Robert Way

Investment Thesis

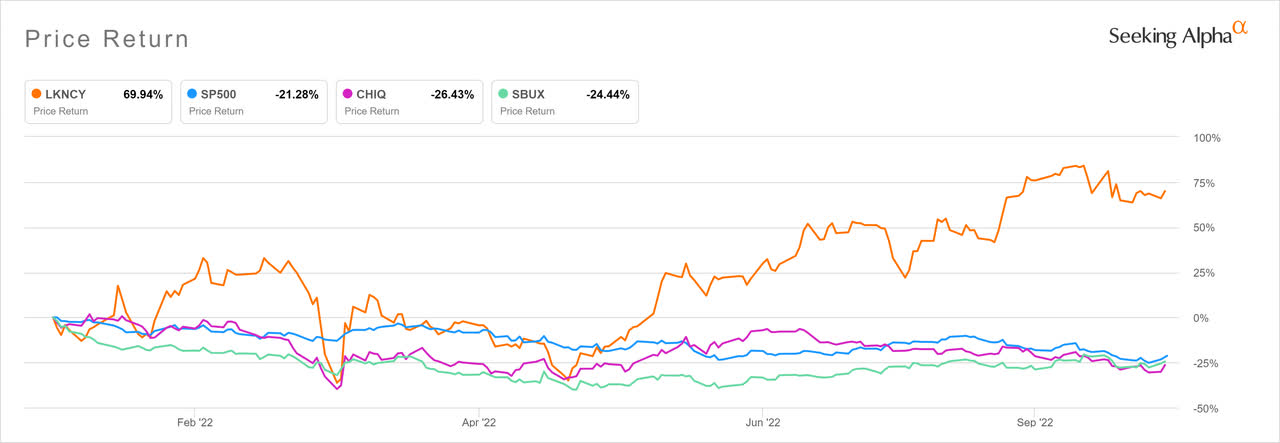

Year to date, Luckin Coffee Inc. (OTCPK:LKNCY) continued to significantly outperform the benchmark indices and industry comparables, e.g., S&P Index (SPY), Global X MSCI China Consumer Discretionary ETF (CHIQ) and Starbucks Corp (SBUX), despite the worsening COVID lockdowns in China and the market selloff across the world (see chart below).

LKCNY vs SPY, CHIQ and SBUX

seeking alpha Seeking Alpha

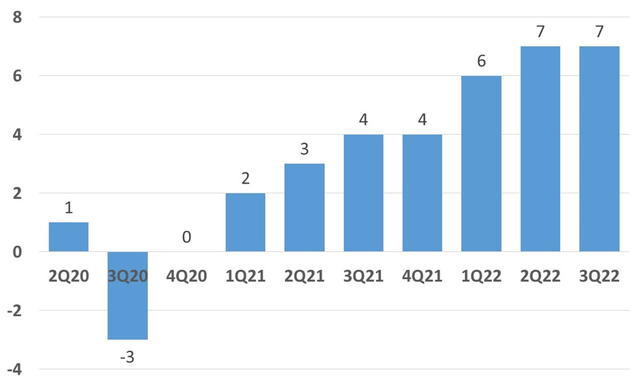

The new store opening data for the third quarter 2022 provided further fundamental support to this outperformance as LKNCY maintained its robust store opening pace across China – averaging 7 new stores per day.

Our investment thesis remains unchanged that the LKNCY stock price could have 3x to 5x upside from its level in April, and that an imminent relisting onto the main exchange will be the key catalyst to unlock the move. For more details, please see our earlier writeup dated April 9th, 2022: “Luckin Coffee: Relisting Or Delisting.” This writeup will focus only on analyzing the new store opening data during the third quarter.

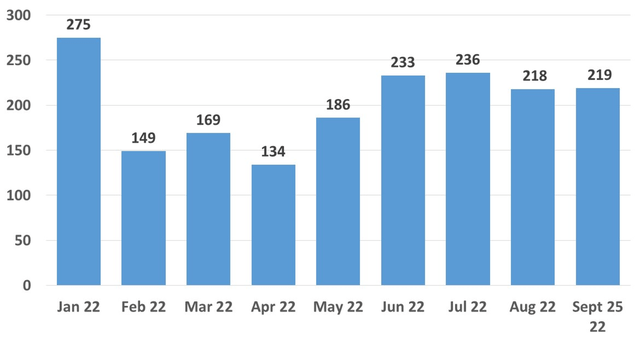

Total Store Count Could Surpass 8,400 by the End of 2022

According to the weekly updates from its official wechat channel, LKNCY had a total of 7,843 stores across China as of September 25, 2022, up 9% from end of 2Q22. LKNCY is now not only the largest coffee chain in China, but also could have more than 8,400 stores by the end of 2022 if it continues to open new stores at the current pace (average 7 new stores per day). This will further expand its lead over Starbucks, the second largest coffee chain in China, which just opened its 6,000th store there on September 30, 2022.

