Nicholas Smith

In a disruptive era MOO is an opportunity and a hedge.

The VanEck Vectors Agribusiness ETF (NYSEARCA:MOO) is an equity ETF that holds companies that sell to farmers. This includes providers of fertilizer, seeds, irrigation equipment, farm machinery, animals health services etc.

We believe MOO is an opportunity because we see a solid chance of one or more of the following disruptions lifting food prices and MOO;

- Ukraine Black Sea exports are disrupted again.

- Weather impact from a third La Nina hurting harvests now and in 2023.

- Climate change continues, forcing farmers to invest in operations for resiliency and new types of crops as weather changes.

The first two would cause a spike in food prices. The likelihood is a coin flip and highly likely, respectively. The third is also highly likely but represents a medium-long term trend supporting demand for agriculture investment.

But first, let’s look at recent movements before we discuss each of the three points listed above in turn.

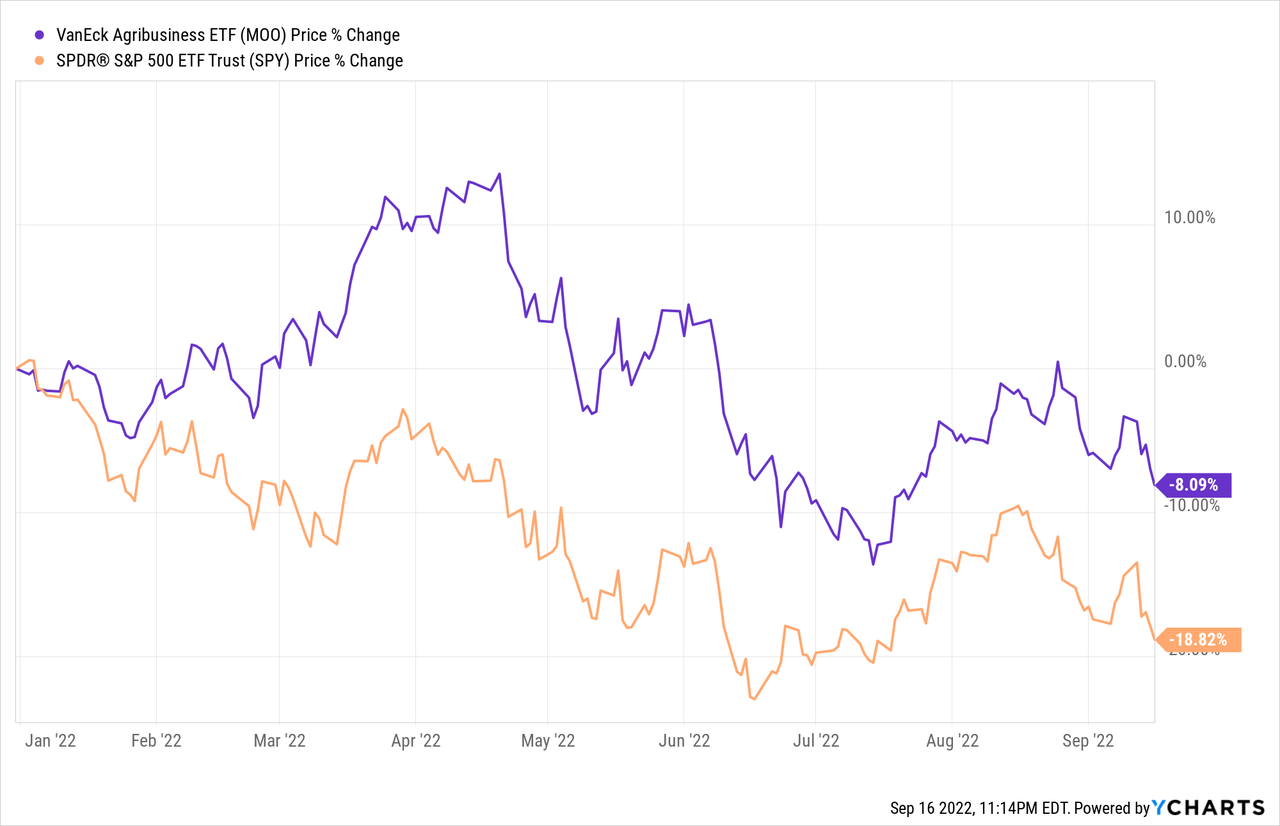

Food prices and MOO are well off their recent highs.

