Khanchit Khirisutchalual/iStock via Getty Images

I have spent the last 12 years working on carbon capture. Last month, I attended the Department of Energy’s 2022 Climate Management Project Review Meeting attended by employees from Exxon Mobil (XOM), Chevron (CVX), Occidental Petroleum (NYSE:OXY), Shell (SHEL), General Electric (GE), L’Air Liquide (OTCPK:AIQUF), Linde (LIN), Honeywell (HON), and a whole host of other industry players. Odds are that you already have an opinion on carbon capture, utilization, and sequestration (CCUS) because it is such a polarizing topic.

This article is my opportunity as someone deeply embedded in the space to both set the record straight and give my thoughts on how to gain from a sector that will be exploding in the next decade. To truly understand the opportunity, I need to establish some basic principles to give a framework for the analysis. I’ll start with a primer of carbon capture and then take a detailed look into Occidental Petroleum’s Oxy Low Carbon Ventures. I plan on releasing a detailed look into other CCUS technologies at a rate of about once every week or two moving forward until I have covered the major technologies and players.

The opportunity

In 2021, Fortune Business Insights (not affiliated with estimated the CCUS market was only $2B and it is expected to grow to $7B by 2028, a CAGR of 19.5%. I think this is an underestimation for a number of reasons. This is at odds with the administration’s stated goal to reduce carbon emissions 50-52% by 2030 compared to 2005 levels. A quick sanity check says we have a lot to do in the next 8 years to meet that target.

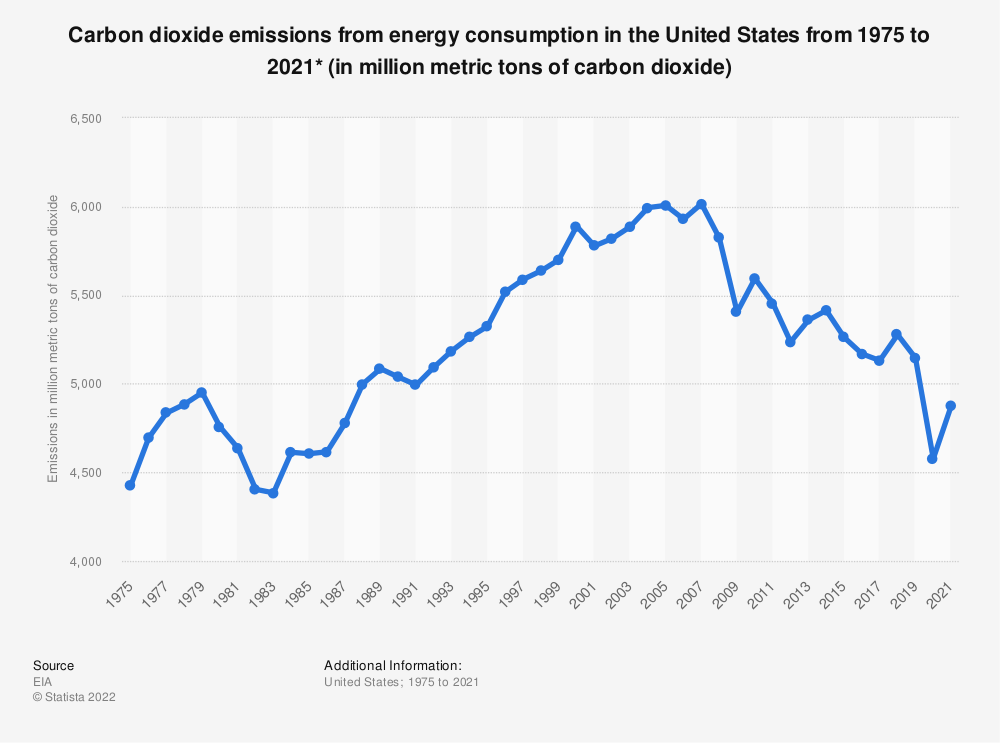

Carbon dioxide emissions in the United States (EIA)

Between 2005 and 2021, a period of 16 years, we dropped CO2 emissions by 19%. We now need to do the remaining 31% in half the time. Not only that, but a lot of the lowest hanging fruit, like switching from more carbon intensive fuels like coal to those that emit less CO2 like natural gas, or capturing the CO2 from ethanol plants, has already been done. Penetration of renewable electricity sources like wind and solar continues to grow, but that alone won’t make up the difference. If the USA plans on hitting those targets it needs other solutions and we need them now.

