iQoncept

By Jeff Weniger, CFA

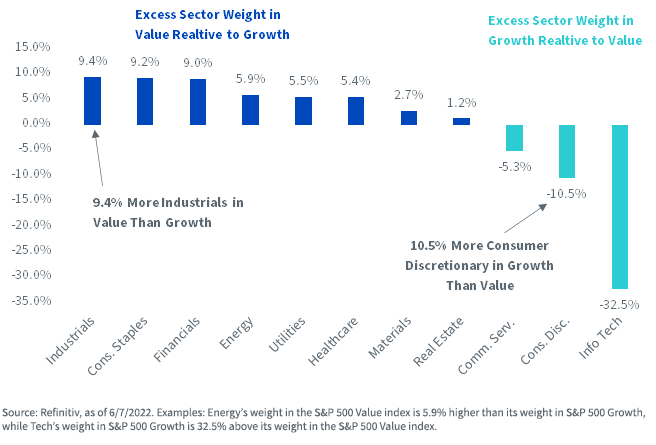

It’s the second-largest sector in the S&P 500 Growth Index, weighing in at 17.2%, but because of Tech’s dominant 44.1% weight in the basket, Consumer Discretionary often gets short shrift in our collective focus. Nevertheless, the sector’s 10.5 extra percentage points of exposure in the S&P 500 Growth Index over the S&P 500 Value Index warrants considerable attention (figure 1).

Figure 1: Sector Weight Differentials, S&P 500 Value Minus S&P 500 Growth

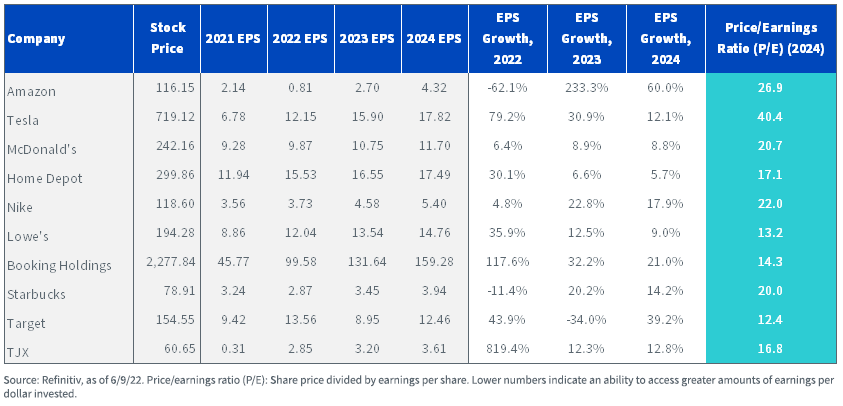

A major reason Discretionary is only 6.7% of the S&P 500 Value Index is that “growthy” Amazon (AMZN) and Tesla (TSLA) are given zero allocation. The other eight major players by market capitalization are McDonald’s (MCD), Home Depot (HD), Nike (NKE), Lowe’s (LOW), Booking Holdings (BKNG), Starbucks (SBUX), Target (TGT) and TJX (TJX) (the owner of T.J. Maxx, Marshalls and HomeGoods). Many of those find their way into growth baskets. The problem for the sector writ large is that four of the top five are trading for more than 20x the Street’s 2024 earnings estimate. That may be okay if there is no recession at any time in the next 30 months, but I think that could be wishful thinking.

Figure 2: Street Consensus Earnings, Top 10 Members of the S&P 500 Consumer Discretionary Sector

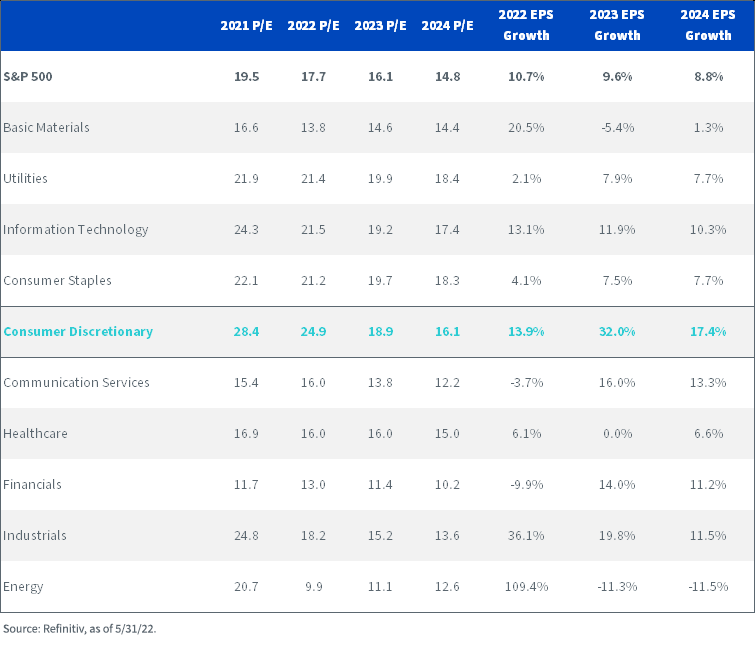

When you combine these 10 companies with the rest of the S&P 500 Consumer Discretionary sector, the Street anticipates that these firms will collectively witness earnings growth of 13.9% in 2022, followed by another 32% pop in 2023 and then another 17.4% in 2024. A recession at any time in the next 30 months would seemingly throw that for a loop.