This has also dragged down MOO which is now well off its highs yet still comfortably outperforming the S&P 500 so far this year.

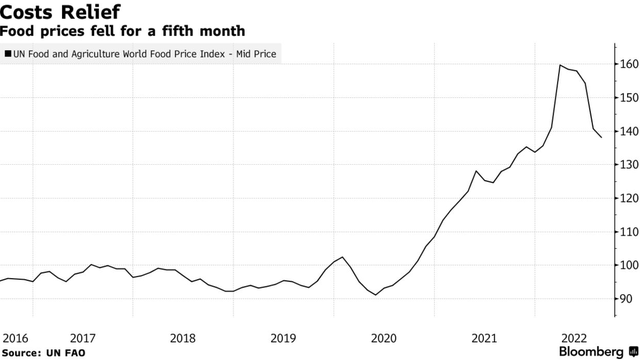

The decline from MOO’s April high is correlated with both equity markets (above), but also food prices, which soared into March, then eased (below).

Food Prices Easing (Bloomberg)

Ukraine matters and exports remain threatened.

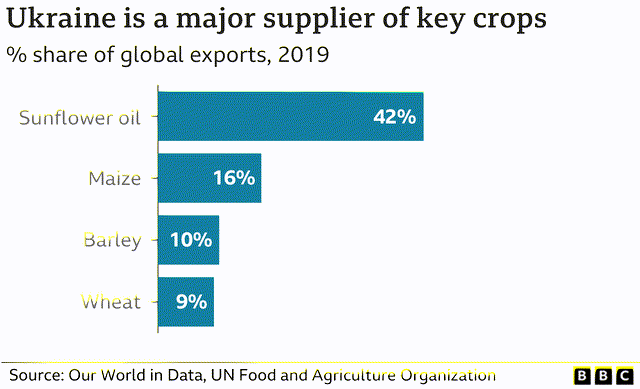

Ukraine is hugely important to global food markets. For wheat, it might seem like 9% is small, but that is still a vast and irreplaceable figure. Ukraine is usually 6th largest exporter in the world exporting 18 million metric tonnes of wheat in 2021. This year the goal might be 10 million metric tonnes.

Any change affects global markets and Ukraine supply remains challenged.

Since Ukraine and Russia have done a grain export deal for 120 days, expiring in November. In July, shipping was still less than half the 5 million tones that is the normal average month across a year.

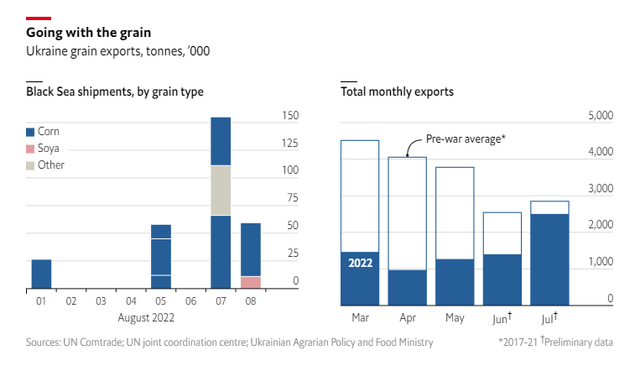

Ukraine Grain Exports (The Economist)

The Economist explained that current export rates are half previous levels and still have a massive backlog to clear.

In July, that increased to 2.5m tones of grain….routes through the Black Sea will allow food exports to return to pre-war levels, reaching 5m tones a month. And exports would have to increase further still to clear the backlog of grain that has been stuck in Ukraine. By The Economist’s own calculation, an estimated 10m tones of wheat, corn and other cereals that should have left the country are still sitting in storage.

Ukraine exported 4.6 million tones in August, which is a good achievement, but still not the 5 million average pre-war and thus not cutting into the backlog. Year to end of August, Ukraine had exported just 52% of normal levels.

