Andrii Dodonov

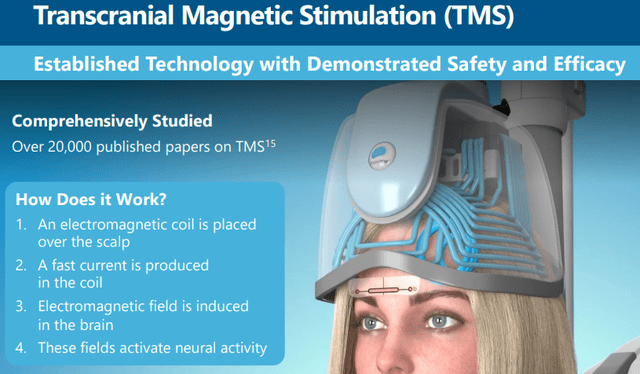

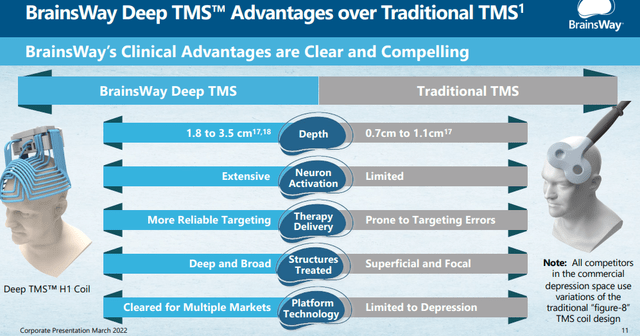

BrainsWay (NASDAQ:BWAY) has interesting technology called TMS or transcranial magnetic stimulation, which has been shown to be helpful in the treatment of a number of conditions and is already FDA approved for several of these.

The company has a more sophisticated and efficient device compared to the competition and this enables it to rapidly scale revenues. Given that the company still has a lot of cash, for now, it is prioritizing growth over profits.

Growth opportunities are plentiful still in already approved treatments both in the US and abroad, but there are a host of additional conditions that are likely to receive FDA approval, significantly increasing the company’s TAM.

Roughly half of the company’s revenue comes from high-margin recurring revenue and the company enjoyed a 78% gross margin in 2021.

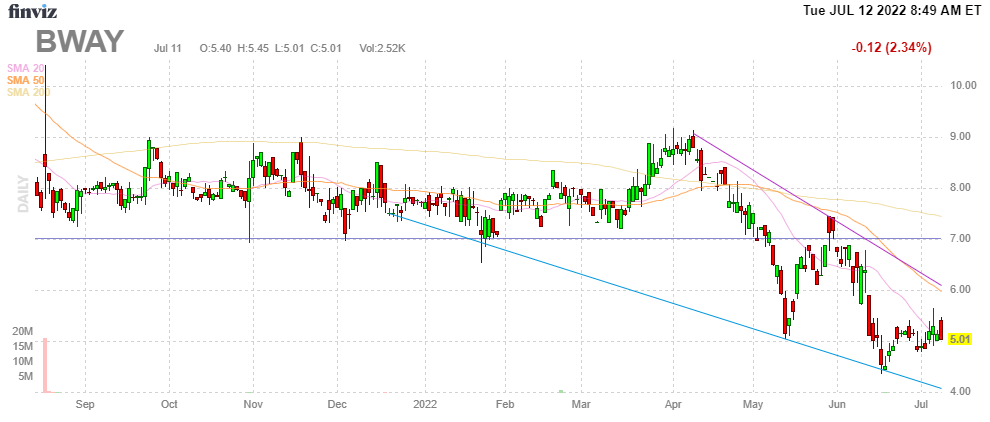

FinViz

The TMS technology

From the March 2022 IR presentation:

There are several different coils for different indications

BWAY 10-K

There are multiple advantages of the therapy:

- Non-invasive

- No anesthesia required

- Well tolerated

- 3-20-minute sessions

- Easy to administer

There are a lot more of these slides in the linked IR presentation that explain the workings further, as well as the treatment and cost-effectiveness and the advantages over the competition:

Business model

- Sales

- Fixed-fee lease

- Risk share

The last two models generate a recurring revenue stream. Since OCD and smoking cessation are only offered in the risk share or fixed lease models, recurring revenues are set to rise as a percentage of revenue.

Growth

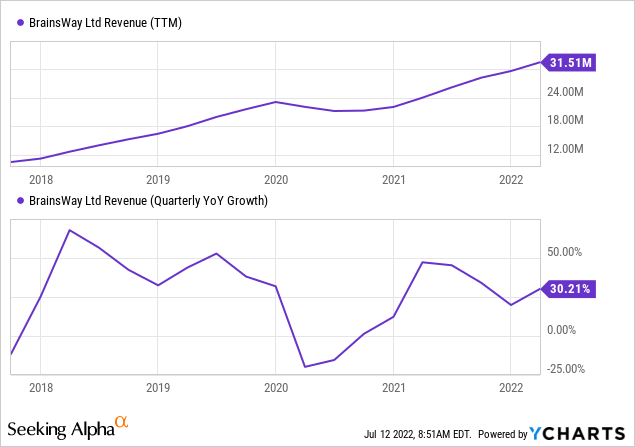

There is a steady 30%+ or so revenue growth that was interrupted by the pandemic:

The main growth vectors are:

- Additional customers

- Additional reimbursement

- Additional applications

- International expansion

Applications

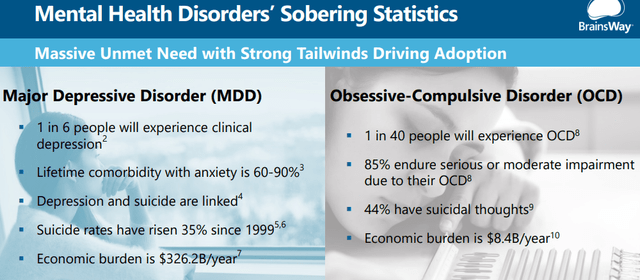

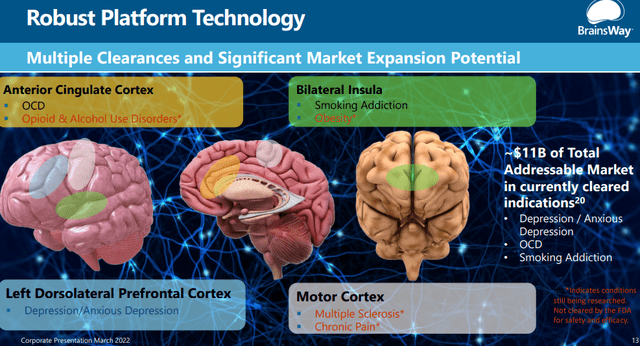

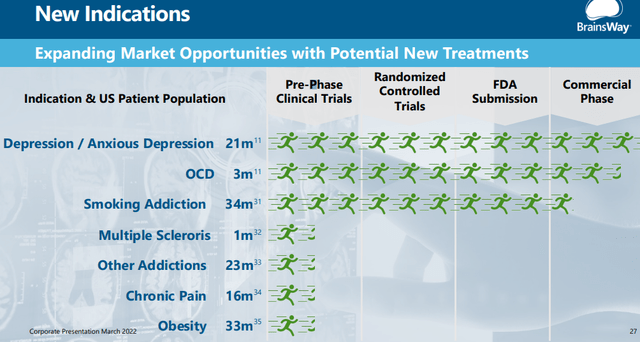

The company’s TMS technology is approved for three types of disorders:

- MDD major depressive disorder (2013), including 3-minute Theta Burst protocol (2021).

