hohl

Investment Thesis

Last month, FedEx (FDX) came out with horrible preliminary results. The companies’ global volumes declined, and they saw macroeconomic trends significantly worsening during the quarter. FedEx even withdrew its FY23 outlook. This news sent FedEx down 21% in a single day. This news also sent down peers UPS (UPS) and Deutsche Post AG (OTCPK:DPSTF) (OTCPK:DPSGY), with Deutsche Post falling over 7% that day. In the earnings call later that month, analysts got the feeling problems might be more company specific as opposed to a broad problem with the economy.

I think so far this year Deutsche Post is getting hammered without good reason. This has made the stock extremely undervalued. The strong business fundamentals in combination with a cheap valuation make the stock a clear buy.

Within this article, I will take you through the fundamentals of the company and show you why I own stock in Deutsche Post.

Deutsche Post

Deutsche Post AG is a German logistics company, also known as Deutsche Post DHL. The company works on multinational package delivery and supply chain management. The company is headquartered in Bonn, Germany. Deutsche Post is one of the three largest carriers worldwide, only behind UPS and FedEx. The Parcel division DHL is a wholly owned subsidiary active in over 220 countries and territories. This is how the company describes itself:

Deutsche Post DHL Group is home to two strong brands: DHL offers a comprehensive range of parcel and international express service, freight transport, and supply chain management services, as well as e-commerce logistics solutions. Deutsche Post is Europe’s leading postal and parcel service provider.

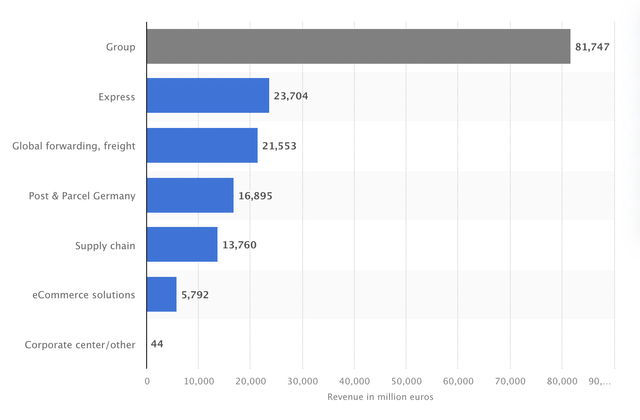

Deutsche Post group employs approximately 590,000 people. The Group generated revenues of more than €81 billion in 2021. The company offers multiple services:

- National and International Mail and Parcel Services

- Dialog Marketing Services, Outsourcing, and System Solutions for the Mail Business

- International Express

- Air Freight, Ocean Freight, European Road Freight

- Contract Logistics

Performance

On the 11th of August, Deutsche Post reported its 2Q22 earnings. This was another quarter with double-digit growth, and they confirmed their outlook (for a record year). Revenue came in at €24 billion, which represents 23.4% YoY growth. EBIT was €2.34 billion (+12.2% YoY) and EPS was €1.20 (+14.3% YoY). All in all, these were excellent results for Deutsche Post and there was no slowdown in growth. Performance for the quarter was mainly driven by forwarding, Freight, and Supply Chain divisions. Express, eCommerce Solutions, and P&P Germany are going through the expected post-pandemic normalization phase. EBIT for the first half of the year was €4.5 billion and gave management the confidence to confirm FY22 targets. H1 results now cover the case of a potential GDP decline in H2.

If we take a closer look at the results per division, we can see a clear expected B2C normalization and continued tight capacity in freight markets. Covid lockdowns in China were a drag on volume growth but showed improvement after the reopening in June.

Deutsche Post reports through multiple segments:

- DHL Express: saw continued strong pricing and weight/shipment growth. The segment reported €1.1 billion in EBIT. This is a drop of 6% compared to the same quarter last year. This is mainly the result of lower shipments/day (-5%) because of China lockdowns.

- DHL global forwarding, freight: This segment mainly reflects tight market conditions. For Air Freight, the China impact was visible in volume (-8% YoY). Ocean freight volumes were up +11%. This segment reported €746 million in EBIT, which is over a 100% growth compared to last year.

- DHL Supply chain: This segment reported double-digit EBIT growth of 23%, driven by higher efficiencies from digitalization, higher renewal rates, and new business wins.

- DHL E-commerce solutions: This segment reported higher revenue of 5% but an EBIT loss of 6%, because of a drop in volumes. The segment was supported by FX effects.

- P&P Germany: This segment saw a normalization from 2021 effects, which led to a volume decline in parcel (-14%) and an increase in Mail (+4%). Additional cost inflation was addressed through cost and pricing measures.

Revenue split by segment (Deutsche Post AG)

By looking at the segments separate from each other we can see some weaknesses in the business. FX effects gave a boost to the company results, but in many segments, volumes dropped compared to last year. Global forwarding, freight still saw very strong growth by YoY comparison.

This is what management said about the results:

Despite continued expected B2C normalization and general economic uncertainties, Group revenue grew double digit. This growth also includes the automatic effect of fuel surcharges and other well-established mechanisms to pass through cost inflation. EBIT, net profit, and EPS are also up double digit. Higher taxes reflect the higher taxable base and expected 29% tax rate

With €1.8bn FCF (excl. Net M&A) already achieved YTD, we are on track towards our Group FCF guidance, which once more confirms the sustainability of our new level of cash flow generation.

The whole group performed well, despite economic headwinds during the quarter. I am also interested in how these results compare to 5 years ago, so we can see income development and growth over a longer period.

In 2Q17 (5 years ago), the company reported revenue of €14.81 billion, operating profit of €841 million, and EPS of €0.50.

This means the following:

– Revenue CAGR over the last 5 years was approximately 10%

– Net income CAGR of 22.71%

– EPS CAGR of 19.14%

So, Deutsche Post saw double-digit growth on all metrics over the last 5 years, with net income and EPS growing by almost 20% CAGR.

Outlook

In the previous section, I already mentioned that Deutsche Post confirmed its FY22 targets but what did management have to say about their outlook?

Moving from the Q2 review onto the relevant factors to consider for our guidance, it is obvious that external market circumstances are marked by a high degree of uncertainty due to a series of partly related factors (Covid pandemic, Ukraine war, inflation, …).

One important strength against this background is our very broad and diversified portfolio of Group activities – all focused-on core logistics. This set-up provides resilience to the DPDHL Group performance in all phases of the economic cycle. This would of course also include countermeasures in case of slowing or declining demand, based on proven business model set-ups and cost measures successfully leveraged through previous cycles.

Management seems very aware of economic uncertainty and the exposure of their business to the economy and GDP growth. Despite this, the company remains confident in its portfolio and group activities but is prepared to take measures in the case of a slowdown. To me, this is very good to hear as a shareholder. It comforts me that management sees the problems and knows how to deal with them. They continued with the following:

Besides the overall GDP uncertainty, we also address the three other major worries in financial markets currently. Wage and general inflation are inherent topics for all our operations and therefore addressed constantly through well-established mechanisms, notably yield management (e.g. General Rate Increase, surcharges). Higher fuel prices are subject to automatic pass-through mechanisms where they are the most sizeable in the group while natural gas is not used as a production feedstock. The rise in interest rates is not of significant relevance for our Group, as financial interest costs are minor and on fixed rates; lease interest being mainly related to rentals and mostly covered by long-term customer contracts.

Yet again, management seems to be well in control of situations. With 590,000 people in their workforce, labor costs can be a big drag on earnings, but management seems not to be worried about this, and so neither will I. Higher fuel prices are being passed on to consumers/businesses and interest rate hikes are no issue, because of the minor influence it has on the company and the fixed rates and contracts that are in place. Management remains confident.

Deutsche Post sees no economic slowdown in its financials yet. Nonetheless, management does acknowledge the current economic worries in the scenario of a global downturn. But they have a set of well-established levers across their portfolio, which have been well-proven in past downturns, to countermeasure a challenging economic cycle, as stated by management.

We today confirm our full guidance set for 2022/24 – acknowledging that different economic assumptions will lead to a range of outcomes. Our own 2024 assumptions factor in slower/below-trend GDP growth. Also, by 2024 we continue to expect freight markets to have reached a more balanced, less disrupted status. We also expect the structural trend of e-commerce to again drive an increasing share of retail sales being made online, as we will be through the current post-pandemic normalization phase by end of 2022. Our unchanged FCF expectation confirms our strong conviction that we have reached sustainably higher cash generation levels, which are also reflected in our shareholder return policies.

Deutsche Post remains confident in its targets and already factored in slower GDP growth, so they were ahead of things. This is a very good thing and I think management is right. I still believe management has everything well under control and I don’t see any problems for Deutsche Post which have not been already factored in by management.

We do have to note that this earnings call was in August and the recent warning from FedEx stated that they saw a significant worsening of conditions towards the end of the quarter. As of now, we do not know for certain whether Deutsche Post has been hit by these same problems at the end of the current quarter, so this remains a risk. But I also think that after the FedEx debacle of last month, the downside risk of a slowdown for Deutsche Post had been already priced in. Their valuation is extremely low and way beneath their peers, but more on this later.