Quarterly Store Count Since 2020

COVID Caused More Lockdowns during 3Q 2022

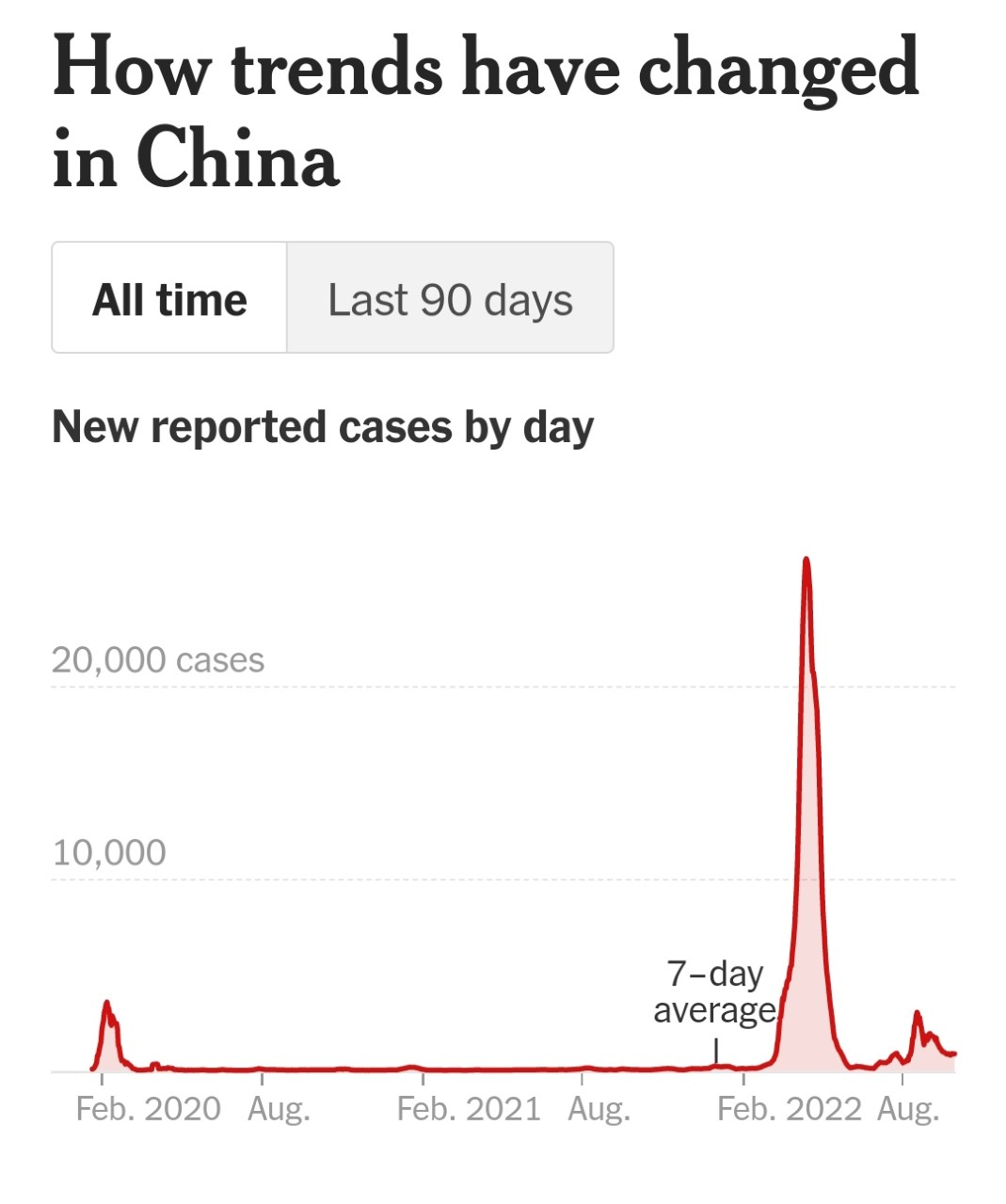

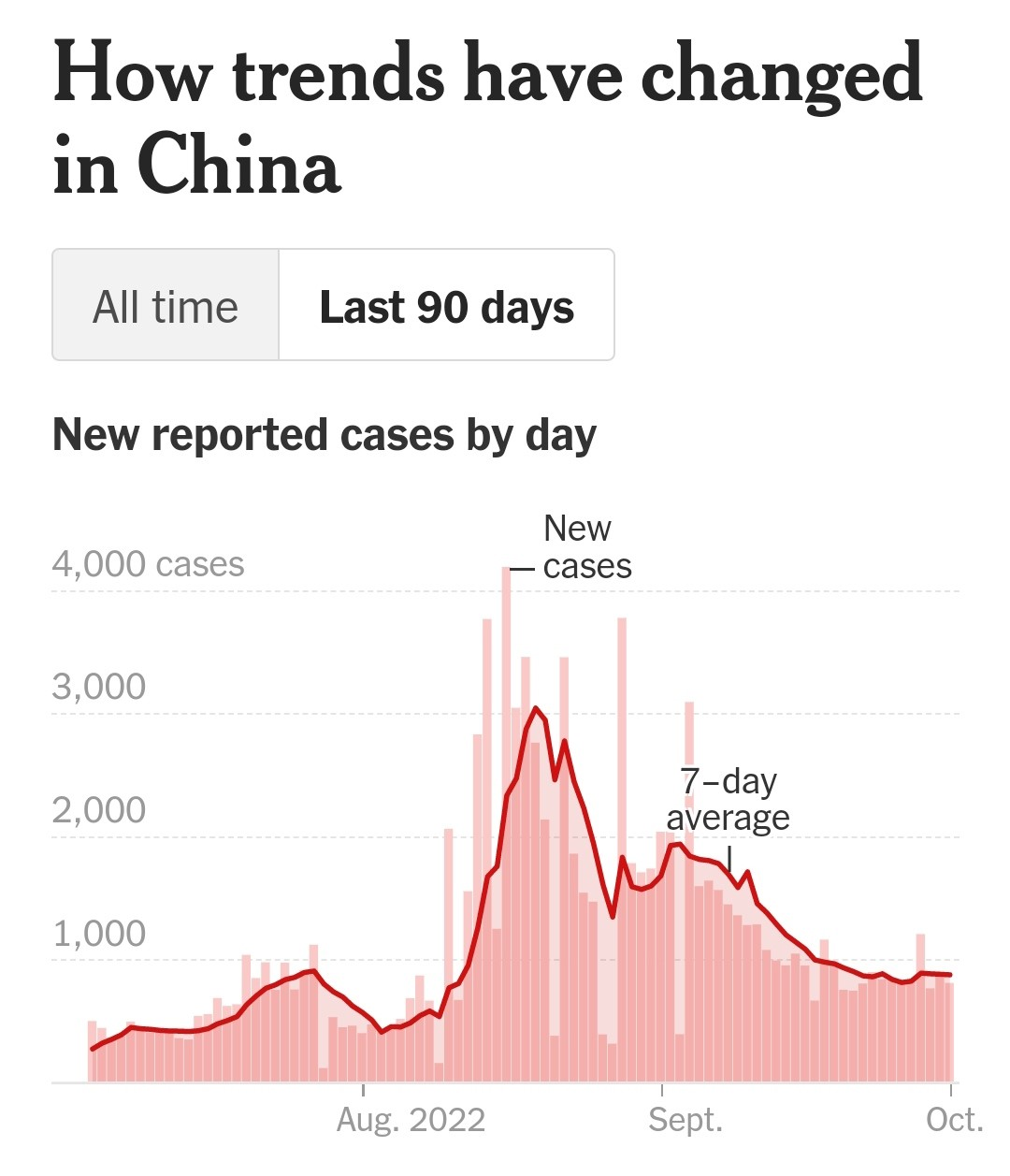

During the third quarter 2022, China experienced another wave of COVID-19 outbreak and subsequent city lockdowns. The good news is that the peak number of the confirmed cases in this round was much lower than that in the second quarter, when Shanghai was shut down for two months (see charts from the New York Times below).

