Khanchit Khirisutchalual

America First Multifamily Investors, L.P. (NASDAQ:ATAX) provides financing for affordable multifamily residential and commercial properties. They do this via Mortgage Revenue Bonds (MRBs) and Government Issuer Loans (GILs), the interest earned on which is exempt from federal taxes. They also have ownership interests in multifamily properties across the US.

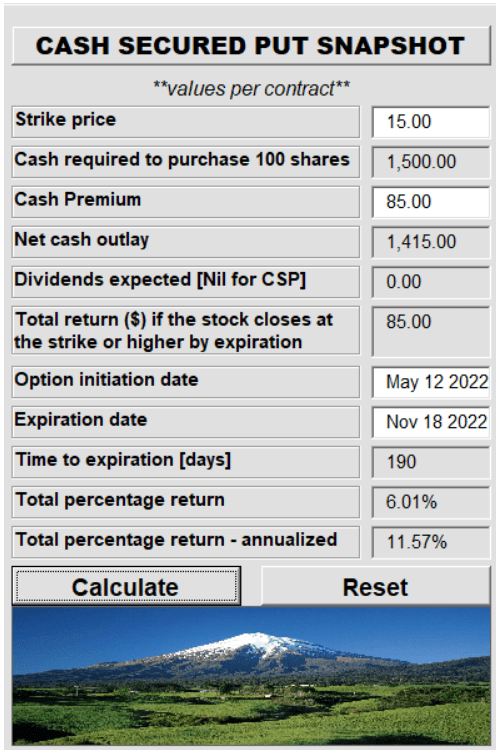

The last time we wrote on this K-1 issuing company, we were neutral on the stock at the price back then. However, we did put in a bid via one of our favorite option strategies.

America First: A Unique Alternative To Mortgage REITs And Muni Bonds

With the current price over $17.50, it does not appear that we will land up with the stock. We will, however, have earned a healthy yield for just putting in the bid. Let us not count our chickens before they are hatched though, and first address the elephant in the room. We are talking about the Q2 results that were just released.

Q2-2022

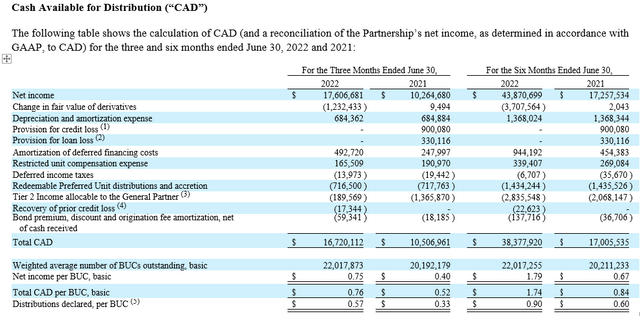

There are two aspects to the results, and both are equally relevant. The first is the cash available for distribution or CAD. ATAX cannot pay unless it earns those distributions, and it’s there that we focus first. The company definitely delivered here, and by a huge margin.

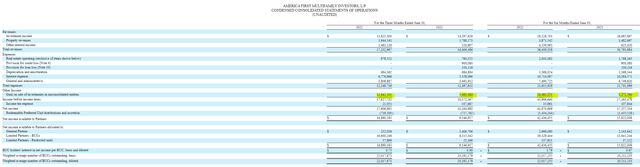

CAD was $0.76 in the quarter, almost 50% higher than the same quarter last year. Year to date run rate was more than twice that seen in 2021. Quite the achievement. What drove these impressive results? If you will note above, the numbers for CAD calculations start with the net income and the net income itself is very, very different in both years. So what drove the higher net income? You will have to enlarge this to read, and the link to the financial statements is here for those that want to go through it.

The key difference is highlighted and comes from “Gain on sale of investments in unconsolidated entities.”

We are extremely pleased with the reported results for the second quarter as we continue to execute on our strategies,” said Kenneth C. Rogozinski, the Partnership’s Chief Executive Officer. “The successful sales of Vantage at Westover Hills in May and Vantage at O’Connor in July continue the series of significant returns on our Vantage joint venture equity investments. We also continue to strategically invest in our affordable multifamily and joint venture equity asset classes where we believe we can earn attractive leveraged returns. We also believe our current liquidity position will allow us to capitalize on additional investment opportunities in our pipeline.”

Source: ATAX Press Release

In this quarter, if you subtract out this delta, there is virtually no difference in net income versus last year. Recording a gain on sale certainly beats the alternative, but that is not an unlimited pool. Realistically, we have to evaluate CAD without that impact. If you subtract this out, CAD is about 19 cents per unit.

Obviously, this is not an exact number as we are unsure how taxes and other numbers would move if we just remove the gain out. Perhaps even revenues would be higher. But we can safely say that CAD would be far, far lower.

Balance Sheet

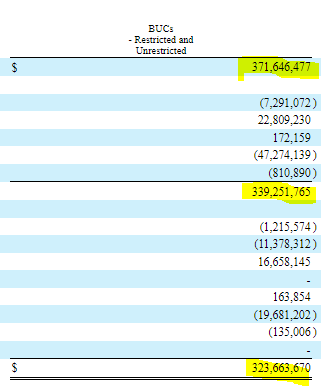

If investors recall, we had expressed some concerns about the impact of interest rates on ATAX’s tangible book value. We saw that play out this quarter. A good way to follow that is the movement in tangible equity. The starting number here is $371.6 million from December 21, 2021.

ATAX Q2-2022 Results

The $339 million comes from March 31, 2022 and the $323.6 million from June 30, 2022. This is a fair bit of movement, but we want to emphasize that this is far less than the drop in tangible book value we see in mortgage REITs. The key reason here is of course the relative lack of leverage by ATAX compared to its mortgage REIT peers. Nonetheless, we did see a $16 million drop despite some massive profits booked via asset sales.

Valuation & Outlook

With about 22 million units (or BUCs as the partnership likes to call them) outstanding, we are looking at a tangible book value of $14.68. We think this understates the true liquidation value here today for two reasons. The first being that mortgage rates have moved back down, and ATAX’s mortgage revenue bonds should be worth more today than they were at June 30, 2022. The second reason is that while the bulk of the balance sheet is fairly valued, the real estate is undervalued, thanks to GAAP rules. We would place fair value of ATAX today close to $16.50-$17.00/unit.

This is in the fairly valued zone, and the key question here becomes your outlook for interest rates. If you believe rates will remain low forever, then ATAX probably is a buy for you, even at $19.00. If you believe rates can move far higher, then you would approach a buy with caution. Our thinking is that ATAX’s core CAD generation capabilities are far lower than what we have seen in the last two quarters, and we are generally hesitant to chase this up. Our previously sold puts look on course to expire worthless and will likely succeed at generating the 11% yield with very little risk. We remain on the lookout for more opportunities to sell cash secured puts on this, but we won’t be chasing this higher.

Be the first to comment