Going forward, other problems loom;

- an estimated 30% decline in planting due to war disruption in spring,

- because wheat is stuck in Ukraine, this has meant low local prices and income, which might prevent farmers from having sufficient funds to plant and fertilize winter crops to the normal size,

- cost of insuring export shipments and reluctance of shipowners to ship via the Black Sea remain.

All these mean reduced production and exports even if the Black Sea remains open. Our guess is that exports could remain 40-60% lower well into 2023.

The Black Sea could well become blocked again.

Above assumes the current deal holds and is renewed, which also seems a brave assumption.

We agree with another Seeking Alpha writer, who when writing on Teucrium Commodity Trust Wheat Fund (WEAT), predicts “my base case is that Russia will stop Ukraine sea grain exports.“

Putin’s words also concur.

In early September Putin threatened to tear up the Ukraine grain deal, probably because it provides much needed foreign income to Ukraine. The deal also slows potential Russian military action against ports like Odessa.

Given recent Ukrainian advances, the pressure to strike back in any fashion becomes more likely. At this point it is helpful to remember that road/rail capacity to export grain is limited – just 10% of normal exports.

The market isn’t pricing in a return of Black Sea disruption. Given Putin’s propensity to use disruption to achieve political goals, that seems optimistic.

Weather disruption might yet cause price spikes.

Here is a summary of recent problems.

- Western United States is experiencing the worst drought in 1,200 years.

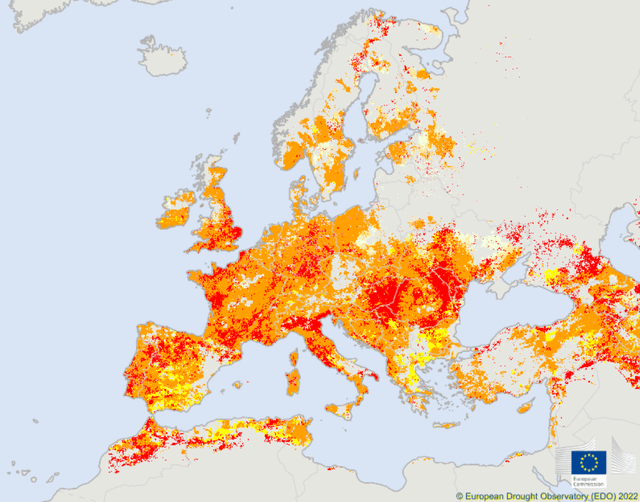

- Europe is in the middle of the worst drought in 500 years (map below).

- China had an awful drought and heatwave that is affecting crops.

- Pakistan’s worst ever floods risks famine in a country of 220 million.

- India bans some rice exports and puts export duty on the rest.

- A famine and worst drought in 40 years is hitting east Africa.

Europe Drought 2022 (Wikipedia)

On the positive side exports are mostly up for.

- Russia – wheat harvest is higher than average.

- Brazil food exports are also higher.

Every year there is some disruption. However it is hard to remember when so many places had such large-scale severe droughts or floods concurrently. Disrupted harvests or low yields in large populated places like China, India and Europe matter a great deal to global markets. We doubt forecast yields in China and Pakistan have been modified enough to reflect the reality.

But here’s the kicker, a big La Niña weather pattern this year was to blame.

Next year? Yet another La Niña has just been confirmed.

That’s a rare triple La Niña, so disrupted harvests this year are just a taste of next year. In other words the drought in China/Europe is likely to continue. Stabilizing factors like emergency stockpiles (eg China’s reputedly has 100 million tone rice) will be further depleted in 2023 with price spikes resulting.

Climate change creates a medium-term opportunity.

First up, a trigger warning. If discussion of climate change angers you, then best go elsewhere. Cognitive dissonance can be painful! You’ve been warned.

As an investor however, you should welcome your assumptions pitted against fact. Especially the uncomfortable facts, like those that follow.

