Chip Somodevilla

With midterm elections around the corner, the United States’ political landscape is undoubtedly heating up. So it shouldn’t come as much of a surprise that each party is trying to dig up as much dirt as possible about their rivals. In such a complex environment, the question of Congressional insider trading is making its way back to front page news, causing headaches for major party members across the political board.

On the other end, insider trading conducted by members of the U.S. Congress is a topic in U.S. politics amongst the public that has seen almost unanimous support for limiting the right of lawmakers to participate in individual securities trading. Given that the nature of their public service makes them privy to sensitive information prior to it becoming available to the public, in some cases even weeks or months before it becomes public knowledge, it remains a strong perception that they enjoy a clearly unfair advantage that allows them to generate returns that far outpace the average stock market investor.

When it comes to discussing the controversies surrounding the question of Congressional insider trading, it becomes almost impossible to glance over the subject of Nancy Pelosi and her trading record. The Speaker of the U.S. House of Representatives has without any doubt been at the forefront of much of the drama and speculation surrounding it, solidifying her position as one of the most active and most controversial, which, after all, became the basis of our trading strategy based on her.

Today’s article is an update focusing on the strategy’s performance during the third quarter of the year. Our original article on the Nancy Pelosi Strategy can be accessed through this link.

Nancy Pelosi Strategy Update

Throughout the years, the average citizen was not always privy to the information of what exact stocks their public representatives were involved in trading, if they possibly had any conflict of interest, and ultimately had generated any profit in doing so. However, a growing outcry for more transparency resulted in lawmakers enacting the 2012 STOCK Act, which can be viewed as a small win for the average investor. A win, that in its current form, requires Members of Congress to publicly file and disclose their stock trading transactions within 45 days of the transaction date.

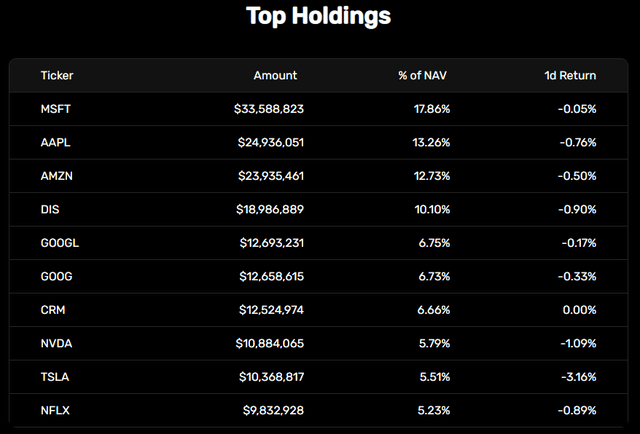

That small step in the right direction allowed us to collect, store and aggregate the insider trading data, which served as the backbone of creating our strategy. You can find this strategy on our website within Quiver Strategies. The “Nancy Pelosi” strategy tracks the performance of companies that have been purchased by Rep. Nancy Pelosi. It takes a long position in stocks that have been purchased, and a short position in stocks that have been sold by her or by members of their family. The current top holding, representing slightly more than 17% of the portfolio’s NAV, is Microsoft, with Apple and Amazon right behind, representing about 14% and 12% of NAV respectively. The strategy is weighted based on the reported size of the disclosed purchases, with an implemented system of daily rebalancing. As of today, the strategy generated a historical CAGR rate of 18.52% across its backtest period.

Nancy Pelosi Strategy (Quiver Quantitative)

If one were to have $100 million invested in the Speaker of the House’s stock-picking abilities at the beginning of 2019, the same investment would compound to $192 million as of today, slightly off the November high, when the portfolio hit its peak of almost $309 million. Pelosi’s strategy generated a negative year-to-date return of 36.04%, accompanied by a negative one-year return of 36.61%, both slightly underperforming the S&P 500 (SPY). The performance is indicative of a very bad year for Pelosi, one that we truly haven’t seen in a while.

