Justin Sullivan

Thesis

Google stock (NASDAQ:NASDAQ:GOOGL) (NASDAQ:NASDAQ:GOOG) is very popular to retail and institutional investors alike. Also, analysts like the stock and few companies can match the same level of consensus “Buy Rating.” For reference, SA Quant Rating gives Google 4.7 out of 5, SA Authors give 4.3 out of 5, and Wall Street Analysts give 4.6 out of 5. Personally, I am also bullish on Google, and I have previously published an article where I priced the stock based on three different valuation methodologies — all implied significant upside.

Although I am still positive on Google, the consensus buy rating makes Google stock vulnerable to a sharp correction, in my opinion. The reason is simple: If everybody is bullish already, who is left to buy on the dip? And remember also that excessive greed / fear is a reliable contra indicator. Accordingly, investors should never ignore the ‘what if’ questions.

In this article, I argue the bear case for Google. I present four key risks that, if materialized, could cause Google stock to trade lower.

Valuation: A Multiple Contraction?

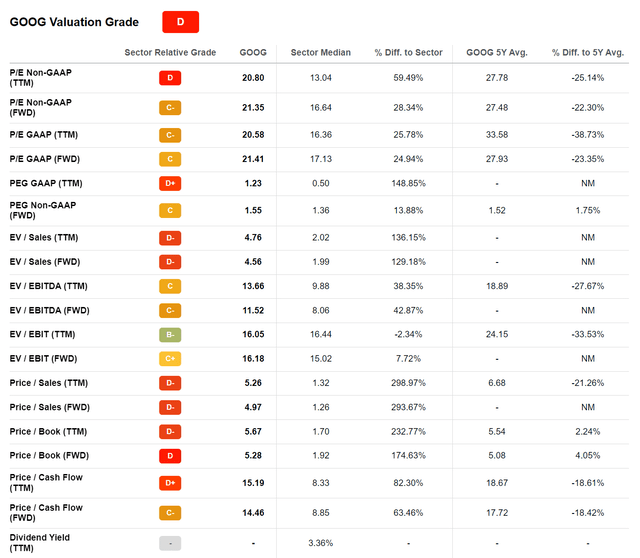

According to Seeking Alpha’s relative multiple comparison, Google is rated very expensive. For reference, Google’s one-year forward P/E is estimated at 21.4, which is a 25% premium versus the sector. The company’s 2023 P/S is x5 and P/B is x5.3, which implies a 295% and 175% premium respectively.

Seeking Alpha

Although I personally, do not think that Google is expensive — in fact, I believe a premium versus the sector median is more than justified — it is worth noting that a multiple contraction is not farfetched.

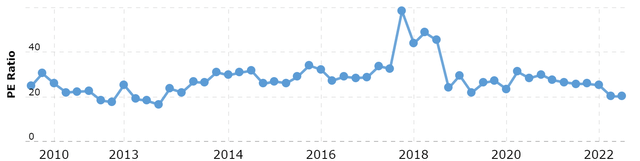

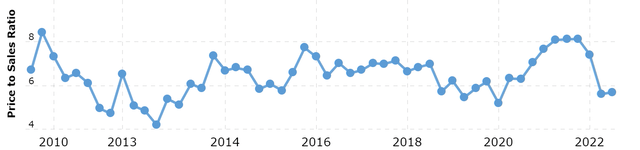

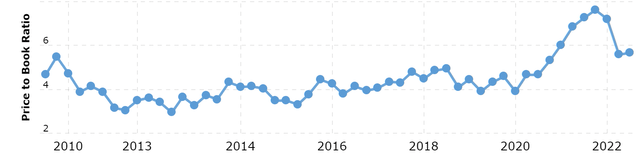

Notably, in 2013 — when policy makers were concerned about the growth outlook for major economies — Google traded lower. At that time, Google’s P/E was close to x16, the P/S was approximately x3 and the P/B was around x4. If Google would trade down to similar multiples (ignoring an EPS contraction at this point), the internet giant could have some 25% downside.

MacroTrends

MacroTrends

MacroTrends

Macro Thesis: A Market Correction

If the market were to correct sharply, Google cannot hide. There are a few arguments to the thesis.

