Kameleon007

Yesterday the bulls regained the ground lost on Friday with another enormous rally in the major market averages. The United Kingdom’s new finance minister completely reversed the initial budget proposals that sent the country’s bond yields soaring and the British pound plunging. The move returned stability to that market and weakened the U.S. dollar index. A weaker dollar fueled the stocks of U.S. multinationals that have seen profits take a hit from this year’s dollar strength. Investors were also impressed with better-than-expected earnings from the banking sector, with Bank of America being the latest to beat on the top and bottom lines yesterday. It is starting to feel like the year-end rally has begun.

Finviz

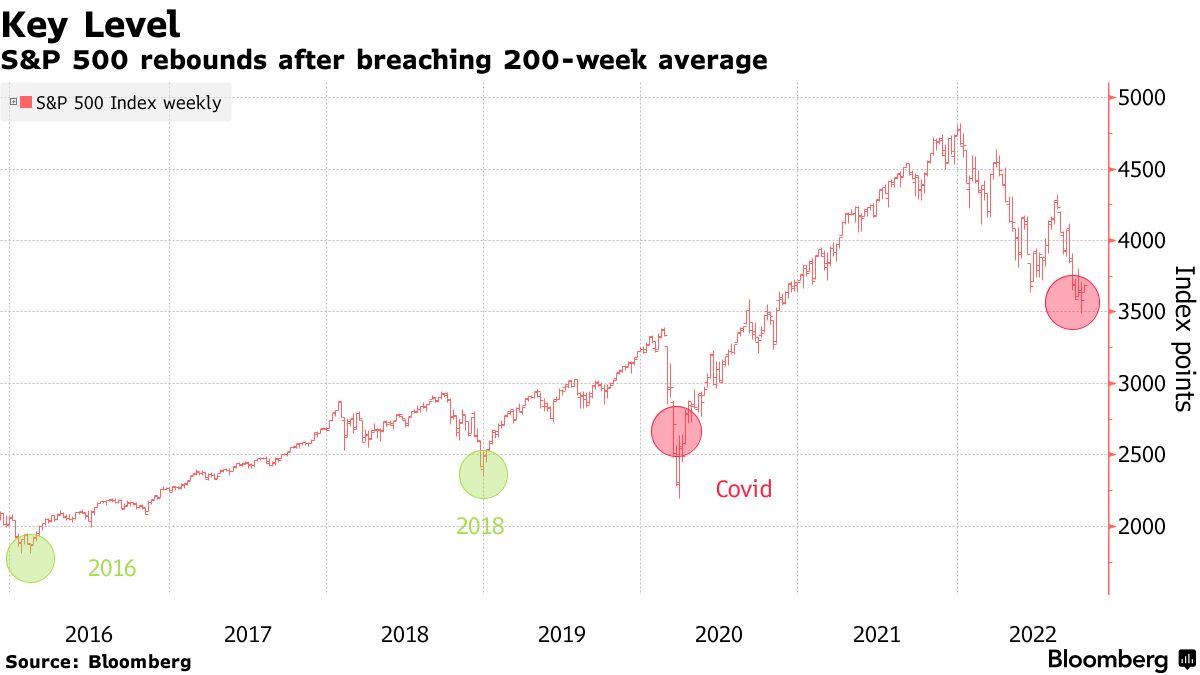

Regardless, the drumbeat of forecasts for a recession grows louder by the day with two economists at Bloomberg raising the probability from 65% to 100% over the coming 12 months. Their model of 13 macroeconomic and financial indicators has deteriorated in recent weeks due to tightening financial conditions, still elevated levels of inflation, and expectations for more rate hikes from the Federal Reserve. Yet bear markets do not always come with recessions, and I think this one will be another exception rather than the rule.

Bloomberg

It makes sense to assume a recession is on the horizon, considering that more than 70% of bear markets have been accompanied by one. The stock market typically discounts economic events, which suggests the S&P 500’s 25% decline over the past 10 months is telling us that a contraction in economic activity is in front of us. The most ardent of bears will say that we already had a recession during the first half of this year, but the official decision maker on that front is very unlikely to call that technical contraction a recession. I think the National Bureau of Economic Research will conclude that we did not see the slowdown in employment, real income, industrial production, or retail sales that defines a recession. Therefore, the expansion continues.

There are still very few indications of a pending contraction in economic activity. To the contrary, Citigroup’s credit card delinquency rate in September was a mere 0.85%, which is nearly half of what it was before the pandemic in September of 2019 at 1.52%. Its charge-off rate of 1.12% was down from 2.61% over the same time frame. This is another indication of the strength of consumer balance sheets. Inflation is taking a huge bite out of consumer purchasing power, but wage gains and surplus savings are helping consumer spending stay in positive territory on an inflation-adjusted basis. Lower rates of inflation in the months ahead should result in higher rates of real growth.

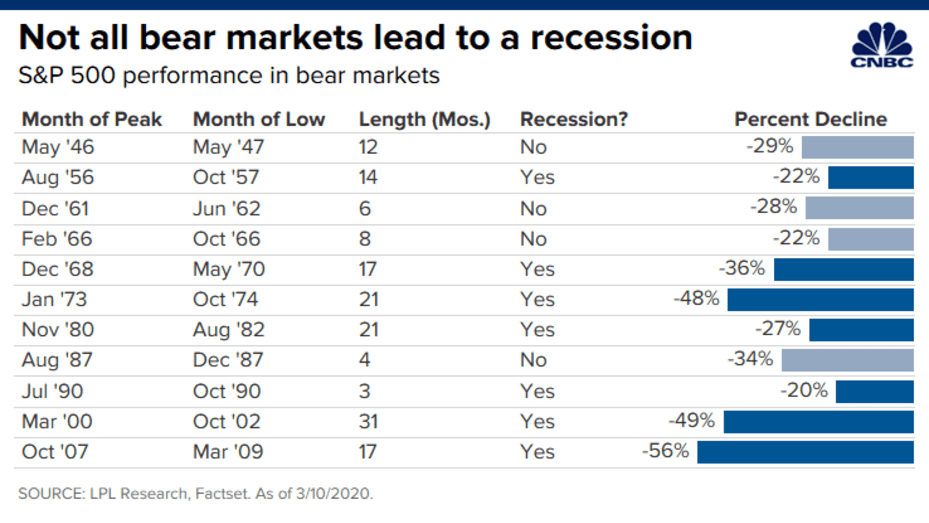

Furthermore, recessions occur to extinguish the excesses built up in the real economy during expansions, but the current expansion at a little more than two-years young is not seeing a lot of excess. The primary excess was the one built up in financial markets, which has been largely irradicated. This is why I think this year’s bear market will not take the economy with it.

CNBC

This is an important distinction, because when bear markets are accompanied by a recession, the decline in the S&P 500 tends to be deeper and last longer. Note that the past four recession-less bears lasted between 4-12 months with an average decline of approximately 26%. That’s in line with this year’s decline of 25% over the past 10 months. It strengthens my resolve that the worst is behind us and that the broad market will outperform in the coming 6-12 months.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment