, up 16% to 73%, and short-term insurance renewal rate at 90.8%, up 18% sequentially over Q4 2021.

Notably, the firm produced positive GAAP operating income and earnings for the quarter, a first since its public debut.

Looking ahead, the company faces significant uncertainties from the regulatory restrictions on the online insurance industry by Chinese authorities in 2021 and 2022.

The general result of recent regulatory changes has been to knock out smaller players from these marketplaces, and the online insurance crackdown appears to put in place the same kinds of restrictions that favor larger, better capitalized players.

WDH is a large marketplace, so should be able to weather the regulatory changes without going out of business, but it may take a long time before the firm can recover to its previously strong growth trajectory, if at all.

The primary risk to the company’s outlook is further regulatory changes which could create more challenges for the company to react to.

Although WDH has produced notable profitability results despite a drop in revenue, I remain cautious on its forward trajectory and wait to see a restart of revenue growth.

I’m on Hold for WDH in the near term until it can demonstrate revenue growth while retaining profitability.

Be the first to comment