Joe Raedle

Can Disastrous Q2 create an Opportunity?

Last quarter, Stanley Black & Decker, Inc. (NYSE:SWK) plunged 16% after reporting disastrous Q2 earnings, missing revenue estimates by 8%, and seeing its profits plunge 80%. Since the initial gap down, the stock has fallen another 22% for a total of 60% since its ATH in January.

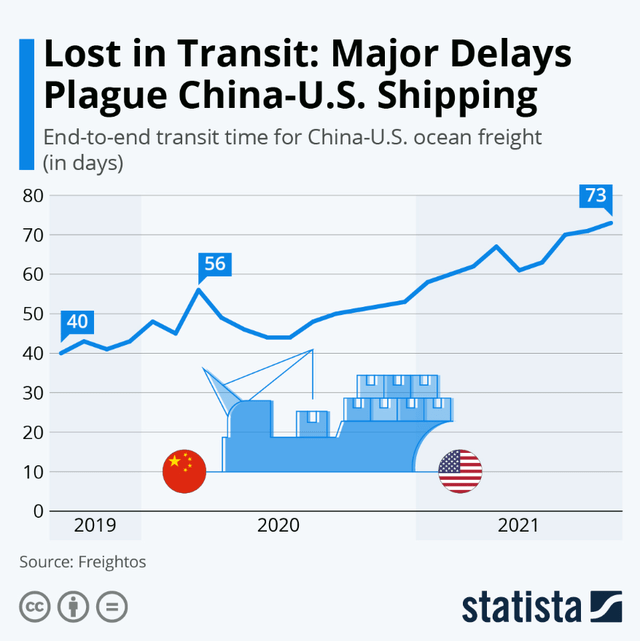

Like many other companies, SWK’s supply chain was disrupted by the significant delays in the Chinese ocean freight. SWK manufactures most of its products in China and imports them back into the U.S. and EMEA. Because of the uncertainty of when the product will arrive, they ordered as much as possible, assuming the consumer would stay strong.

Throughout this article, I’ll primarily refer to Stanley Black & Decker as its ticker, SWK.

China container shipment delays (Statista)

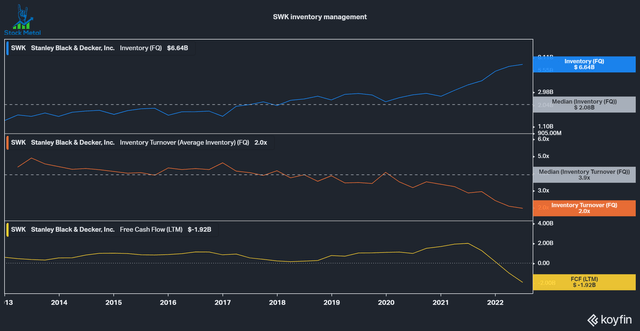

As a result of this over-ordering of inventory, SWK saw an extreme jump from $6.64 billion, over three times above its 10-year median and over twice as much as its 3-year median ($2.8b). As a result of that Inventory turnover, the number of times the company can sell its inventory within a year declined from its median of 3.9x to just 2.0x. Free cash flows also declined from $2 billion to Free cash outflows of $2 billion!

SWK inventory management (Koyfin)

Cost cutting

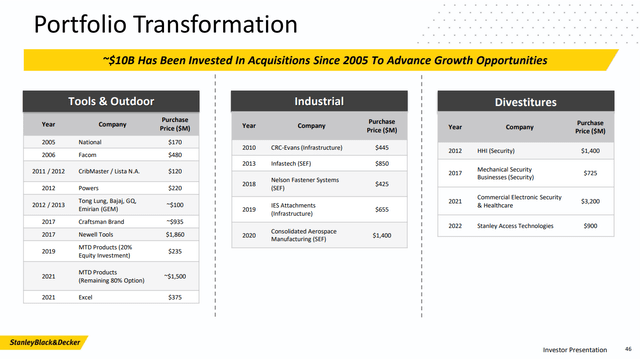

As a result of the extreme increase situation, SWK announced an aggressive plan to reduce cumulative costs of $2 billion within the next three years (Slide 7). $0.5 billion are expected to come out of SG&A and $1.5 billion out of the supply chain. I see both of these areas of fat to trim as a result of an M&A strategy and continuous portfolio transformation without proper integration. In the last 17 years, SWK spent over $10 billion to acquire new segments and divested businesses for a total of $6.225 billion. These acquisitions led to a bloated corporate structure and an unoptimized supply chain with lots of outsourced manufacturing in China. Outsourcing to China is becoming more of a liability in recent years, with tensions between the U.S. and China rising, for example, seen by the recent restrictions on semiconductor exports from U.S. firms to China.

SWK Portfolio Transformation (SWK Investor Day)

These cost-cutting initiatives are great and I applaud management for announcing them, but I’m asking myself why just now? Did they somehow just now realize that there are massive inefficiencies in the business? This could have been a continuous learning and optimization process for the firm. It makes management look like they do not have a good focus on one goal.

The supply chain transformation plan has four different tasks:

- Product Platforming ($300m saving potential) – Reduce SKUs by 40% to eliminate competing products and bad-selling SKUs.

- Strategic Sourcing ($500m saving potential) – Consolidate and localize the supply chain.

- Facility Consolidation ($300m saving potential) – Reduce its 120 facilities by 30%.

- Operational Excellence ($400m saving potential) – Optimize production and inventory management.

All of these tasks must have been visible to management beforehand.

Past Capital Allocation

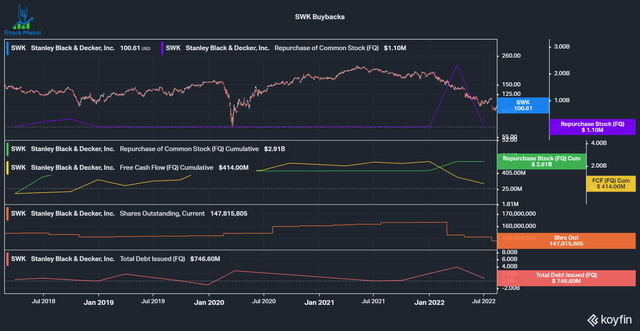

Capital allocation is one of the most critical decisions a management team makes. The capital allocation framework for SWK is pretty simple: use 1/2 of earnings for M&A into brands growing 2-3x as fast as the market with a 35% gross margin within a few years and 100%+ cash conversion. The other 1/2 of earnings are returned to shareholders via a growing dividend at a 30-35% payout ratio and the remaining cash is returned via buybacks. Sounds good on paper, but we already talked about the M&A strategy, which probably bloated up corporate and production structures and could be questioned. Let’s look at buybacks now: over the last five years, SWK has been pretty silent about buybacks, up until Q1 2022, when they repurchased $2.3 billion worth of stock right before announcing a $4 billion increase in inventories and seeing profits decline 80%. Now that the stock has been hammered (pun intended) down, the buybacks stopped. This is a very questionable use of Capital. In my opinion, management must have seen the inventory situation and should have been able to expect the market to react to it in the wrong way. SWK has been taking on a lot of new debt, over $4 billion in the last two quarters, roughly equaling the cash outflows.

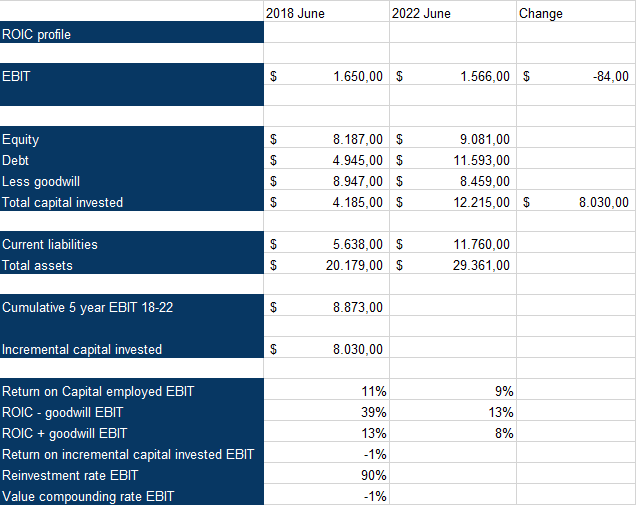

Now let’s look at the various returns on Capital for the business. I usually calculate them for both free cash flow (“FCF”) and EBIT, but in this case, I just stuck to EBIT due to the negative FCF. Most people calculate ROIC with the net income or NOPAT, but I prefer to stick to EBIT and FCF.

Return on Capital employed declined from 11% to 9% compared to 2018. A similar picture can be seen in Return on Invested Capital, dropping from 13% to 8%. The cost of Capital for SWK is also 8%, according to gurufocus. As a rule of thumb, we want to have an excess ROIC of at least 2% compared to the cost of Capital, which is not the case here.

Now let’s look at the reinvestment rate and the Return on incremental invested Capital(ROIIC). Over the last five years, invested Capital increased 3x, driven almost exclusively by rising debt levels. On the other hand, EBIT stagnated, resulting in a hefty 90% reinvestment rate(due to the debt being invested into the company) with a negative 1% ROIIC. This is not great to see and indicates that capital allocation is not working great for SWK.

SWK ROC profile (Authors Model)

Valuation

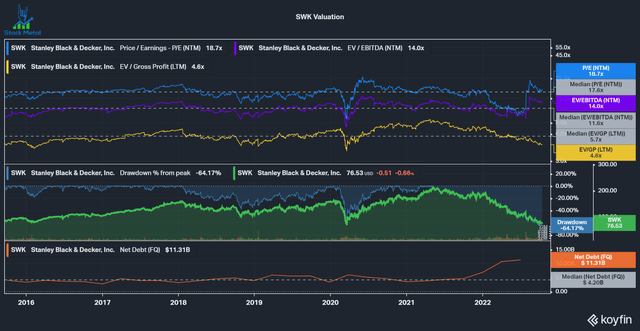

Looking at historical valuation metrics, the stock doesn’t even look that cheap, even after a decline of 64% from its highs, still trading around or even above its median due to the rising debt levels and plunging profits. This is a turnaround story, and if management can get back to Free cash flows of $1.5 billion in the next year or even increase that to $2 billion with the cost-saving initiatives, then this stock is at a decent value versus its enterprise value of $23.25 billion. That would leave us with an FCF yield between 6.5% and 8.6%.

Conclusion

Stanley Black & Decker is a turnaround play, with debt exploding and cash flows collapsing. The company has a lot of initiatives that sound good on paper to turn the ship around, but the track record of management for the last five years does not instill confidence in me. Although the Altman Z-Score of 1.89 is alarming, I do not see a significant risk of the company heading for bankruptcy, and a lot of the downside has already been taken out of the stock. That’s why I’m putting a hold rating on Stanley Black & Decker.

Be the first to comment