The CO2 market also just got a huge catalyst with the passage of the Inflation Reduction Act. It is covered in depth below and should cause significantly higher growth than was estimated above. The current TAM just in the USA for CO2 capture after accounting for the changes with the passage of the Inflation Reduction Act is $425B based on 45Q subsidies alone. Even if you assume that carbon capture accounts for only one quarter of the remaining 31% in reductions to meet the administration’s goal, that would result in a $42.5B CO2 market in the USA by 2030. Consider also that other countries, especially Canada, Europe, and Australia already have real CO2 markets that will also be growing during this time.

Isn’t CCUS just a way for oil companies to pretend they are doing something while they keep polluting?

One argument that gets trotted out almost every time I have this discussion is that carbon capture is just a ploy. It’s lip service designed to appease the environmentalists so that the oil majors and other companies can just keep up business as usual. I’m in discussions with these people all the time and trust me when I say that they understand the scope of this problem and the need for change and solutions more than most environmentalists do. They simultaneously understand how complex and far-reaching the solution has to be. People often think that turning off CO2 is as easy as putting up more wind turbines and solar panels. They ignore the reality of the status quo and how much they rely on fossil fuels, and particularly oil and natural gas, for their modern lifestyle.

Sally and the magic lamp

Sally is concerned about global climate change and happens across a magic lamp. Out pops a genie and grants three wishes. Sally uses her first wish to provide enough renewables to completely get rid of all fossil-generated electricity.

The next morning she wakes up and hears a report that the new renewable grid is great, but the largest source of US CO2 emissions, transportation, must still come down. Sally thinks to herself, “How could I be so stupid?” She furiously rubs the lamp and uses her second wish to change every car in the world to an electric vehicle.

That afternoon at work, she overhears Jim mention how he still feels guilty because his plane trip that afternoon would still use jet fuel. Marcy responds by lamenting about how the shipment of rubber chickens from China is on its way in a container ship that also is still spewing greenhouse gases into the atmosphere. Sally despondently pulls out the lamp when she gets home and uses her last wish to make the hydrogen economy a reality to replace all remaining fossil fuels used for transportation with green hydrogen.

The next morning the president is talking on TV about the amazing strides that have been made in the fight for climate change. Sally contentedly listens with the knowledge that her wishes have led to a brighter tomorrow. The President continues and the tone of the speech changes slightly as he says, “now it’s up to us to get rid of the other 60% of worldwide emissions that these changes haven’t affected…” and Sally faints in disbelief.