Returns

We know that over the last year the company posted strong financial results with double-digit growth. We also know that over the last 5 years the company managed to grow revenue with a 10% CAGR and net income and EPS by almost 20% CAGR. So, how did the stock performance do?

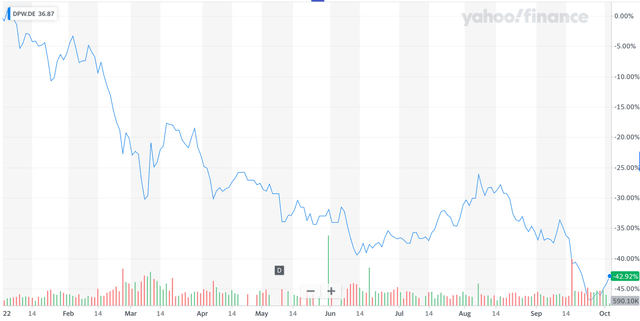

Deutsche Post YTD (Yahoo Finance)

In the graph above we can see that Deutsche Post is down by 42.92% YTD. The company almost lost half its value over the last 9 months. That is seriously extreme for a company that is as strong as Deutsche Post. Then obviously the question arises whether it’s sector-wide or company-specific. Let’s have a look.

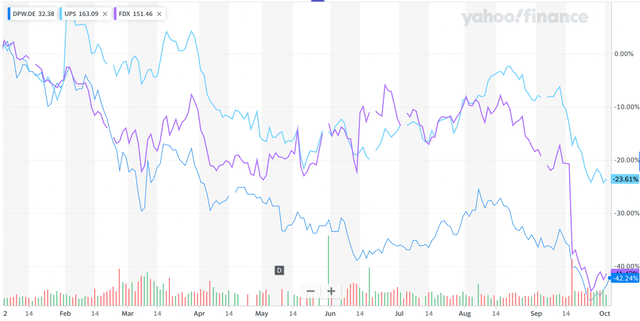

Deutsche Post compared to peers (Yahoo Finance)

We can draw different conclusions from the graph above. Yes, the problem is industry-wide since all three of the biggest companies in the industry had massive drops, but it also seems like it is company specific. Before the earnings warning of FedEx and its 22% drop, FedEx was the best-performing of the three. It would be down around -20% together with UPS, but Deutsche Post was already down there before the warning. Deutsche Post dropped way further down during the year while posting the strongest growth of all three companies. Deutsche Post also grew its profits strongly so far this year, yet the stock price does not reflect the growth at all. Valuation is also not a problem since Deutsche Post already had the lowest valuation of the three at the start of the year. The company got a lot cheaper YTD. It is important to note that the industry in which these three perform, is heavily correlated with GDP growth and a strong economy. The current environment, and a recession threat, obviously don’t support the share price. The problem for me is that a heavy recession is being priced into the stock right now, while the company fundamentals and financials are still incredibly strong.

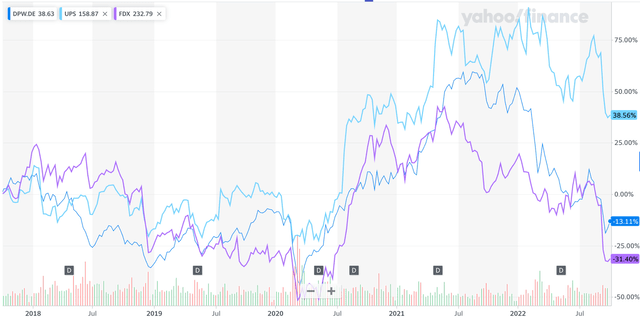

Does the 5-year graph show the same story?

Deutsche post compared to peers (5 years) (Yahoo Finance)

We can see that Deutsche Post returned a negative result over the last 5 years. Of the three major companies, only UPS delivered positive results. FedEx performed the worst, but again, because of its profit warning last month. It is just difficult to understand how a company can grow by 10% CAGR and its EPS by almost 20% CAGR yet have a lower stock price. Growing fundamentals in combination with a dropping share price results in a very attractive valuation.

The Sector

Deutsche Post operates in the courier sector. As I just mentioned in the previous section, the sector is highly correlated with GDP. More people and more wealth, equal more business, and more business means more transport of products. All makes perfect sense, right? This is the reason why Deutsche Post will drop in a bad macroenvironment and because of recession fears. Less consumer spending results in fewer products sold, which results in less production, and this means less demand for transport. Besides a lower number of transport, also transport prices will go down because of less demand and the same capacity. These are big headwinds for the sector and so also for Deutsche Post. In the current environment, I still think Deutsche Post dropped by way too much and it is very much undervalued, also compared to its peers. If the slowdown in the economy persists, then revenue and profit will go down for Deutsche Post, there is no denying that. But If we look at the stock price of Deutsche Post, a severe recession is being priced in already, and this seems a bit much to me. I think that if we enter a recession, which I already doubt, it is probably going to be a shallow one. It will not be like 2008/09, in my opinion. I believe the sector right now is undervalued, and Deutsche Post most of all. E-commerce, a big tailwind for the industry over the last few years, is seeing a slowdown right now. I do think this will only be temporary and over the coming quarters will find its way back to growth. This will remain a strong part of the transport business. The market cap of the courier sector is $345.45 billion. UPS is by far the largest one with a market cap of $146.7 billion. FedEx and Deutsche Post are the number two and three, respectively. These two currently have a market cap of around $40 billion.

