imaginima

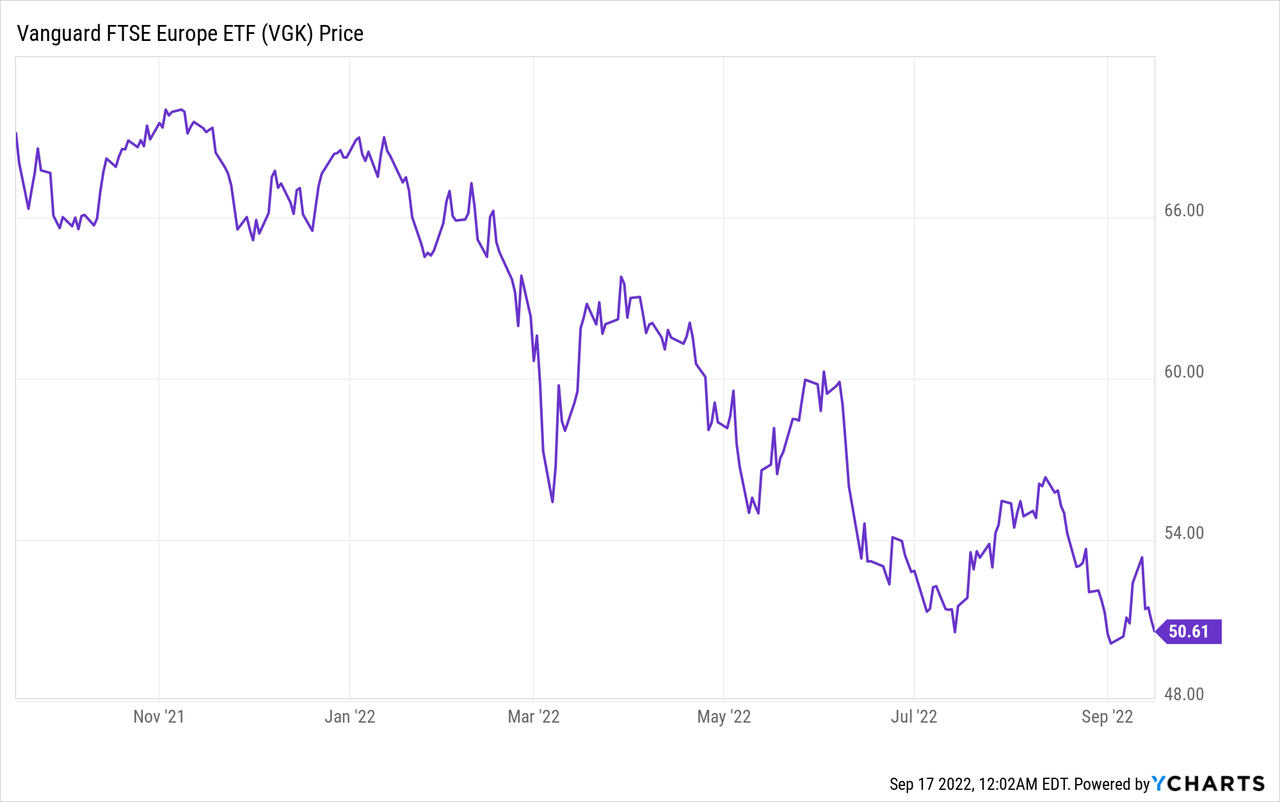

There has been a tendency to lump the whole European continent together and predict the worst-case scenarios in the aftermath of the Ukrainian war, rising fuel costs, and falling euro following the ECB review of monetary policy. With so much negativity priced in, the Vanguard FTSE Europe ETF (NYSEARCA:VGK) is now available for less than $51, after it suffered from a one-year drop of nearly 27% as shown in the chart below.

However, Europe consists of many countries and regions which have been impacted differently by supply chains and high commodity prices, and, this thesis attempts to look beyond the gloom to identify opportunities, while also highlighting the risks.

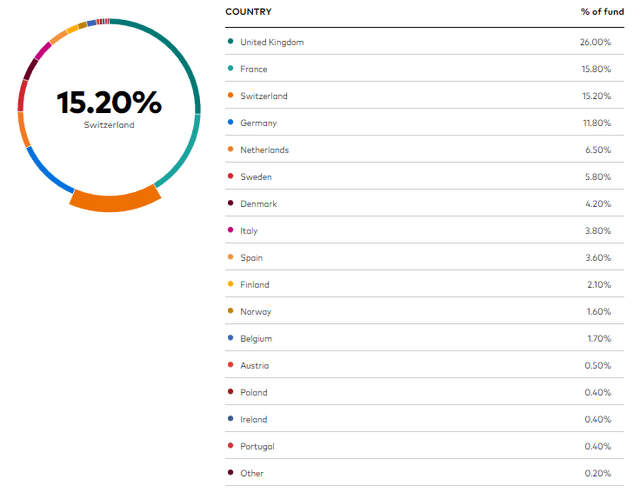

I start by providing an overview of country exposure.