Strategy Top Holdings (Quiver Quantitative)

Microsoft Corporation (MSFT)

As previously mentioned, the maker of Windows OS remains the largest holding in the Pelosi portfolio as of today, taking up almost 17.8% of the portfolio AUM. Microsoft has been one of the most popular investments among active Congress members in the recent period. The producer of the most used operating system in the world garnered interest from 6 different lawmakers in more than two dozen trades in the past quarter. The company is on the back of achieving some tremendous success with CEO Satya Nadella in the leading role. Pelosi has long held a positive outlook on the company, with the family having acquired their position for the first time all the way back in February 2020. The family then bought 25 thousand shares through call options that were later exercised in the first quarter of 2021. In the middle of an earnings season where big tech names one after another fell behind expectations, Microsoft managed to deliver solid results beating both the top and bottom-line analyst expectations. Recently disclosed purchases of Microsoft’s LEAP call options expiring in mid-2023 raise further interest as the tech giant is expecting to close the greatest acquisition in the history of the gaming industry sometime later next year. While Microsoft has been operating in the industry for decades, it has recently doubled down on establishing a more substantial presence in the market by acquiring Activision Blizzard (ATVI) in a record-breaking $68.7 billion deal. It is still up to debate as too if the deal passes regulators requirements, but the Pelosi family’s involvement once again raised questions about a potential conflict of interest. Unlike most of the other tech stocks, MSFT largely traded in line with the market, generating a negative year-to-date return of 30.42% and a negative one-year return of 27.96%. This led to a somewhat more attractive valuation with the tech giant selling for an NTM EV/EBITDA of 16.84x, an NTM P/E of 24.53x, and an NTM P/FCF of 26.27x. Seeking Alpha Authors have a rather positive outlook on the company, assigning it a “Buy” rating with an average score of 3.85/5.00. Wall Street Analysts on the other end are much more bullish, assigning it a “Strong Buy” rating with an average score of 4.60/5.00. The company is currently trading for $231.86 per share.

Microsoft vs S&P500 YTD Return (Seeking Alpha)

Apple Inc. (AAPL)

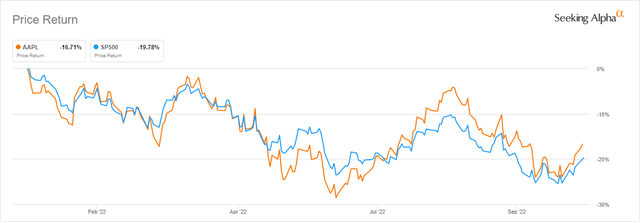

The iPhone producer was held for long in high regard by the Pelosi family, with half a dozen disclosed trades in the last past year alone. As noted earlier, AAPL is solidified as the second largest holding in the Pelosi strategy, taking up almost 13% of the portfolio’s AUM. With the seemingly ever-degrading macroeconomic situation, many presume that consumers slowly cutting back on discretionary spending could lead to difficult times ahead for the company that reported its fourth-quarter results on Thursday. Investors closely monitored the newest iPhone 14s sales, which launched only a couple of months ago. However, with the cards largely stacked against it, the company managed to hold up well despite the bear market sentiment which seemingly, at least judging by the results, didn’t cause that big of an impact on the “last standing FAANG stock“. Apple managed to outperform the market by generating a negative 12.13 year-to-date return, accompanied by a one-year return of 2.32%. We have gotten used to AAPL commanding a premium valuation and that part stayed the same even after the 16% decline the company suffered, as it is currently being sold for an NTM EV/EBITDA of 18.29x, NTM P/E of 24.06x, and an NTM P/FCF of 22.56x. The relatively high valuation might be a part of the reason why Seeking Alpha Authors assigned the iPhone maker a “Hold” rating with an average score of 3.12/5.00. Wall Street Analysts however remain largely bullish about the prospects of the tech giant, assigning GE a “Strong Buy” rating alongside an average score of 4.36/5.00. Shares of Apple are currently trading at $152.50.

