Igor Kutyaev

It’s a wonderful combination for the retiree; a rising income stream that comes with less volatility. Diversify your assets to protect against all economic regimes and you’ve gone a long way to protect your retirement years. We face sequence of returns risk in retirement. The need to sell shares in a bear market can impact our portfolio’s health and longevity. When a rising dividend stream runs through it (your portfolio), the need to sell shares will decrease. Let’s have a look at dividend growth and your retirement portfolio.

Retirees love their dividends. There is comfort in seeing those dividends flow into the portfolio. After all, dividends are less volatile than share prices. And if we optimize our retirement portfolio for greater dividend health, and greater dividend growth, we can do much better compared to buying the market.

That said, I will often write that we should not become too obsessed with the current income level of the portfolio. We should refuse the ultimate seduction of the current high yield. There are other, and perhaps greater attributes to consider, such as dividend growth rate and the health of the companies that we own. And once again, let’s throw economic conditions and sectors into the mix.

The Dividend Growers

While there is no perfect index to find the ultimate in dividend growth and dividend safety, the Dividend Growers Index (VIG) is a great place to start. The index demands a 10-year dividend growth streak. The index also applies dividend health screens. It has a large cap bias.

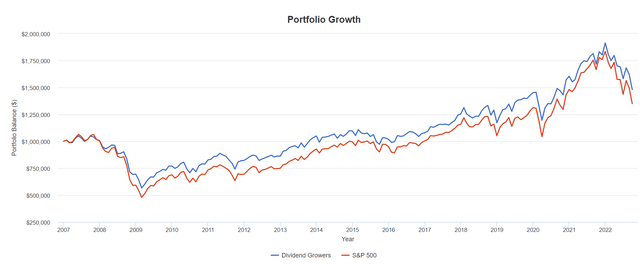

The ETF has been modestly superior to the market (IVV) for delivering retirement income. Here’s a quick test using a hypothetical $1,000,000 retirement portfolio with a 4.8% spend rate. The period is June of 2006 to the end of September 2022.

Dividend Growers vs S&P 500 – Retirement (Author / Portfolio Visualizer )

Dividend Growers vs S&P 500 – Final Balance (Author / Portfolio Visualizer )

We see that the Dividend Growers deliver an ending balance that is 9.6% greater than market. That said, total returns for both of the ETFs is the same for the period. Less volatility (drawdowns in corrections) and a growing income stream turns the tables in favour of the dividend growers.

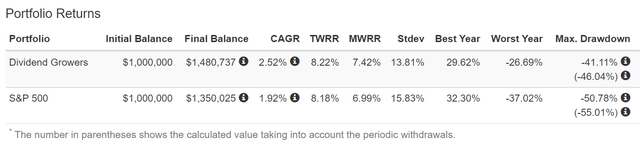

We start with a hypothetical $1,000,000 portfolio. $20,000 of annual income would represent a 2% starting yield. Dividends are not reinvested to represent the underlying (organic) dividend growth.

Dividend Comparison – Growers vs Market (Author / Portfolio Visualizer )

The Dividend Growers dividend held up and grew quite nicely during times of market stress. We can’t say the same for the S&P 500 ETFs. Also, given the price of VIG held up better than IVV, less shares were sold to make up any additional income needs beyond what is delivered by the dividends. It’s a one-two punch as Dividend Growers top the market as a retirement funding option.

Living off of the dividends

In this post – living off dividends; why sell yourself short, you’ll find an example of a current Dividend Grower, BlackRock (BLK). The dividend growth is strong and quickly surpasses any need to sell shares to create retirement income.

Over a period of several years, only 2.8% of shares were sold to boost the total income to an initial 5%. Over the period, there was also generous retirement income growth to combat inflation. From that post …

|

Year |

Dividends |

Share Sales |

Total Income |

|

2012 |

$33,090 |

$16,932 |

$50,022 |

|

2013 |

$34,348 |

$15,261 |

$50,109 |

|

2014 |

$41,826 |

$8,530 |

$50,356 |

|

2015 |

$47,070 |

$7,252 |

$54,322 |

|

2016 |

$49,377 |

$8,423 |

$57,800 |

|

2017 |

$53,373 |

$5,968 |

$59,343 |

|

2018 |

$68,903 |

$0.00 |

$68,903 |

We see the dividends quickly devour any need to sell shares. But the main thrust of the article is that we did not have to fear selling shares to create retirement income. The retiree could continue to sell shares to create even greater income. And they might employ a variable withdrawal strategy, selling more shares when the market rocks, and selling less shares or no shares when the markets are rocked (see 2022 bear market).

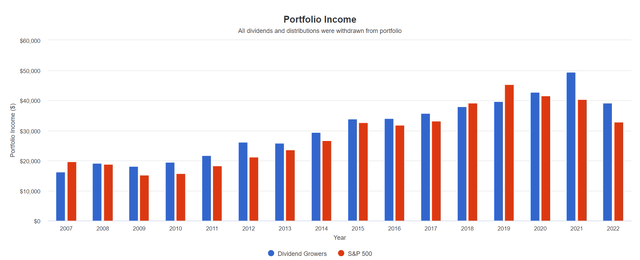

The Dividend Aristocrats

Many retirees like to go one farther on the dividend growth history front and look to the Dividend Aristocrats (NOBL). These companies are S&P 500 constituents that have increased their dividends for 25 years and more. That said, most of these companies have been increasing their dividends for 40 years or more. You’ll find many of the Aristocrats in the Dividend Growers index.

The Aristocrats strategy has demonstrated history of weathering market turbulence over time by capturing most of the gains of rising markets and fewer of the losses in falling markets. Defense wins championships.

Dividend Aristcrats vs S&P 500 (Dividend Growth Investor Blog )

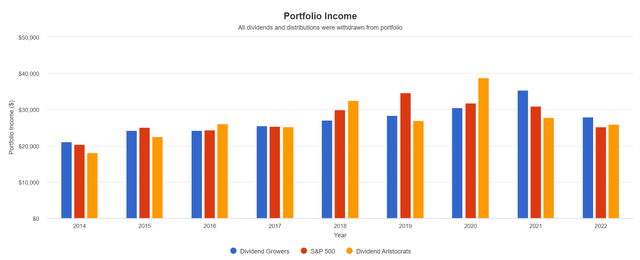

We can also see that the dividend growth record of the Aristocrats is superior to the Dividend Growers. There is a limited time frame for the NOBL ETF (launched in 2014), but it is very telling, nonetheless.

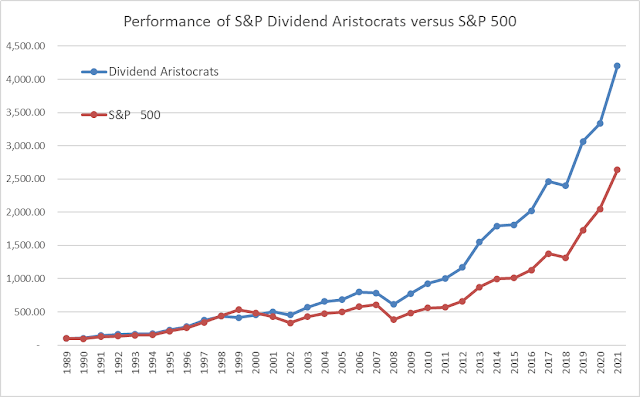

Dividend Growers and Aristocrats Dividend Growth (Author / Portfolio Visualzier )

We see the strong dividend growth at work. Again, we start with a hypothetical $1,000,000 portfolio. $20,000 of annual income would represent a 2% starting yield. Dividends are not reinvested to represent the underlying (organic) dividend growth.

The reconstruction of the Aristocrat index in 2021 removed some big dividend payers to bring down the total income. We see that for this brief period of evaluation the Dividend Growers come out on top for dividend growth and reliability.

You might consider the dividend growth streak when selecting individual stocks or funds for retirement. Historically, the Aristocrats would have been far superior to S&P 500 for retirement funding.

Of course, additional research beyond dividend records is required for those who create their own stock portfolio.

Defense first in retirement

Many self-directed investors embrace an equity-heavy portfolio, even in retirement. Given that, I offered this backgrounder on – building the retirement stock portfolio. We can use certain types of stocks and sectors to build a defensive wall. At times, we’ll call those stocks bond proxies, or bond replacements. You might consider 60% or more in defensive sectors.

Utilities / Pipelines / Telecom / Consumer Staples / Healthcare / Canadian banks

We can also select stocks to help us prepare for changes in economic conditions. These days, we are experiencing a major shift in economic regimes. We’ve only known the slow growth disinflationary environment of the last 40-plus years; we’re now in an inflationary regime, and possibly on the cusp of stagflation. Meanwhile, recession risks swirl.

Check out the all-weather portfolio for 2022.

And here is the post with the stocks for the retirement portfolio. Keep in mind, this is not advice, but ideas and stock candidates for consideration.

Defensive dividends

We should not be surprised to discover that defensive sectors also deliver dividend durability.

Check out the growing dividend stream of the consumer staples sector (XLP), even through the last two major corrections and recessions of the dot com bust, and the financial crisis. You’ll also find a near spotless dividend record within the healthcare sector (IYH).

And you might consider utilities (IDU) as well for the dividend defensive line.

For our personal retirement portfolios (for my wife and me), I build around those Dividend Growers – previously named the Dividend Achievers index. We have a perfect dividend growth record (no cuts) from the time of creating the portfolios in 2014/2015.

I have been so pleased with our performance through the turmoil that began in 2020 with the first modern day pandemic that moved onto inflation and recession concerns.

Our U.S. and Canadian stock portfolio outperforms in tumultuous times. Here’s a post that covers the Canadian Wide Moat stocks. We are also benefitting greatly from Canadian oil and gas stocks.

Our Canadian contingent offers very generous dividends and consistent dividend growth. The oil and gas sector is delivering outrageous dividend growth. And with those energy stocks we also get that inflation hedge.

Cash and bonds

While sector arrangement and a growing dividend stream can go a long way to help protect your retirement funding needs, you might also consider cash and bonds. That can help fortify the defensive stock portfolio for retirement. We hold cash and bonds levels in the 15% to 20% range.

Thanks for reading, we’ll see you in the comment section? And please hit that like button, if you liked this post.

Be the first to comment