Justin Sullivan

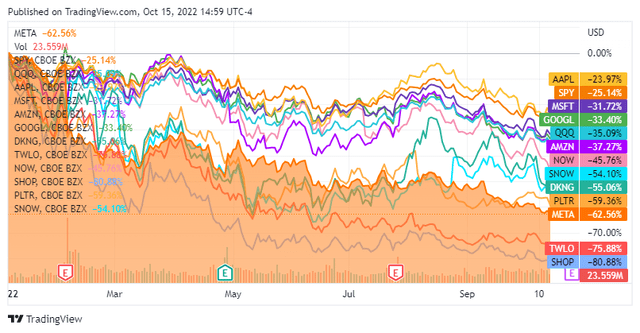

While the investment community has felt Mr. Market’s wrath throughout 2022, shareholders of Meta Platforms (NASDAQ:META) have received an extra dose as shares have declined -62.56% YTD. Mr. Market is treating META as a profitless tech company, not as a major component of FAAMG or one of the most profitable companies in the world. Everywhere you look, bear markets can be found from the major indices as the S&P 500 has declined -25.14% and the Nasdaq is down -35.09% to Apple (AAPL) as not even the gold standard could escape the bear market. AAPL, Microsoft (MSFT), Alphabet (GOOGL), and Amazon (AMZN) have declined between -23.97% to -37.27% YTD, yet META looks more like a Meme stock that has imploded as it’s fallen more than DraftKings (DKNG) and Palantir (PLTR) in 2022.

I was wrong, and I thought the pain being inflicted on shareholders of META would have ended months ago. I didn’t think META would go below $200, I certainly didn’t believe it would fall under $175, and I am astonished that it has fallen below $150. META started the year at $338.54 per share and just recently made fresh lows of $122.63. Throughout META’s decline, I have said it doesn’t look like a technology company, as it continued to look more and more like a value stock. Now META’s valuation is so low that I am not even sure it can be classified as a value company. I think Mr. Market has overdone it on shares of META, as there is no way it should have fallen more than AMZN on a percentage basis in 2022. I don’t know how long this will last, but META looks like the best opportunity in big tech going into the holidays.

Mr. Market has overdone it, and the news shouldn’t cause META to lose -62.56% of its value

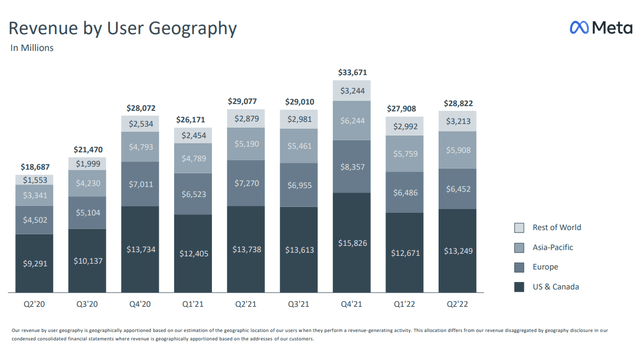

Things were already bad for META after a large decline occurred after Q1 earnings, then META’s revenue fell for the first time YoY in Q2, setting the stage for additional capital destruction. Not only did META’s revenue decline YoY in Q2, but it also missed analysts’ estimates. The analyst community was looking for $30.38 billion of revenue in Q3, and META’s guidance came in weak as they set the stage to deliver $26 – $28.5 billion of revenue in Q3. Like many companies, META’s costs increased in Q2 as their expenses rose 22%, leading to a drop in both operating income and operating margins. META’s Q3 outlook reflects a continuation in weak advertising driven by macroeconomic uncertainty in addition to foreign currency headwinds. Outside of the financials, some are skeptical about the Metaverse and the relevancy of META’s next chapter in Reality Labs.

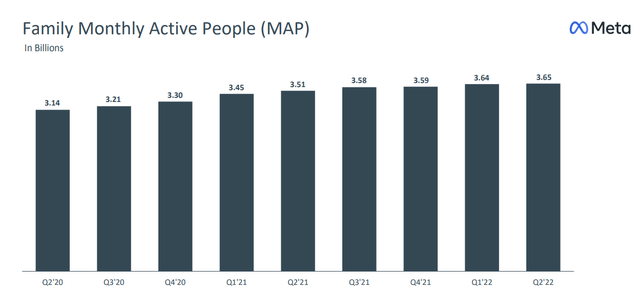

The news isn’t flattering, and META delivering its first-ever YoY revenue decline is significant, but it’s not earth-shattering. I guess Mr. Market and the investment community missed several key points as they have become fixated on META not achieving the consensus estimate while not sharing in Mark Zuckerberg’s vision of how large the Metaverse opportunity will be. Currently, there are 7.98 billion people globally, and the net population growth is roughly 147,225 daily. META’s family daily active people (DAP) increased 4% YoY to 2.88 billion, and family monthly active people (MAP) increased 4% YoY to 3.65 billion. Facebook’s daily active users ((DAUs)) increased 3% YoY to 1.97 billion, and Facebook’s monthly active users ((MAUs)) increased 1% YoY to 2.93 billion. META has converted 36.09% of the global population into DAPs, and 45.74% into MAPs.

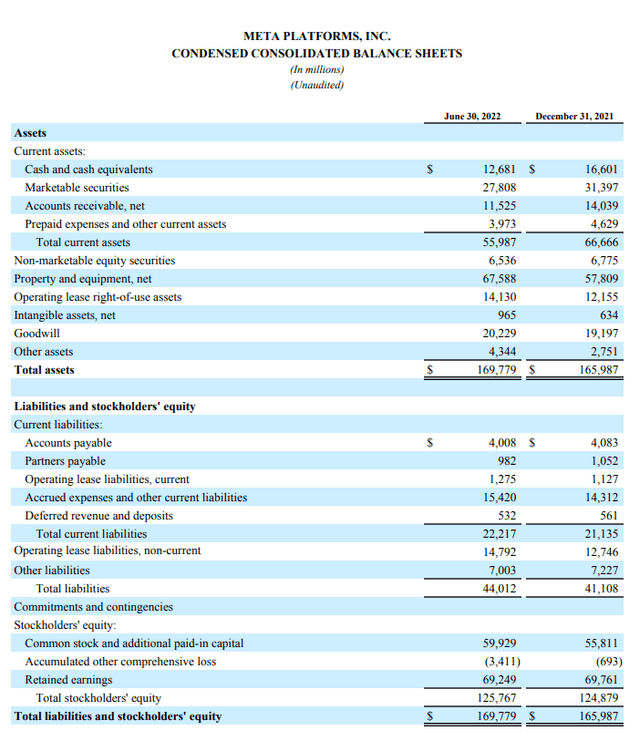

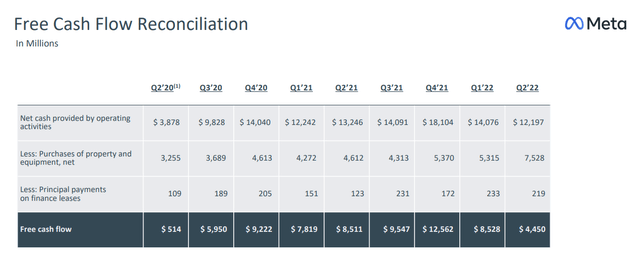

People are not leaving META’s products, and in Q2, the average revenue per user (ARPU) ticked up slightly QoQ by $0.28 (2.94%). If there was a mass exodus or a modest reduction in users, then I would agree META had a problem, but that’s not the case. META has revised its expense guidance from $87-$92 billion to $85-$88 billion and placed a freeze on hiring. While META’s user growth is slowing, and it experienced its first-ever YoY revenue decline, this is hardly a reason to worry. When a company declines by -65% in less than 11 months, it sends a message something is drastically wrong. Over the TTM, META has generated $119.41 billion in revenue, $33.63 billion in net income, and $35.09 billion in FCF. META also has a spotless balance sheet where long-term debt is non-existent, and its $40.49 billion of on-hand liquidity creates a liquidity-to-liability ratio of 0.92x. META isn’t a profitless tech company and shouldn’t be treated as one. I believe META should have stayed within the range of between -23.97% to -37.27% YTD and traded with the FAAMGs.