Apple and S&P500 YTD Returns (Seeking Alpha)

Amazon Inc. (AMZN)

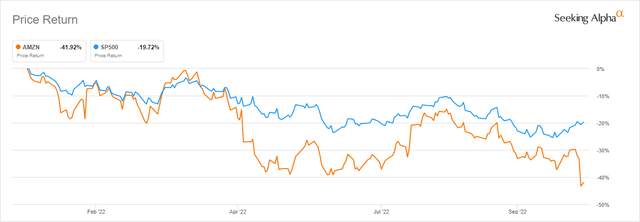

Jeff Bezos’s brainchild climbed its way up and became the third-largest holding in our Pelosi trading strategy. It currently takes up almost 12% of the portfolio’s AUM. The company, similar to many other well-known high-flying tech stocks, generated some extraordinary returns for investors over the past decade. However, this year was not looking that optimistic for Amazon, with shares of the company coming under increasing pressure in the markets. The e-commerce giant was one of the big tech names that disappointed investors with its last quarter results, which were significantly below expectations. This led to the first year of significant market underperformance for the e-commerce giant, which delivered a negative 39.61% year-to-date return and a negative 41.57% one-year return. Just back in November of last year, AMZN was trading for as high as $183.83. The pullback possibly had to do with investors getting less tolerant of high-end valuations, as the tech behemoth is currently selling for an NTM EV/EBITDA of 15.16x, NTM P/E of 63.14x, and an NTM P/FCF of 41.30x. Seeking Alpha Authors became much less bullish on the stock lately, assigning it a “Hold” rating alongside an average score of 3.31/5.00. On the other end, Wall Street Analysts are still firmly convinced of Amazon’s strengths and abilities to weather the ensuing storm, assigning it a “Strong Buy” rating with an average score of 4.60/5.00. Amazon is currently selling for $101.67 per share.

Amazon vs S&P500 YTD Returns (Seeking Alpha)

The Walt Disney Company (DIS)

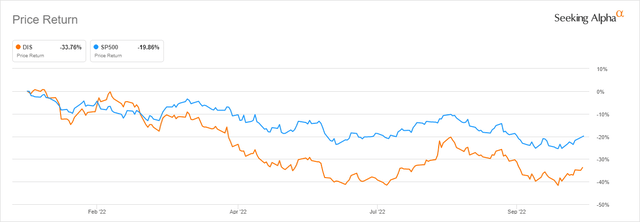

The soon-to-be hundred-year-old integrated entertainment company is the fourth-largest holding of our Nancy Pelosi strategy taking up 10.1% of the portfolio’s AUM. The Pelosi family is immensely bullish, having acquired a position in the Burbank-based Mickey Mouse company on two different occasions this year alone. Initially, they exercised 100 call options with a strike price of $130 in early January, only to add another ten thousand shares through options exercised last month. This time around, they carried a strike price of $100 per share. The company itself has been through a rough patch for the better part of the year. On top of an already difficult year in terms of macroeconomics, the entire streaming sector is still suffering from the selloff that ensued after Netflix (NFLX) posted its disastrous first-quarter earnings results. The report sheds light on several fundamental weaknesses in the streaming business model that had many investors and analysts excited for years. The thesis behind the investment is rather simple, Disney is still arguably the most well-rounded entertainment company in the industry after its rather controversial $71 billion acquisition of 20th Century Fox back in 2019. It also has a rock-solid IP portfolio that other competitors can only envy and a legacy business that will ensure cash flow stability even at the most difficult of times. Even after the significant pullback as of late, DIS is still trading for an NTM EV/EBITDA of 14.05x, NTM P/E of 21.92x, and NTM P/FCF of 43.85x. As previously stated, alongside essentially everything and anything streaming-related, DIS significantly underperformed the market for the year. The company generated a negative year-to-date return of 32.59% and a negative one-year return of 38.48%. That didn’t stop Seeking Alpha Authors from being bullish on Disney, assigning it a “Buy” rating with an average score of 3.68/5.00. Wall Street Analysts, on the other hand, are even more enthusiastic about the company, assigning it a “Strong Buy” rating with an average score of 4.44/5.00. The Mickey Mouse company is currently trading at $105.17 per share.

