ktsimage/iStock via Getty Images

Investment Thesis

First Solar (NASDAQ:FSLR) had experienced a dangerously high rally, which looks unsustainable especially since the market is in a tragic correction phase, post-pandemic hyper-growth. Enphase (ENPH) has already fallen by -20.21% from its peak optimism levels, with more pain ahead despite its stellar earnings thus far.

The surprisingly robust US labor market in September is not helping matters either, as the payrolls increased by 263K and the unemployment rate fell by 3.5% sequentially. As a result, it is not overly pessimistic to assume that the September CPI to be released by 13 October 2022 will likely still show elevated inflation rates. Thereby, triggering more pain for the stock market in general, with 80.4% of analysts projecting another 75 basis point hike for the Fed’s November meeting.

There are already terrible whispers in the market that the Feds may have to raise its terminal rate beyond the previous projection of 4.6%, due to the persistently sticky inflation rates, which would prove catastrophic to the stock market as a whole. Given the massive volatility, investors should tread very carefully ahead.

FSLR Boasts Exponential Growth In Order Backlog

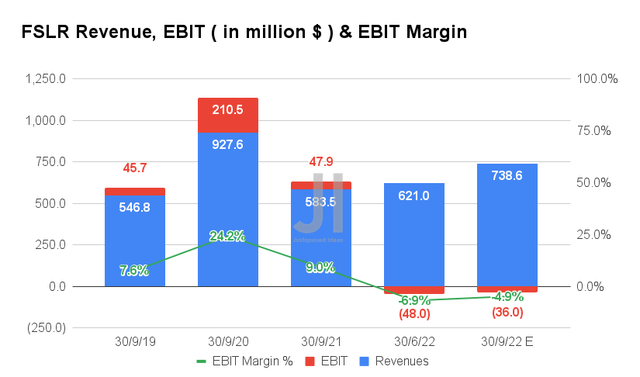

For its upcoming FQ3’22 earnings call, FSLR is expected to report revenues of $738.6M, indicating an excellent increase of 18.93% QoQ and 26.58% YoY. In the meantime, FSLR’s profitability continues to underperform, with the projected EBIT of -$36M and EBIT margins of -4.9% for the next quarter. It indicated a decent QoQ growth of 25% and 2 percentage points, respectively. Otherwise, a massive decline of -75.15% and 13.9 percentage points YoY, respectively, attributed to the rising costs and operating expenses.

Nonetheless, investors have nothing to worry about since FSLR boasts a massive sum of $1.7B of cash and equivalents on its balance sheet in FQ2’22.

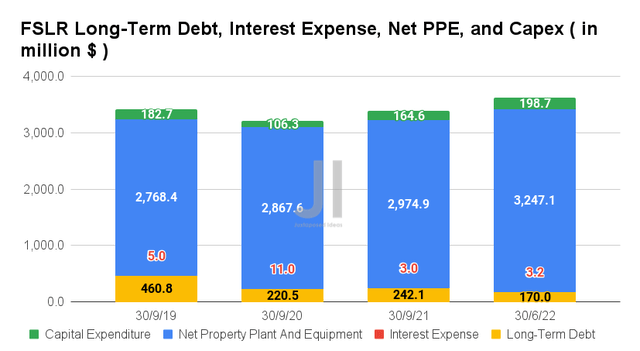

In addition, FSLR has been diligently paying off its long-term debts down to $170M by FQ2’22, indicating a massive decline of -31.17% QoQ and -38.4% YoY. The company also continues to expand its capabilities with capital expenditures of $198.7M and net PPE assets of $3.24B in FQ2’22, indicating a massive increase of 219.23% and 14.08% YoY, respectively, with up to $1.1B of Capex planned for FY2022. We may also see more capacity expansion planned within the US, as hinted at its previous earnings call, due to the uplifting effect of the Inflation Reduction Act.

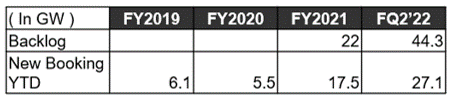

FSLR’s Growing Backlog & New Bookings YTD

Author, S&P Capital IQ

It is evident by now that FSLR has been reaping the enormous rewards from its aggressive expansions, since it reported an ever-growing backlog in future deliveries of 44.3 GWs and new bookings of 27.1 GW YTD by FQ2’22. Its current backlog already represents a massive increase of 201.63% from FY2021 levels, with new bookings eclipsing previous years. FSLR’s production capacity is also booked through 2024, with deliveries planned through 2026. Impressive indeed, given the perceived destruction of demand amidst recessionary fears.

It is no wonder then, that the FSLR stock had rallied tremendously by 71.07% from $76.76 on 27 July to $131.32 at the time of writing, significantly aided by the lifted solar tariffs for the next two years and the record high oil/gas prices. Nonetheless, this current high looks unsustainable and may moderately tumble at the slightest sign of fundamental/ market weakness, significantly worsened by the Fed’s aggressive rate hikes through 2023. Therefore, investors would be well advised to take some gains off the table at these peak levels.

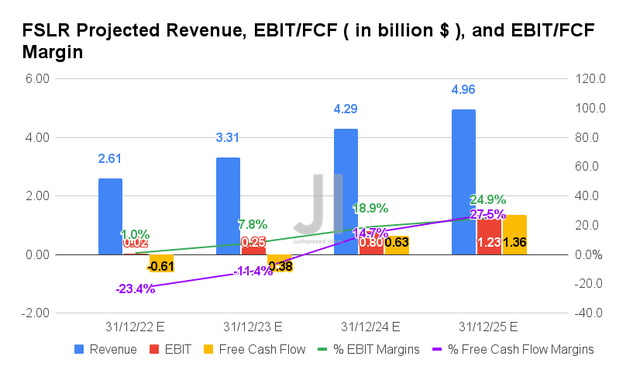

Over the next four years, FSLR is expected to report impressive revenue and EBIT growth at a CAGR of 17.41% and 180.04%, respectively. Given the immense strength of its exponentially growing backlog, the company is expected to report profitability from FY2023 onwards, with significant improvement in its projected EBIT/FCF margins from 6.6%/-16.1% in FY2019, to 15.4%/-10.4% in FY2021, and finally to 24.9%/27.5% by FY2025.

For FY2022, FSLR is expected to report revenues of $2.61B, EBIT of $0.02, and FCF generation of -$0.61B, representing notable YoY decline of -10.7%, -95.23%, and -201.49%, respectively. Nonetheless, since these are attributed to the increased start-up expenses by 404.76% YoY and capital expenditure by 203.7% YoY, amongst other gains/losses for certain assets, we are not overly concerned for now. These aggressive investments would eventually be top and bottom lines accretive in the long run, indeed.

So, Is FSLR Stock A Buy, Sell, Or Hold?

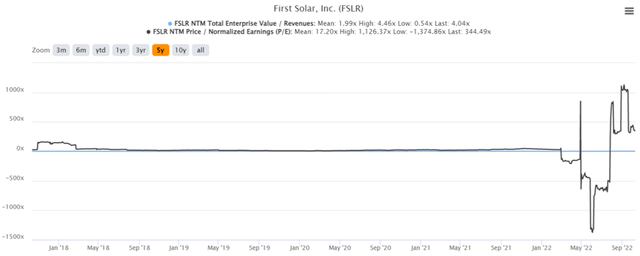

FSLR 5Y EV/Revenue and P/E Valuations

FSLR is currently trading at an EV/NTM Revenue of 4.04x and NTM P/E of 344.49x, higher than its 5Y mean of 1.99x and 17.20x, respectively. The stock is also trading at $131.32, down -9.89% from its 52 weeks high of $145.74, though at a premium of 220.33% from its 52 weeks low of $59.60. Nonetheless, consensus estimates remain bullish about FSLR’s prospects, given their price target of $156.46 and a 19.14% upside from current prices.

FSLR 5Y Stock Price

Nonetheless, given the multiple factors discussed above, investors would be well advised to take some gains off the table and sell at current highs, while waiting to add once the rally has been meaningfully digested. Stay safe during this bear market. Do not be fooled as with the previous November 2021 peak again.

Be the first to comment