True scope of the problem

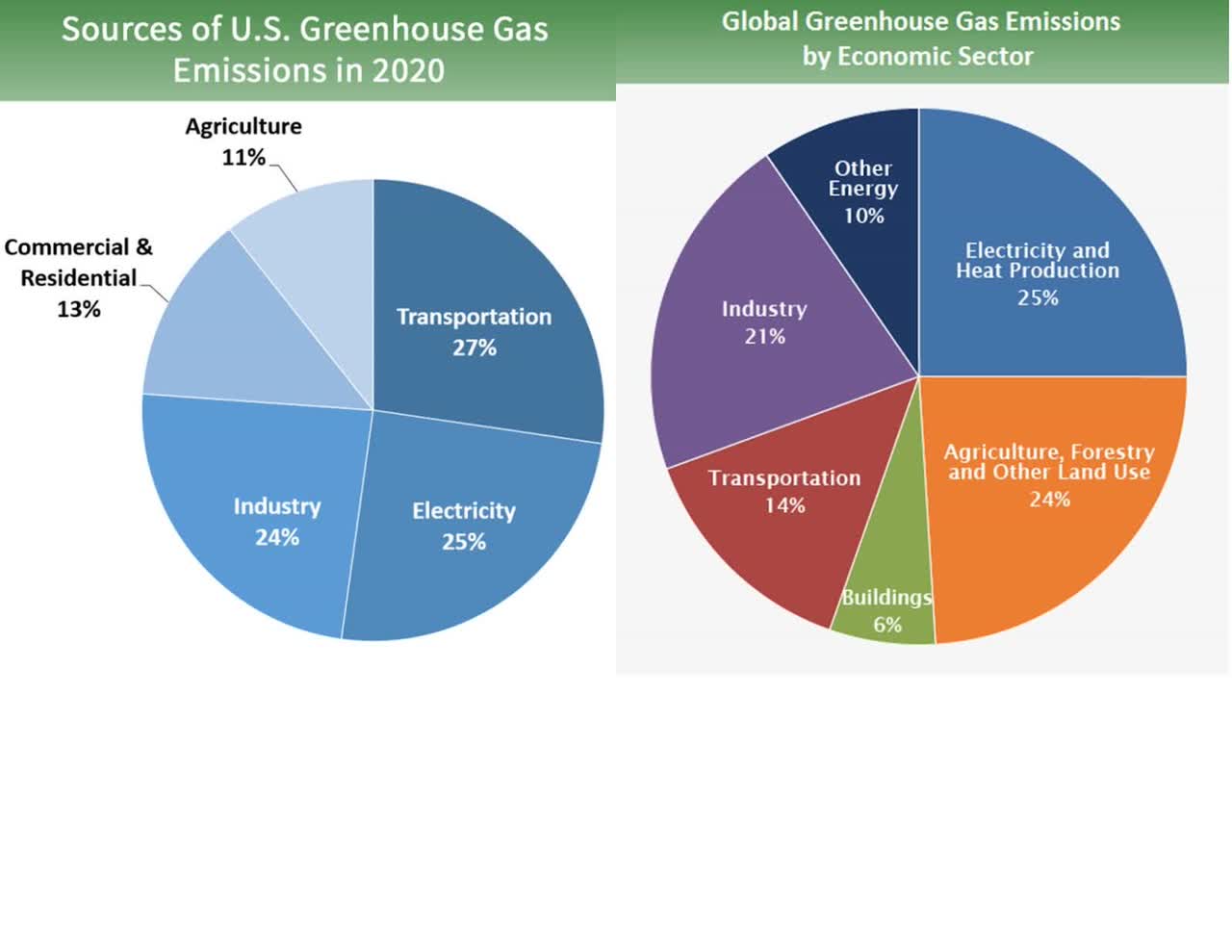

Surely I must be exaggerating, right? All those changes must result in a reduction of more than 40% of CO2 emissions. If you look at US greenhouse gas emissions, I would be exaggerating because 52% of emissions come from transportation and electricity. However, worldwide, transportation and electricity only make up 39% of greenhouse gas emissions, so the worldwide reality is that 60% is the right number. Even ignoring how difficult it is to decarbonize the entire electric grid and transportation, especially aviation, maritime shipping, and long haul trucking, there are other industries that are even harder to decarbonize. Our modern world is built from steel and cement, both of which have huge carbon footprints. Cement is literally impossible to decarbonize without carbon capture because the chemical reaction that makes cement releases CO2. Even if you had an infinite source of free heat and electricity, you’d still be emitting gigatons of CO2 every year just to build the modern world. The fertilizer industry that feeds our world requires fossil fuels as a raw material and needs to be decarbonized (this is a large part of the agriculture piece of the pie below). Without fertilizer a significant portion of the world’s population would starve within months (up to half of it, according to Our World In Data). Carbon capture isn’t a side show or a distraction, it is a necessary part of a large portfolio of green technologies that we need to hit our climate goals.

