DNY59/E+ via Getty Images

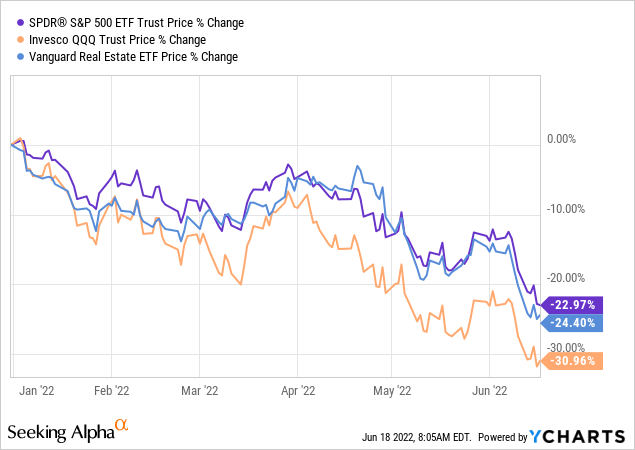

2022 has been a rough year for everyone.

The S&P 500 (SPY) is down 23%…

Tech stocks (QQQ) are down 31%…

And our favorite sector, REITs (VNQ), is down 24% so far.

When the whole market drops so heavily, there is nowhere to hide. One of our members at High Yield Landlord pointed out that even Berkshire Hathaway (BRK.B) (BRK.A) was down 9% in a single day, which really shows how pessimistic the market has become.

We are not immune to this volatility. Some of our positions are down substantially, and in today’s article, we will review two of our biggest losers so far this year.

Is now a good time to buy the dip?

Or should we cut our losses and move on?

We answer these questions below:

iStar Inc. (STAR)

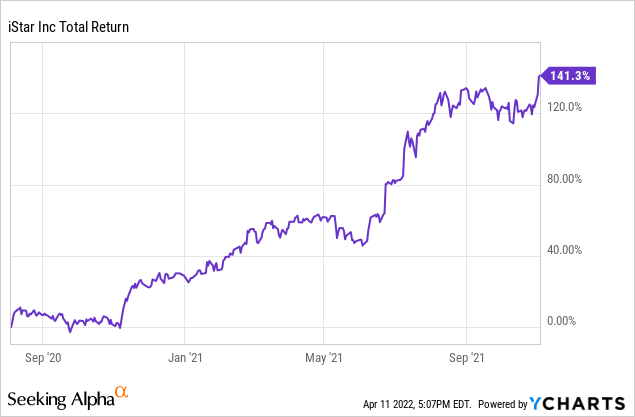

One of our most successful investments in late 2020 and 2021 was iStar. We were early to recognize that this complex mortgage REIT was in the process of transforming itself into a much simpler ground lease REIT, and its share price was enormously discounted back then.

We first invested in the company in August of 2020, and a short year later, we had already doubled our money:

iStar’s transformation creates significant shareholder value (YCHARTS)

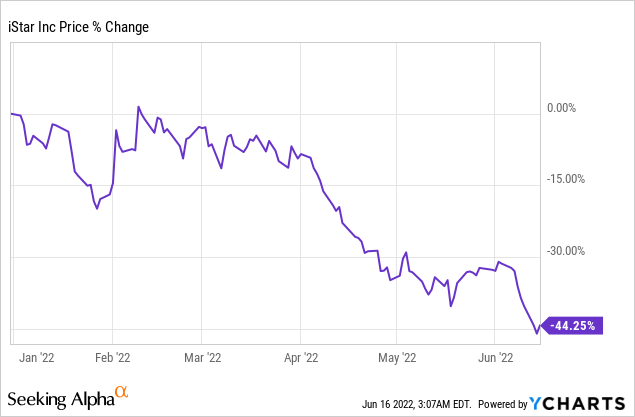

But going into 2022, iStar has actually become one of our worst-performing investments. From its peak, iStar is down 44% over the past few months:

What’s causing this sell-off?

In one word: inflation.

