designer491/iStock via Getty Images

Co-produced with PendragonY

(This article was first published to HDO subscribers on June 9th, and all data is from that date.)

Introduction

I get a lot of questions about municipal bond funds ever since we sold our exposure in 2020. We recently added BNY Mellon Municipal Bond Infrastructure Fund (NYSE:DMB) to our portfolio. I believe right now is the time to be buying municipal bonds with prices beaten down by inflation and rate-hike fears. While inflation and rate hikes are real headwinds, the market has acted like it always has, taking a legitimate fear, and amplifying it to unreasonable levels.

The market is often over-reactive – going too far and pushing prices to extremes. As income investors, this allows us to invest when the market is overly fearful, and get a higher yield for doing so.

Municipals are defensive investments. It is a sector with low defaults, while still providing very reasonable yields. When recession strikes, municipal bonds are a favorite for investors to pour into, making them a defensive investment both from a cash flow standpoint and a price standpoint when tough times hit.

The time has come to make municipals part of our portfolio again.

Is it time for Municipal Bonds?

Given the current concern over the potential for a recession, people have begun to think about moving into ultra-safe investments. One such very safe investment is municipal bonds. Municipal bonds are a very defensive investment. While they are not completely immune to defaults, municipal bonds rarely default. So it makes sense to look at them when there are concerns about the economy.

While municipal bonds tend to have yields below our target yield, the interest on these bonds is Federal Tax Exempt. Held in a taxable account, this exemption produces an after-tax income similar to higher-yielding but fully taxable investments. This benefit is passed along to shareholders through the CEF structure.

As Treasury rates have climbed, the prices of all debt have come down. Recently this price drop has leveled off. Prices (and NAVs too) have risen over the last few weeks. This makes it an attractive time to get back into municipal bonds. We sold our exposure in late 2020, and now it is time to step back in.

Citibank is advising that now is the time to get back into bonds. Their rationale is that if the Fed is successful at moderating inflation, this will slow growth. The slow growth will mean that equities and bonds will have fairly similar returns. This should shift some funds from equities to bonds. And if the Fed does trigger a recession, bonds will do better than equity. Given the greater safety of municipal bonds, this makes it a good time to get back into the municipal bond market.

A Look at BNY Mellon Municipal Bond Infrastructure Fund

DMB pays out a monthly dividend of 5.3 cents per share, which it was able to maintain during the COVID crash. That produces a current yield of 5%.

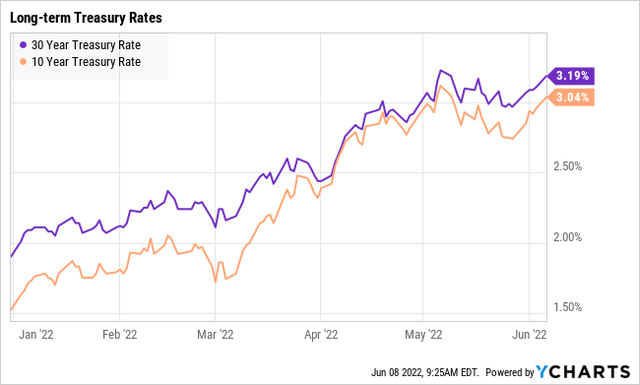

Looking at the longer-term Treasuries, rates seem to have generally flattened over the last month or so (still volatile but the rates are about where they were a month ago). With the rates on the longer-term Treasuries being just over 3%, that makes the 5% yield for DMB quite attractive. Let’s take a look at how the fund generates that income.

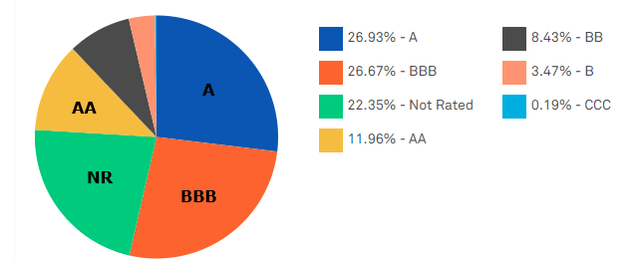

DMB has a lot of high credit assets. Just under 39% of its assets are A-rated or higher. Investment-grade assets total 65.6% of its portfolio. Just 0.19% of its assets are rated CCC. (for reference: Credit Rating Scale)

DMB Credit Ratings of Assets

DMB has an emphasis on infrastructure allowing investors to participate in the rebuilding of American roads, bridges, and other infrastructure projects. Many of these bonds have dedicated revenue streams from taxes or tolls. This dedicated revenue adds another layer of safety.