US and Global Greenhouse Gas Emissions by Sector (EPA.gov)

Thermodynamics picks a winner between PSC and DAC

Imagine you are a janitor at an elementary school. The front doors open straight into the highest foot traffic area of the entire school. You have two options to keep your school clean. First, you can put down a rug inside the front doors and make sure you clean it every morning right after school starts and after every recess. This allows you to clean most of the dirt right where it enters the school and doing so makes it so you only have to vacuum the classrooms every other week. That is a workload that you can manage by yourself. The alternative is to let the students track that dirt with them all day. Doing so spreads dust all over the school and you have to vacuum every classroom every day, which requires a janitorial staff of 4 people to clean the same amount of dirt.

Carbon capture is broken down into two main types, point source capture, and direct air capture. Point source capture (PSC) occurs where carbon is made and emitted, e.g. the power plant, cement kiln, or steel factory. Direct air capture (DAC), sometimes referred to as carbon dioxide removal, scrubs CO2 directly from the air. DAC is the sexy carbon capture. You can put it anywhere you want, theoretically capture as much as you want, and you can run it off wind and solar so it takes no emissions. People love hearing about DAC because it makes them feel warm and fuzzy and green.

PSC is decidedly less popular in the public domain. To have PSC you need a high concentration source in the first place. People like to pretend that point sources should all be eliminated while ignoring the realities of the world we live in as mentioned above.

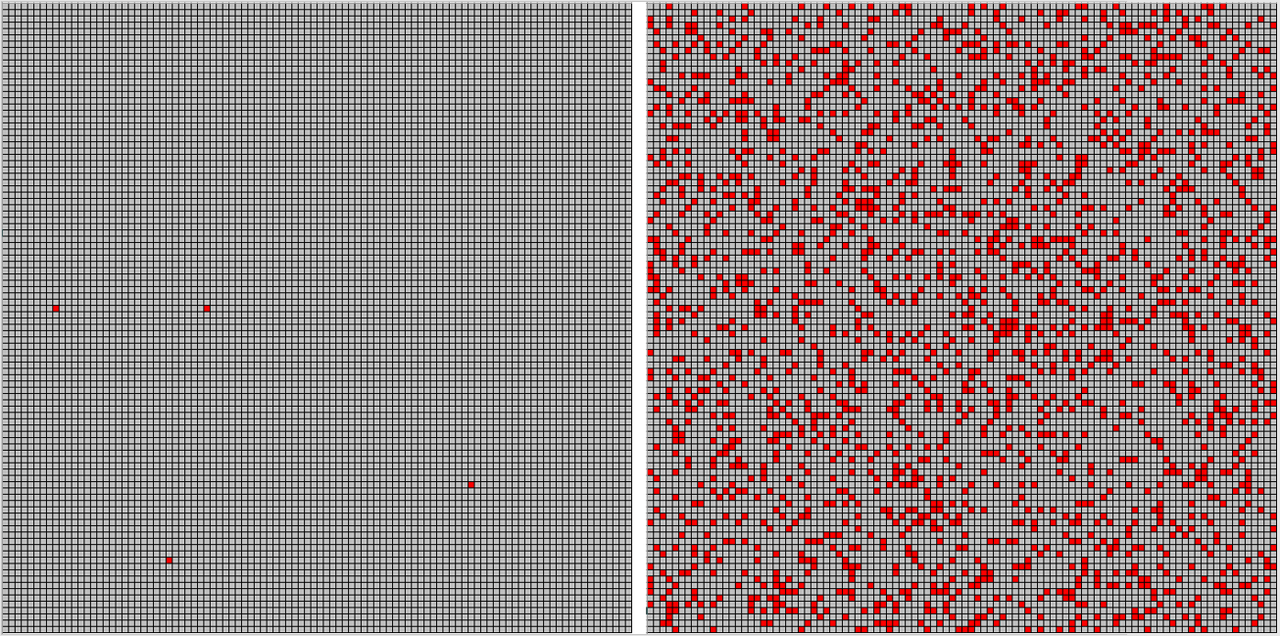

Here is where the janitor analogy comes into play. The gas coming out of a cement plant is around 20% CO2. That’s 200,000 parts per million. The concentration in air is higher than it has ever been in recorded history at around 420 parts per million. This leads to the following stark reality: CO2 is 475x more concentrated in the cement gas than in the air. Like anything else, it’s easier to catch CO2 when there is a lot more of it in the gas you process. The graphic below helps to visualize this. The square on the left has the correct ratio of CO2 molecules in red that you would find in the air compared to all other molecules in gray. The one on the right shows the same thing for the gas leaving a cement kiln.