Inflation is already at a 40-year high, and according to the latest remarks of the Treasury Secretary, inflationary pressures are likely to only become stronger due to Russia’s invasion of Ukraine. Here is what Yellen commented on this topic (emphasis added):

We think it’s a price that’s important to pay to punish Russia for what it’s doing in Ukraine. But energy prices are going up, the price of wheat and corn that Russia and Ukraine produce are going up and metals that play an important industrial role – nickel, titanium, palladium – the cost of those things are going up. This is going to escalate inflationary pressures as well.

This is hurting STAR’s market sentiment because it is mainly invested in ground leases through its holding of Safehold Inc. (SAFE). [In case you aren’t familiar with SAFE, it is a ground lease REIT that STAR created, and STAR still owns 2/3 of SAFE’s equity.]

Ground leases are extremely safe. They have a particularly long duration (up to 99 years), but they also trade at low cap rates and their rent hikes are limited.

Understandably, then, investors are worried about the high current inflation. When inflation is at 8.6%, but you are buying assets at 3-4% cap rates with extremely long leases and limited rent hikes, things just don’t add up.

If the high inflation persists, the cash flow of its ground leases could lose in real value and their cap rates could expand, causing them to lose substantial value.

That explains why STAR has been trending lower in the past months.

Even then, we remain bullish and believe that now is a good time to buy more shares of the company.

Why buy the dip?

The long-term thesis remains intact, despite the current inflationary pressures.

Obviously, the high inflation is a negative to our thesis in the near term, and we don’t need to sugarcoat that. But it is not quite as bad as the market makes it seem to be, and there are other balancing factors that have actually improved our investment thesis and been ignored by the market.

Let’s start with the topic of inflation:

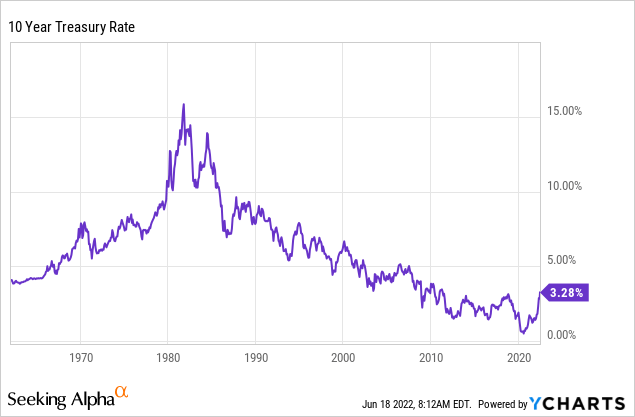

Here, it is important to recognize that the current high inflation is likely to be temporary. The market is quick to extrapolate recent trends far into the future, but the reality is that this recent spike in inflation was mainly caused by supply-chain issues that won’t last forever. As we explained in a recent market update, there are substantial deflationary forces in play that should bring inflation back under control sooner or later, and there are trillions of capital in the bond market betting on it.

That’s why the 10-year Treasury is only yielding 3.2% even despite the fact that inflation is at 8.6%:

Moreover, SAFE enjoys better inflation protection than the market appears to realize. We agree that if inflation remains persistently high, it would be bad for the company. But, in the near term, it can deal with it without suffering any major damage.

- 1) Leveraged Rent Growth: Its leases have annual rent hikes and capped 10-year CPI-lookbacks. This growth demands zero additional capital since these are ground leases, and because SAFE is leveraged, the growth on equity is exponential. The debt to book is 2x so the impact of leverage is substantial.

- 2) Fixed Rate Debt: Something that’s often forgotten when assessing SAFE’s inflation hedging attributes is that it finances its ground leases with fixed-rate debt with very long maturities. This serves as a natural hedge against inflation because its debt is also being inflated away. As noted earlier, the debt to book is 2x so it makes a real difference.

- 3) Growing Value of UCA: As ground leases expire, SAFE will receive the buildings that are on its land, free of charge. With inflation on the rise, the value of these buildings is rising and ultimately, they will belong to SAFE. The management estimates that they added $1.4 billion of UCA in the fourth quarter of 2021 and another $1.3 billion in the first quarter of this year. That’s huge for a company with a $2.2 billion market cap.