- OCD obsessive-compulsive disorder (2018)

- Smoking addiction (2020)

- Anxious depression (2021), although this is usually subsumed under MDD

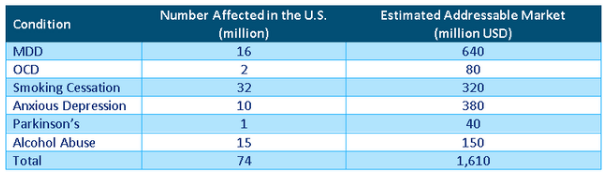

These are large markets:

And the TAM from the already approved treatments is very large, $11B:

Progress in getting more of the TAM is dependent on several dimensions:

- Education, marketing, and sales

- Reimbursement

- Competition

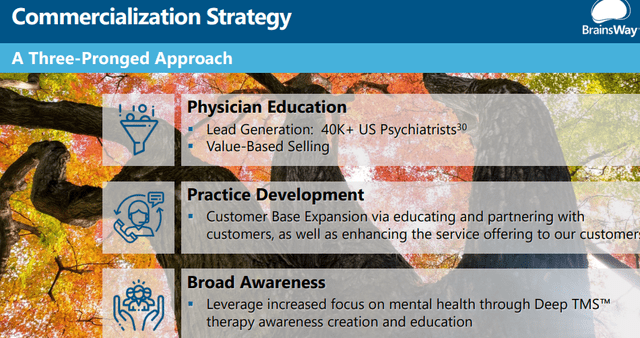

Education and market awareness

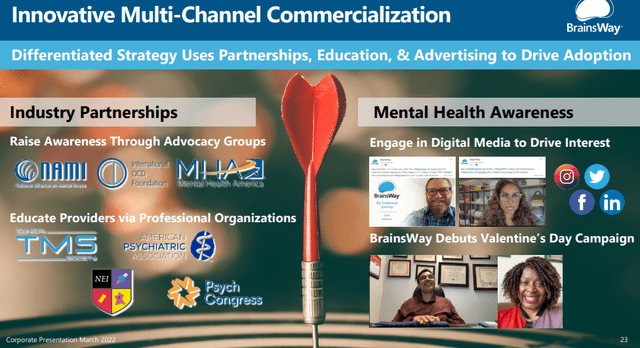

Before one can sell relatively new medical devices one has to educate the market and convince potential adopters of the advantages. The company does this with the help of a multi-pronged approach:

Market awareness is increased through Industry partnerships with advocacy groups and professional organizations, as well as digital marketing campaigns:

Its organic web traffic increased 46% in Q1 and they apply an innovative web chatbot H-Coil which logged nearly 50 sales meetings with clinics and 1200 engagements with interested parties, 20% of which led to further inquiries. Management will also increase its use of social media and participate in medical conferences on-site and online.

Marketing and sales

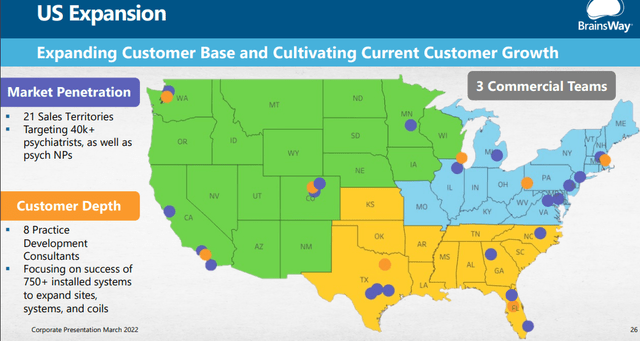

- The company hired the experienced Eric Hirt as their new Vice President of Sales

- The company is building out the sales infrastructure by going from two regions with 18 territory sales managers to three regions with 21 territory sales managers.

- They have 8 Practice development consultants and 11 field clinical engineers supporting their 21 territory sales managers.

Reimbursement

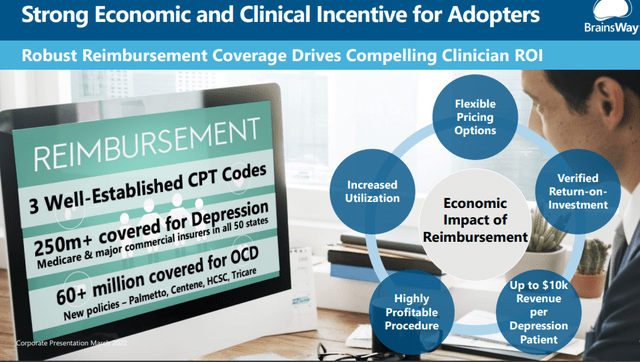

There are already 3 CPT codes for the three approved treatments, but there is still progress to be made for reimbursement. For MDD, already some 6.3M out of 7M treatment-resistant patients are eligible for reimbursement, that is, 90% of the addressable population.