Representation of the concentration of CO2 molecules (red) to other molecules (gray) in air (on the left) compared to a cement kiln exhaust gas (on the right) (Author)

DAC is like separating a few needles from a haystack. PSC is like separating the red skittles from the other colors. Assuming that your task was to gather 1000 needles from 2,400,000 pieces of hay or 1000 red skittles from 5000 skittles, which would you prefer? It takes significantly more energy and expense to capture CO2 from the air than from a high concentration source. Thermodynamics don’t care about public opinion. It will always make more sense to just capture concentrated CO2 at the source before giving it the time to mix with all the gas in the entire atmosphere. PSC is less expensive, takes less energy, requires less equipment, less water, less heat, less maintenance, and has a much smaller footprint than DAC. The only thing that DAC has going for it is that it can be installed anywhere, as long as that anywhere has a ton of electricity to power massive fans and a significant source of heat to run the DAC process. Those happen to be the exact same things PSC processes need, only in much smaller quantities to capture much more CO2.

The other argument for DAC is that at this point we will need to actively remove CO2 that has already been emitted if we want to hit our climate goals. This is like arguing that since you have to vacuum the classrooms anyway that you might as well just vacuum them every day at 4x the cost instead of just cleaning the rug when it gets dirty (and 4x is almost certainly an underestimation of the difference in cost between DAC and PSC). PSC is a much lower-hanging fruit, and there are PSC technologies that offer negative emissions solutions just like DAC, although that’s beyond the scope of this article. DAC’s fruit grows only at the very top of the tree. Trying to pick that fruit first is expensive and inefficient and makes no sense in the absence of legislation or subsidies.

Inflation Reduction Act

Speaking of subsidies, let’s talk about the recently passed Inflation Reduction Act. This legislation really moves the needle for carbon capture because of the changes to the 45Q tax credit. Previously, if you captured CO2 from any source, you could get a $35 tax credit per tonne captured if the CO2 was used for enhanced oil recovery or another utilization technology, and $50 per tonne if it was permanently sequestered. That was for PSC or DAC and you received the credit for 12 years after you started capturing CO2.

The new legislation does 4 key things:

-

Increases the tax credit from $35 and $50 per tonne to $60 and $85 for PSC, and $130 and $180 for DAC.

-

Makes it so that the tax credit is paid up front as direct pay for the first 5 years of operation. The tax credit can also be transferred to any tax-paying entity for a non-taxable cash payment in years 6-12.

-

Decreases the minimum amount of CO2 capture required to qualify.

-

Extends the timeline to any projects that break ground before 2033 (this was previously 2026).

It’s hard to overstate how much of an effect these changes will have. Obviously the increase in the subsidy is a big deal, but the others are just as important. A lot of these companies, especially utilities, did not even have a tax liability large enough to make full use of the tax credit. Direct pay solves this problem for the first 5 years, and the ability to transfer the credits to any business that makes profit in exchange for a non-taxable cash payment solves it for the remaining 7 years. Previously, you needed a huge installation to qualify, but the changes mean even small plants can now get a leg up in their economics while scaling new technologies to full scale. The extended timeline also helps as these projects often take years to plan before even breaking ground. A lot of carbon capture technologies were flirting with economic viability, and the extended and expanded 45Q credits give them the push they needed to overcome that barrier.

Where to invest

In order for carbon capture to impact a company’s stock, it’s going to have to hit on each of these criteria:

-

Market cap

-

Scale

- Economic viability with 45Q

Market Cap

The CO2 market, while rapidly expanding, is still going to be in the tens of billions of dollars in this decade before expanding into hundreds of billions and possibly trillions in the decades beyond. In order for carbon capture to make a real impact on company revenues and therefore the stock, we probably need to be looking at businesses whose market cap is small enough for this to make a meaningful impact on revenues and profits.

