Inna Dodor

Introduction

The elimination of incentive distribution rights is normally viewed favorably by investors, although in the case of KNOT Offshore Partners (NYSE:KNOP), it appeared to be lining up for a distribution cut in the future given the way the transaction was structured for their parent company, as my previous article explained. After a weak start to 2022, there is a troubling outlook for their charter contracts as we head towards 2023 and thus as a result, it is now prudent for unitholders to brace for a distribution cut, possibly as soon as their upcoming third quarter of 2022 results, as discussed within this refreshed analysis.

Coverage Summary & Ratings

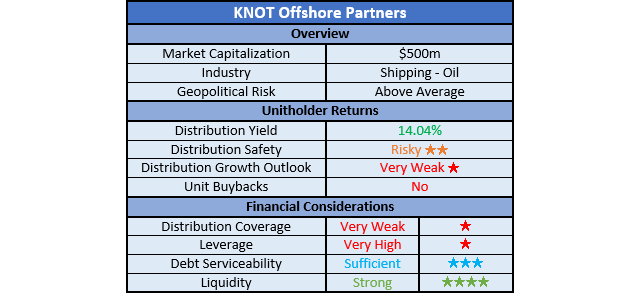

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

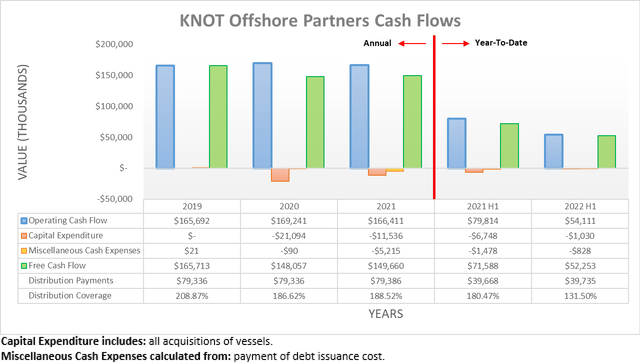

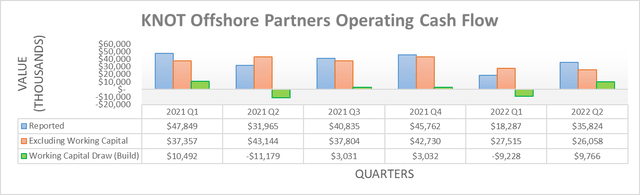

Despite their resilient cash flow performance during the economic turmoil of 2020 and bumpy recovery of 2021, sadly, 2022 started off weak with their operating cash flow of $54.1m during the first half down almost one-third compared to their previous result of $79.8m during the first half of 2021. On the surface, they still saw strong distribution coverage of 131.50% during the first half of 2022 despite their otherwise weak operating cash flow, although this was simply due to their almost non-existent low capital expenditure of only $1m that is obviously not sustainable.

If looking at their distributable cash flow that works on an accrual basis, their maintenance capital expenditure was $19.1m for each of the first and second quarters of 2022, as per slide eight of their second quarter of 2022 results presentation. These aggregate to $38.2m but include their dry docking expenses of $11.3m that were already included within their operating cash flow, thereby making for an estimated maintenance capital expenditure of $26.9m. If subtracted from their operating cash flow of $54.1m, it would have left their free cash flow at only $27.2m and thus only provide very weak coverage of circa 69% to their distribution payments of $39.7m.

Even without the impacts of working capital movements, their underlying operating cash flow was practically unchanged versus their reported results during the first half of 2022, as their working capital build of $9.2m during the first quarter practically offset their subsequent draw of $9.8m during the second quarter. Interestingly, this is similar to one year prior during the first half of 2021 when their working capital draw of $10.5m during the first quarter broadly offset their build of $11.2m during the second quarter. This means their weak cash flow performance during the first half of 2022 was fundamental, which was due to their abnormally high number of dry dockings.