New York Times |

New York Times |

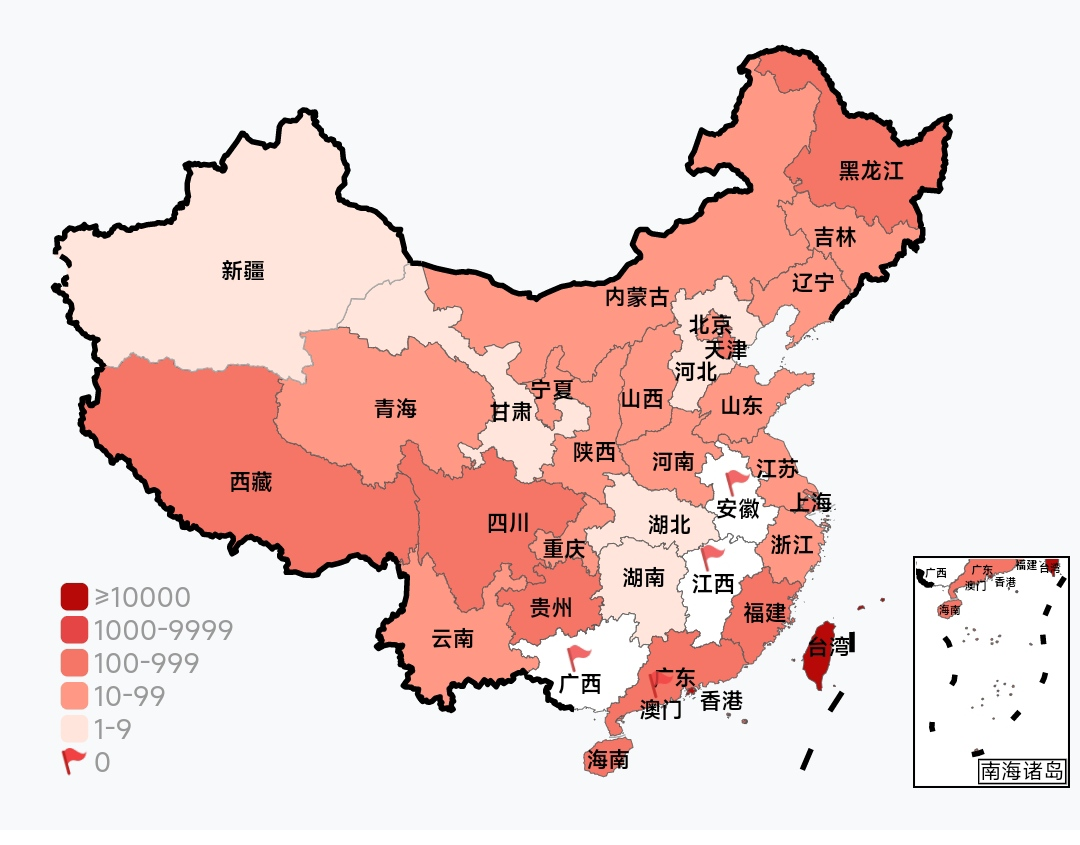

The bad news is that this new wave of outbreak is more widespread than before (see COVID map of China below). According to the media in China, 103 cities in 26 provinces (out of total of 31 provinces) reported COVID cases, and 33 cities were under partial or full lockdown at the end of August. This impacted 65 million people, which was the peak since the early days of the case count in 2020.

Baidu.com

These COVID lockdowns have caused temporary store closures by LKNCY, which in turn would hit the company’s top line. Based on the company’s first quarter and second quarter earnings release, the impact on its existing stores is as follows:

“The Company’s temporary store closures gradually increased during the first quarter of 2022, with March being the most impacted. The Company experienced around 700 daily store closures on average during March 2022. Starting from April 2022, there was a nearly complete lockdown in Shanghai, resulting in a further increase of average daily store closures. For the period between April 1, 2022 and the day prior to this earnings release, the daily average number of temporary store closures was around 950.” (First quarter earnings release).

“The Company experienced around 900 daily store closures on average in April and May 2022. With the gradual lifting of COVID-19 pandemic related restrictions, the Company experienced around 152 daily store closures on average in June 2022 and around 96 daily store closures on average in July 2022. While the negative impact of the COVID-19 pandemic on the Company has lessened in the second quarter of 2022, the COVID-19 situation remains highly unpredictable.” (Second quarter earnings release).

The daily store closures reached its peak at 950 on average in April (approximately 14% of total store count then) and started to trend down till July. We suspected that the number of store closure went up again in August after several large cities such as Chengdu (21 million population) were locked down. However, based on the financial results of the first half 2022, the company seemed to have been very well prepared for the situation and the negative impact had been manageable.