Scale

Carbon capture plants take about 2-3 years to plan, build, and commission. Realistically, the only technologies that have a chance to contribute this decade are ones that have operating plants or funded projects at Technology Readiness Level (TRL) 6 or higher. This means they have a working or planned plant that is at least a small commercial operation. This might sound really odd to people used to investing in high-growth SaaS companies or sectors, but even the most aggressive development timeline for a new carbon capture technology will take a minimum of 7-10 years to scale from idea to commercial-sized plants. You’ve probably read articles about cool new carbon capture technologies in national labs or universities or commercial R&D labs. There is less than a 1% chance that a novel technology will scale to commercial viability before 2030 if it’s at lab scale right now.

Economic viability with 45Q

The amendments to 45Q are meant to help carbon capture find its economic legs and lower costs the same way that credits helped lower the cost of solar systems in the last decade. If a technology cannot be profitable with this significant subsidy, it will lose out to others that can.

Occidental Petroleum

Everyone is talking about OXY because of Berkshire Hathaway’s (BRK.A) (BRK.B) large purchases in the last year. I think they overpaid for Anadarko at the time of acquisition a few years ago and have not always made full use of their capital. There are certainly reasons to invest in OXY, but carbon capture is, sadly, not one of those reasons.

First of all, their market cap is already over $60B, so the carbon capture market is too small to really move the needle this decade. They have put a lot of money and PR into their Oxy Low Carbon Ventures (OLCV) subsidiary. I don’t see that bet resulting in substantial payoffs.

1PointFive

The biggest OLCV bet is their 1PointFive business unit, which is a joint venture that utilizes Carbon Engineering’s DAC system. We covered why DAC struggles above, but here is where the economic rubber hits the road. If DAC costs were anywhere near $180/tonne, these plants would be popping up like daisies. One is being planned and constructed in Texas, but there are no other projects underway right now. That is because real costs for DAC are 2.5-4x the amount of the 45Q subsidy. Carbon Engineering is a good company with an important mission, but consider these three points:

-

They refuse to publicly state their current cost per tonne.

-

Their aspirational target is $94-$232 per ton, which was generated using natural gas and electricity prices of $3.5/GJ and $30-$60 per megawatt-hour. Current costs are about $7.90/GJ for natural gas and $89.6/MWh for electricity.

-

Capital costs for those were based on 2016 dollars. The price of steel has roughly doubled since then.

Building a plant today is more expensive than their estimates above. Operating that plant is also more expensive than those same estimates. Despite the increased subsidy for DAC, the economics still don’t make sense. Additionally, these aren’t pieces of equipment that are at the beginning of their cost curve. There are very few remaining improvements that can be made to fans, calciners, and compressors. These are pieces of equipment that already exist at large scales and have already taken full advantage of economies of scale. The result is that it is going to be very difficult to decrease costs from where they are moving forward