First, investors should note that Google is a major component of US indices. For reference, Google accounts for more than 7% weight in the Nasdaq 100. And for close to 4% in the S&P 500.

Secondly, Google is a levered play to the broad market — with a beta of about 1.1 versus the S&P 500. Although this factor is not ‘dangerous’, it still implies more risk than what an investor would assume by investing in the index.

Note how closely Google stock matched the S&P 500 for the past twelve months. And Google has also underperformed by approximately 13 percentage points.

Seeking Alpha

Earnings Contraction

The macro-economic outlook is very challenging — and without a doubt Seeking Alpha readers are well aware of the various risk factors that currently pressure economic growth. Mark Zuckerberg, CEO of Meta Platforms (META) and Evan Spiegel, CEO of Snap (SNAP) have already voiced concerns about a slowdown in digital ad spending. That said, Google’s Q2 earnings were better than expected.

However, an investor could argue that an economic slowdown doesn’t immediately materialize in digital advertising, but with a 3 – 9 months lag. The argument is simple: At the beginning of a slowdown, companies have still lots of liquidity and can push excess inventory through advertising. But the longer challenging macro-economic backdrop persists, the tighter ad budgets become. Consequently, Google’s earnings slowdown might materialize as late as in Q4 2022 or Q1 2023.

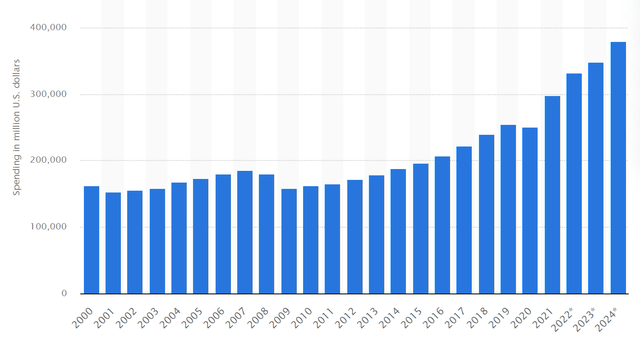

Statista

Ad spending in the US decreased by about 6.5% in early 2000, after the dot-com bubble broke, and by some 10% during the financial crisis. If we can take past recessions as a reference, then an investor could assume about 7 – 8% topline contraction for Google’s ad business. Based on Google’s 26% net income margin, and if one would take the P/E ratio as the relevant valuation metric, an investor could expect 2% – 3% valuation downside. This is not much. However, if we layer a multiple contraction on top of the earnings contraction, an investor could assume 27% downside risk.

Regulatory Risk

Google has achieved scale and size of such dimensions, that cannot be ignored by regulators around the world. In the US, for example, Google needs to deal with multiple antitrust suits that claim the company would operate a monopoly in general search and search advertising: one from the U.S. Justice Department and eleven more from various states. The argument that Google would operate a monopoly in search and search advertising is hard to dispute, in my opinion, with some 90% market share in both the US and the EU.

In addition, US policy-makers are currently working on two notable legislations: The American Innovation and Choice Online Act, and The Bipartisan Digital Advertising Act, which aim to contain the market power of leading internet technology companies. For interested readers, there was an amazing article written by a Seeking Alpha analyst: Google Stock: This Regulatory Pressure Is A Disaster (NASDAQ:GOOG). In my opinion, this article sums up the issue pretty well.

That said, advertising accounts for about 80% of Google’s total revenues. And if this cash-generating business vertical would see more challenging regulatory scrutiny, the thesis for investing in Google could be significantly disrupted. However, since the regulatory headwinds are not yet defined in detail, it is hard to model their economic impact. And any thesis would only be a speculation. In any case, investors should watch this risk closely and actively — it could be a tail risk for Google, in my opinion.

Investor Takeaway

Google is an amazing business, and the company’s stock isn’t less appealing: Google is loved by retail and institutional investors alike and analysts are enormously bullish. However, the investment is not without risk. In this article, I presented four key risk factors that could pressure Google stock lower: (1) multiple contraction, (2) market correction, (3) earnings slowdown/earnings miss, and (4) regulatory tightening. In case of a unfavorable combination of the first 3 risk factors, I argue that Google could trade as much as 25% – 27% lower. This, however, would be my worst-case scenario.

Be the first to comment