Management believes OCD will achieve a similar ratio, and a significant step was taken at the beginning of Q1 with (PR):

a final Local Coverage Determination (LCD) has been published providing coverage applicable to the BrainsWay Deep TMS™ system for the treatment of obsessive-compulsive disorder (OCD). The final LCD was issued by the Medicare Administrative Contractor (MAC) Palmetto GBA, which covers Medicare patients in Alabama, Georgia, North Carolina, South Carolina, Tennessee, Virginia, and West Virginia, representing over 9 million covered lives.

This brings the total number of lives eligible for OCD reimbursement on the company’s device to roughly 60M. Palmetto also increased the population for reimbursement for depression and anxious depression as it reduced the requirement of four failed medications to so now 60%+ of Medicare patients are eligible.

There was further good news on the reimbursement front from Highmark BCBS (6.8M lives covered) and Israel.

The company is also launching a customer support program in May with respect to reimbursement. Smoking cessation isn’t yet reimbursed and this isn’t guaranteed to arrive anytime soon, or even at all either.

Additional applications

There are more to come:

The one recent approval (apart from anxious depression, which is subsumed under depression) is smoking cessation. Not even mentioned is Parkinson’s disease, despite a first study showing considerable effectiveness, although lacking longer-term follow-up data.

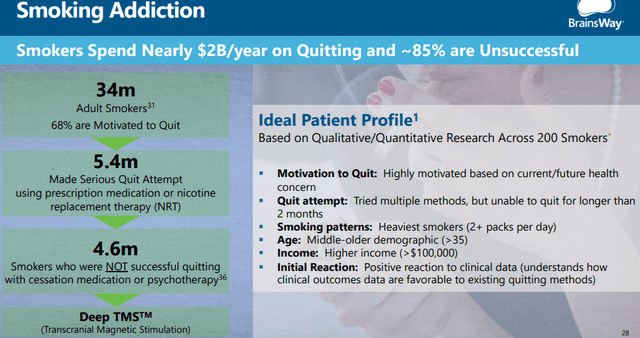

Smoking cessation

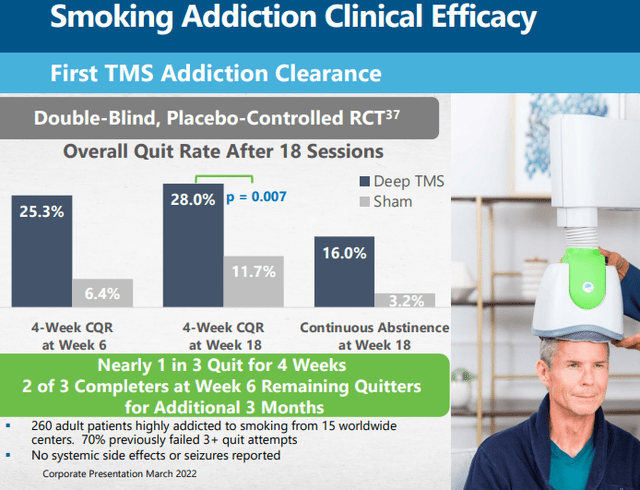

After an initial phase, smoking addiction is now in full market release although much will depend on positive reimbursement decisions for which the company is gathering additional data. There is data available indicating the effectiveness of their TMS interventions:

Widespread reimbursement isn’t guaranteed though as TMS is fairly expensive and in line with other cessation methods like nicotine replacement therapies (especially in combination with behavioral therapy) but it could catch reimbursement for patients who do not respond to alternatives.

Even without reimbursement, there is likely a market for their helmets as there are pay-per-use models that make adoption easier, although the market will be much smaller.

What does this all add up to? SA contributor Richard Durant has produced a useful calculation of the company’s TAM:

Richard Durant calculation

We have to note though that this is much less than what the company argues in its 20-F, take for instance MDD (our emphasis):

approximately 6.3 million or more are currently eligible to receive reimbursement for Deep TMS from either governmental or private insurers. Assuming a course of treatment per patient of 33 treatment sessions and a price paid to us per treatment session of $70 (which is our benchmark price per treatment session), we believe our total annual addressable market opportunity for MDD in the United States is approximately $14.6 billion.

And OCD (our emphasis):

Assuming our emerging OCD coverage ultimately reaches a target of 90% of covered lives (as with MDD), and assuming a course of treatment per patient of 29 treatment sessions and a price paid to us per treatment session of $70 (which is our benchmark price per treatment session), we believe our total addressable market opportunity for OCD in the United States is approximately $2.7 billion.

And smoking cessation, even without reimbursement (our emphasis):

assuming a course of treatment per patient of 18 treatment sessions, and even assuming an average price paid to us per treatment session of $50, we believe our total annual addressable market opportunity for smoking addiction in the United States is approximately between $3.9 and $4.1 billion.

These are of course theoretical maxima, but that is what TAMs are supposed to be, Durant rightly points out that TMS therapy will only appeal to a fraction of these, and then there are other companies offering TMS therapies.

On the other hand, one could argue that population growth and an increase in the incidence of these conditions are likely to add to the TAM, not to mention overseas expansion which they have not even scratched the surface of.

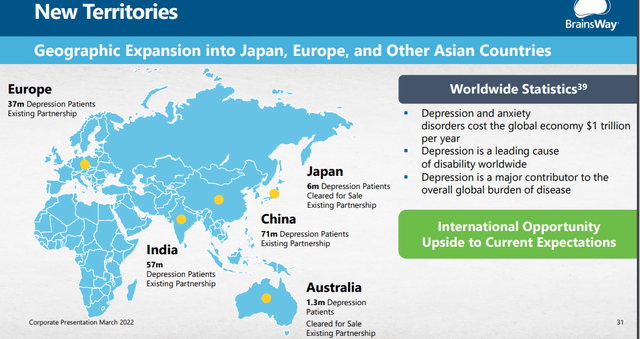

International expansion

They appointed Joe Seidal for overseeing international expansion and they have local partnerships in place, from the 20-F:

We currently have exclusive distribution agreements in various territories, including, notably, Japan, South Korea, Taiwan, Thailand, the Philippines, and the United Arab Emirates. In Israel, we directly provide operations for our customers.

Competition

Competitor Neuronetics (STIM) with its NeuroStar, which was also recently cleared for OCD treatment, filed a complaint against the company in relation to anxious depression treatment. Here is what management had to say about that (Q1CC):

Our depression labeling expansion to include anxious depression followed our submission to the FDA of data from several pivotal studies, as well as other publicly available data. So we look forward to examining the specific factual and legal allegations in Neuronetics complaint and intend to mount a vigorous defense. As to the allegation that Neuronetics effect size was manipulated by presenting an endpoint, representing an incomplete course of therapy. We used the endpoint of four weeks after the start of the treatment, which is in the same as Neuronetics FDA cleared protocol.

Their NeuroStar device received FDA clearance for OCD the day before the Q1CC. Management wasn’t all that impressed (Q1CC):

we’re the only company that’s has Deep TMS and we’re the only Deep TMS company out there that’s received the clearance with pivotal sham controlled data on its own device.

However, there is no doubt this isn’t a positive as a main competitive advantage of BrainsWay’s helmets, the fact that they can be used for several conditions has been eroded by the NeuroStar’s OCD clearance.

As fellow SA contributor Richard Durant noted, more than a quarter of Neuronetics revenue depends on Greenbook. This can be a weakness as well as a strength, but given that Greenbrook bought Check Five, we fear it’s more of the latter as that’s a pretty aggressive expansion.