COVID Impact on New Store Openings is Limited

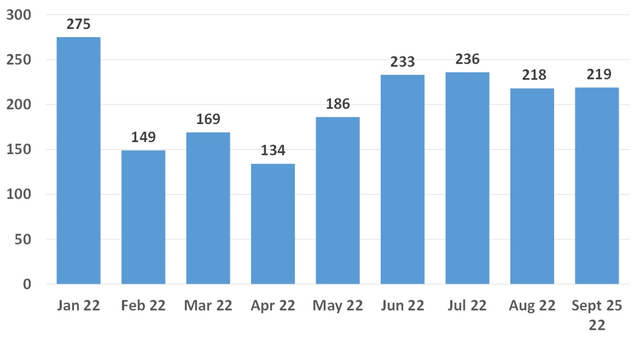

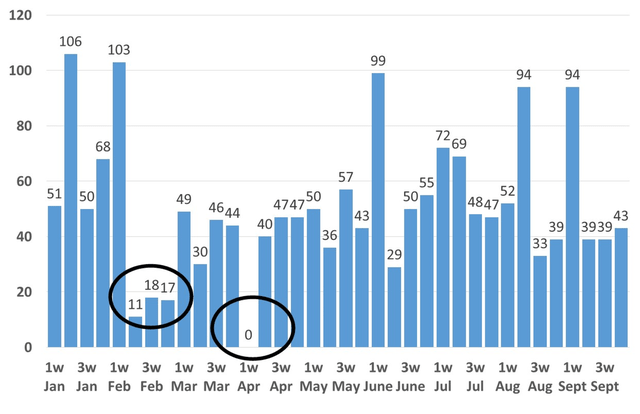

New store openings were negatively impacted by COVID outbreak in April, but quickly bounced back and stayed at above 200 per month since June (see chart below). Even when the new wave of outbreak hit during August and September, the momentum of new store openings was not affected at all.

Monthly New Store Openings

The weekly new store openings data shows the similar trends in the third quarter (see below). The two spikes of 94 new openings were primarily driven by Shanghai market, most likely due to the pent-up openings delayed by the full lockdown in April and May.

Weekly New Store Openings

Our most favorite data point for assessing new store openings is the average new store openings per day, i.e., the pace of opening. As illustrated in the chart below, the pace of new store opening during the second and third quarter has stayed at the all-time high of 7 new stores per day despite the continued COVID outbreaks across China.

