jetcityimage

The global economy is transitioning as rising interest rates lower economic demand. As rates rise and demand declines, many companies have seen stark declines in their earnings outlooks. Some sectors have only seen minor negative revisions while others, such as consumer discretionary retail, are seeing more dramatic pressures. Of course, investor concerns regarding such changes have led to significant declines in the stock prices of many retail companies, leading to very low valuation multiples.

One notable example is the retail giant Kohl’s (NYSE:KSS), which has seen its stock price fall by around 50% this year, giving it a low 5.1X TTM “P/E” ratio and a high TTM dividend yield of 6.5%. On the surface, Kohl’s may seem like a great “value” dip-buying opportunity. That said, investors must consider the risk of financial restructuring when considering low-margin retailers with high leverage. It is incorrect to assume “stocks always bounce back” as those which fail are often delisted. I believe Survivorship Bias is extremely strong among many of today’s dip-buyers, potentially leading many investors to purchase value traps.

While there is potential value in Kohl’s, I believe the stock is among a growing number of value traps. The company has relatively high debt and recently lost its “investment grade” credit rating, meaning its interest costs could rise quickly enough to absorb much of its earnings. Additionally, if cost pressures continue while consumption demand moderates, the firm’s already low margins may become far thinner. Even more, Kohl’s has growing inventories and fragile cash levels, creating significant liquidity risk in the event of a slowdown. Overall, I believe this situation puts Kohl’s at material risk of bankruptcy or, at least, a considerable chance of permanent business reduction.

Economic Pressure Hit Kohl’s with Downgrade

The “big box” consumer retail industry has struggled to survive for the past two decades as the online shopping industry has grown. Kohl’s has an immense competitive disadvantage compared to Amazon (AMZN) due to its much higher overhead costs, particularly considering rising electricity and wage pressures. The company has created an online platform that is somewhat attractive, but its fulfillment network is not nearly as strong as Amazon’s. Indeed, the primary economic trend benefiting Kohl’s has been the bankruptcy is its competitors, such as JCPenney, improving Kohl’s market share.

Fundamentally, large department stores are at a disadvantage compared to e-commerce giants with more efficient distribution networks. Assuming electricity, labor, and item costs continue to rise, Kohl’s core competitive disadvantage will likely become more considerable. The chief advantage of large department retailers is that customers can try on items before they purchase; however, with the development of Amazon’s “Try before you buy” program, combined with its generally lower prices, Kohl’s is likely to lose its remaining advantage.

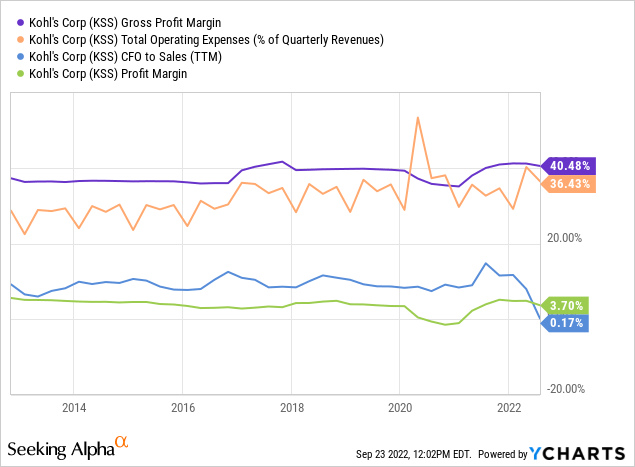

During Kohl’s last earnings call, the company noted growing margin pressures from wages and freight costs. Freight costs may be moderated due to the decline in gasoline costs, but that may change if oil sees supply pressures, as I suspect. At any rate, the labor shortage and high natural gas prices will likely keep pressure on Kohl’s wage and electricity costs. Thus far, its gross margins have been maintained while its operating expense-to-sales ratio has slowly climbed higher. At the same time, the company’s bottom line has slipped slightly while its operating cash flows have plummeted. See below:

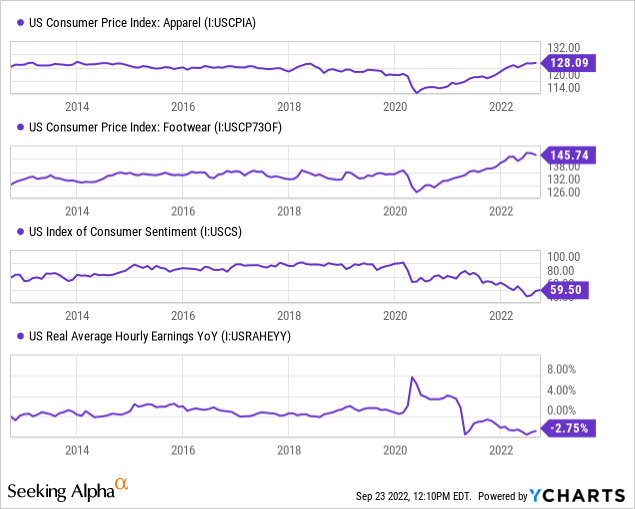

Over the coming quarters, I expect Kohl’s operating expense ratio will rise faster, given wage pressures. Even more, its gross margins may see growing pressure as apparel and footwear prices rise quickly, particularly given the decline in consumer spending capacity. See below:

Initially, inflation did not impact apparel and footwear prices and fell dramatically during 2020. This trend significantly benefited Kohl’s as consumer prices declined while real wages grew, giving the company a tremendous cushion against economic woes. In my view, 2020’s economic stimulus may have artificially boosted Kohl’s sales, making it appear to be a stronger company than it truly is.

Looking forward, we’re seeing accelerating prices in footwear and apparel combined with falling real wages and weak consumer sentiment. These trends indicate that apparel and footwear import prices are rising. Some of this pressure comes from heavy lockdowns in China, creating a textile supply-chain crisis across Asia. Considering much of China remains in “zero-COVID” lockdowns, these pressures are likely to accelerate.

The overwhelming majority of Kohl’s products are not made in the U.S, and most are shipped from Asia, so China’s unending lockdowns are likely further to increase apparel and footwear costs in the U.S. Thus far, Kohls has managed to push these costs onto customers, but the overall rise in prices is relatively low considering prices fell initially in 2020. If prices continue to rise, I expect Kohl’s will face some difficulty raising costs, particularly given the waning consumption demand. Kohl’s operates with a thin 3% profit margin, so it would only take a slight decrease in gross margins or a small rise in operating costs to erase much of the company’s bottom line.

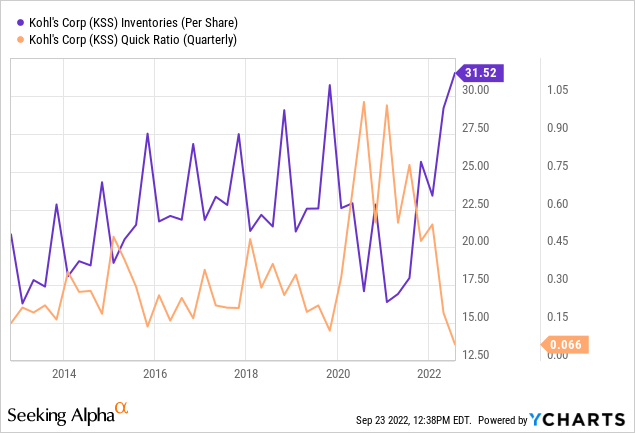

Kohl’s ended the last quarter with very high inventories per share and a meager quick ratio. See below:

Its high inventory going into winter sales protects partially against Chinese import woes. However, given Kohl’s low quick ratio (liquid current assets-to-current liabilities), it must sell its inventory or risk liquidity troubles. If the winter sales season is not as strong as expected, then Kohl’s may with insufficient cash going into 2023. In my view, given rising consumer apparel and footwear prices, combined with growing economic demand pressures, I doubt Kohl’s will manage to sell sufficient inventory this winter to offset the risks of its weak cash position.

Rising Interest Rates Create Further Pressures

Kohl’s recently fell as Moody’s placed its Baa2 rated senior unsecured debt on review for downgrade due to its lagging competitive profile, high leverage, and margin pressures. S&P Global Ratings downgraded its debt further to BB+ from BBB-, meaning it is no longer “investment grade” debt. This change is significant because BBB debt has an effective average yield of 5.75% today, while BB debt has an average effective yield of around 7.25%. There is a large spread between these two rungs because many investment funds categorically do not, or cannot, purchase non-investment grade debt.