People are overlooking the true potential of the Metaverse, and even if it goes bust it doesn’t matter

The Metaverse has also become a point of contention as some don’t share the same vision as Mark Zuckerberg and others don’t see it as a profitable venture. I have been a shareholder of META since its IPO, and back then, many didn’t see Facebook as the next big thing, and the discussion around the Metaverse feels very similar. In 2020, META’s Reality Labs lost -$6.6 billion, and in 2021, it lost -$10.2 billion. This has played a significant role in META’s price decline, but I don’t believe it should.

Every company needs to innovate, and META has changed the way individuals communicate and socially engage with each other. META is allocating tens of billions to the Metaverse, and while some people can’t see the vision, META shouldn’t be penalized for that. In 2021, META lost -$10.2 billion due to its Metaverse endeavor. While this would cripple a normal company, META is far from normal. META’s net income in 2021 was $39.37 billion. META didn’t take on a single dollar of debt and is funding this entire project in cash. Regardless of how this plays out, META shouldn’t be penalized for something that is unproven. It should be judged on the numbers, and in the TTM, META has generated $35.09 billion of FCF and $33.63 billion of net income. As a shareholder, I am unhappy with the price action, but I am thrilled with its endeavor into the Metaverse. If, for some reason, META was to call it a bust and scrap the project, it would have been a poor allocation of capital, but it was META’s capital to allocate, as they didn’t tap the debt market. If the Metaverse works, there is unlimited potential, and it could change computing forever. META will also be the king of the Metaverse, and only AAPL or Alphabet GOOGL would be in a position to try and compete.

MSFT is betting on the Metaverse and partnering with META. This should be a clear indication of how large the potential market will be. At the recent Meta Conference, Mark Zuckerberg brought in Satya Nadella (CEO of Microsoft) to discuss the integration of Microsoft Teams, Office, Windows, and Xbox Cloud Gaming. Mr. Nadella stated that “We’ve been thinking about how to bring the power of Microsoft 365 and Windows 365 to 3-D spaces to really help drive productivity and enable you to create, communicate and collaborate in completely new ways.” As Microsoft 365 comes to the Meta Quest platform, it’s going to provide a revolutionary way for companies to build out their virtual office and enhance the Microsoft Teams experience through VR.

There is a tremendous runway of potential for the Metaverse and teaming up with MSFT is the tip of the iceberg. MSFT provides legitimacy to this project as it’s clear, VR will be the next frontier in gaming, and computing. What about live events as well? Recently Mark Zuckerberg attended UFC Vegas 61, and I would be shocked if Dana White and Mark Zuckerberg didn’t discuss creating a UFC VR experience in the Metaverse. The Metaverse could become a live extension of ticket sales, and while there is the pay-per-view model, live sporting events and concerts could be selling virtual tickets to experience events in the Metaverse down the road.

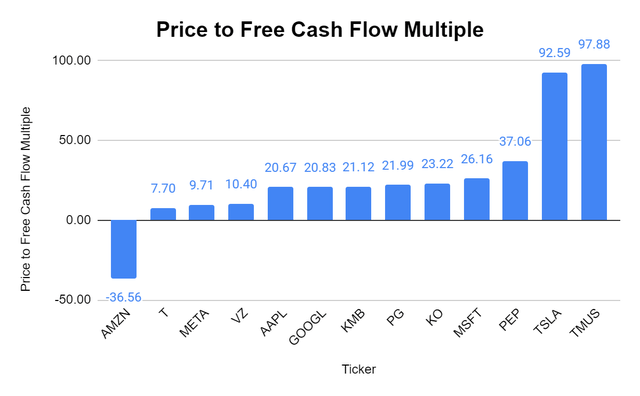

Meta Platforms valuation has become so cheap that its jousting with AT&T (T) to see how low it can go

Looking at Meta’s valuation on a price to FCF methodology, it’s astonishing what has occurred, and quite frankly, it’s outrageous. Putting market and investor sentiment aside, the numbers are the numbers, as $1 of revenue and $1 of Free Cash flow [FCF] equals $1 of revenue and $1 of FCF regardless of the company’s name or sector it does business in. With every investment an investor makes, they are paying the present value for a company’s current and future cash flow. FCF is often looked at as one of the best measures of profitability as FCF excludes the non-cash expenses of the income statement and includes spending on equipment and assets as well as changes in working capital from the balance sheet. To some investors, FCF is more important to analyze than net income because it’s harder to manipulate as it is a true indication of the company’s cash. FCF is also the pool of capital that companies can utilize to repay debt, pay dividends, buy back shares, make acquisitions, or reinvest in the business. With every share of stock purchased, you’re getting an equity share of the business in return, and your shares represent a portion of the revenue and earnings generated. In my opinion, businesses that generate large amounts of FCF should be rewarded, not discarded.

