FrozenShutter

(This article was in the newsletter on October 4, 2022.)

Disney (NYSE:DIS) has a pretty good backlog as do many others in the competition. Included in that backlog is some previous “bombs” that are now worth money. Disney often makes movies that have second chances elsewhere. Just ask the Sanderson sisters who were headed to oblivion until they became a Halloween cult classic.

One of the advantages Disney has is some established classics that make money every year. “Hocus Pocus” was originally a money loser that had sour reviews to go with it. That money loser movie is now a cult classic. That money loser starts off a robust fourth quarter every year with sales on a product that essentially is paid for and it now has a “Part 2” to build on that franchise. Investors can bet that “Part 2” is going to do better on the first run than the original did, in my opinion.

That is not the only thing that Disney has that makes “free money” this time of year as there is also the “Halloweentown” series of movies as well. For Disney, Halloween is practically as good as the Christmas season is for the retail business. This established business gives the company a fantastic way to hook onto viewers and subscribers as a lead into a fairly robust pipeline for the better part of the movie season. Disney has these “cash cows” that are as close to sure things in the movie business as one can get. Some of these “oldies” draw larger audiences every year. That is an excellent way to begin the movie season.

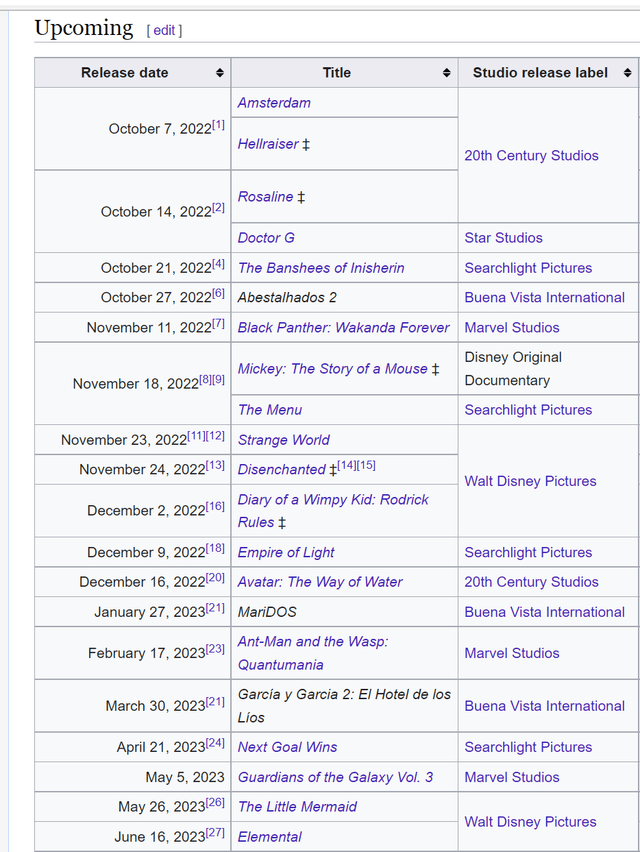

Disney Partial List Of Future Movie Releases (Wikipedia Summary October 4, 2022)

The October Halloween Season will launch the stronger part of the movie season for the whole theater industry. After the Disney introduction of some traditional classics, viewers will likely anticipate a fair amount of the public part of the pipeline shown above. One thing that Disney always has over much of the competition is franchises that make money regardless of whether the pipeline above meets expectations. “Hocus Pocus” is a good example of that. Christmas will have some more standards.

The current movie is sort of “free advertisement” for the previous movie that became a cult classic. It leads to still other classic Halloween movies. This is a cash flow source that few competitors have access to.

Admittedly, Disney is expected to have some big success stories each year. The expectations for Disney have been high for some time because Disney has met that “bar of expectations” time and time again. But it is important to look at all of the sources of cash because this company has a few extra sources.

Similarly, these movies lead to visits to the amusement parks, and clothing sales. One thing that has been mentioned before is like with the Sanderson sisters, the original attempt did not have to make money for the idea to become a recurring cash flow. Disney is very good at marketing and that talent often turns losers into long term winners. Luck helps as well. But you need the talent to take advantage of luck and Disney has always had that talent.

As shown above, much of the blockbusters that Disney expects in the near future will be extensions of well-known franchises. This provides a margin of safety for the company compared to many movie making competitors. The level of certainty of success (while not guaranteed by any means) is higher as a result of extending franchises.

Lost in the discussion of the latest hurricane issues and the shutdown in China is the fact that this company has a ready-made source of money. As a result, a pivot to making money elsewhere whenever there is a setback somewhere else is almost a foregone conclusion. Such setbacks are unlikely to forestall total company financial improvement as the recovery from covid challenges continues.

Fiscal year 2022, which will end with the current quarterly report, marks the end of a year in which the company essentially “turned things back on”. Cash flow and many activities engaged in getting business back to where it was before a myriad of unusual challenges began in calendar year 2020. The coming fiscal year is likely to see sharply reduced startup charges along with sharply investments that are not matched to income from the previous year.

Management has long made movies first and then made or lost money from them. But those movies had their costs paid for by movies being shown that were previously made. That process broke with the challenges of calendar year 2020 and the following restart in 2021. It is now being re-established both with the parks and with the movies.

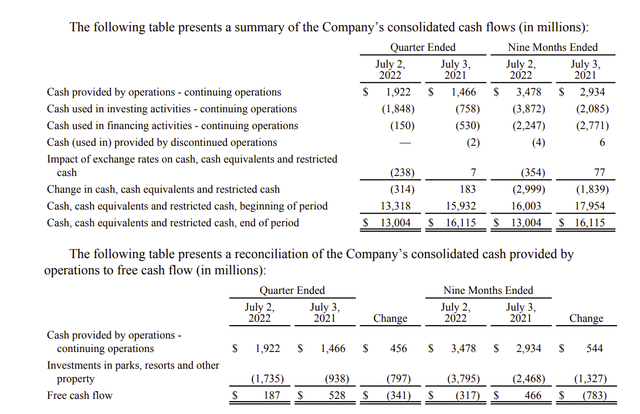

Disney Cash Activity Summary Third Quarter 2022 (Disney Third Quarter 2022, Earnings Press Release)

The market has clear concerns when a traditional cash generator stops generating cash. Clearly Disney has had good reason to invest in the future while the economy leaves covid concerns behind. But any large company takes a fair amount of time to recover from the challenges of the recent past.

Therefore, next year will likely see a return to a normal performance. It also means that the acquisition made before covid will likely be exploited now that things are returning to normal. This company is one of many that I follow (Occidental (OXY) is another) that made an acquisition but then really could not take advantage of it when things really changed almost overnight.

Management is beginning to have faith in the future as the strong cash balance shown above is slowly decreasing to repay the outstanding debt balance needed for all that cash. That likewise is happening with a fair number of companies I follow.

The Future For Disney

I believe management will re-establish a pipeline of movies that will pay for the next set of potential blockbusters. In the meantime, the established franchises that provided some very necessary cash flow during the recent challenging periods will continue to provide that base cash flow. Those franchises limit some of the inherent volatility of the movie industry cycle that regularly goes from boom to bust.

The parks are now back to providing the cash flow needed for upgrades while making better than sufficient returns. These two areas alone should generate cash now that business is returning to pre-Covid levels.

The one thing this company has is a steady cash flow from classics that many competitors lack. Management has adroitly exploited those classics to keep the money coming in regardless of the competitive industry atmosphere. Just the short review of Halloween demonstrates a small part of that cash generating potential that many competitors do not have at all (or very little).

It also means that the new streaming business can essentially show films that are already paid for. Hence, any money earned by these classics is mostly profit even though accounting usually allocates costs based upon relative revenue amounts (and of course depreciation over an assumed lifetime). That is an important cost advantage going into the upcoming streaming wars.

To the extent a franchise is extended with yet another blockbuster film, then there is that much more potential cash flow into the future. That cash flow is as good as any competitive moat provided by a patent. Ever since I was a child, Disney had been retiring some of these franchises and then successfully relaunching them. That process will likewise be continued where it is successful.

That makes streaming another area for the company to make money. But unlike some others, streaming will not be a “make or break” issue. This company has a lot of ways to succeed that are not going away any time soon.

The future here is one of more diversification with the ability to wait out an unprofitable area because other areas will make money. Not many competitors can say that. So that makes Disney a favorite to be a long-term winner in a new area like streaming.

Be the first to comment