Pgiam/iStock via Getty Images

Investing Thesis

As outlined in the above bullet points, well-informed professional coming price-change expectations are regularly suggested by behavioral actions of capital-intensive activities in derivatives markets of futures, options, swaps, and other financial devices.

Today’s Developments

Regular daily comparisons of the Dow Jones 30 stocks with one another today took on an unusually appealing appearance for coming stock prices, quite different from recent conditions.

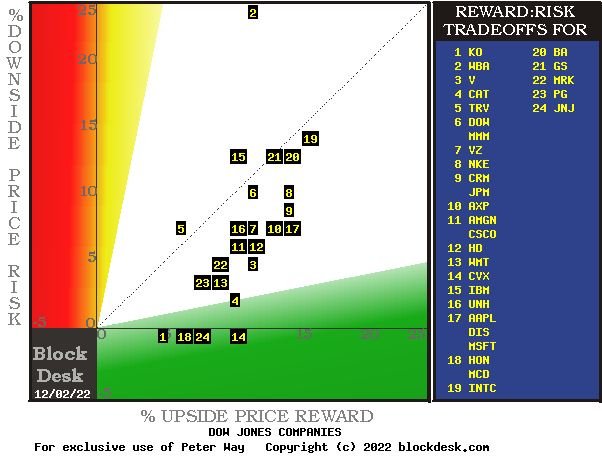

Here is their Reward-Risk tradeoff picture:

blockdesk.com

(used with permission)

This is unusual because of the low-risk emphasis of most DJ stock components, particularly those five down at the zero-risk level of the green horizontal scale line. They mostly now are at forecast proportions of near-term price declines relative to forecast price increases not experienced in the last 3-5 years.

This picture is of possible price changes seen likely enough in the next 3-5 months to warrant Market-Maker purchases of hedging price protections for their at-risk capital while big-volume trades in these issues are being negotiated on a daily basis.

Issues above the dotted diagonal line are being seen to have price decline exposures greater than coming price increase expectations.

Conclusion

Apparently, the informed and highly-motivated major participant owners of these 30 stocks have quite different notions of what price changes are likely in the next few months than do those most likely to be influencing the trumpeted opinions of wide-spreading public information media.

Be the first to comment