Country-Level Diversification

As seen by the table below, in addition to the U.K, France, and Germany, VGK holds stocks of companies located in many other countries like Austria, Belgium, Denmark, Finland, Greece, Ireland, Italy, the Netherlands, Norway, Portugal, Spain, and Sweden. Interestingly, it has 15.2% of its assets dedicated to Switzerland which includes pharmaceuticals and financial institutions.

Country-level diversification (Vanguard)

This diverse country-level exposure in itself constitutes diversification and includes a whole swath of value opportunities that pass under the radar, as many of the holdings are currently trading cheaply. This is in contrast to the U.S., where there are limited opportunities because valuations still remain above historical averages despite the recent stock market downturns.

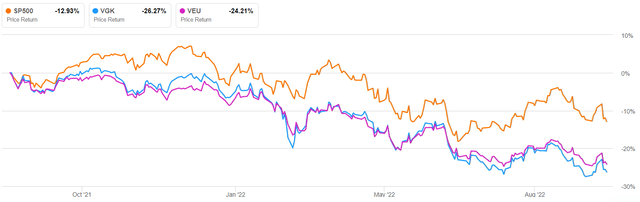

Furthermore, in spite of the majority of countries suffering on a global basis, VGK in blue underperforms both the S&P 500 (in orange) and the Vanguard FTSE All-World ex-US ETF (VEU) in purple. Hence, purely from the valuations perspective, Europe is far from a superbubble.

Comparison of performances (Seeking Alpha)

This undervaluation is not normal as despite being faced with an unprecedented energy crisis that risks causing a rationing of natural gas for its industries, Europe possesses some of the world’s most competitive multinationals which can shift production to other countries where they operate.

Moreover, VGK seeks to track the performance of the FTSE Developed Europe All Cap Index. Now, these are developed markets, not underdeveloped or developing countries whose economies have to be rescued at the first signs of deterioration of the balance of payments or acute currency devaluations. To this end, many European states have developed resiliency in their economic models, namely through elaborate welfare systems financed by taxpayers’ money.

Thus, it may happen that there may be a capping of surging energy prices with higher taxation for oil companies to finance widening national trade deficits. For this matter, the Vanguard ETF has only 5.76% of exposure to energy companies. Also, the abrupt raising of interest rates by the ECB (European Central Bank) or the Bank of England can lead to economic slowdowns, but this does not mean that there will be a crisis of apocalyptic dimension, which would suddenly blow VGK’s holdings out of existence.

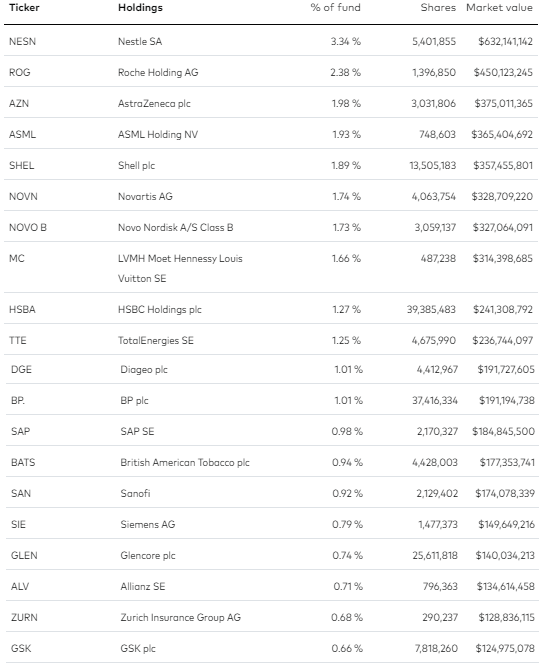

The holdings – Strengths and Weaknesses

As investors will notice, the first ten holdings out of the total of 1369 are not from Germany or Italy, whose economies have a higher dosage of industrials which should be impacted the most by rising energy costs. Normally, when we think of Germany, we automatically associate the country with automakers.

The Holdings (Vanguard)

Well, VGK does not include any of these big German automakers as part of its top twenty holdings, but, on the other hand, holds shares of SAP SE (SAP) as shown above. After some short-term headwinds due to its exposure to Russia, this German enterprise software and cloud play should benefit from more sales as the products of its American competitors become more expensive in Europe and other parts of the world as a result of a strong dollar. Along the same lines, VGK includes other companies who should benefit from currency windfall gains, despite a lower euro or GBP being bad for inflation.

The ETF also includes behemoth Allianz (OTCPK:ALIZF), as well as other insurance, plays like Zurich Insurance (OTCQX:ZURVY) which are seen as beneficiaries of the ECB’s policy of rising interest rates. The reason is that in addition to investing, insurance companies also hold policyholders’ money in banks and when interest rates go up, the value of their assets goes up too. As a matter of fact, the fund dedicates about 15% of its assets to financials including banks like HSBC plc (OTCPK:HBCYF).

Furthermore, one sector that is seen as defensive in times of trouble is healthcare which constitutes about 15% of VGK’s assets including big names like Swiss-based Roche AG (OTCQX:RHHBY) and Novartis (NVS). As evidenced by the one-month stock performance of these two companies, the health sector has held up well.