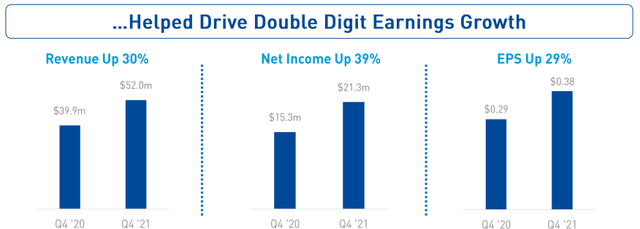

- 4) Spread Investing: SAFE is first and foremost a spread investing business and today, they are still able to close accretive deals to push for growth. This is how they grew their EPS by nearly 30% year-to-year, despite only having limited rent hikes in their leases:

Safehold continues to grow rapidly in 2022 (Safehold)

So, the recent surge in inflation is not breaking our thesis. If it remained persistently high, it could become an issue, but that’s not what we are expecting.

Beyond that, STAR has shared some great news in the recent months, and it has been largely ignored by the market:

- 1) Sold Net Lease Portfolio: We already discussed this in a previous Trade Alert, but in short, STAR managed to sell its net lease portfolio at a large premium relative to what most investors expected. It drastically increased the upside potential of the company and it also simplified the company, which should help its market sentiment and accelerate its path to an eventual merger with SAFE.

- 2) UCA Transaction: Recently, SAFE sold and received commitments to purchase 1.37% of its UCA for $24 million at a $1.75 billion valuation from a group of leading private equity, sovereign wealth, and high net worth investors. As part of this transaction, SAFE must seek a public market listing for these units within 2 years. This is very positive because it validates that this component of the thesis really has value and secondly, it also demonstrates that STAR is focused on unlocking this hidden value for its shareholders.

For these reasons, we remain very bullish. We think that the short-term outlook has deteriorated due to the surge in inflation, but the long-term outlook has improved due to the sale of the net lease portfolio and the clearer path to unlock the value of the company.

I would expect the market sentiment of STAR to remain under pressure as long as the market remains fearful about inflation, but as soon as we get some indication that inflation is cooling down, it should recover strongly. The best time to buy is when others are fearful. This is the case today.

We think that STAR has 50%+ immediate upside from today’s share price and a lot more in the long run as it continues to reinvent the ground lease sector. The biggest catalysts are SAFE’s continued growth, STAR’s continued efforts to simplify its business, an eventual merger between the two, a listing of the UCA units, and most importantly, a cool down in inflation.

This is a 10+ year investment for us because if we think that STAR is still just scratching the surface of what it will accomplish in the long run. Stay patient and occasionally re-watch the below video if you feel like you are losing track of the bigger picture:

Medical Properties Trust, Inc. (MPW)

MPW recently dropped from $24 all the way down to $14.5 primarily because of the broader market sell-off. Adding fuel to the fire, the WSJ and short sellers posted negative articles on the company that made it seem a lot riskier than it really is.

It caused uncertainty and pushed many to sell their shares. But if you actually understood their business, you would have done the opposite and bought the dips.

As we explain in a recent update, the company is a lot safer than it is portrayed to be and, therefore, the dip is a market inefficiency that’s causing a mispricing. We bought more shares at the lower share price, hoping that the management would clarify some of the points made by WSJ and others in their next earnings call.

And that’s precisely what they did. Here are the CEO’s opening statements:

“As first quarter results continue to demonstrate, the MPT in its portfolio are in the strongest positions in our history. Our portfolio is well-diversified and performing well. Our tenants are generating strong lease coverages and are poised for a strong 2022. We have a strong balance sheet and we have more and better worldwide opportunities in both acquisitions and joint venture possibilities than ever before.“

“To further demonstrate this point, in the supplement to our filings this morning, we have provided individual tenant coverages for our portfolio. I’ll start with Steward. Steward has kept coverage ratios at or above the industry standard and has remained flat close to an almost three times coverage for the past three quarters. One item of note is that the recent acquisitions in the Miami region continue to far exceed our original expectations.“

“Our operators have done a tremendous job over the past few years and expect — except for some labor pressures for a few they are all close to or at record levels of EBITDARM. Even if the labor pressures don’t subside, given where our operators are in their operations today, they all feel good about their overall expected outcome for 2022. An important historical note to recognize, on a cumulative basis, Medicare reimbursements to hospitals have always exceeded inflation.” [emphasis added]

Hospital owned by MPW:

Hospital real estate investment (Medical Properties Trust)

Does this sound like a troubled company to you?

It sure doesn’t to me. I want to repeat once again that MPW isn’t risk-free, but I think it is fair to say that the recent negative articles on the company overstated its risks and caused needless fears among investors.

Yet, the shares are today priced at an 8% dividend yield, which makes little sense for a company that has a path to 5%+ annual growth. The fact that the CEO directly addressed the negative reports and confirmed that their tenants are doing well is reassuring.

But equally important to us is the fact that they are committed to growing on “a per share basis” and taking their cost of equity into account:

The CEO continued (emphasis added): “Our expected acquisitions of one to three billion dollars in 2022 is focused on the most compelling opportunities available and sized to be funded primarily with non-dilutive and attractively priced proceeds from partnership transactions such as the Macquarie deal and single asset dispositions such as the Adeptus sales.”

This is fantastic news. Just for context: MPW sold an interest in a Steward-operated portfolio at a 5.6% cap rate in late 2021.

The management is guiding that they will do more similar deals in 2022 to raise equity at low prices, close accretive deals, and further diversify its tenant base.

This is music to our ears, because it is exactly what MPW needs to do to earn a higher FFO multiple.

The final point that I want to make is that the rent growth is accelerating thanks to the CPI adjustments that they include in their leases (emphasis added):

“Our hospitals continue to perform exceptionally well, and the organic growth benefits provided by our inflation-protected leases were realized early in 2022, as average cash rents for the majority of our portfolio increased by roughly 4%.”

In short, the investment thesis is stronger than ever. The organic growth is accelerating, the tenants are recovering nicely from the pandemic, the diversification continues, and the share price is at its cheapest in a long time.

Priced at an 8.1% dividend yield and 11x AFFO, we remain buyers.

Bottom Line

I believe that there hasn’t been a better time in years to buy STAR and MPW. Both are deeply discounted due to fears that are temporary in nature.

But the same is true for a lot of REITs right now. According to Green Street Advisors, REITs are currently priced at the lowest valuations in years, trading at steep discounts to the underlying value of their real estate.

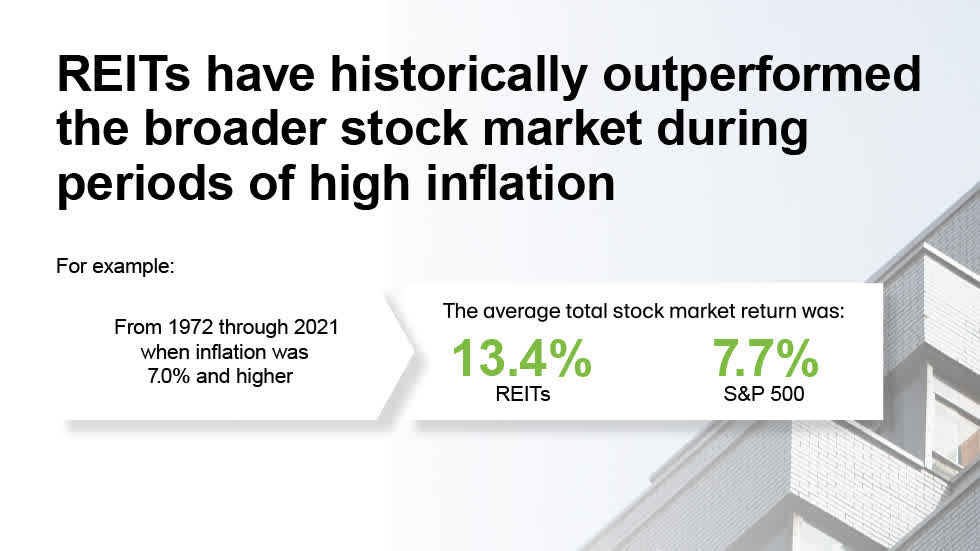

Historically, it has always been rewarding to buy the dips in REITs when they were discounted, and this is especially true when inflation was this high.

REITs outperform when inflation is high (NAREIT)

Will this time be different?

I doubt so, and this is why I am buying the dips in the REIT sector.

Be the first to comment