kynny/iStock via Getty Images

What constitutes an attractive investment opportunity can change over time. A company that once was not appealing can become a feeling based on changes in fundamental condition and/or price. One great example of this type of change can be seen by looking at Myers Industries (NYSE:MYE), an enterprise that produces durable plastic reusable containers, pallets, small parts bins, and more, as well as engages in the distribution of tools, equipment, and supplies mainly centered around the automotive space. Earlier this year, I viewed the company as just a mediocre prospect. But based on recent financial performance, and a decline in the company’s share price, I do now think that it offers enough upside potential to be appealing. Because of this, I’ve decided to change my rating on the company from a ‘hold’ to a ‘buy’.

The picture changed for the better

Back in July of this year, I wrote my first article covering the investment worthiness of Myers Industries. In that article, I discussed the robust financial performance the company had seen, but I also explain that its overall historical track record had not been fantastic. I felt as though the long-term outlook for the company was likely positive, but I felt as though chairs were more or less fairly valued at the time. Ultimately, this led me to rate the firm a ‘hold’, reflecting my belief that it would likely generate returns that more or less match the market moving forward. Since then, things have been a bit more difficult for shareholders than I expected. While the S&P 500 is up by 1%, shares of Myers Industries have dropped by 8.8%.

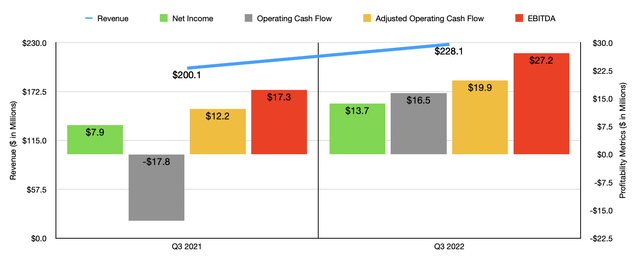

You might think that this return disparity was caused by some change in fundamental condition for the enterprise. But that has not, in fact, been the case. Consider, for instance, the third quarter of the company’s 2022 fiscal year. Revenue during that quarter came in at $228.1 million. That’s 14% higher than the $200.1 million in sales generated the same time one year earlier. Although the company did see a 4% rise in revenue associated with this material handling operations, the real increase came from its distribution side theory under this segment, revenue jumped by 43.6% from $50.4 million to $72.4 million. This $22 million increase, which driven mostly by a $16.6 million rise caused from incremental sales from the firm’s acquisition of Mohawk in May of this year. Higher pricing added $3.9 million to the company’s top line, while increased volume and product mix changes attributed $1.5 million to its top line growth.

With the rise in revenue also came improved profits. Net income, for instance, jumped from $7.9 million in the third quarter of 2021 to $13.7 million in the same quarter one year earlier. While the increase in sales certainly helped, the company also benefited from its gross profit margin finding from 27.1% to 31.4%. Although this may not seem like a large increase, when applied to the sales during the quarter, it would have translated to $9.8 million in additional pretax profits for the firm. this improvement, management said, was driven by increased contributions from higher pricing and by two various acquisitions. Other profitability metrics followed suit. For instance, operating cash flow went from negative $17.8 million to positive $16.5 million. If we adjust for changes in working capital, it would have risen from $12.2 million to $19.9 million. And finally, EBITDA for the company rose from $17.3 million to $27.2 million.

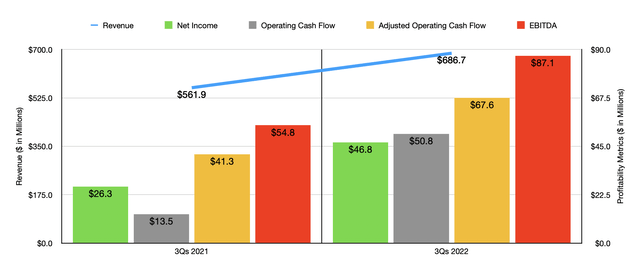

Strong results for the quarter were instrumental in helping total results for the first nine months of the 2023 fiscal year. Revenue of $686.7 million came in 22.2% higher than the $561.9 million generated one year earlier. Net income nearly doubled, rising from $26.3 million to $46.8 million. Operating cash flow surged from $13.5 million to $50.8 million, while the adjusted figure for it rose from $41.3 million to $67.6 million. As can be expected, EBITDA also improved year over year, jumping from $54.8 million to $87.1 million.

When it comes to the 2022 fiscal year as a whole, management has provided some guidance. For instance, sales growth should be around 4%, with its aforementioned acquisitions contributing about 45% of the increase. Earnings per share should be between $1.39 and $1.59, with adjusted earnings of between $1.50 and $1.70. Using the midpoint of expectations for earnings, the company should generate net income of $58.7 million. Assuming that other profitability metrics increase year over year at the same rate, we should anticipate adjusted operating cash flow of $94.4 million and EBITDA of $115.1 million.

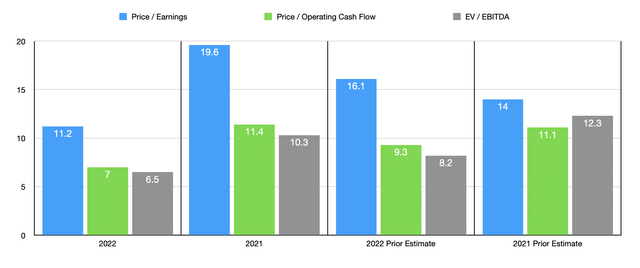

Using these figures, we can calculate that the company is trading at a forward price-to-earnings multiple of 11.2. The forward price to adjusted operating cash flow multiple should be considerably lower at 7, and the forward EV to EBITDA multiple should come in at 6.5. To put this in perspective, the numbers using data from the 2021 fiscal year would be 19.6, 11.4, and 10.3, respectively. Also shown in the table above are the estimates that I provided in my prior article on the company. As you can see, shares of the company do now look cheaper than they were when I last wrote about it. In addition to benefiting from a decline in share price, guidance figures also increased for the company. As part of my analysis, I also compared the firm to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 5.7 to a high of 15.3. In this case, two of the three companies were cheaper than our prospect. Using the price to operating cash flow approach, the range was between 4 and 12.8. And when it comes to the EV to EBITDA approach, the range was between 4.8 and 11.4. In both of these cases, only one of the companies was cheaper than Myers Industries.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Myers Industries | 11.2 | 7.0 | 6.5 |

| TriMas (TRS) | 15.3 | 8.6 | 8.4 |

| O-I Glass (OI) | 5.7 | 4.0 | 4.8 |

| Greif (GEF) | 10.7 | 8.0 | 7.4 |

| Ardagh Metal Packaging S.A. (AMBP) | N/A | 9.5 | 11.4 |

| Silgan Holdings (SLGN) | 14.4 | 12.8 | 10.5 |

Takeaway

With the fundamental data looking better from Myers Industries than it did earlier this year, and shares getting cheaper because of both that and the decline in share price, I must say that the company looks much more attractive now than it did previously. I understand that economic conditions could hurt the company in the near term. But given how cheap shares are, I think that downside from this point on would be limited if that does take place. In all, I view the company as fairly attractive at this point, enough to rate it a soft ‘buy’.

Be the first to comment