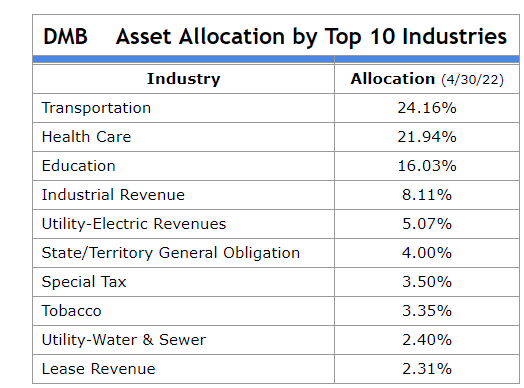

Asset Allocation by Industry (BNY Mellon)

Bridges, roads, and other transportation infrastructure make up nearly a quarter of the fund’s assets. Funding such infrastructure is a basic function of government with a long history of successfully repaying bonds in full. Healthcare is another area where municipal governments have a good history of repaying debt.

With all debt falling because of interest rate increase expectations, DMB has seen its NAV and price drop. The price has dropped much faster than the NAV. The has erased the premium DMB was trading at last year. DMB now trades at a discount of 3%.

Maturity vs. Duration

For bond funds, there are two aspects we want to consider.

- How durable is the dividend over time?

- How sensitive is NAV to interest rate changes?

The two measures that will help us discover this are related but different. Maturity will provide us insight into how stable income is. Duration will provide us insight into how volatile NAV might be as interest rates change.

Maturity

Dividend stability is created by reliable cash flow. However, interest rates change over time. As interest rates decline, any bond principal that is paid off will be reinvested at lower interest rates. For the past 30 years, interest rates have gone up and down, but the long-term trend has been decidedly down.

As a result, bonds today yield much less than they did in the 1990s or even early 2000s. For a bond fund, persistent declines in interest rates will eventually lead to lower-income as higher coupon bonds are paid off and the new bonds available for purchase have lower yields. This is why we’ve seen most bond funds reduce their dividends over the past 10 years.

One way to combat this trend, and at least slow it down, is to have debt that has very long maturities. A 20+ year bond will pay the same coupon its entire existence, regardless of what interest rates do. Having a high average maturity will lead to a very stable and predictable income. While having a short average maturity will lead to more volatile income that will change with interest rates.

DMB has an average effective maturity of 17.61 years. That is quite long and provides DMB with a stable and predictable income, which is passed along to shareholders as dividends. You can expect municipal CEFs to adjust their dividends as interest rates change. With a very long average maturity, only long-term interest rate trends will impact the ability to pay the dividend. Note that DMB’s portfolio turnover rate is only 11%, which is the portion of the portfolio that is changed over the past year. At only 11%, DMB is primarily buying and holding long-term, not trying to trade in and out.

As a result, DMB is a holding that will provide a stable income, that will only be impacted by long-term forces.

Duration

In a rising rate environment, one metric to look at for a bond fund is the duration. Duration measures the sensitivity of a debt instrument to changes in interest rates. It is measured in years, so some confuse it with maturity. In reality, it measures the sensitivity of NAV to interest rate changes.

The idea is that an existing bond will change in price so that it earns a similar yield-to-maturity as bonds being issued at current interest rates. In other words, investors have a choice to buy new bonds, so if new bonds are more expensive (interest rates are lower) then the price of existing bonds will go up as more investors choose to buy old bonds over new bonds. If interest rates are higher, that trend reverses and investors will favor buying new bonds, so the price of old bonds will decline to attract buyers.

Duration is a measurement that estimates the impact of rate changes. As a rule of thumb, for every 1-year of duration, a fund’s NAV should change 1% for every 1% change in interest rates. If the bond fund has a 5-year duration, then a 1% increase in interest rates should decrease NAV by approximately 5%, and a 1% decrease in interest rates should increase NAV by approximately 1%.

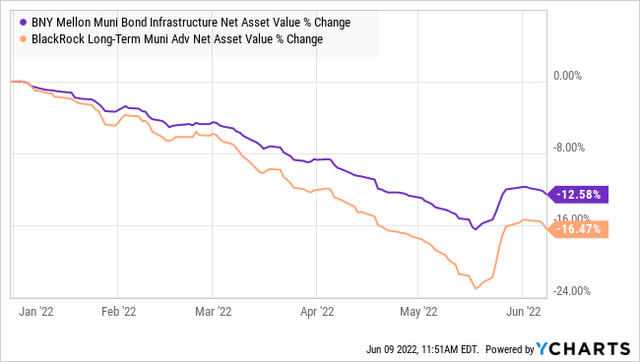

DMB has a duration of 5.84 years. BlackRock Long-Term Municipal Advantage Trust (BTA), a similar muni fund, has a duration of slightly over 9 years. So we would expect DMB’s NAV to fall less than BTA’s NAV in a rising rate environment.

Sure enough, that is what we have seen year-to-date.

Duration can be influenced by leveraging, interest rate hedging, call dates, and maturity dates. Note, that duration changes and is one of the main tools that the manager can use to improve the performance of the fund in the future. DMB had a duration of 5.84 years as of April 30th – this was up from 4.61 years as of March 31st.

DMB has a long average maturity date, which provides stability in income and a moderate duration. This combination is the primary reason we chose DMB over many peers. It’s likely a good time to buy any municipal bond fund, as a bottom is forming, but you want to keep your eye on these two metrics to choose positions that are best for you.

Why Now?

The market is already pricing in an aggressive Federal Reserve. Or at least what passes for aggressive in the modern era.

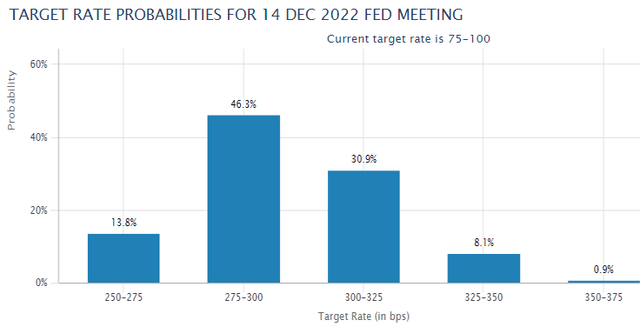

The market is pricing in an 85% probability that the Fed will raise to 2.75% or more by December. These are the assumptions that the bond markets have been using. As a reminder, in March the Fed itself projected 1.75%-2.00%.

Having a modest duration will help ensure that any remaining impact on NAV will be small if the Fed does decide to lean to a more hawkish stance and looks at hiking rates to +3%.

Over the last week or so, both price and NAV have recovered some from the drop they have seen since last fall. It’s also worth noting that DMB went from trading at a premium to NAV to trading at a discount. This is common for CEFs to “overshoot” in both directions with the price moving more than NAV. This makes CEFs a very compelling opportunity when you believe that bottom is near or has already come in for a sector because the price that overshot to the downside will often overshoot upwards during the recovery.

Tax Benefits

In a taxable account in the U.S. an investor will typically be paying ordinary income tax rates on interest income, which is the source of the distribution for DMB. However, municipal bond interest is federal income tax-exempt, and that benefit is passed along to investors.

For many investors, holding DMB is like holding a higher-yielding fully taxable investment. How much higher? That depends on your highest marginal rate. For those in the 22% bracket, DMB has the same after-tax distribution as a fully taxable investment that yields 6.60% in interest. If you happen to be in the 24% bracket, then DMB pays like a 6.78% investment. And if you happen to be in the 32% bracket, DMB is very attractive with the same after-tax income as a fully taxable 7.57% investment.

Some states will also exempt the income from state taxes, so some investors might get even better benefits. We would never buy an investment solely because of tax benefits, but when a compelling opportunity comes with a favorable tax cherry on top, we aren’t going to turn it down!

Shutterstock

Conclusion

The belief that the Federal Reserve will hike rates aggressively over the next year to 18 months has driven down the price of municipal bonds. That is why, despite fears of a recession, the prices are so low.

The current prices in the municipal bond market have priced in the likely Fed actions, and the market is likely more pessimistic than is justified. If the Fed does hike as aggressively as the market fears, it would likely cause a recession and quick turnaround in policy like we saw in 2006-2007.

This opportunity allows us to buy when the prices have been depressed. The lower price will allow us to adjust our portfolios to be a bit more defensive, collect a great yield, and have some upside potential if the Fed ends up being less aggressive than it is talking now. Plus, if the Fed is overly aggressive and tips the economy into recession, a safe-haven investment like municipal bonds is exactly where we want to be anyway. When others are rushing in, we’ll already be holding.

Whichever direction the Fed decides to go, we view the future of municipal bonds over the next 2 to 3 years as very positive.

There are many municipal bond funds, and we believe that the entire sector is attractively priced. Here is DMB’s Fact Sheet and website that will provide additional information.

Be the first to comment