J. Michael Jones

Investment thesis

With the COVID-related madness that pumped the price of Generac’s (NYSE:GNRC) stock up to unsustainable levels out of the way, there is an emerging opportunity to look at the company based on market and company-specific fundamentals once again. There may still be some more downside to its stock price, mostly driven by sentiment and some potential technical setbacks in regard to some of its products. By some measures, it is starting to be more reasonably priced, which suggests we will now head into oversold territory. Looking at some emerging potential consumer preference shifts, as the world adapts to a decade that keeps reshaping our economic, social, and geopolitical realities, there may be an opportunity for Generac to fill the energy security void that the shifting of our overall institutional frameworks are creating. While it may not be a definite buying opportunity just yet, this may be a decent future investment opportunity worth keeping an eye on.

Addressing the COVID stock price spike and the immediate aftermath

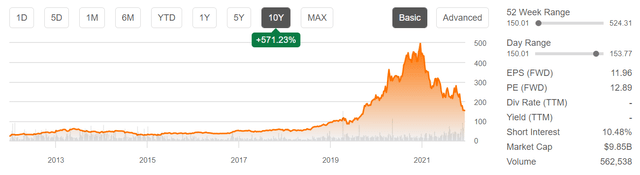

It may be understandable why many investors would much rather never hear about this stock again if one looks at this company’s stock price history for the decade so far.

Even though it is currently priced at less than a third of the record price that it was trading at just a year ago, it is still up almost 600% for the past decade. There are some fundamentals that support the argument in favor of such a significant increase in its stock price, but it is nevertheless hard to ascertain whether it is entirely or just partly justified. Those investors who bought its stock pre-COVID or just before this stock took off, and then sold into the massive price spike, are probably happy to have sold and may never want to look back. Those who bought into the spike, most likely at a price that was much higher than it is trading at currently, may want to look at even less, regardless of whether they already took the loss, or whether they are still riding this stock on the way down. There is some glimmer of potentially good news for those who are still riding the downtrend. When adjusting for revenue growth compared with the end of 2019, just before the COVID madness, Generac’s stock price is now trading as if the COVID price spike never happened.

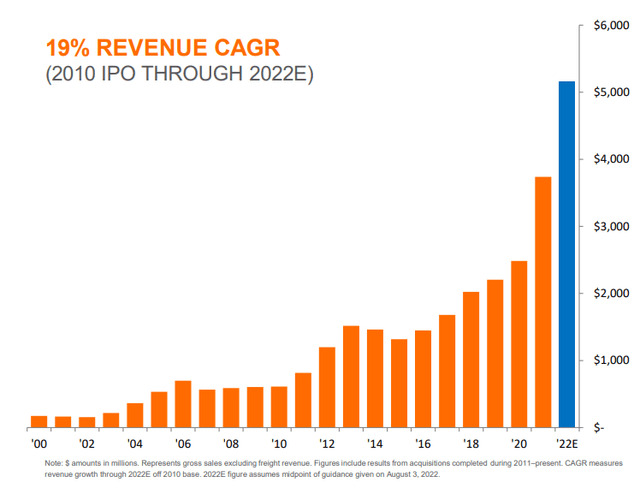

Generac’s stock price reached over $100/share just before the end of 2019. It is currently trading about 50% higher, but as we can see, revenues are estimated to have approximately doubled compared with 2019.

In terms of its forward P/E ratio, at nearly 13, it is arguably still on the expensive side. The Dow Jones P/E average is at over 17 however, and unlike the overall companies that make up the index, there is an argument to be made for Generac to continue being a growth company, even as we are apparently headed into a global recession based on the latest IMF forecast.

Other financial metrics of interest include its debt situation. It has $1.3 billion in long-term debt as of the second quarter of this year, which is equivalent to roughly a quarter of its net sales for the current year. For the first six months of this year, its revenues came in at $2.43 billion, with net income coming in at $270 million, for a profit margin of 11%. Interest expenses came in at less than $20 million, which is less than 1% of revenues. based on this brief overview, Generac’s financial performance and its long-term health prospects both look healthy.

In the aftermath of the COVID-inspired stock price spike that Generac experienced, followed by the crash back towards reality, it is understandable why emotionally speaking the tendency continues to be towards selling. It should be recognized however that fundamentally speaking it seems that this stock has caught up to its current financial performance. The continued market negativity towards its stock, together with an overall souring investment mood, due to the gathering economic and geopolitical upheaval means that there is still likely to be a great deal of selling pressure on Generac’s stock. It should be noted that we are probably entering the often unavoidable portion of the selloff where it is overdone, no longer driven by fundamentals, such as its current financial performance, or its future prospects for continued growth.

It should also be noted that there may always be bad news selloffs along the way. Recent reports of high failure rates for its solar equipment may have an outsized negative effect on its stock valuation, within the context of pre-existing negativity towards the stock. Such effects may take a long time to wear off, and it may feel like an unbearable hit for investors already reeling from the already steep decline in the value of their position in this stock.

The great disorderly unraveling of the globalized post-WW2 World order, and where Generac products fit within new realities

While I felt for a long time now that the post-WW2 global order, with the rules-based hierarchy, which drove us towards more global interdependence will soon break, I always hoped that it will be an orderly unraveling. With proxy wars, regime change operations, trade wars, sanctions, cyber warfare threats, and even growing threats of a nuclear confrontation, things seem to be unraveling in a less than orderly manner, meaning that the negative effects of the loss of global synergies are likely to be amplified. In a worst-case scenario, we can be looking at a vicious cycle of mutually destructive hostile actions, ranging from acts of sabotage to full-blown major conflicts.

For us ordinary mortals, adaptation starts with reacting to the effects, whether we are talking about the growing cost of everything we consume or occasional outright shortages, or adjusting our investment portfolio to match the economic, social, and geopolitical realities that are emerging. There is no doubt that acting preemptively beats reacting, especially if one has a good understanding of unfolding events and trends. This may be valid in regard to investing in stocks and other assets, as well as investing in one’s safety and enhanced self-sufficiency.

Whether they have a clear understanding of it or not, more and more people perhaps feel the growing need for self-sufficiency, in the event that a temporary emergency may arise, which is what Generac offers with its various products. That may be the reason why as far as we can tell, demand continues to rise, as shown in yearly sales data. Just as nations are striving for more self-sufficiency in the face of the growing rupture of interdependence, individuals may also seek to gain more self-sufficiency from the grid that we became accustomed to taking for granted.

Investment implications

For those already existing investors who rode this stock on the way down, the fact that we may have reached the point where Generac’s market cap corresponds to its financial fundamentals is not yet the good news that they are desperately looking for. We are now entering the stage where this stock will get over-sold, in other words, it will become cheap. The recent negative news in regards to Generac’s solar equipment may mean that the over-selling will be steeper and may also last longer.

For those looking for a buying opportunity, GNRC stock should start to appear on the radar, but for myself, I am not looking to take a nibble at it just yet. If or when I will, it will be limited in size, with an eye on picking up more in case the selling will continue for a while longer. In the meantime, I will just continue watching for developments along the way and see what the stock price will do accordingly. It may not be an investment opportunity just yet, but it may become one soon.

Be the first to comment