NET Power

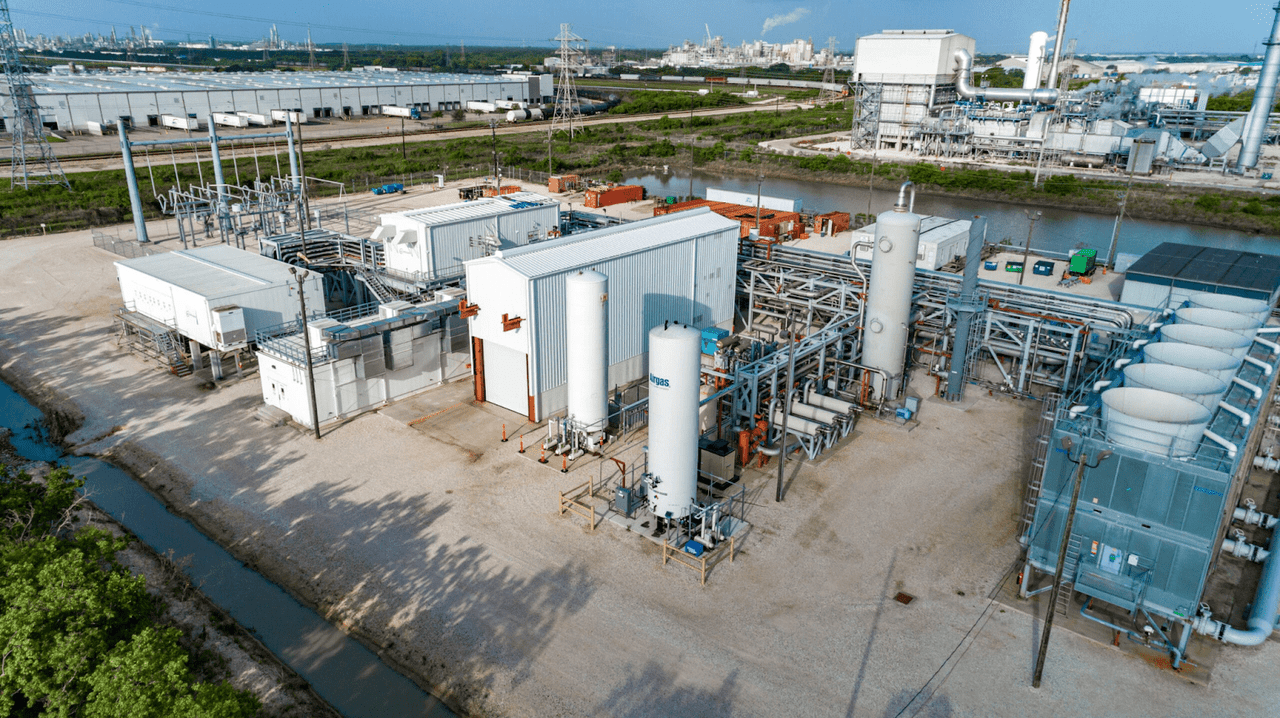

OLCV’s second bet is a joint venture with NET Power to develop emissions-free power plants from natural gas combustion. They have a working facility in La Porte, Texas, so this is a proven technology. NET Power’s technology is excellent but will struggle for two economic reasons. First, existing fossil-burning electric plants have already spent the capital it took to build that plant. Using a CCS technology that can retrofit onto an existing plant will result in better economics than decommissioning an existing plant in order to build a new one from the ground up. Second, if you are going to decommission an existing plant for environmental reasons, the most likely outcome is that you will replace it with a renewable alternative rather than another fossil plant. NET Power exists in a weird middle ground because it is a fossil-based green solution to a fossil-caused problem. NET Power also cannot do anything to address decarbonizing the industrial and agricultural sectors, their product is strictly for power generation.

NET Power plant in Texas (netpower.com)

OXY’s carbon capture business therefore strikes out on two of the three criteria. Their existing market cap is too large for any of their carbon investments to truly move the needle in the near term. While both of their joint venture technologies have already achieved significant scale, neither of them seems viable even with 45Q benefits. In terms of CCUS, OXY is a sell.

Conclusion

Carbon capture, utilization, and sequestration is a market that is set to grow at an exponential rate in this decade and beyond. The companies with the best technology and execution will separate themselves from the pack and stand to benefit from this growing sector. Occidental Petroleum is vocal in their support of a sustainable future and have backed that up with investment in the carbon capture space. Unfortunately, they’ve allocated that capital into technologies that are too expensive, exist in a niche that will most likely result in minimal returns, or both. While OXY’s core operations are still highly profitable, they overpaid for Anadarko and are putting large investments in green technologies that I think will only lead to losses. Overall, I rate them as a hold.

In the coming weeks I’ll be exploring capture technologies from other oil majors and industrial players as well as unique and emerging second generation technologies. I’m also excited to write about the only pure-play carbon capture company I know of who is building one of the largest plants that has ever been built. Follow me if you’d like notifications when those articles publish.

Be the first to comment