Disney and S&P500 YTD Returns (Seeking Alpha)

Alphabet (GOOG) (GOOGL)

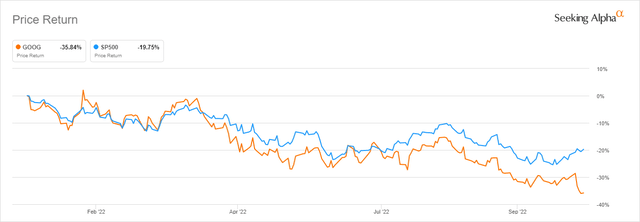

The fifth-largest holding in the Nancy Pelosi portfolio is yet another high-tech-oriented FAANG stock. Alphabet is one of the more recent purchases by the Pelosi family, given that they acquired a position in the company only last month on the 16th of August. They exercised 200 call options, gaining 20,000 shares at a strike price of $100, which is just $3 dollars shy of the options expiring worthless, as Google closed at $103.63 on that day. Just recently, Google successfully completed a 20-1 stock split, making individual shares of the company a lot “cheaper” for the average investor. Like other tech stocks this year, Alphabet had a very difficult year in the markets, underperforming the S&P 500 for the first time in a while. It is also on the back of some horrible earnings results, which it reported last Tuesday. GOOG generated a negative 34.64% year-to-date return alongside a negative one-year return of 35.29%. This opened the way to a relatively affordable valuation all things considered, as the tech giant is currently selling for an NTM EV/EBITDA of 9.75x, an NTM P/E of 18.47x, and an NTM P/FCF of 16.39x. Alphabet has been held in high regard by both Seeking Alpha Authors and Wall Street analysts. Seeking Alpha Authors have been long bullish on the company assigning it a “Buy” rating with an average score of 4.07/5.00. Wall Street analysts like the prospects even more and have assigned GOOG a “Strong Buy” rating with an average score of 4.60/5.00. The company is currently selling for $94.91 per share.

Alphabet and S&P500 YTD Returns (Seeking Alpha)

Other than the discussed top five holdings, the portfolio currently also holds shares of Salesforce Inc. (CRM), Nvidia (NVDA), Tesla (TSLA), Netflix (NFLX), AllianceBernstein Holding (AB), PayPal Holdings (PYPL), American Express (AMP), CrowdStrike (CRWD), AT&T (T), Micron Technology (MU), and Roblox (RBLX).

Final thoughts and conclusions

There is hardly a better testament to the edge that a well-informed policymaker could have upon the average investor than the current trading record of the Speaker of the House of Representatives, Nancy Pelosi. For a long time, Rep. Pelosi has managed to attract some significant attention when it comes to Congressional insider trading, as many of her stock trades have been notoriously well-timed and immensely lucrative. Still, after dominating market indexes for a long time, this year marked the first year in many in which the Nancy Pelosi portfolio underperformed and led to some serious losses. It generated a negative year-to-date return of 36.04%, alongside a negative one-year return of 36.61%.

On the other end, the S&P 500 generated “only” a negative 20.0% return year-to-date. It would also be fair to note that Nancy does most of her trading through her husband, Paul Pelosi, who owns and operates a successful San Francisco-based investment company. The Pelosi family remains adamant that Paul has never based his investment decision upon insider information provided by his wife. Most of the public remains largely unconvinced by this argument, as the pressure continues to slowly build on Capitol Hill. In the end, even the Pelosi family couldn’t escape the bloodbath 2022 has been so far, and this might give the Speaker of the House a temporary shield against the almost never-ending criticism she had to endure. The strategy still managed to ensure a 18.52% compounded annual growth rate.

Be the first to comment