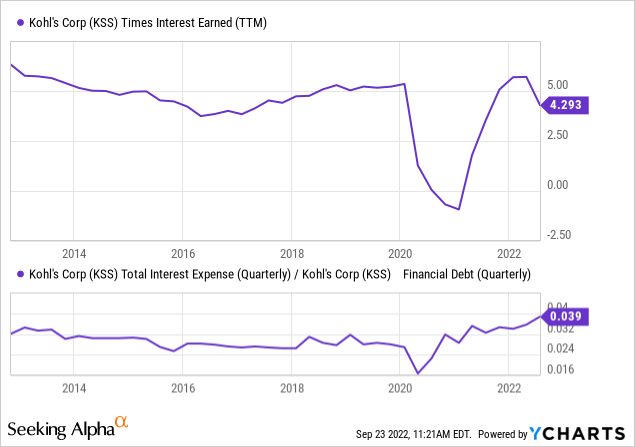

Across all of Kohl’s financial debt, it is already paying a high price, with a total interest expense to debt ratio of 3.9% last quarter (15.6% annualized). Its interest costs have risen very rapidly in recent years from around 2.6% before 2020. Given its credit rating downgrade and rising interest rates, I expect its total interest costs will increase faster over the coming year. The company currently has a Times Interest Earned (EBIT-to-interest expense) of 4.3X TTM and ~$700M in annual income compared to $275M in annual interest costs. As such, doubling its total interest costs (likely given the rise in interest rates and downgrade) may absorb much of its net income. See below:

Looking just at its long-term debt, the company currently pays an effective interest rate of 4.89% (10-Q pg. 8). Roughly 15% of its long-term debt, or $275M, will mature in 2023. This debt has a coupon rate of 3.25-4.75%, which will likely double (or more) if Kohl’s rolls its debt forward. Much of the company’s remaining debt expires in 2025; however, the remaining portion (~60%) does not expire until 2030-2045.

While rising interest costs will lower Kohl’s income, it alone should not reduce it by more than 20-30% over the next two years. Of course, the company also faces interest on leased assets, which changes in short-term interest rates may more rapidly impact. More importantly, the interest rate and margin pressures may cause Kohl’s to break its financial covenants. The company’s quarterly and annual reports do not state specific covenant maximum leverage ratios but note that default, cross-default, or acceleration would occur if leverage ratios are broken (10-K pg. 9).

Essentially, if the company suffers a decline in EBIT, then much of its debt may become immediately due, forcing the company into Chapter 11 bankruptcy. In 2020, most banks were lenient on covenants due to the one-off circumstances (and a lack of pressure due to the Q.E stimulus). Still, I highly doubt this leniency will exist in the event of another economic downturn. Given the secular pressures on Kohl’s (competitive disadvantages), acute economic pressures (rising costs and falling demand), its low quick ratio (and rising inventories), and rising interest rates, I believe bankruptcy is relatively likely over the coming 12-24 months.

The Bottom Line

Overall, I believe Kohl’s is a “sell,” and I am bearish on the stock. The list of its woes continues to grow as activist investors recently urged the removal of Kohl’s CEO. In my opinion, changing management is unlikely to save Kohls, given the combination of secular and cyclical pressures on the company. Fundamentally, I believe the era of large department stores is ending as the ongoing wave of cost pressures, combined with demand declines, may be sufficient to create insolvency for many department stores. Given Kohl’s balance sheet situation and its lack of a “luxury” or “discount” niche, I believe it has a more significant disadvantage than most of its peers.

The company may sell its e-commerce segment, some of its remaining real estate, or other assets to try to shore up capital and avoid bankruptcy. While there are some avenues Kohl’s can take to buy time, I believe there is very little the company can do to create a stable competitive moat necessary for long-term survival. Given rising input cost pressures, interest rates, faltering economic demand, and its already low margins, I believe it is more than likely Kohl’s will face a breach of covenants over the coming year or two. Further, I think its EPS will likely decline given these woes, giving the stock little discount value today.

A Short Opportunity?

KSS has a higher short interest ratio of 19% but an immaterial short interest cost. Recently, the stock has broken below its 2022 support level, creating a potential brief opportunity as it finds a new low. Its high short interest creates some squeeze risks, mainly if retail spending levels do not decline as I expect. These risks can be offset by using options, but KSS has a ~60% implied volatility level, making these options quite costly. I believe KSS is a short opportunity with potential catalysts being a dividend cut, weak holiday sales, and its early 2023 bond maturity. My long-term expectation price is zero, but it may see some support if it reaches its 2020 lows of $15-$20 and could see an upward spike given its short interest – so I would keep short positioning low.

Be the first to comment