michaelquirk/iStock via Getty Images

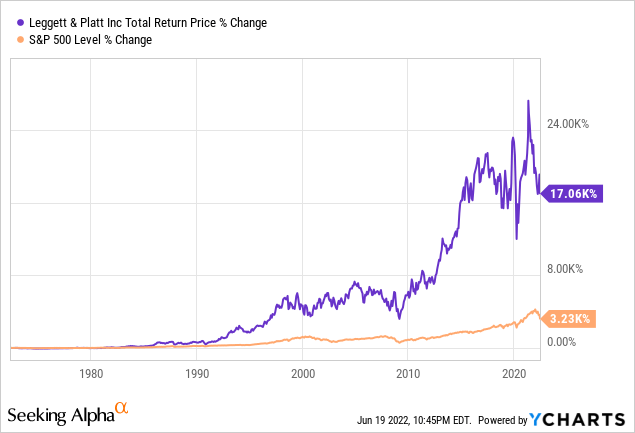

Leggett & Platt (NYSE:LEG) has grown its dividend for a whopping 51 years in a row. With over half a century of consistent annual dividend increases, LEG is not only a very proven dividend growth machine, its business model has also been a very proven wealth compounder across all types of market cycles. As a result, it is unsurprising that the company has generated massive outperformance over the course of its existence:

In this article, we will look at why LEG has been so successful in the past and why we remain bullish on it moving forward. However, the dividend is not as safe as the growth streak implies, so we also look at why it could be at risk moving forward.

Why Leggett & Platt Has Been So Successful

LEG was founded all the way back in 1883 by inventor J.P. Leggett who created a market-leading innovative bedspring. Over nearly a century and a half of business as a manufacturer, LEG has grown into a diversified manufacturer of bedding products (50% of 2022E net trade sales), specialized products (automotive, aerospace, and hydraulic cylinders – 20% of 2022E net trade sales), and furniture, flooring & textile products (30% of 2022E net trade sales) with tens of thousands of employees and a presence across the globe (65% exposure to the U.S., 12% exposure to Europe, 11% exposure to China, 5% exposure to Canada, 5% exposure to Mexico, and 2% other).

LEG has an investment grade balance sheet that earns a BBB credit rating from S&P with plenty of liquidity via its strong free cash flow generation and $1.2 billion revolving credit facility, a well-laddered debt maturity profile, and access to inexpensive debt.

In November of last year, LEG issued $500 million of 30-year 3.5% notes, which were impressive terms at the time and look even better in hindsight. Given that the company’s weighted average debt maturity is 10.8 years, LEG has plenty of financial flexibility to pursue opportunistic growth investments. As management stated on its Q4 2021 earnings call:

Our strong financial base, along with our deleveraging efforts over the last two years, gives us flexibility when making capital and investment decisions. We remain focused on cash generation while reducing debt and deploying capital in a balanced and disciplined manner that positions us to capture near- and long-term growth opportunities both organically and through acquisitions.

LEG also enjoys what we believe are durable competitive advantages that offer the company a solid platform for driving long-term growth.

These durable competitive advantages are clearly illustrated by the company’s ability to generate double-digit returns on capital and equity year after year and include economies of scale and substantial brand power. It can – and does – then leverages these existing platforms of strength to make bolt-on acquisitions and invest in organic growth initiatives to unlock additional synergies and generate continued high returns on invested capital with lower downside risk, thereby generating long-term alpha for shareholders.

A big reason why LEG has been able to generate such consistently strong returns on capital and equity is due to its shareholder-friendly capital allocation strategy. As management stated on the Q4 earnings call:

Our long-term priorities for use of cash are unchanged. They include, in order of priority, funding organic growth, paying dividends, funding strategic acquisitions and share repurchases with available cash. Total capital expenditures in 2021 were $107 million, reflecting a balance of investing for the future, while controlling our spending.

By paying and growing the dividend year after year as a high priority for the company (that is above strategic acquisitions and share buybacks), management is forced to be quite disciplined with how it allocates shareholder capital. Only once it has pursued all attractive organic growth opportunities (which tend to be lower risk and higher returning than acquisitions) and fully funded its growing dividend can management then look for attractive inorganic growth opportunities and potentially repurchase shares. This results in high-grading acquisitions and therefore higher returns on invested capital and equity.

This approach prevents management from pursuing reckless empire-building acquisitions that wind up leading to massive impairments and destruction of shareholder capital down the road and/or buying back shares at what turn out to be expensive prices in the future.

LEG’s capital allocation strategy aligns closely with ours at High Yield Investor, making it a good fit for our portfolio. It also gives us confidence that LEG will likely continue to compound shareholder wealth and grow its dividend for years to come.

Why We Remain Bullish On LEG Stock

In addition to its qualitative strengths, we remain bullish on LEG stock due to its discounted valuation. Its EV/EBITDA multiple is currently 8.52x, well below its 5-year average of 10.49x, its price to normalized earnings ratio is 12.40x, which is also far below its 5-year average of 16.89x, and its price to free cash flow ratio is also discounted at 10.37x compared to its 5-year average of 11.46x. On top of that, its 5.1% dividend yield is quite elevated compared to its 5-year average of just 3.80%.

All of this implies that LEG has an enormous margin of safety that tilts the odds in favor of outperformance over the long term as its competitive advantages and proven shareholder friendliness combine with the cheap valuation to provide an attractive risk-reward for investors.

Why LEG Stock’s Dividend Could Be At Risk

While all this sounds good, investors should keep in mind that the dividend is not as risk-free as a 51-year growth streak might make it sound. LEG faces numerous challenges, in particular raging inflation, meaningful China exposure, and the increasing likelihood of a recession.

While LEG’s Q1 FY2022 results showed revenue growing by an impressive 14.8% year-over-year, inflation clearly weighed on margins with earnings per share increasing by a much more muted 3% year-over-year. That said, this is still growth, and combined with the yield of over 5%, investors should be happy with a high-single-digit total return during a tough macro environment for the company and can then expect to see growth take off once inflation abates.

However, when you factor in that it has 11% exposure to China and 12% to Europe – both of which are even more likely than the U.S. to face major economic consequences given the severe recent COVID-19 lockdown policies in China and Europe’s economic disruptions and sanctions due to the Russia-Ukraine war – the company could have difficulty in sustaining this growth in Q2 and beyond. This is even more true when you consider that the past few months have not seen inflation slow down at all, so pressures on its margins are not subsiding.

On top of that, the economy is increasingly likely to be headed into a recession, assuming we are not already effectively there. The company took a beating during the Great Recession as evidenced by its earnings-per-share performance illustrated below:

- 2006 earnings-per-share of $1.57

- 2007 earnings-per-share of $0.28 (82% decline)

- 2008 earnings-per-share of $0.73 (161% increase)

- 2009 earnings-per-share of $0.74 (1% increase)

- 2010 earnings-per-share of $1.15 (55% increase)

Granted, given that a large percentage of its revenues come from housing-related products, the collapse of the housing market during the Great Recession inflicted outsized downside on the company during that period and the next recession might not see quite as large of a downturn in housing, but it is impossible to predict. With mortgages having doubled in the past few months, housing is increasingly unaffordable. A recession could be the final straw that breaks the Housing market’s back and significantly reduces demand for LEG’s products.

LEG is expected to generate $2.79 in earnings per share this year while paying out an expected $1.71 dividend according to analyst consensus estimates. If it were to suffer another ~50-60% drop in earnings per share in a severe recession, its dividend would not even be remotely covered. On top of that, with inflation looking like it is unlikely to dissipate anytime soon and its overseas markets in even worse shape than the United States, the hit to earnings per share could potentially be worse in the upcoming recession than it was in the last one.

While LEG’s substantial liquidity and investment grade balance sheet should enable it to do what it did back in 2008-2009 and continue paying the dividend with debt for the foreseeable future, the company would likely suffer a credit rating downgrade in the process and does not have much wiggle room to keep its investment grade credit rating at just a BBB at present.

Ultimately, we do not expect LEG to cut its dividend and ruin over half a century of dividend growth at the first sign of trouble, but if the recession drags on for more than a year or two, the dividend will very likely be at risk. While LEG has proven remarkably resilient across economic cycles and able of weathering technological innovation, it has also proven that it is not recession resistant at all. It is also highly susceptible to inflation risks and has international exposure as a result, if the current storm turns into a prolonged perfect storm, LEG’s dividend could very well wind up on the chopping block.

Investor Takeaway

LEG is a classic case of a strong, conservatively positioned business that has hit a few speed bumps due to unfavorable macro trends. However, the underlying business quality remains very strong from everything we can tell. It enjoys strong competitive advantages, a stellar balance sheet, and is paying out a well-covered, attractive, and growing dividend.

With shares at clearly discounted levels relative to its recent history and the long-term trajectory of the business still looking positive, we believe that now is a great time to add shares. Even if macro headwinds persist, we will gladly collect the nice dividend while we wait for the winds to shift and capital appreciation to follow.

That said, investors should keep in mind that just because LEG is a Dividend King does not mean it is recession- and inflation-resistant. The headwinds are real, and if they end up prolonged, its dividend growth streak and even current payout level could be put at risk.

Be the first to comment