Financials

Some notable data points:

- Q1 Rev +30% to $8M

- 36 system placements +21% to 790 systems (652 at the end of Q1/21)

- Nearly 45% of these include OCD treatment capability

- Gross profit $6.1M or a gross margin of 77% vs $4.6M/76% Q1/21

- R&D $1.6M vs $925K in Q1/21

- S&M $4.1M vs $3.1M in Q1/21

- G&A $1.9M vs $1.4M in Q1/21

- Operating loss $1.5M vs $801K in Q1/21

- Net loss $2M vs $1.4M in Q1/21

- $54.7M in cash and eq vs $2.7M in Q1/21

- 16.5M ADS outstanding

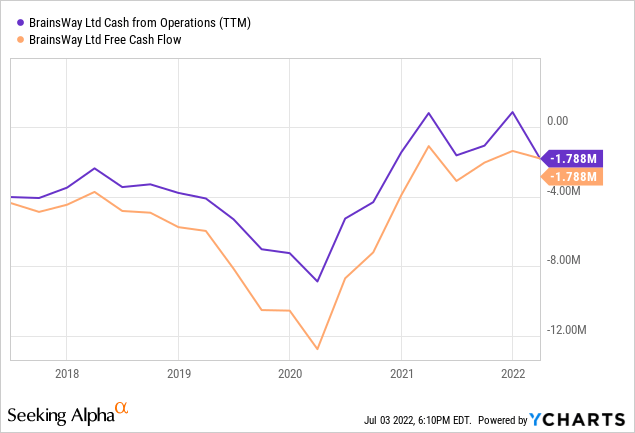

The company is hardly losing any cash and it has plenty ($54.7M) left even for an expansion in domestic and international sales efforts:

Valuation

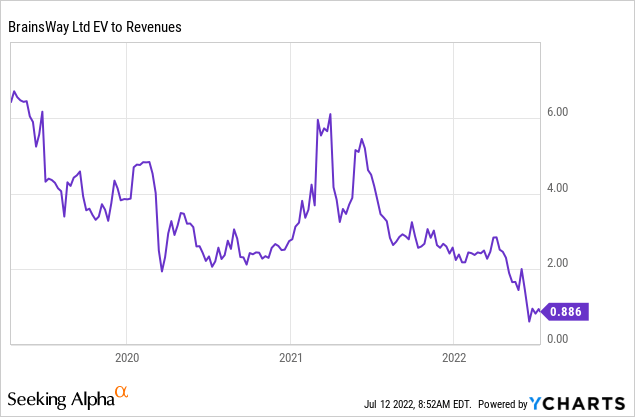

Valuation is at a historic low and seems pretty cheap for a company producing 30%+ revenue growth, 70%+ gross margin, and half the market cap in cash.

Analysts don’t expect losses to disappear anytime soon, expecting a $0.25 net loss per share this year and falling to a $0.22 net loss per share next year.

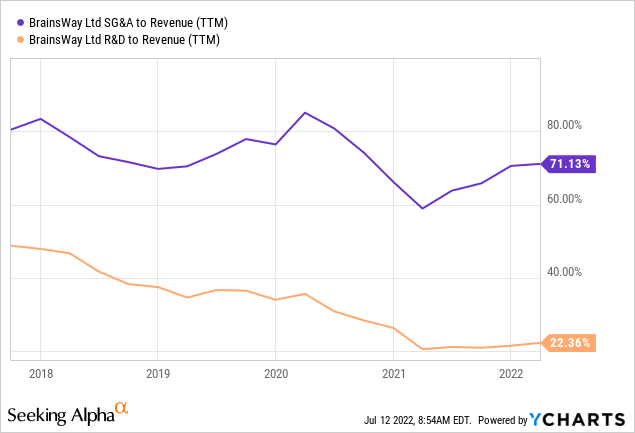

While there is a downward trend in R&D expenditures in relation to revenue, much larger SG&A is actually rising again so there is little in the way of operational leverage yet:

Conclusion

The company has a lot going for it:

- State-of-the-art technology with a number of competitive advantages like the helmets can be used for multiple conditions (3 FDA approved already), their H-coils producing deeper and more targeted brain regions compared to traditional ‘figure-8’ design coils.

- Applicable for an increasing number of conditions.

- A high gross margin and a half of revenue is recurring, a part that could grow further.

- International expansion is still in its infancy and there are additional conditions that are likely to receive FDA approval and reimbursement in the coming years.

- The company has plenty of cash left and the shares are pretty cheap.

Against that there is aggressive competition, now also approved for OCD, and we’ll have to see how the company does in smoking cessation.

Be the first to comment