On the other hand, the consumer discretionary sector represented here by luxury brand LVMH Moët Hennessy (LVMH) has suffered by 9% during the last month, and this despite seeing revenues increasing by 13% in the second quarter of 2022 on a year on year basis. There has been a slight drop on a sequential basis though, instilling doubts in the minds of investors as to whether there may be further pains going into the second half of the year.

Remaining on the cautionary side, industrial holdings which constitute 15% of VGK’s total assets are likely to suffer the most as in addition to suffering from higher energy and material input costs, they are likely to face an uncertain demand outlook. This uncertainty appears to have been priced in Siemens’ (OTCPK:SIEGY) 40% downside since the start of 2022.

Discussing the Outlook

Still, Europe’s largest manufacturing company has not capitulated yet and recently commissioned one of the biggest green hydrogen production plants in Germany. In a way, this shows Europe’s commitment to green technology while the U.S. gets stuck with its oil companies. Thus, Europe is better prepared for global warming while on the other side of the Atlantic Ocean, many choose to keep their heads buried in the sand. This implies that there is a risk that the U.S. federal government falls short of having sufficient money to bail out flooded areas, or locations ravaged by major fires or hurricanes.

Still, the future remains uncertain, not only in the old continent but pretty much everywhere in the world including the U.S where confidence has now given place to doubt as the Fed now has to apply the most drastic monetary tightening policies after a rise in the CPI (consumer price index).

In these circumstances, Europe deserves a fresh look, and scrutinizing the price action, VGK reached a low of $49.97 on the first day of September which coincided with Russia cutting and not resuming natural gas supply to Germany. It is now currently trading at $50.25 and tested the $50.50 level on July 14. Therefore, $50.25-50.50 seem to constitute a resistance level.

Also when the ECB hiked rates by 75 basis points, VGK subsequently rose by about $2 to $53.51 which shows that investors appreciate the fact that the ECB is prepared to do what it takes to fight inflation. Also, many corporations which have cash are fighting back through commodity hedging like Volkswagen (OTCPK:VWAGY) which gained 400 million euros in this way.

Consequently, sticking to the diversification rhetoric, not all holdings are likely to witness the same level of headwinds, namely those based in France. This country is in a unique situation as it was not relying as much on Russian oil as Germany due to having more nuclear plants and engineers are working very hard to fix older ones before winter. It is much therefore less vulnerable to the war in Ukraine.

Concluding with the Dividend rationale

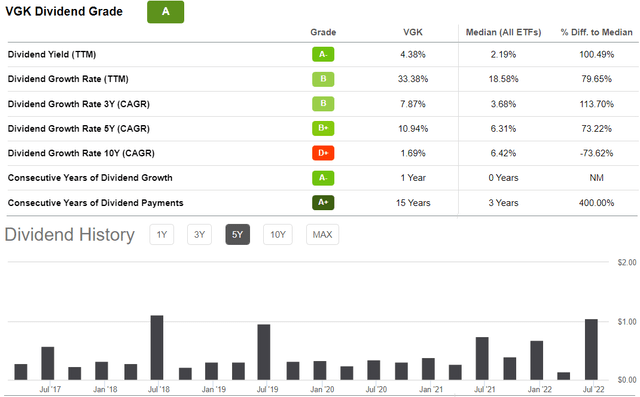

Therefore, it is not all gloom and there are many “pockets of opportunities”. For those who have been long cash and who want to diversify into an income-generating ETF, VGK pays one of the highest yields (at 4.38%) as seen in the table below.

Dividend Grades (www.seekingalpha.com)

Now, one of the reasons for yields being so high is VGK losing value. Also, the chart above shows that the quarterly dividend payments are non-uniform. The reason is that in contrast with some U.S. counterparts, European companies have no intention of becoming dividend aristocrats. Instead, when the business is not faring well, they cut the dividend and when conditions improve, they raise yields. That’s why a high dividend does not mean their business is underwater and they are desperately trying to lay out a value trap. Thus, the higher dividend payment made in July shows that the underlying fund is doing well.

As an alternative to VGK and for those (like myself) whose brokers provide them access to European-listed funds, there are the Lyxor CAC 40 (DR) UCITS ETF for French equities, the Xtrackers XDAX INCOME ETF for Germany, and the Lyxor Core UK EQ ALL CAP DR ETF which provide access to many of the holdings I mentioned above. They also pay good dividends. However, the Vanguard ETF remains cheaper with an expense ratio of only 0.08% and you get all the stocks in the same basket.

Finally, the Ukrainian conflict and high commodity prices, all have the hallmarks of a “predictable recession” where investors, as well as the common people, already know in advance about many of the pains to come. Therefore, while there could be further downside in VGK in case of a “winter recession” occurring in Germany or further pains in the U.K. as the pound’s value dwindles down, I do not foresee a market crash of apocalyptic proportions as is the case during a normal recession.

Be the first to comment