davidf

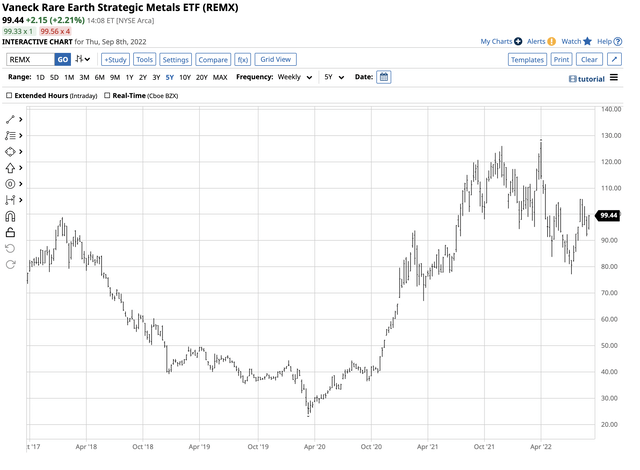

On May 28, 2020, during the height of the global pandemic, I wrote an article for Seeking Alpha and stated that “If the prices of rare earth minerals and metals are going to move higher over the coming months and years, REMX, at its current price, is a bargain.” The VanEck Vectors Rare Earth/Strategic Metals ETF (REMX) product was trading at the $33.25 per share level on May 27, 2020. By April 2022, the ETF reached a high of $127.50, over 3.8 times the price at the time of the May 28 piece.

Rare earth metals are essential components for a wide range of technological products. Meanwhile, the REMX ETF has pulled back from the April 2022 high to just below the $100 per share level on Sept. 8, a 22% decline, but the ETF remains over three times the price in late May 2020. The case for rising rare earth metal and minerals prices could be even more compelling in September 2022 than in May 2020. However, the road high is perilous as relations with the country that controls the bulk of rare earth supplies have deteriorated.

Rare earth metals and REMX had quite a run

While REMX rallied from the price in late May 2020, it reached a low of $23.91 in March 2020 as the global pandemic gripped markets across all asset classes.

Chart of the REMX ETF Product (Barchart)

The chart highlights the explosive move that took the rare earth metal ETF to a $127.50 high in April 2022. Since then, the ETF has corrected with many other commodities. At just below $100 on September 8, REMX had over $842.5 million in assets under management. The ETF trades an average of over 104,000 shares each day and charges a 0.53% management fee. Meanwhile, the ETF has paid shareholders a $5.89 dividend, translating to a 5.9% above-market yield. The top holdings include:

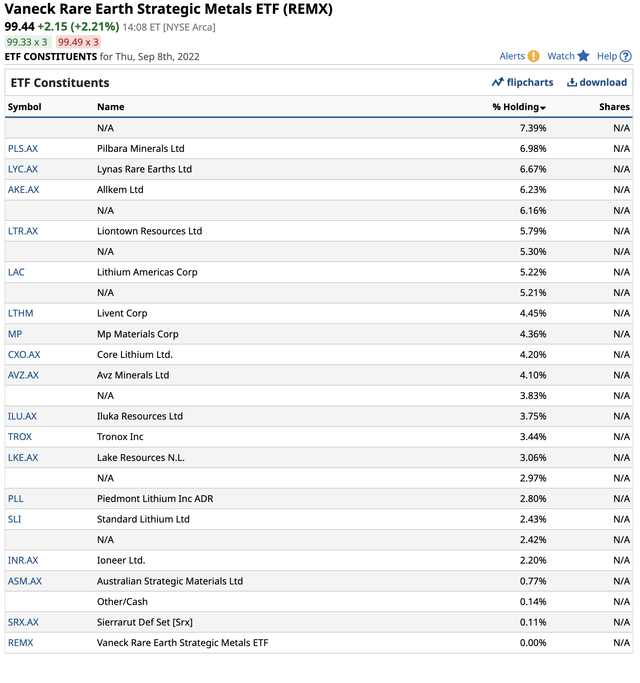

Top Holdings of the REMX ETF Product (Barchart)

The chart shows the non-Chinese companies that produce, refine, and recycle rare earth and strategic metals and minerals.

Demand will continue to rise

In an April 2021 article in The Conversation, the author pointed out that “The annual demand for rare-earth metals doubled to 125,000 tons in 15 years, and the demand is projected to reach 315,000 tons in 2030, driven by increasing uptake in green technologies and advancing electronics. This is creating enormous pressure on global production.“

The article summarizes the mining challenges, citing costly and inefficiencies as small amounts of production require large extraction areas. While rare earths are critical for decarbonization, the catch-22 mining poses significant adverse environmental impacts. Mining extracts substantial volumes of toxic and radioactive materials from the earth’s crust.

Realizing the importance of rare-earth production for national security, the Trump administration ordered the Defense Department to fund more at-home output of rare earth elements for military-grade products and clean energy technologies. The Biden administration ordered the Defense Department to consider at least five metals – lithium, cobalt, graphite, nickel, and manganese, essential to national security.

A supply monopoly

The rising demand and trade frictions under the Trump administration and the bifurcation of the world’s nuclear powers caused by the Chinese-Russian 2022 alliance have caused the Biden administration to hasten US production of commodities that support technological and military advances. Meanwhile, China is the 800-pound gorilla in rare-earth metals production, with Chinese domestic production and investments in other producing countries.

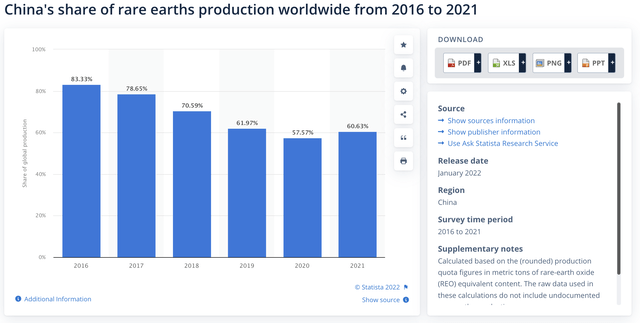

As of 2019, China produced around 85% of the world’s rare earth oxides and 90% of the rare earth metals, alloys, and permanent magnets. The world depends on China for supplies of the commodities required for technological advances with military, electronic, and green energy applications.

As the world realized that Chinese dominance was becoming a national security issue, production from other countries increased, eating into China’s share.

China’s Share of Global Rare Earth Metals Production (Statista.com)

The chart highlights the decline of China’s share of global rare earth production but still shows that at over 60%, China dominates the market.

Geopolitics support the Rare Earths – Natural gas could be an example

At the opening ceremony for the 2022 Beijing Winter Olympics, a few weeks before Russian troops stormed across the Ukraine border, Russian President Putin shook hands with Chinese leader Xi on a massive trade package and “no-limits” support pledge. The Russian President had long believed Ukraine is a territory in Western Russia, while the US and NATO allies think it’s a sovereign country in Eastern Europe. Meanwhile, China believes Taiwan is a Chinese province, while the US and other countries support Taiwanese independence. The war in Ukraine continues to rage in September 2022, and the potential for a “special military operation” to unify China with Taiwan is increasing.

The bifurcation between the world’s nuclear power significantly impacts on world trade. Sanctions on Russia and Russian retaliation have caused commodity prices to soar as demand-side concerns have underpinned prices. The most glaring example has been in the natural gas market. The UK and Dutch natural gas prices rose to all-time highs in 2022 as Europe depends on Russian gas. In the US, nearby NYMEX natural gas prices probed over $10 per MMBtu in August, the highest price since 2008.

The friction between the US and China over Taiwan and Chinese support for Russia could cause severe trade ramifications. As Russia uses natural gas as a weapon against the West, China could easily restrict rare earth metal supplies, causing shortages that hamper technological advances over the coming years.

The bottom line is that Chinese dominance in rare earth metals will likely continue to prompt more production in the US and other allied countries to offset the supply risks.

Caution over China

China is a pragmatic country that has succeeded because of its patience and long-term approach to achieving economic and political goals. China’s plans to surpass the US as the world’s leading economy depend on the US, European, and other countries’ consumption of Chinese products and services. While the Russia alliance has a political underpinning, economic growth depends on the flow of goods and cooperation with the wealthiest countries.

If China decides to follow in Russia’s footsteps and force reunification with Taiwan, it could lead to a cold or even a hot war in the region. China is likelier to bide its time until a peaceful reunification becomes plausible. A slow and steady policy would allow China to play on both sides of the war in Ukraine, giving limited support to Russia but cooperating with the US, Europe, and their allies to keep the economic status quo in place.

Meanwhile, national security concerns will likely continue to support rare earth metal production that reduces Chinese dominance. However, if China decides to crush prices by increasing supplies, it could make production uneconomic, and foster continued reliance on Chinese rare earth metals.

Rare earth supplies are a geopolitical issue that will continue to cause volatility and boom and bust periods for the metal’s prices. The REMX is an ETF that will move higher and lower with those prices over the coming months and years. In September 2022, REMX has declined by over 20% from the April 2022 high, which could be an excellent time to add the ETF to portfolios. The above market dividend pays for the management fee and offers an attractive income flow. Meanwhile, any purchase of the REMX ETF requires leaving plenty of room to add on further declines as the sector is likely to experience lots of price variance.

Be the first to comment