FilippoBacci

Introduction

Shares of Capri Holdings Limited (NYSE:CPRI) have dropped significantly, currently -36% YTD. I believe that now we have an attractive entry point for opening a long position.

First, the company has demonstrated that it is able to successfully show revenue growth and maintain profitability against the backdrop of macro uncertainties. Secondly, the company operates in the luxury segment, where the consumer is less sensitive to prices, as a result, management has the opportunity to raise prices and maintain operating margins. Moreover, the reduction of COVID restrictions in China will support the growth of revenue in Asia in the following periods.

Forecasting

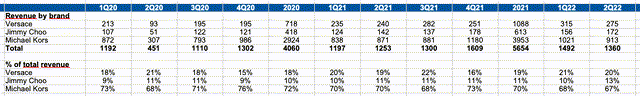

The company develops and promotes brands of clothing and accessories in the luxury segment. The company owns 3 brands: Versace, Jimmy Choo, and Michael Kors.

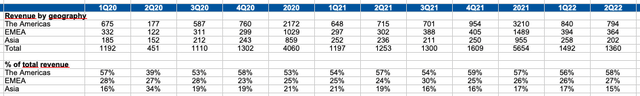

Capri operates in the Americas, EMEA, and Asia. The largest share in revenue is occupied by the American segment, whose share was 58% in the 2nd quarter of 22, followed by the regions of EMEA and Asia, which contribute 27% and 15%, respectively. However, we see that during the last quarters, the revenue in the Asian segment continues to decline (as % of total revenue) due to the introduction of COVID restrictions in China.

Revenue model

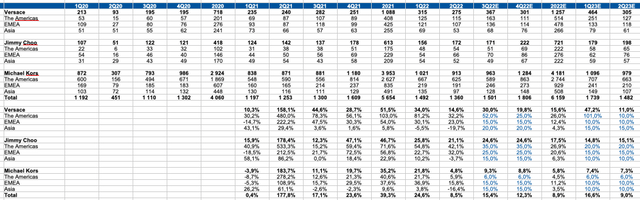

For a more detailed understanding, I made a quarterly model of the company’s revenue by brand and geography of operation.

First of all, I would like to point out that:

1) Revenue in Asia came under strong pressure in Q2 amid COVID restrictions in China. However, based on the latest updates, I see demand recovering in China in the coming quarters, which should support revenue. In addition, I think that in Q3 we will see the effect of pent-up demand.

2) I predict that the Jimmy Choo brand will continue to be the main driver of the business based on brand novelty, low base effects from previous years, and management statements.

Since the company operates in the luxury segment, where the consumer is less sensitive to higher prices for final products, I assume that the company will be able to maintain the gross margin that it showed in Q2 22.

In addition, the company has demonstrated that it is able to keep costs (% of revenue) at a stable level, thanks to:

1) revenue growth

2) effective cost control.

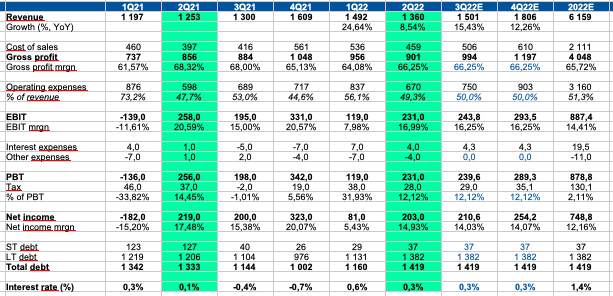

Quarterly projections:

Personal calculations

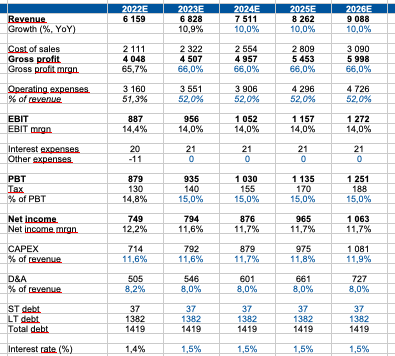

Yearly projections:

Personal calculations

Valuation

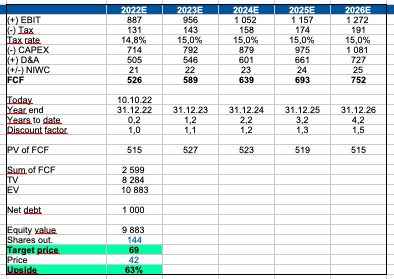

I believe that we can use the discounted cash flow (“DCF”) model to value Capri because:

1) We have a long period of historical observation

2) We can make assumptions about the dynamics of the company’s revenue depending on the brands and geography of the business

3) Also, we can make assumptions about the level of spending based on macro trends and historical data

4) In addition, we understand the necessary level of CAPEX for the stable operation of the business.

To evaluate a company, I use the following parameters:

WACC: 9.4%

TGR: 3%

Personal calculations

Drivers

Growth: work in the luxury segment, successful positioning, and rising prices for products will help the company successfully shift inflation to the end consumer, which should support the business’s revenue growth.

China COVID easing: The easing of restrictions in China could provide significant growth support in the next quarters. In addition, we can see the effect of pent-up demand.

Margin: Rising prices and effective cost control will allow the company to continue to demonstrate a solid level of business operating profitability.

Risks

Macro: rising inflation and a decline in real income may have a negative impact on the well-being of the company’s clients, which may negatively affect the business growth rate.

Margin: continued price growth for materials and labor could have a negative impact on operating profitability

Conclusion

I believe that Capri Holdings Limited continues to successfully cope with macro challenges. Despite rising inflation and declining revenues, the company continues to demonstrate revenue growth and control of operating costs. In addition, COVID easing in China, in my personal opinion, can provide additional support in the following periods. According to my DCF model, the fair share price for Capri Holdings Limited is $69, with an upside potential of 63%.

Be the first to comment