Scott Olson/Getty Images News

Investment thesis: Ford Motor Company (NYSE:NYSE:F) has had arguably the most inspired approach to building an electric vehicle (“EV”) strategy of any legacy carmaker. It is not over the top, while the continuing and always evolving Mustang story now has made a seemingly natural transition to the next chapter, which is as an EV. It created waves where so many EV concepts offered by legacy carmakers failed.

At the same time, Ford is not neglecting its conventional car lineup, even as more and more legacy carmakers are deciding to risk it all. With a solid EV strategy in place, Ford is set to have a solid future in the longer term. That being said, the global economic picture is worsening, and most factors point to Ford’s most important markets stalling out in terms of economic growth, and therefore personal vehicle sales. A combination of higher interest rates, slowing economic growth, and inflation rates that are outpacing average wage growth make for a bleak outlook for car sales in Ford’s two largest markets, namely the U.S. and Europe. China, Ford’s third largest market has its own economic issues.

My personal view is that these problems will persist for longer than the market currently anticipates, while the odds of things taking a turn for the worse are higher than the odds of improvement. This means that for the short to medium term, Ford is facing tough market conditions, along with most other carmakers.

Ford’s latest quarterly results are decent, but the wider global auto market is showing signs of weakening

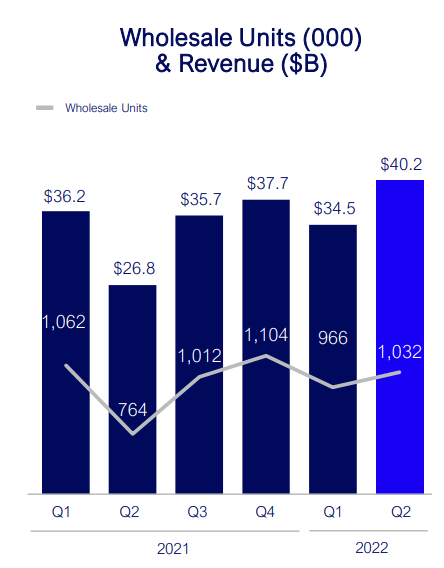

For the second quarter of this year, Ford posted decent sales and revenue numbers, within the context of less than stellar industry-wide automotive sales results in its main markets.

Ford quarterly sales (Ford)

While revenues were solid for the quarter, net earnings did not increase much compared with the same quarter a year earlier. At $667 million in net earnings, profit margins are looking very thin, given that revenues came in at over $40 billion. It should also be noted that for the first half of the year, Ford has so far posted a loss of $2.44 billion.

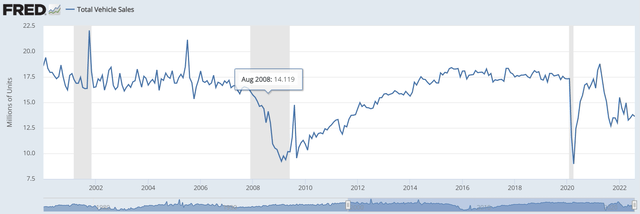

Auto sales data for major markets like the U.S. shows that in the past 12 months or so, there has been a decline to levels that were only seen so far this century during the 2008 economic downturn, as well as during the COVID-caused plunge in sales.

The sales data is misleading in this particular case because sales volumes have been impacted in large part by parts shortages, which led to production volume declines. Having said that, there are also some demand-side signs of trouble ahead for automakers. In the EU, for instance, where Ford sells over 20% of its cars, total auto sales are now the lowest since 1996 as of June of this year and demand increasingly seems to be a major factor. There is also talk of growing auto loan default rates here in the U.S., although there is yet to be a return to pre-pandemic default levels. Therefore, it should not be considered an issue, at least for now.

The global auto industry continues to face energy price inflation, semiconductor and other shortages, and a battered consumer

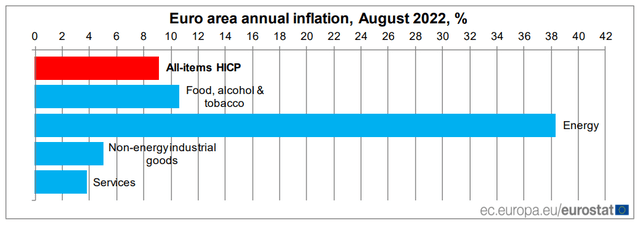

The latest U.S. CPI numbers are not very encouraging. Despite a massive drop in oil prices, year-over-year numbers came in rather high, at 8.3%. The more worrisome part is the fact that month-over-month prices increased by .1%, despite the drop in energy prices in the past few months. It means that even as energy costs were deflationary, other factors seem to have taken on a life of their own and are no longer driven indirectly by higher energy cost inputs. What this means is that taming inflation will be a lot harder for the Federal Reserve to achieve.

Europe is looking a lot worse in this regard. The latest EU-wide data suggests that despite declining oil prices, the overall regional energy situation is still pushing inflation higher, with no end in sight in this regard.

My take on the EU situation is that we are perhaps just months away from the energy crisis leading to a breakdown in the region’s supply chains, where breweries for instance will stop making beer, for lack of bottles and aluminum cans. Such systemic shortages will lead to an unavoidable surge in prices, which will lead to an equally unavoidable rise in household nominal incomes, especially once we factor in state aid schemes. At that point, even if the energy situation will ameliorate somewhat, the ECB will be fighting a losing battle to contain inflation, which is clearly morphing into an entrenched stagflationary nightmare.

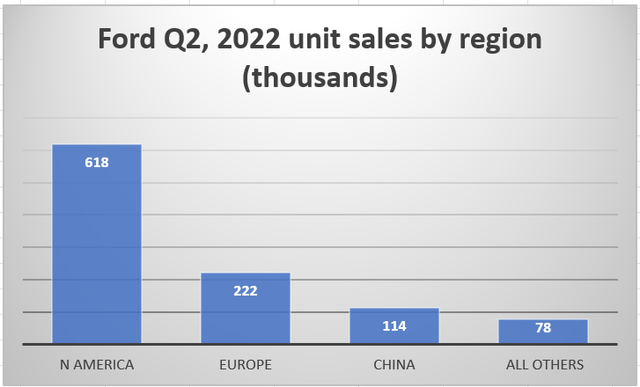

As we can see, Ford relies on the North American and European markets for about 80% of its sales. Both markets are facing an inflation-fighting central bank policy, resulting in higher interest rates, even as the economies of these regions are set to slow down. In the case of Europe, it could be entering contraction either in the second half of this year or next year. Ford’s sales outlook, especially next year, is likely to be bleak as a result of these developments. Rising loan defaults could also threaten its financial results if too many people will feel financially squeezed by the rising price of everything and will feel the need to default on their car loans as a result.

The next largest market for Ford is the Chinese market, where the news is not particularly encouraging either. A continued zero-COVID policy is seemingly threatening to throw China’s economy into a stagnation trap, along with a number of other factors, such as the continued economic frictions with the U.S. and the EU. China remains a wild card for Ford as well as for the overall global auto industry. A sharp reversal in COVID policies, coupled with other measures could potentially lead to an acceleration of China’s economy. On the other hand, a prolonged continuation of the lockdown policy could lead to some permanent damage to China’s economy, with the outlook for auto sales in that market suffering a setback accordingly.

The evolving EV story and Ford’s place within it

When I first bought Ford stock, it was largely based on my view of its EV strategy, which I judged to be adequate and beneficial for its long-term outlook within the context of the overall continued evolution of the auto industry as I see it. I continue to believe that Ford got its EV strategy right compared with most of its industry peers, which makes it a potential auto industry outperformer in the longer term.

The short explanation of why I believe that Ford got its EV strategy right is because it managed to do two main things. First and foremost, it created enough brand recognition for its Mach-E as being specifically an EV, even as it is associated with Ford’s iconic multi-decade and constantly evolving Mustang story. In other words, much like a Tesla (TSLA), when one drives up in a Mach-E, people tend to know it is an EV, which addresses the status symbol aspect of owning one.

Second, Ford is selling its successful Mach-E and F-150 electric version in the higher-end part of the EV market, where carmakers are able to offer EV buyers some practical range. As I pointed out in an article some years ago, range inequality is very likely to become a social issue going forward, especially if or when conventional cars will become outlawed. In effect, it means that those with the means will be able to drive a car that one can take on a long-range road trip, while the majority of people will only be able to afford a city car.

I don’t see the complete outlawing of conventional cars happening throughout most of the world, because public outrage will most likely spill over once the public comes to terms with what it means in practice to force everyone to buy exclusively non-conventional cars. For this reason, I believe that conventional cars made for the global middle class will continue to have a future for many decades to come. Ford seems to be positioning itself for a future where its high-end market offers will become increasingly electric, while it will continue to provide conventional cars for the middle class, for the foreseeable future. This is in stark contrast to the likes of Volkswagen (OTCPK:VWAPY, OTCPK:VWAGY, OTCPK:VLKAF), which recently decided to abandon further developing its conventional technology beyond the middle of this decade. I believe that will be a massive strategic mistake, and it seems to be a mistake that quite a few legacy carmakers are set to make in the next few years.

Investment implications:

In the next two years or so, things will look increasingly bleak for most carmakers, as a function of the overall economic situation in most major global car markets is looking bleak. Personal vehicle purchases will be one of the first major items that will be on the chopping block as households are increasingly feeling squeezed by rising inflation, with most households not seeing a corresponding increase in wages. For this reason, the entire automotive sector, with perhaps a few pure EV companies being the exception, is now a risky bet. I decided to cut my position in Ford stock by about three quarters. I kept the rest of the shares in case my thesis is wrong. If I am right, there will be an opportunity to increase my position at a better price.

Be the first to comment