Figure 3: S&P 500 Sector-Level P/E Ratios and Earnings Growth

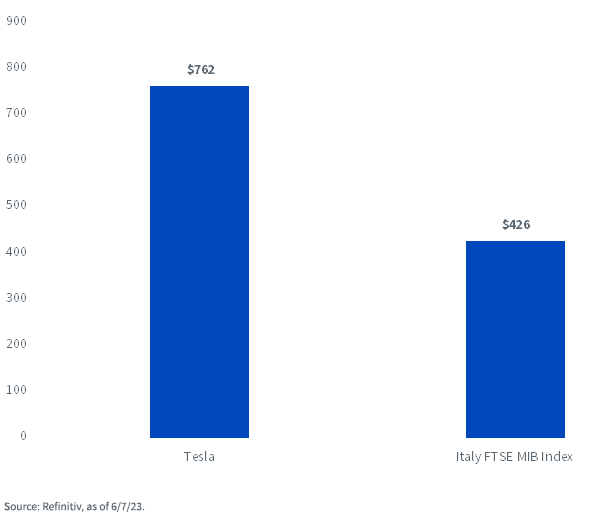

Much of the calculus depends on what happens with Tesla, whose CEO, Elon Musk, is currently distracted by not only his $44 billion bid for Twitter (TWTR) but also the little matter of colonizing Mars. I am not the world’s authority on whether SpaceX, Musk’s company engaging the Martian project, can pull that off. But whatever fate awaits that venture, it seems a bit distracting if you are also trying to manage an electric car company of such size that it’s accorded a $741 billion market capitalization. For an idea of just how large that is, it’s $315 billion more than the combined value of Italy’s 40-stock FTSE MIB Index.

Figure 4: Market Capitalization of Tesla vs. Italy’s FTSE MIB Index ($ Bil.)

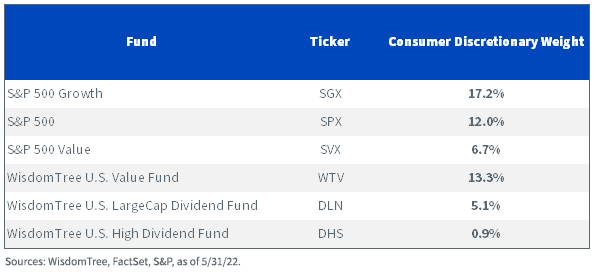

Figure 5 shows some of our large-cap value strategies, along with their exposure to the Consumer Discretionary sector.

Of the 10 stocks listed in figure 3, WTV owns only Home Depot, Lowe’s and Target, though the rest of its Consumer Discretionary holdings bring that group to 13.3% of the total weight.

DTD and DLN own a bunch of the sector’s 10 largest companies, but in weights that tend to be smallish because of those stocks’ paltry dividends. Inside those ETFs, there are exposures to McDonald’s, Home Depot, Lowe’s, Starbucks, Target and TJX.

The screen for DHS is for higher dividends, so it owns none of Consumer Discretionary’s 10 largest companies, bringing its total exposure to the sector down to around 1%.

Figure 5: WisdomTree Large-Cap Value Funds by Weight in Consumer Discretionary

For a list of holdings, please click on the respective ticker: WTV, DTD, DLN, DHS.

Important Risks Related to this Article

WTV: There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on quantitative models and the models may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

DTD: There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

DLN: There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

DHS: There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeff Weniger, CFA, Head of Equity Strategy

Jeff Weniger, CFA serves as Head of Equity Strategy at WisdomTree. In his role, Weniger helps to formulate the firm’s stock market outlook by assessing macro and fundamental trends. Prior to joining WisdomTree, he was Director, Senior Strategist at BMO, where he worked in the office of the CIO from 2006 to 2017. He served on the firm’s Asset Allocation Committee and co-managed the firm’s ETF model portfolios for both the U.S. and Canada. In 2013, at the age of 32, Jeff was chosen as the youngest member of BMO’s Global Investment Forum, which collected the firm’s top global strategists to formulate the firm’s official long-term outlook for investment trends and markets. Jeff has a B.S. in Finance from the University of Florida and an MBA from Notre Dame. He has been a CFA charterholder and a member of the CFA Society of Chicago since 2006. He has appeared in various financial publications such as Barron’s and The Wall Street Journal and makes regular appearances on Canada’s Business News Network (BNN) and Wharton Business Radio.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment