stphillips/E+ via Getty Images

The market downturn seems to be unending, as the bears appear to be firmly in control. Even market pundits such as Jim Cramer have proclaimed that any rally is provides an opportunity to sell, citing interest rates, oil prices, and lower consumer sentiment.

However, where others see fear, I see opportunity as I’m reminded that all bull markets are born from pessimism. This brings me to quality names such as Paramount Global (NASDAQ:PARA), which I view as being a “baby that’s been thrown out with the bathwater”. This article highlights what makes PARA an ideal buy for those who seek rewarding income at a value price, so let’s get started.

Why PARA?

PARA is primarily a media holding company that invests in and operates a diversified group of branded entertainment businesses. The Company’s segments include filmed entertainment, television stations, live events and consumer products.

It owns the highly valuable Paramount Pictures brand and library as well as a number of broadcast and cable television networks including CBS, Comedy Central, MTV, Nickelodeon, VH1, and BET. In addition, PARA’s production studio business is responsible for hit shows such as the popular series, Yellowstone.

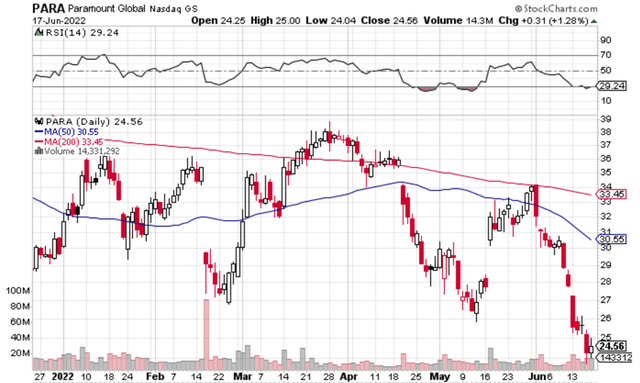

Meanwhile, PARA’s stock has been no stranger to volatility, as it’s now trading well below its 52-week high of $47.46. At the current price of $24.56, PARA is also well below its 200 and 50 day moving averages of $33.45 and $30.55, and carries an RSI score of 29, indicating that it’s now in oversold territory.

PARA Stock Technicals (StockCharts)

Perhaps some of the sell-off has to do with subscriber declines at its competitor, Netflix (NFLX). I see this as being unjustified, as PARA has seen strong growth thus far this year, with a strong 6.8 million net subscriber additions in just the first quarter.

While total revenue fell slightly by 1.1% YoY, to $7.3 billion, due more to a difficult year-on-year comp in broadcasting the Super Bowl back in 2021, its direct to consumer business is showing promising growth, with revenue expanding by 82%, driven by advertising and subscriptions. Speaking of which, advertising appears to be an area that peer Netflix wants to get into, as it seeks to offset its stagnating subscriber growth.

Meanwhile, I find PARA to be rather cheap at the current price of $24.56, which translates to an EV/EBITDA of just 8.1, comparing favorably to NFLX’s 13.8. In other words, the market is assigning little-to-no value to the company’s media networks and production studio businesses. This seems like a major oversight given the broad reach of PARA’s networks, especially CBS, which reaches nearly all households in the U.S.

PARA EV/EBITDA (Seeking Alpha)

This is probably best exemplified by comments from Para’s CEO, who highlighted the strengths of the platform’s media and theatrical production segments during the recent Credit Suisse Communications Conference:

Our positioning is unique and differentiated. We’re really the only major media company with a scale of broadcast, cable, paid streaming, free streaming and theatrical offering. And the truth is we have momentum across all those businesses. We only start with our TV Media segment.

We have the number one broadcast network. We have a leading cable network portfolio, and those deliver a broad range of popular content that consumers love. And that I’m talking about FBI, I’m talking about the NFL, I’m talking about Yellowstone, and there’s real resiliency in that business where price increases and cost optimization really offset – largely offset ecosystem declines.

And then there’s our theatrical business. That’s a market that is strengthening and again, one where we have real momentum. All five films that Paramount Pictures released this year opened at number one. And that of course includes the incredible success of Top Gun: Maverick. And I’d note that all those titles, the first four already will be available on Paramount+.

Meanwhile, PARA maintains a strong BBB rated balance sheet and the recent price weakness has driven the dividend yield to 3.9%. The dividend is also well-covered by a 37% payout ratio. Sell side analysts have an average price target of $36.41 and Morningstar maintains a fair value estimate of $58. This implies a total return of 52% based on the lower of the two estimates.

Risks

One risk for PARA is that cord-cutting accelerates and consumers continue to shift their viewing habits away from traditional linear television. This trend has already caused PARA’s advertising revenues to decline in recent years. However, the company has offset this decline through cost cuts and by increasing its focus on content production.

Another risk is that the theatrical release window for movies continues to shorten. This would likely have a negative impact on PARA’s studio business, as movies would generate less revenue from ticket sales and concessions.

Bottom Line

PARA is a high-quality media company that trades at an attractive valuation. The company’s dividend yield is attractive and well-supported by earnings. While there are some risks to the story, I believe they have been overestimated by the market. PARA is an ideal stock for income investors who seek a high yield at an attractive price.

Be the first to comment