Spencer Platt

Thesis

The world’s leading asset manager BlackRock, Inc. (NYSE:BLK), reported a Q3 earnings release that came below the consensus estimates as equity and bond markets faced another onslaught in the summer.

The market’s positioning in BLK had already turned negative from its August highs, as it anticipated a worse-than-expected performance from CEO Larry Fink & team. As such, even though we had postulated in our previous article that it could hold, the market had other ideas, it sent BLK spiraling down toward its October lows, forcing weak holders to flee.

However, we urged investors not to get overly pessimistic about BLK now. Our analysis suggests that BLK still traded at a substantial premium against the industry. Despite that, we postulate that the market had reflected a mild-to-moderate recession in BLK’s valuations. Furthermore, industry analysts have also revised their earnings estimates markedly through September. Hence, we believe a significant level of pessimism has been baked into the analysts’ estimates, as BLK remains well-positioned to ride through the current downturn.

Furthermore, BLK’s price action remains constructive. It could validate a double bottom bear trap (indicating the market rejected further selling downside decisively) bullish reversal if it could find its way back above its June lows over the next two weeks.

As such, we revise our rating on BLK from Buy to Strong Buy and urge investors to capitalize on its recent steep selldown to add exposure.

One Of The Toughest Market Environments For BlackRock

It’s clear that Blackrock is not immune to one of the most challenging investing backdrops over the past decade (easily), where even the 60/40 portfolio was obliterated in 2022. Barron’s reported in a recent commentary: “The annualized change in its recent [YTD] value has been down 34.4%, according to Bank of America. That’s the worst performance in 100 years.”

With BLK’s YTD total return is down nearly 37%, we are not surprised that it has underperformed the SPDR S&P 500 ETF’s (SPY) -24% return. CEO Larry Fink also accentuated the significant challenges Blackrock had to navigate in 2022:

The speed at which central banks are raising rates to rein in inflation alongside slowing economic growth is creating extraordinary uncertainty, increased volatility, and lower levels of market liquidity. After an early summer rally in equities, markets again came under pressure in the third quarter, with equity markets ending down 25% for the first 9 months, and the aggregate bond index is down over 14%. [However,] even when much of the industry has experienced outflows, clients entrusted us with more than $248 billion in net new business in the first 9 months of 2022, including $65 billion in the third quarter. (Blackrock FQ3’22 earnings call)

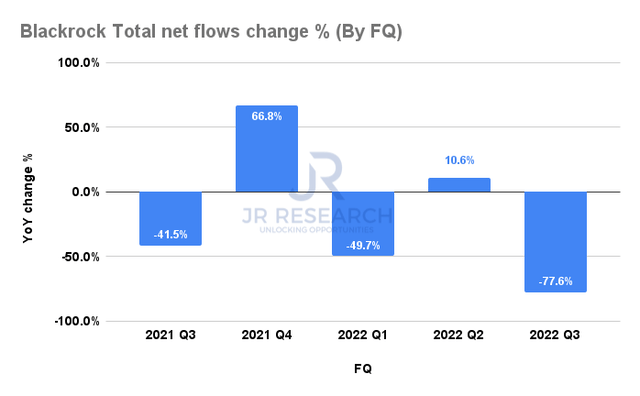

Blackrock total net flows change % (By FQ) (Company filings)

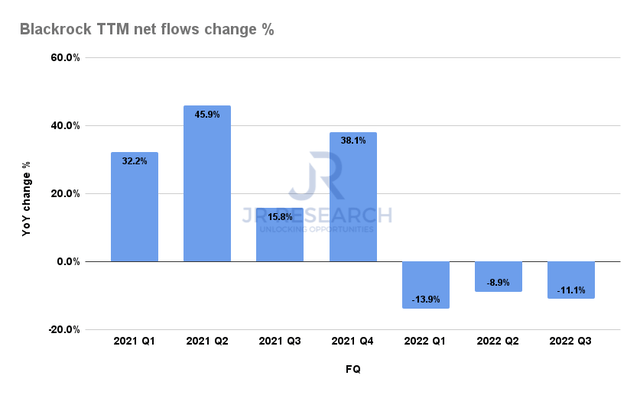

Blackrock TTM net flows change % (Company filings)

Undoubtedly, Blackrock’s $65B growth in long-term net inflows came well below the Street’s consensus of $104B. However, as seen in the first chart above, net flows are highly volatile and unpredictable on a QoQ basis. Hence, we urge investors not to read too much into the missed consensus estimates for its long-term fund flows.

Furthermore, on a TTM basis, Blackrock’s change in net flows has improved from the depths seen in Q1’22. Coupled with its robust performance in fixed income, Blackrock’s competitive advantage could see it benefit from the flows to fixed income funds in the near term, even though it could impact its base fee growth. Management accentuated:

So clients are coming to BlackRock to help them pursue what I would call generational opportunities in the bond market, both institutional and individual. And we’re helping those clients to navigate recalibrations of their fixed-income portfolios. We saw $37 billion of net inflows into bond ETFs, which is the second-best quarter we’ve had in history. (Blackrock earnings)

As such, we believe that Blackrock remains well-positioned to ride through the mayhem in the market, offering long-term investors a fantastic opportunity to capitalize on the current entry levels.

Is BLK Stock A Buy, Sell, Or Hold?

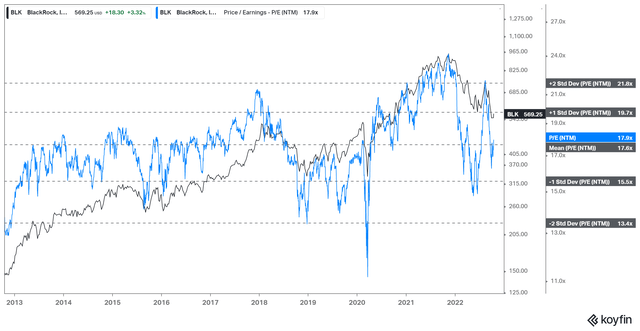

BLK NTM normalized P/E valuation trend (koyfin)

BLK last traded at an NTM normalized earnings multiple of 17.6x, in line with its 10Y mean. However, analysts have revised its forward earnings further to reflect worsening macroeconomic headwinds, coupled with the Fed’s aggressive rate hikes.

Hence, we are confident that the lows seen in its earnings multiples in June should hold as Blackrock rides through a challenging 2023 while lapping tougher comps through H2’23.

Notwithstanding, we postulate that the market has likely reflected a mild-to-moderate recession and not a severe one. Hence, investors should be prepared for further value compression if the market anticipates one to occur.

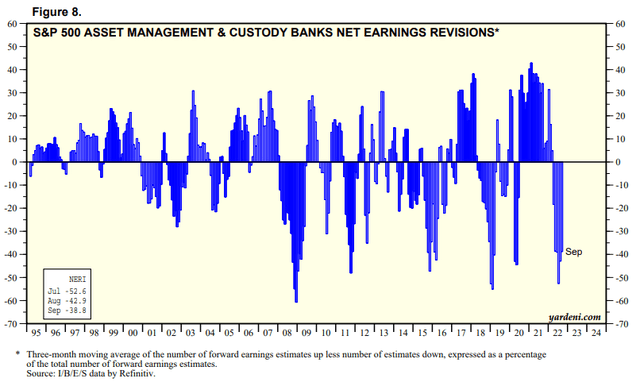

Asset management industry net earnings revision (Yardeni Research, Refinitiv)

Still, we gleaned that Street analysts have already turned highly pessimistic about the industry’s prospects over the next twelve months. Hence, we believe such positioning is constructive for the industry’s recovery of its momentum, as the industry had bottomed decisively in the 2018 and 2020 bear market when the analysts panicked en masse. We also observed a similar trend in the bear market in 2007/08.

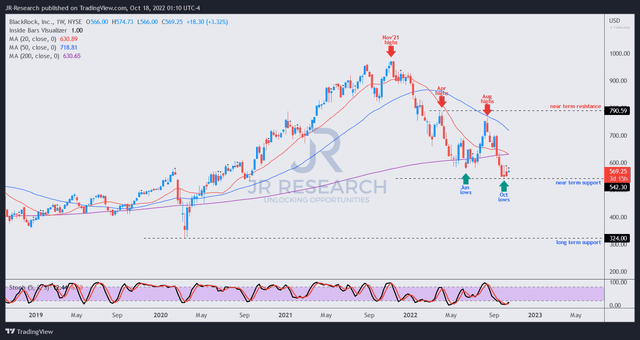

BLK price chart (weekly) (TradingView)

The steep selloff in BLK after breaking below its June lows has likely forced weak hands who chased the summer rally to capitulate.

Notwithstanding, we had anticipated its June lows to hold, but it did not materialize, as the market could be forming a double bottom bear trap over the next couple of weeks.

Furthermore, BLK’s price action is constructive. Also, if the bullish reversal is validated by retaking its June lows, it could signal the early stages of a medium-term bullish recovery in BLK’s long-term trend.

While still not validated, we are leaning increasingly bullish, as we are confident of BLK’s prospects at these levels.

As such, we revise our rating on BLK from Buy to Strong Buy and urge investors to capitalize on the market’s pessimism and look ahead.

Be the first to comment