Valuation and Balance Sheet

Deutsche Post is currently valued at a forward P/E of 8.81. For comparison, UPS has a forward P/E of 12.17 and FedEx of 9.51. Deutsche Post has the lowest valuation of the big three couriers.

Total cash on the balance sheet is $3.69 billion as of the last quarter. Total debt was $20.96 billion with no short-term debt.

The company pays a forward dividend yield of 5.78%, and this is way higher than its peers with UPS paying a 3.6% yield and FedEx paying a 2.89% yield. Deutsche Post pays a way higher yield and still only has a 41.86% payout ratio. The company pays a safe and well-supported dividend, which is not at risk in the situation of a downturn in the economy. The growth streak for the dividend is 3 years now and the average growth rate over the last 5 years is 14.80%.

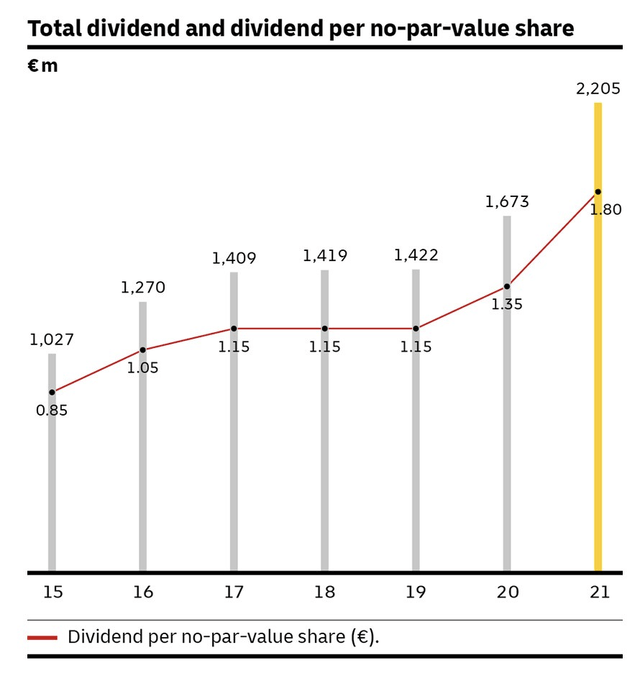

Dividend history of Deutsche Post (Deutsche Post AG)

Threats

The main threats for the company are the ones that were already acknowledged by management during their last earnings call. The company is very sensitive to macroeconomic uncertainty and a drop in GDP. The courier sector is very much connected to the GDP number, so if this one drops, this will likely have a bad influence on the business of Deutsche Post. I think the company is positioning itself very well to be able to cope with a worsening environment and looking at the earnings call, we can see management is very aware of the current economic turmoil. But even though management is very well prepared, a drop in consumer spending will result in less production and less demand for delivery and transport services. This drop is inevitable and needs to be priced in if you believe a severe recession is incoming.

I do believe the only threat for this company is this economic slowdown. The moat of the company is too strong and the barriers to enter this industry are too high. Companies and consumers appreciate their delivery platform, which they have already been using for years.

Conclusion

Deutsche Post has a very solid balance sheet with no short-term debt and plenty of cash. The 5.78% dividend yield makes the stock very appealing and is well covered by its 40% payout ratio. During the latest earnings call management committed once again to their outlook and the company looks like it is heading towards a record year. Management was very clear about the possible risks for the company in the near term, concerning a slowing GDP and less consumer spending, with the risks of a recession in the near term. Despite all their challenges, management did not seem impressed. I do not see any problems for Deutsche Post apart from the economy but if we look at the current valuation, I believe investors already priced in a severe recession. If the economy does not enter a recession or only a very mild one, then the company could see a lot of upside.

A growing E-commerce business and a growing economy will be a boost for the company. I do believe under normal circumstances the growth will go down compared to the last couple of years, but from its current valuation, double-digit returns over the next 5 years don’t seem unlikely.

I rate the company a buy. I think Deutsche Post is a good place to put your money.

Be the first to comment