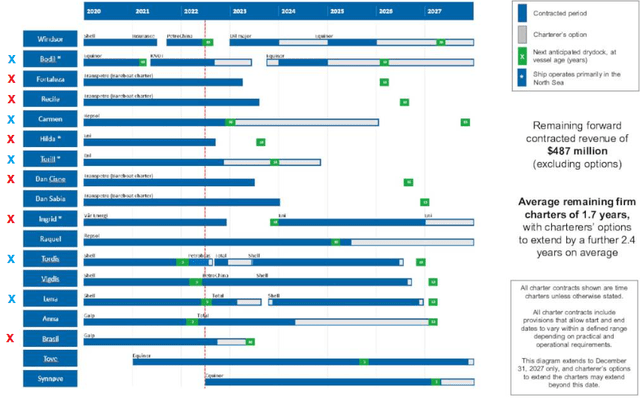

KNOT Offshore Partners Second Quarter Of 2022 Results Presentation

When examining the deployment of their fleet, the first half of 2022 saw three dry dockings completed with a further two commencing that should be completed during the third quarter, thereby causing their weak financial performance. Whilst this was only a temporary setback, the outlook for their charter contracts is troubling and thus creates bigger issues when looking ahead, which risk prolonging their weak financial performance.

Unless they can quickly secure new charter contracts, they are facing a large portion of their fleet idling starting from the fourth quarter and worsening throughout 2023, as denoted by the red marks on the above graph. These total six of their 18 vessel fleet with a further five at risk of idling at the choice of the charterer, as denoted by the blue marks on the above graph. When combined, this is more than half of their fleet that is either losing work or could lose work, which would likely have an even worse impact on their financial performance than the three to five dry dockings during the first half of 2022. Not to mention, they also face another two dry dockings during 2023, which sees additional costs, as denoted by the green squares on the above graph.

The oil market is still very strong and thus supportive, although this is nevertheless a very large portion of their fleet seeking new charter contracts at the same time. Even if possible, raises the scope for less profitable terms given the laws of supply and demand whereby more available vessels equals lower prices. When they release their upcoming results for the third quarter of 2022, new charter contracts will be the most important aspect to monitor because sadly, they do not have the necessary financial resources to bridge the prolonged gap in their distribution coverage that would occur if most of these vessels are idled. Whilst the third quarter saw another dropdown acquisition of the Synnove Knutsen, which thankfully sees charter contract coverage until 2027, this alone cannot possibly make up for another ten or more vessels potentially idling.

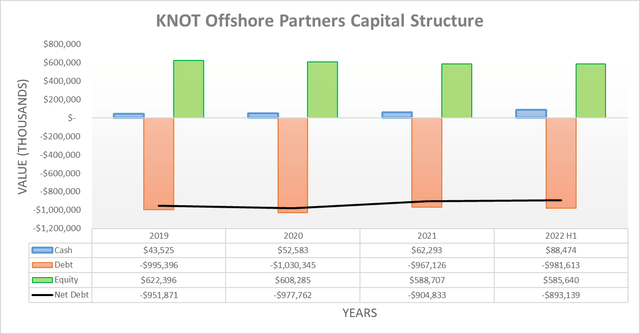

Thanks to their almost non-existent capital expenditure helping offset their otherwise weak cash flow performance, their net debt still decreased during the first half of 2022, albeit only to a very small extent with its latest level of $893.1m down slightly from its previous level of $904.8m at the end of 2021. Upon the release of their upcoming third quarter of 2022 results, their net debt should jump another $119m due to their Synnove Knutsen acquisition, less any immaterial accompanying retained free cash flow. When looking ahead into the fourth quarter and 2023, unless they secure more charter contracts or cut their distributions, their net debt will likely increase and place pressure on their financial position.

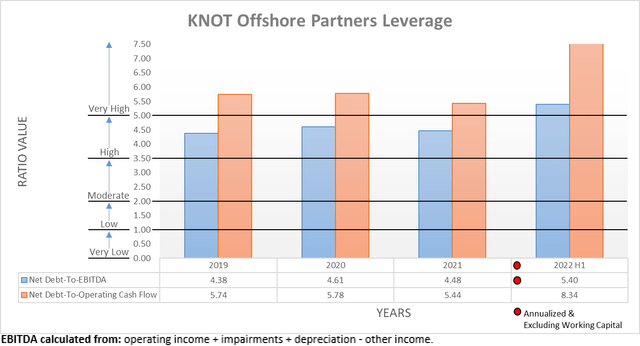

When 2021 ended, their leverage was spread across the high and very high territories given their net debt-to-EBITDA of 4.48 and net debt-to-operating cash flow of 5.44 still on either side of the threshold of 5.01 for the very high territory. Unsurprisingly, their weak financial performance during the first half of 2022 saw these both climb higher to 5.40 and 8.34, obviously now exceeding the threshold for the very high territory.

Whilst this instance of very high leverage would normally not be too concerning because it stemmed from an abnormally high amount of dry dockings, the questionable outlook for their charter contracts creates uncertainty that could see prolonged very high leverage. Disappointingly, this leaves little to no scope to fund distributions via debt, even for one year, at least not safely and is further compounded by rapidly tightening monetary policy, plus as subsequently discussed, their lack of available debt funding.