I am going to compare META’s FCF and FCF multiple to a wide range of companies which include:

- Apple (AAPL)

- Microsoft (MSFT)

- Alphabet (GOOGL)

- Amazon (AMZN)

- AT&T (T)

- Tesla (TSLA)

- Kimberly-Clark (KMB)

- Procter & Gamble (PG)

- The Coca-Cola Company (KO)

- PepsiCo (PEP)

- Verizon (VZ)

- T-Mobile (TMUS)

|

Price to Free Cash Flow |

|||

|

Ticker |

Market Cap |

Total Free Cash Flow |

Price to Free Cash Flow Multiple |

|

AMZN |

$1,089,049,110,544.00 |

-$29,784,000,000.00 |

-36.56 |

|

T |

$107,740,000,000.00 |

$14,000,000,000.00 |

7.70 |

|

META |

$340,673,590,221.00 |

$35,087,000,000.00 |

9.71 |

|

VZ |

$152,870,000,000.00 |

$14,705,000,000.00 |

10.40 |

|

AAPL |

$2,223,870,463,470.00 |

$107,582,000,000.00 |

20.67 |

|

GOOGL |

$1,264,041,822,440.00 |

$60,697,000,000.00 |

20.83 |

|

KMB |

$38,222,208,952.00 |

$1,810,000,000.00 |

21.12 |

|

PG |

$298,378,219,287.00 |

$13,567,000,000.00 |

21.99 |

|

KO |

$237,768,045,460.00 |

$10,242,000,000.00 |

23.22 |

|

MSFT |

$1,704,575,548,752.00 |

$65,149,000,000.00 |

26.16 |

|

PEP |

$234,876,669,519.00 |

$6,338,000,000.00 |

37.06 |

|

TSLA |

$642,330,032,512.00 |

$6,937,000,000.00 |

92.59 |

|

TMUS |

$166,890,000,000.00 |

$1,705,000,000.00 |

97.88 |

META is trading at a price-to-FCF multiple of 9.71x. Putting big tech aside for a moment, PEP trades at 37.06x its FCF, KO trades at 23.22x its FCF, PG trades at 21.99x its FCF, and KMB trades at 21.12x its FCF. PG and KO are both in the top-10 holdings of the SPDR Portfolio S&P 500 Value ETF (SPYV), and considering how low META’s price to FCF is, it’s arguably a better value play than them at these levels. PG has generated $13.57 billion of FCF and has a multiple of 21.99x. There isn’t a scenario imaginable at this point in time as to why META would trade at a lower FCF multiple than PG, or other consumer staple companies, for that matter. The reason I did such a large and diverse group is that I didn’t want to be selective or just show similar companies. META is being treated like AT&T, which is ridiculous, in my opinion. META should trade at a multiple of at least 20x FCF, if not higher. It is unlikely that PG or KO will experience more growth than META over the next 5-10 years, and even less likely that they will produce more FCF or net income over that period. The valuation today is crazy, and I think Mr. Market has drastically mispriced META.

Steven Fiorillo, Seeking Alpha

Conclusion

I have been incorrect the whole way down, and each day META trades at a cheaper valuation. I am continuing to add shares at these levels, as META is trading under 10x its FCF. META could be considered a deep value play at this point as PG and KO are both in SPYV’s top-10 holdings, yet META trades at a fraction of their FCF multiples. I think the market is treating META too harshly, as this is still a company generating tens of billions in FCF and net income. The Metaverse is more likely to succeed than not, and the partnership with MSFT could be just what META needs to add a layer of legitimacy to it. META has $0 in debt and is allocating self-funded capital to build what could become the next phase of computing and gaming. I don’t know how long the negative sentiment will continue, but META is being treated as a profitless tech company, and I think it’s creating an extraordinary opportunity for long-term investors.

Be the first to comment