Average New Store Openings per Day

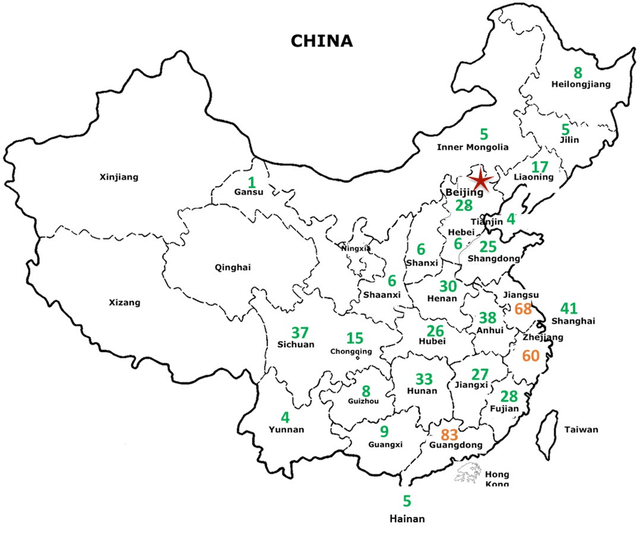

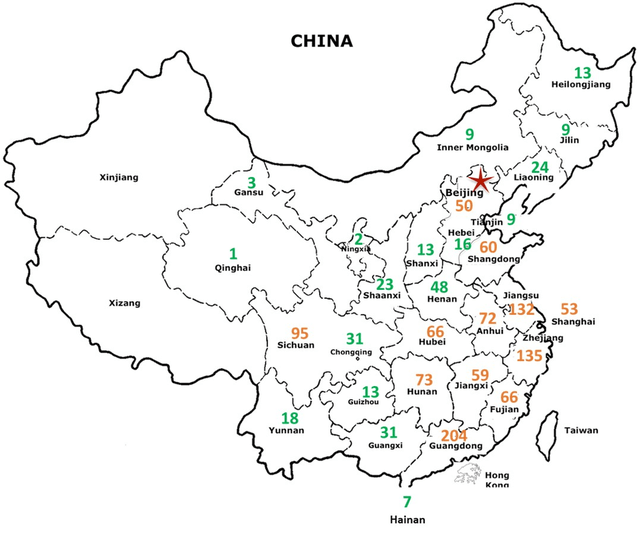

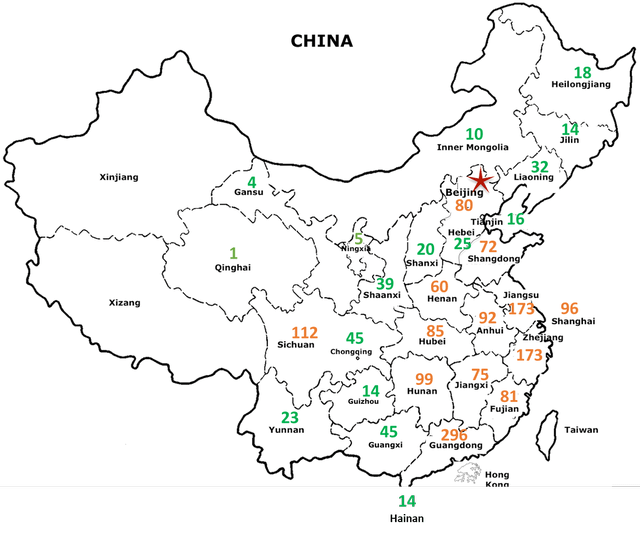

We also updated the new store openings map with the Q3 2022 data. In order to better illustrate the progress of new store openings in the first nice months of 2022, we label the provincial level new openings in orange if the number is at or above 50. We then placed the three quarterly maps in the chronological order (see below) to show the evolution.

New Stores Openings Map in 1Q 2022

Company wechat channel |

|

New Stores Openings Map in 2Q 2022 |

Company wechat channel |

|

New Stores Openings Map in 3Q 2022 |

Company wechat channel |

Our observations are as follows:

1) The provinces with the orange numbers had grown very fast from just 3 in 1Q2022 to 13 in 3Q022;

2) The majority of this expansion was established during 2Q2022 and was from coast into the inland; and

3) The growth during 3Q2022 was more on density (more new stores in a given province) than expansion (more provinces with orange numbers).

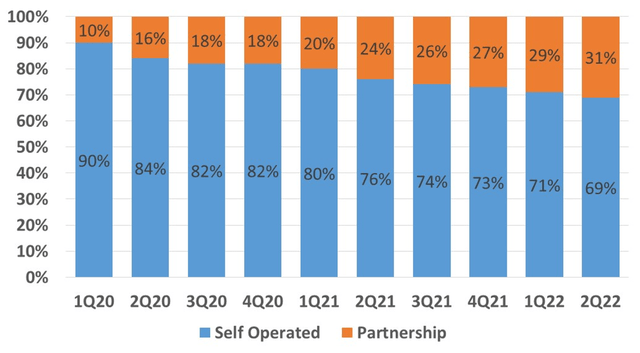

The new store openings are primarily driven by LKNCY’s partnership stores (i.e., franchised stores). Over the past two and half years, the share of the partnership stores continued to increase in the total store mix and surpassed 30% for the first time in 2Q2022 based on the company’s earnings release dated August 8, 2022 (see chart below).

Partnership Stores as % of Total Stores

Key Risks

1) COVID policies in China. China has been strictly enforcing its zero-COVID policies, which could cause large scale store closures for whenever there is a new wave of COVID outbreak. However, one natural mitigation for LKNCY is that a majority of its revenue is from pickup stores or via on line order and third party delivery. As long as the COVID lockdowns do not ban customer pickup or delivery, LKNCY could still generate fair amount of revenues during lockdowns.

2) New store opening data are not official SEC filings. The new store opening data are from LKNCY’s weekly updates in its wechat channel, not the official disclosures in the company’s SEC filings or press releases. Also, the data is just for new store openings, which should not be used as a direct indicator for future revenue or profit.

Conclusion

LKNCY continued its robust momentum of new store openings during the third quarter of 2022, averaging 7 new stores per day. At this speed, LKNCY’s total store count could be over 8,400 by the end of 2022, further expanding its lead over its competitors, i.e., Starbucks, in China. Our investment thesis remains unchanged that a relisting on the main exchange is imminent and will unlock significant upside of the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment