iLexx/iStock via Getty Images

A Quick Take On Graphex Group

Graphex Group Limited (GRFX) has filed to raise $8.0 million in gross proceeds from the sale of American Depositary Shares representing underlying common stock in an IPO, according to an amended registration statement.

The company sells graphene products that are used in lithium-ion batteries for a variety of growing markets.

Given the firm’s contracting topline revenue, worsening operating losses and ongoing regulatory uncertainty, I’m on Hold for the GRFX IPO, although day traders may see opportunity in a potentially highly volatile stock.

Graphex Overview

Hong Kong, PRC-based Graphex was founded to develop graphene products for use in lithium-ion batteries, especially for electric vehicle and clean energy storage applications.

Management is headed by Chief Executive Officer Andross Yick Yan Chan, who has been with the firm since January 1991 and was previously a director of Earth Asia Limited.

The company’s primary offerings include:

-

Spherical graphite

-

High-purity graphite

-

Micronized graphite

Graphex has booked fair market value investment of $53 million as of June 30, 2021 from investors including various individuals.

Graphex – Customer Acquisition

The firm derives most of its revenue from spherical graphite sales in the PRC and Hong Kong.

GRFX’ current facilities have a production capacity of about 10,000 metric tons of graphene products per year.

Selling and Marketing expenses as a percentage of total revenue dropped as revenues have decreased, as the figures below indicate:

|

Selling & Marketing |

Expenses vs. Revenue |

|

Period |

Percentage |

|

2021 |

2.6% |

|

2020 |

3.6% |

(Source)

The Selling and Marketing efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling and Marketing spend, fell to negative (0.3x) in the most recent reporting period. (Source)

Graphex’ Market & Competition

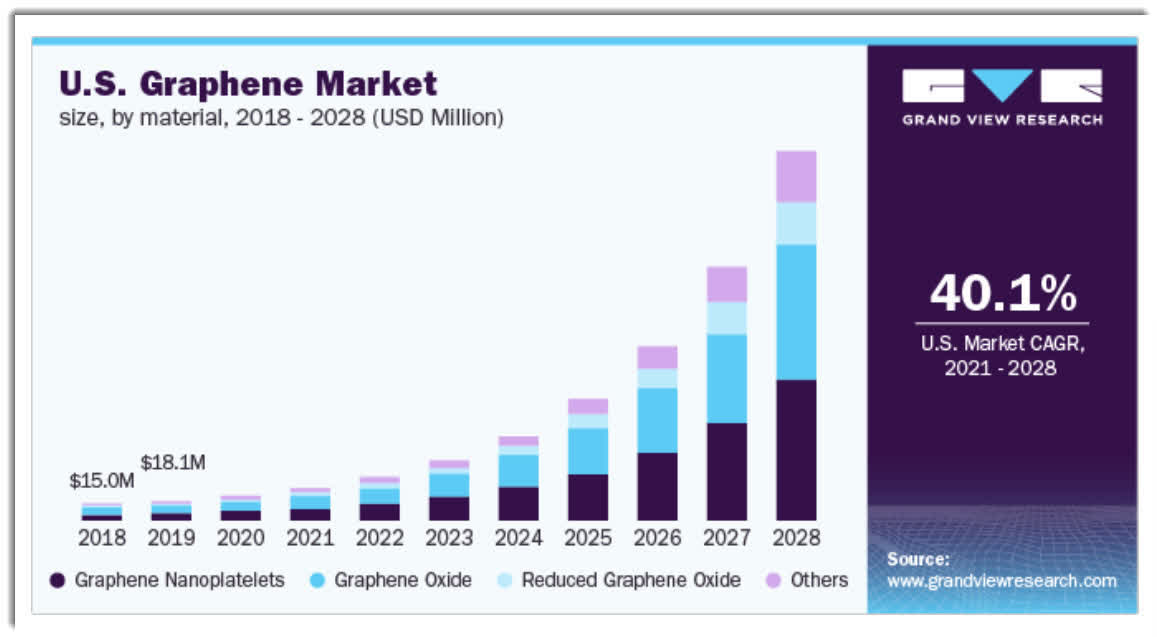

According to a 2021 market research report by Grand View Research, the global graphene market was an estimated $94.4 million in 2020 and is forecast to reach $1.67 billion by 2028.

This represents a forecast CAGR of 43.2% from 2021 to 2028.

The main drivers for this expected growth are increasing demand for such products in a wide variety of industries including, biomedical, composites and coatings, electronics, water & wastewater treatment and energy storage.

Also, below is a chart showing the historical and projected future growth trajectory of the U.S. graphene market:

U.S. Graphene Market (Grand View Research)

(Source)

Major competitive or other industry participants include:

-

Angstron Materials, Inc.

-

ACS Material, LLC

-

BGT Materials Ltd.

-

CVD Equipment Corp.

-

Grafoid Inc.

-

Graphenea

-

Graphene NanoChem

-

NanoXplore, Inc.

-

G6 Materials Corp.

-

XGSciences

-

Thomas Swan & Co. Ltd.

-

2D Carbon Graphene Material Co., Ltd.

-

Haydale Graphene Industries plc

-

Applied Graphene Materials (OTCQX:APGMF)

Graphex Group Limited Financial Performance

The company’s recent financial results can be summarized as follows:

-

Contracting topline revenue

-

Lowered gross profit and decreasing gross margin

-

Increasing operating losses

-

A swing to cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

2021 |

$ 50,133,000 |

-0.8% |

|

2020 |

$ 50,550,760 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

2021 |

$ 19,019,000 |

-6.8% |

|

2020 |

$ 20,412,340 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

2021 |

37.94% |

|

|

2020 |

40.38% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

2021 |

$ (9,749,000) |

-19.4% |

|

2020 |

$ (8,810,620) |

-17.4% |

|

Comprehensive Income (Loss) |

||

|

Period |

Comprehensive Income (Loss) |

Net Margin |

|

2021 |

$ (13,792,000) |

-27.5% |

|

2020 |

$ (7,093,710) |

-14.1% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

2021 |

$ (3,729,000) |

|

|

2020 |

$ 798,200 |

|

(Source)

As of December 31, 2021, Graphex had $3.9 million in cash and $120.3 million in total liabilities.

Free cash flow during the twelve months ended December 31, 2021, was negative ($3.8 million).

Graphex IPO Details

GRFX intends to sell 3.2 million ADSs representing underlying common stock at a proposed midpoint price of $2.50 per ADS for gross proceeds of approximately $8.0 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest to purchase shares at the IPO price.

The firm’s stock is currently quoted on the OTCQX market under the symbol “GRFXY.”

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $64.1 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 10.57%. A figure under 10% is generally considered a “low float” stock which can be subject to significant price volatility.

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

We plan to use approximately US$3.3 million of the proceeds for improvement and expansion of production facility(ies) for our Graphene Products Business.

We plan to use approximately US$3 million of the proceeds for repayment of short-term indebtedness to reduce our financing costs, which indebtedness will be determined by GGL prior to the pricing of this offering and disclosed in an amendment to this prospectus.

The remaining amount of the proceeds of this offering will be applied for working capital and general corporate purposes.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is not the subject of material legal claims, although it is pursuing claims related to the acquisition of an equity interest in the Suzhou Industrial Park Wenlvge Hotel Management Company Limited.

The sole listed bookrunner of the IPO is EF Hutton.

Valuation Metrics For Graphex

Below is a table of the firm’s relevant capitalization and valuation metrics at IPO, excluding the effects of underwriter options:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$75,673,269 |

|

Enterprise Value |

$64,118,739 |

|

Price / Sales |

1.51 |

|

EV / Revenue |

1.28 |

|

EV / EBITDA |

-6.58 |

|

Earnings Per Share |

-$0.45 |

|

Operating Margin |

-19.45% |

|

Net Margin |

-27.51% |

|

Float To Outstanding Shares Ratio |

10.57% |

|

Proposed IPO Midpoint Price per Share |

$2.50 |

|

Net Free Cash Flow |

-$3,828,000 |

|

Free Cash Flow Yield Per Share |

-5.06% |

|

Debt / EBITDA Multiple |

0.00 |

|

CapEx Ratio |

-37.67 |

|

Revenue Growth Rate |

-0.83% |

(Source – SEC)

Commentary About Graphex

Graphex is seeking U.S. public capital market investment to expand production and pay down debt.

The company’s financials have produced reduced topline revenue, less gross profit and decreasing gross margin, higher operating losses and a swing to cash used in operations.

Free cash flow for the twelve months ended December 31, 2021, was negative ($3.8 million).

Selling and Marketing expenses as a percentage of total revenue have dropped as revenue has decreased slightly and its Selling and Marketing efficiency multiple was negative (0.3x) in the most recent reporting period.

The firm currently plans to pay no dividends on its capital stock and “is subject to restrictions on its ability to pay dividends.”

The market opportunity for graphene products is expected to grow at a high rate of growth as the lithium-ion battery market is forecast to grow markedly in the coming years.

Like other firms with Chinese operations seeking to tap U.S. markets, the firm operates within a WFOE structure or Wholly Foreign Owned Entity. U.S. investors would only have an interest in an offshore firm with interests in operating subsidiaries, many of which are located in the PRC. Additionally, restrictions on the transfer of funds between subsidiaries within China may exist.

The recent Chinese government crackdown on IPO company candidates combined with added reporting and disclosure requirements from the U.S. has put a serious damper on Chinese or related IPOs resulting in generally poor post-IPO performance.

Prospective investors would be well advised to consider the potential implications of specific laws regarding earnings repatriation and changing or unpredictable Chinese regulatory rulings that may affect such companies and U.S. stock listings.

EF Hutton is the sole underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (66.4%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

An important risk to the company’s outlook is the uncertain regulatory environment for technology companies in China.

Since Graphex operates in a potentially sensitive technology area, the firm may become subject to regulatory changes with little advance notice and shareholders should assume they are at high risk for potential volatility in the stock as a result.

The stock also will have a low float, which can further exacerbate volatility.

Additionally, the nominal IPO price of $2.50 per share at the midpoint means that day trading and retail persons may create intense volatility for the stock in the minutes and hours after trading starts.

Given the firm’s contracting revenue, worsening operating losses and regulatory uncertainty, I’m on Hold for the GRFX IPO, although day traders may see opportunity in a potentially highly volatile stock.

Expected IPO Pricing Date: To be announced.

Be the first to comment