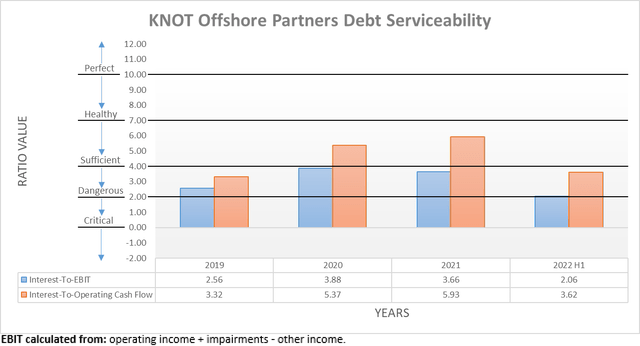

Due to their weak financial performance, their debt serviceability followed in tandem with their leverage and deteriorated during the first half of 2022, which is becoming increasingly important to consider as interest rates climb rapidly. This now sees their interest coverage barely sufficient when compared against their EBIT with a result of 2.06, whilst compared against their operating cash flow sees a better but still only sufficient result of 3.62. Considering the outlook for prolonged weak financial performance, their debt serviceability could easily slide lower and become dangerous during 2023, thereby putting further pressure on their financial position.

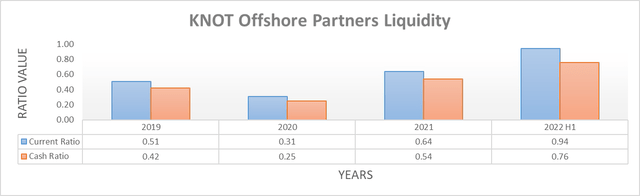

Despite their very high leverage, thankfully their liquidity continues sporting a current ratio of 0.94 and more importantly, a cash ratio of 0.76. On the surface, this appears positive but as alluded to earlier, significant issues remain when considering their available debt funding following their Synnove Knutsen acquisition, which drained most of their credit facility availability, as per the quote included below.

“As of June 30, 2022, the Partnership had $123.5 million in available liquidity, which consisted of cash and cash equivalents of $88.5 million and $35.0 million of capacity under its revolving credit facilities, part of which was used to purchase the Synnøve Knutsen on July 1, 2022.”

-KNOT Offshore Partners Q2 2022 6-K.

The $119m total cost of their Synnove Knutsen acquisition includes $87.7m of debt assumption and thus sees the cash cost at $31.3m, thereby almost completely draining their $35m of credit facility availability. As a result, they are almost completely reliant upon their cash balance to survive, which at $88.5m provides breathing room but at the same time, drawing it down to plug holes in distribution coverage is risky even in the short-term. If they opt for this path, their presently strong liquidity would quickly deteriorate, thereby potentially jeopardizing their ability to remain a going concern.

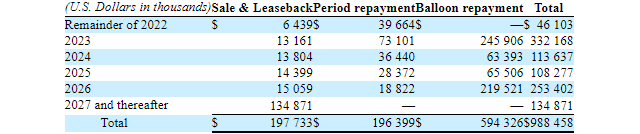

To make matters worse, it is difficult to imagine debt markets being willing to extend more funding so that an already very highly indebted company that is experiencing problems with demand for their vessels can return cash to their unitholders, especially as central banks rapidly tighten monetary policy. Meanwhile, they also face a $332.2m of debt maturities during 2023 that obviously cannot be repaid via free cash flow, regardless of their distributions. Apart from asking debt markets to help fund their distributions if their vessels are idled, either way, they are still going to debt markets asking for refinancing as well, thereby making this an even bigger hurdle.

KNOT Offshore Partners Q2 2022 6-K

Conclusion

Unless they can quickly secure new charter contracts for more of their fleet, it makes a distribution cut likely as 2023 approaches because they clearly do not have the financial resources necessary to bridge any prolonged gap in their coverage. Whilst their upcoming third quarter of 2022 results may see decent financial performance, I would not be surprised to see management pre-emptively move to shore up their financial position by cutting their distributions sooner rather than later. Even though they offer a double-digit distribution yield, I still believe that downgrading to a sell rating is appropriate as the risks are skewed to the downside.

Notes: Unless specified otherwise, all figures in this article were taken from KNOT Offshore Partners’ SEC filings, all calculated figures were performed by the author.

Be the first to comment