kokkai

Thesis

Sea Limited (NYSE:SE) is due to report its highly anticipated Q2 earnings release on August 16, amid worsening macro headwinds that have buffeted its e-commerce and gaming peers.

However, we noted that SE had held its May lows resiliently, as buying support has been robust to undergird its consolidation zone. Therefore, we are confident that even a relatively downcast Q2 print may not impact it markedly as the market looks ahead. Moreover, given the significant battering in SE since its November 2021 highs, the destruction seems almost complete as it has been staging a reversal.

Coupled with what we believe are more constructive market sentiments for unprofitable speculative stocks, SE looks ready for a re-rating, as its long-term growth story remains intact. Still, a positive Q2 card that indicates that Shopee has continued to gain operating efficiencies would be highly beneficial to lift sentiments further, helping SE to gain further buying support.

Therefore, we revise our rating on SE from Hold to Speculative Buy.

Watch For Margins Improvement From Shopee

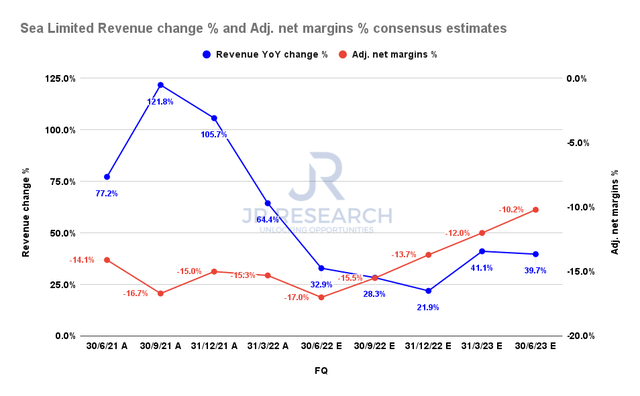

Sea Limited revenue change % and adjusted net margins % consensus estimates (S&P Cap IQ)

Investors should recall that management reiterated in Q1 that it remains confident of achieving adjusted EBITDA profitability (less HQ costs) for Shopee in FY22. Therefore, we urge investors to parse management’s commentary on whether the company is on track to meet its previous guidance.

The consensus estimates (bullish) suggest that Sea Limited’s adjusted net margins could hit a bottom in Q2 before reversing higher through FY23. We believe the estimates are reasonable, as it aligns with management’s guidance of improving efficiencies for Shopee.

Parse Bookings Stabilization For Garena

As the company’s most important profit driver, we believe investors would likely assess whether Garena’s bookings trends have stabilized in Q2.

Note that in Q1, Garena notched a -27.3% YoY decline in bookings, demonstrating the end of the pandemic tailwinds as growth normalized markedly. However, investors should recall that management offered some nuggets of hope, as Group CEO Forrest Li highlighted:

While Garena experienced headwinds in its growth post-COVID, we saw some preliminary positive effects from our efforts to improve user engagement in Free Fire. In particular, the monthly user trends for Free Fire began to show some early signs of stabilizing toward the end of the first quarter. We are assessing the long-term trends in user engagements post-COVID to better tailor our strategies and areas of focus. Building ever more engaging content within Free Fire and strengthening our pipeline of new games remain our key priorities. (Sea Limited FQ1’22 earnings call)

Recent earnings commentary from Roblox (RBLX) showed that macroeconomic headwinds had impacted bookings and engagement growth. Therefore, in-game spending could continue to come under pressure, and investors should be prepared for some disappointment here. Yet RBLX still finished the week strongly, suggesting that the market has anticipated these challenges and is not concerned about them being structural impediments. Therefore, we look forward to a positive print from Garena showing a slower decline in bookings for Q2.

SE’s Price Action Is Constructive Of A Long-Term Bottom

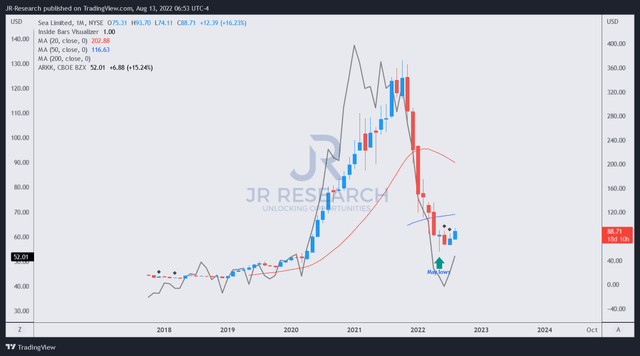

SE price chart (weekly) (TradingView)

We observed that SE has likely staged its long-term bottom in May, as it has based constructively over the past three months. Note that we are taking a more conservative stance with SE, given its unprofitability.

Coupled with the potential bottoming process in ARK Innovation ETF (ARKK), we are confident that unprofitable, speculative stocks are ready to emerge from hiding.

Is SE Stock A Buy, Sell, Or Hold?

SE’s pummeling from its November 2021 highs demonstrates the importance of not being overexposed to so-called “high-growth” and unprofitable stocks. The pandemic tailwinds have also distorted investors’ assessment of the underlying drivers of their business models.

While assessing SE’s fair valuation will continue to be an ongoing challenge, we are confident that it has staged its long-term bottom.

Accordingly, we revise our rating on SE from Hold to Speculative Buy.

Be the first to comment