Michael Burrell/iStock via Getty Images

The dividend aristocrats are some of the most trusted blue-chips on Wall Street, and for good reason.

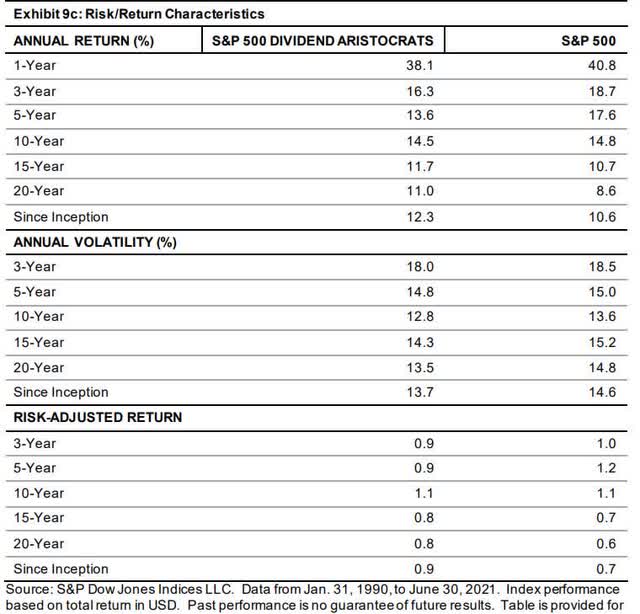

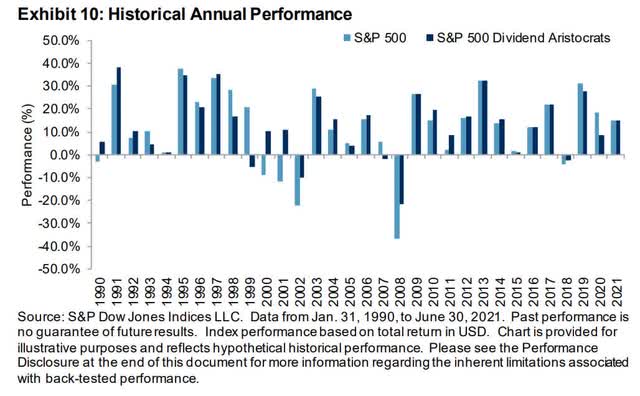

Since 1990 the aristocrats have delivered 12.3% annual returns, outperforming the S&P by 1.7% per year and with 7% lower annual volatility and 31% better volatility-adjusted returns.

- 41X total return since 1990

- 18X inflation-adjusted return

- 70% more inflation-adjusted wealth over 31 years

However, what’s especially impressive is that when the market takes a tumble, the aristocrats tend to fall much less, especially during the tech crash and great recession.

This shouldn’t be a surprise since aristocrats tend to be very stable and well-run companies. Their shareholders are long-term focused and less likely to panic sell than those in high-flying speculative companies.

The aristocrats include 65 of the world’s most famous companies, such time-tested giants as Johnson & Johnson (JNJ), PepsiCo (PEP), and 3M (MMM).

The official aristocrats must be in the S&P 500, meaning large-cap US companies. But there are 135 dividend champions, which include foreign aristocrats and small to medium-sized companies, each with 25+ year dividend growth streaks.

These include many wonderful, faster-growing companies, the dividend aristocrats of tomorrow.

So let me show you why SEI Investments (SEIC) and Pentair (PNR) are two hidden gem future aristocrat bargains that could be just what you are looking for in today’s turbulent market.

SEI Investments: One Of The First Fintechs In History

What SEI Does

SEI Investments provides investment processing, management, and operations services to financial institutions, asset managers, asset owners, and financial advisors in four material segments: private banks, investment advisors, institutional investors, and investment managers. SEI also has a minority interest in LSV Asset Management, a value equity asset manager with about $99 billion in assets under management. As of Dec. 21, SEI (including LSV) manages, administers, or advises on over $1.3 trillion in assets.” – Morningstar

Further Research (Comprehensive Look At The Investment Thesis, Growth Outlook, Risk Profile, and Valuation And Total Return Potential)

Reasons To Potentially Buy SEIC Today

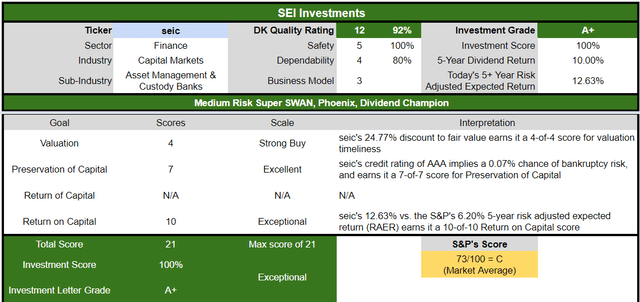

- 92% quality medium-risk 12/13 Super SWAN (sleep well at night) dividend champion

- the 65th highest quality company on the Master List (87th percentile)

- 100% dividend safety score

- 31-year dividend growth streak

- 1.5% very safe yield

- 0.5% average recession dividend cut risk

- 1.0% severe recession dividend cut risk

- 25% historically undervalued (potential strong buy)

- Fair Value: $72.78

- 14.8X forward earnings vs. 20.5X to 21.5X historical

- 10.9X cash-adjusted earnings = 0.91 PEG

- Effective AAA credit rating (No debt and $803 million in cash) = 0.07% 30-year bankruptcy risk

- 57th industry percentile risk management consensus = above-average, bordering on good

- 10% to 14% CAGR margin-of-error growth consensus range

- 12.0% CAGR median growth consensus

- 5-year consensus total return potential: 14% to 18% CAGR

- base-case 5-year consensus return potential: 17% CAGR (3X more than the S&P consensus)

- consensus 12-month total return forecast: 38%

- Fundamentally Justified 12-Month Returns: 73% CAGR

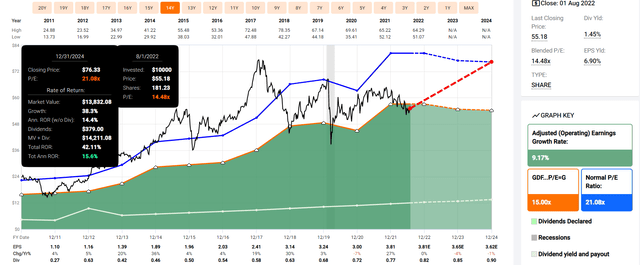

SEIC 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

SEIC is undergoing a modest turnaround effort which is why growth is expected to flatline through 2024. However, analysts are confident that the new CEO has what it takes to restore this future aristocrat to its historical 12% growth rate.

And while you wait, you have the opportunity for some very attractive 16% annual returns.

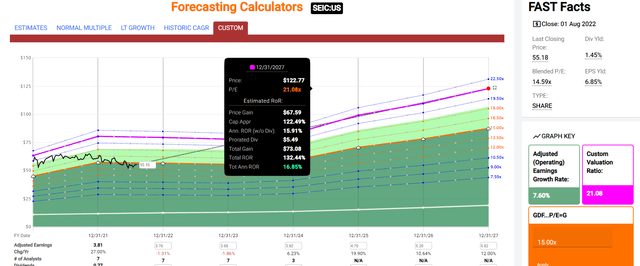

SEIC 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

17% potential annual returns are on offer from SEIC, which trades at a 25% historical discount.

Now compare that to the S&P 500.

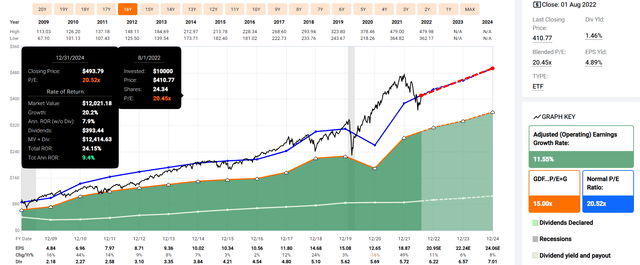

S&P 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

Analysts expect about 9% annual returns from the market in the coming years.

S&P 500 2027 Consensus Return Potential

| Year | Upside Potential By End of That Year | Consensus CAGR Return Potential By End of That Year | Probability-Weighted Return (Annualized) | Inflation And Risk-Adjusted Expected Returns | Expected Market Return Vs. Historical Inflation-Adjusted Return |

Conservative Years To Double |

| 2027 | 48.12% | 8.17% | 6.13% | 3.97% | 58.38% | 18.14 |

(Source: DK S&P 500 Valuation And Total Return Tool)

And about the same over the next five years.

