JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

The Container Store’s (NYSE:TCS) expansion plans are a bold choice in the current environment. The company has ambitious plans to increase its store count by 76 before 2027. But these plans are hurting its free cash flow and negatively impacting margins. I think this story is promising, but I’m waiting for the company to make progress before buying shares.

Aggressive Expansion Plans

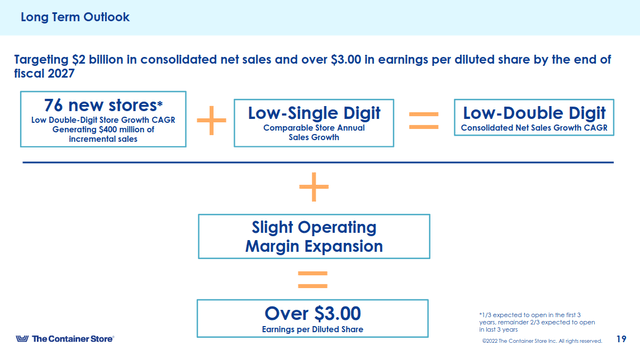

Even in this time of uncertainty, The Container Store is focusing on its expansion plans. In the fourth quarter of the year, the company affirmed an ambitious target of opening 76 new stores by 2027. The company projects $3.00 in earnings per share for that year. At the current valuation, this would give it a 2027 P/E of 1.8 times. This would certainly make shares undervalued if the business pulls this off.

The Container Store Q4 2021 Earnings Presentation

But the details of the business’s long term outlook are more concerning. The company’s growth story is based almost entirely on opening new stores. Management predicts extremely mediocre organic top line growth over the next decade. They believe that their path to a 20% earnings CAGR is simple geographic expansion. On their last earnings call, management discussed their progress towards these goals.

You know we’re expecting one-third of the 76 stores through 2024. And while we do have a pipeline actively working, like since you said there’s a lot of factors that come into play you know I will say, looking into 2023, we haven’t announced anything yet, but we do have a very solid pipeline as we’re looking 2023 and we’re building one for 2024. So, at this point in the process, I think the real estate team has done a great job working on our ambition of that growth of additional 76 stores and we’re looking forward to sharing more in the coming months.

The company reaffirmed their goal of opening 25 new stores in the next few years. It plans to open two of these in the current fiscal year. This seems tricky in the current environment. In general, I think that this strategy is both risky and expensive. The business is significantly increasing its capital expenditures. Because of this, its cash generation and its margins will likely continue to suffer. The business has decent liquidity to back this up. But this investment could drastically reduce future shareholder returns if it doesn’t pan out.

From a competitive perspective, The Container Store’s main advantage is also its main weakness. The company has very little diversification, with its narrow focus on one category. The home storage and organization space is somewhat cyclical. I think that the space is driven by short term purchasing trends more than I’m comfortable with. The company has strong gross margins, but its operating margins aren’t very high. This means that even a small pullback could seriously hurt the business’s bottom line.

Financial Performance

The Container Store grew its top line year over year by a decent 7.9%. But 280 basis points of these gains were due to the company’s acquisition of Closet Works. Of the remaining 5.1% growth, almost 90% of these gains were driven by the business’s custom closets segment. Outside of this one segment, the company only reported 0.8% organic growth.

At the same time, the company is experiencing severe margin headwinds. Its net income declined by 40% year over year in spite of its top line growth. Some of this pressure is elevated shipping costs, but other expenses are likely to be more sticky. The company’s marketing costs increased. The business is also investing heavily in its expansion.

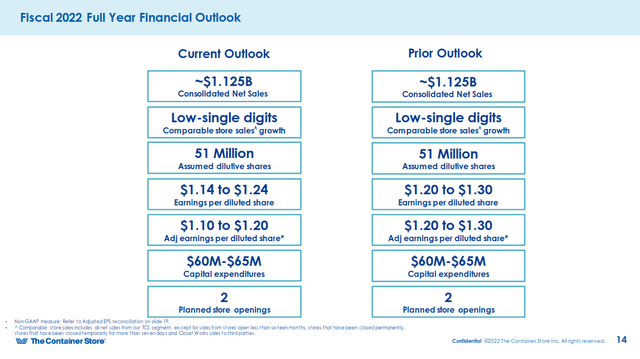

The Container Store Q1 2022 Earnings Presentation

The Container Store’s guidance was moderated from its previous outlook. The business retained its previous revenue guidance. But it reduced its profit expectations by 10 cents per share. These expectations are still solid, but I’m worried that there may be further downside if demand starts to fall.

I believe that The Container Store’s elevated inventory position adds to this risk. Its balance sheet has over $190 million in inventory, or over 150 days. This is a 43% increase over 2019 inventory days. The Q1 inventory position and the company’s Q3 number were the highest inventory days on record. This could create a major gross margin headwind if the company needs to liquidate any of its products.

Cheap Valuation With Cash Flow Issues

The Container Store’s shares are trading at a relatively cheap earnings multiple. Its forward P/E is 4.64 times, and its P/S is under 0.25 times. The company also has over $500 million in long term debt and other obligations. After adjusting for this debt, the company has an EV/E of about 14 times. This is a cheap valuation, and it looks like the market is already discounting the company’s expansion plans.

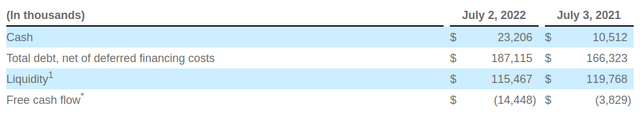

Most of The Container Store’s obligations are its operating leases. Looking specifically at long term debt, the business has a debt to EBITDA ratio of about 1.2 times. This is quite healthy compared to some of its peers. The company’s liquidity is reasonable. The balance sheet shows $23 million in cash on hand and $81 million remaining on its revolver. The company’s Elfa subsidiary has an additional $10 million in available credit.

The Container Store Q1 2022 Earnings Press Release

In recent quarters, the company has struggled with free cash flow. Of the business’s $74.5 million in LTM net income, it only converted $13 million into free cash flow. The company has generated negative free cash flow for three of the last five quarters.

This is unlikely to improve as the business increases capital expenditures. Management is still trying to expand the company, so this is likely to be an ongoing expense. The business guided for $60 to $65 million in capital expenditures. This implies a major acceleration from its seven year average of $29 million.

The company expects to spend about $1.21 per share on capital expenditures. This is even higher compared to its $1.15 profit guidance. I want to see evidence that the business is generating a meaningful return on these investments.

Management authorized a $30 million buyback to prop up the share price. At the current market cap, this could buy back over 10% of shares. But the company doesn’t really have the cash on hand or the free cash flow to back this up. The business’s expansion is likely to offset a lot of its operating cash flows.

Final Verdict

I’m generally bullish on the retail sector. But right now, The Container Store’s narrow focus and increasing spending concern me. I think there’s potential here, and I’m adding this to my watchlist. If the company is able to maintain its margins, this could become an interesting deep value play. But right now, I want to see the company make more progress toward its goals before I would buy in. I don’t believe that the risk to reward is favorable enough just yet.

Be the first to comment