- SEIC offers 2X the market’s annual returns over the next five years.

And after 5 years?

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return | Long-Term Inflation And Risk-Adjusted Expected Returns | Years To Double Your Inflation & Risk-Adjusted Wealth |

10-Year Inflation And Risk-Adjusted Expected Return |

| SEI Investments Company | 1.5% | 12.0% | 13.5% | 9.5% | 7.0% | 10.3 | 1.96 |

| Dividend Aristocrats | 2.6% | 8.6% | 11.1% | 7.8% | 5.3% | 13.5 | 1.68 |

| S&P 500 | 1.7% | 8.5% | 10.2% | 7.1% | 4.7% | 15.4 | 1.58 |

(Sources: Morningstar, FactSet, YCharts)

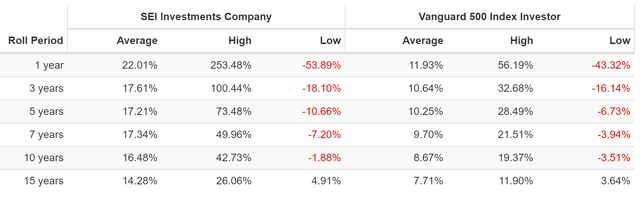

Analysts think SEIC can deliver about 14% long-term returns better than the aristocrats and S&P, consistent with the average 15-year rolling return over the past 32 years.

SEIC Rolling Returns Since 1990

SEIC Investment Decision Score

DK (Source: DK Automated Investment Decision Tool)

SEIC is one of the most reasonable and prudent fast-growing aristocrats on Wall Street for anyone comfortable with its risk profile.

- 25% discount vs. 4% market premium = 29% better valuation

- 35% better consensus long-term return potential

- 2X better risk-adjusted expected return over the next five years

Pentair: One Of The Most Important Companies You’ve Never Heard Of

What PNR Does

Pentair is a global leader in the water treatment industry, with 10,000 employees and a presence in 25 countries…

Pentair is a pure-play water company manufacturing a wide range of sustainable water solutions, including energy-efficient swimming pool pumps, filtration solutions, and commercial and industrial pumps. Pentair’s business is organized into two segments: consumer solutions and industrial and flow technologies.” – Morningstar

Further Research

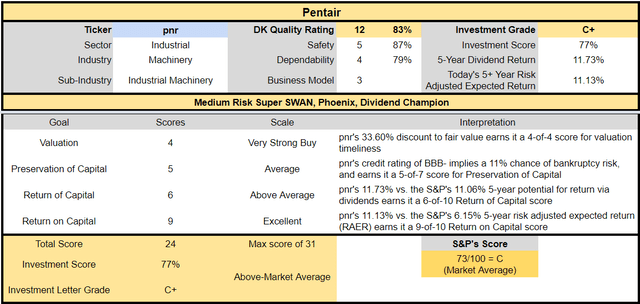

Reasons To Potentially Buy PNR Today

- 83% quality medium-risk 12/13 Super SWAN dividend champion

- the 196th highest quality company on the Master List (61st percentile)

- 87% dividend safety score

- 46-year dividend growth streak

- 1.7% very safe yield

- 0.5% average recession dividend cut risk

- 1.7% severe recession dividend cut risk

- 34% historically undervalued (potential very strong buy)

- Fair Value: $71.39

- 13.1X forward earnings vs. 18X to 20X historical

- 10.5X cash-adjusted earnings = 1.1 PEG vs historical 2.3

- BBB- stable credit rating = 11% 30-year bankruptcy risk

- 56th industry percentile risk management consensus = above-average,

- 5% to 12% CAGR margin-of-error growth consensus range

- 9.6% CAGR median growth consensus Vs. 8.5% S&P 500

- 5-year consensus total return potential: 10% to 16% CAGR

- base-case 5-year consensus return potential: 21% CAGR (4X more than the S&P consensus)

- consensus 12-month total return forecast: 19%

- Fundamentally Justified 12-Month Returns: 48% CAGR

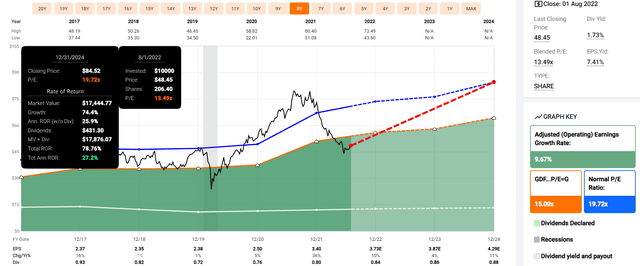

PNR 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

If PNR grows as expected and returns to historical fair value, it could deliver 27% annual returns, outperforming the S&P 500 by about 3X.

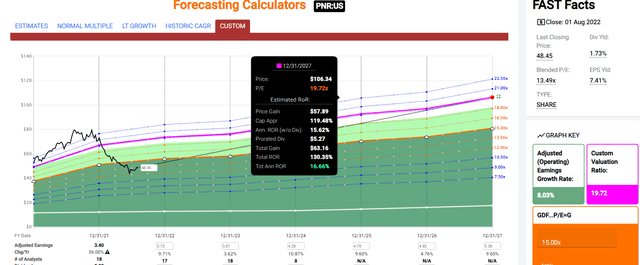

PNR 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

17% potential annual returns are what analysts expect from PNR, which trades at a 32% historical discount.

- about 3X better than the S&P 500

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return | Long-Term Inflation And Risk-Adjusted Expected Returns | Years To Double Your Inflation & Risk-Adjusted Wealth |

10-Year Inflation And Risk-Adjusted Expected Return |

| Pentair | 1.7% | 9.6% | 11.3% | 7.9% | 5.4% | 13.2 | 1.70 |

| Dividend Aristocrats | 2.6% | 8.6% | 11.1% | 7.8% | 5.3% | 13.5 | 1.68 |

| S&P 500 | 1.7% | 8.5% | 10.2% | 7.1% | 4.7% | 15.4 | 1.58 |

(Sources: Morningstar, FactSet, YCharts)

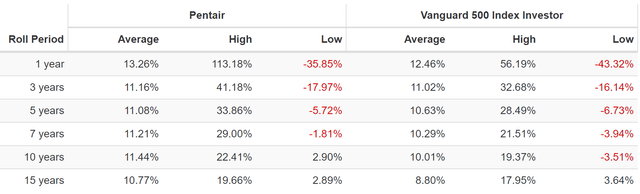

PNR isn’t expected to deliver life-changing returns overnight, but it offers the potential to beat the aristocrats and S&P 500, which can add up over decades.

- 31% more inflation-adjusted wealth than the S&P 500 over 30 years

- and with a much safer and slightly faster-growing dividend

PNR Rolling Returns Since 1985

PNR has been delivering modestly market-beating returns for the last 37 years, and that’s expected to continue thanks to massive growth potential in global water infrastructure investment.

PNR Investment Decision Score

DK Dividend Kings Automated Investment Decision Tool

PNR is a reasonable and prudent undervalued future aristocrat for anyone comfortable with its risk profile.

- 34% discount vs. 4% market premium = 39% better valuation

- 10% better consensus long-term return potential

- 2X better risk-adjusted expected return over the next five years

Bottom Line: Buy These Future Aristocrats Before Everyone Else Does

There are many different roads to a prosperous retirement you can travel.

- deep value aristocrats

- high-yield aristocrats

- fast-growing aristocrats

- future aristocrats

SEIC and PNR represent two hidden gem aristocrats that are likely to eventually make the official list, thanks to their growth rates being higher than the broader markets.

That will put them on the radar of more investors and attract fund inflows from NOBL.

The wonderful thing about aristocrat investing is that it involves relatively low fundamental risk because these are some of the world’s best managed and often boring businesses.

But you don’t need exciting businesses to do well on Wall Street, as the aristocrats’ 18X inflation-adjusted returns since 1990 showcase.

In turbulent economic times, with a recession potentially arriving in early 2023, stable businesses with good balance sheets, trustworthy management, and sound long-term risk-management are often the most reasonable choices.

That’s what SEIC and PNR offer today, for anyone who is willing to look beyond the short-term pain of this bear market and remember one of the most important truths of Wall Street.

Fortunes are made by buying right and holding on.” – Tom Phelps

Be the first to comment