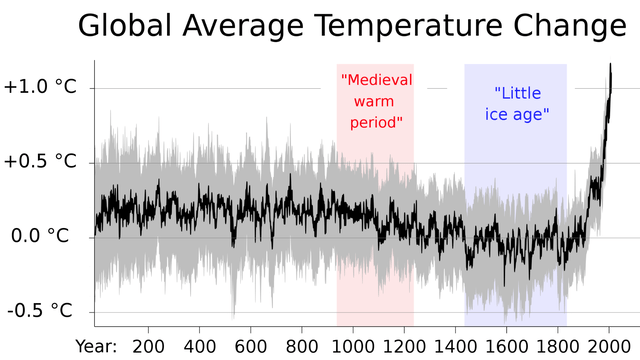

Global Temperature Change (Wikipedia)

The facts on climate change are clear. We can see continual increase in CO2 correlated with emissions, the time lapse of the North Pole showing declining sea ice, or the clear spike in the global temperature record (above), rising ocean acidity (from higher CO2 levels), and ice-melt in Greenland will quickly lift oceans by almost 12 inches. We could go on, but let’s return to MOO.

For potential MOO investors, climate change means three things.

- A higher average temperate = some crops will move closer to the poles.

- Higher variability = more frequent drought and flood events.

- Weather patterns change = some regions dry while others get wetter.

All three require more investment by farmers, increasing sales for companies that are in MOO’s ETF.

The investment opportunity of new regions and climate resiliency.

This investment demand will be funded by higher average prices for the lucky and prepared operators. Moving operations closer to the poles or to new regions requires investment. In reality, operators will stay put and change their operations to new crops/products that suit the new weather. That will require new equipment. Greater variability also requires investment to replace damaged equipment or put in irrigation or better seeds.

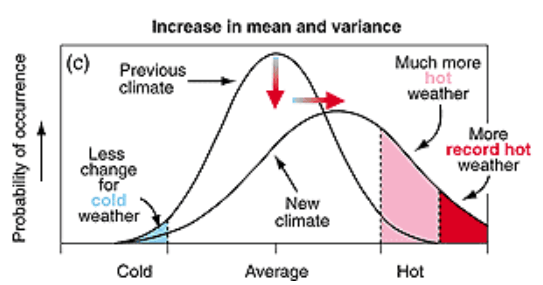

Much attention is paid to the increase in average temperatures, but higher variance will be more destructive and thus equally important.

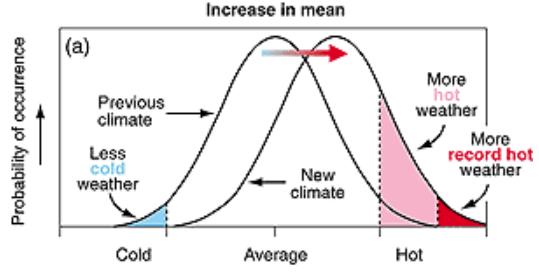

Climate change isn’t just a higher average temperature like below.

Increase average temperature (IPCC)

But climate change is also added variance in conditions.

Two factors are climate change (IPCC)

But many in the media are missing the increased variability element. Higher variability means that cold snaps can still happen. But it reduces the chances of previously “average” years (hurting yields on balance) and increases the likelihood of extreme weather events significantly, both wet and dry.

The bottom-line is that higher mean temperatures open new regions which mean greater investment to start operating and more spending for resiliency.

Either way, this all totals greater sales for the agriculture companies in MOO for the medium and long term.

Risks to MOO investors.

- The Ukraine war is won quickly, shipments resume and rebuilding proceeds.

Being no fan of Russia’s invasion, we’d love Ukraine to win quickly. But neither this nor a Russian victory seems imminent. Yes, there have been Ukrainian victories recently around Kharkiv, but this seems to be encouraging pro-war right wing Russian groups to push for “total war” including weapons like ‘tactical’ nukes. Yowzah. The risks here don’t skew towards peace, sadly.

- The US Federal Reserve raises interest rates aggressively to the point where the US enters a significant recession.

The chances of this are at least 50% depending on how you define “significant”. The landing strip between defeating inflation yet avoiding recession seems awfully narrow.

However we’d also point out that high and rising food prices will at least partly insulate agribusiness investment because a recession doesn’t usually have much negative impact on total food demand. Supply disruptions matter more.

- The stock market takes another leg down by 20-30% this cycle.

This is almost restating the point above, but it is subtly different. There is a solid chance too, although impossible to guess the likelihood. We’d argue that MOO’s decline would be less than other sectors that are more exposed like consumer discretionary, capital market deal-making or real estate amongst others.

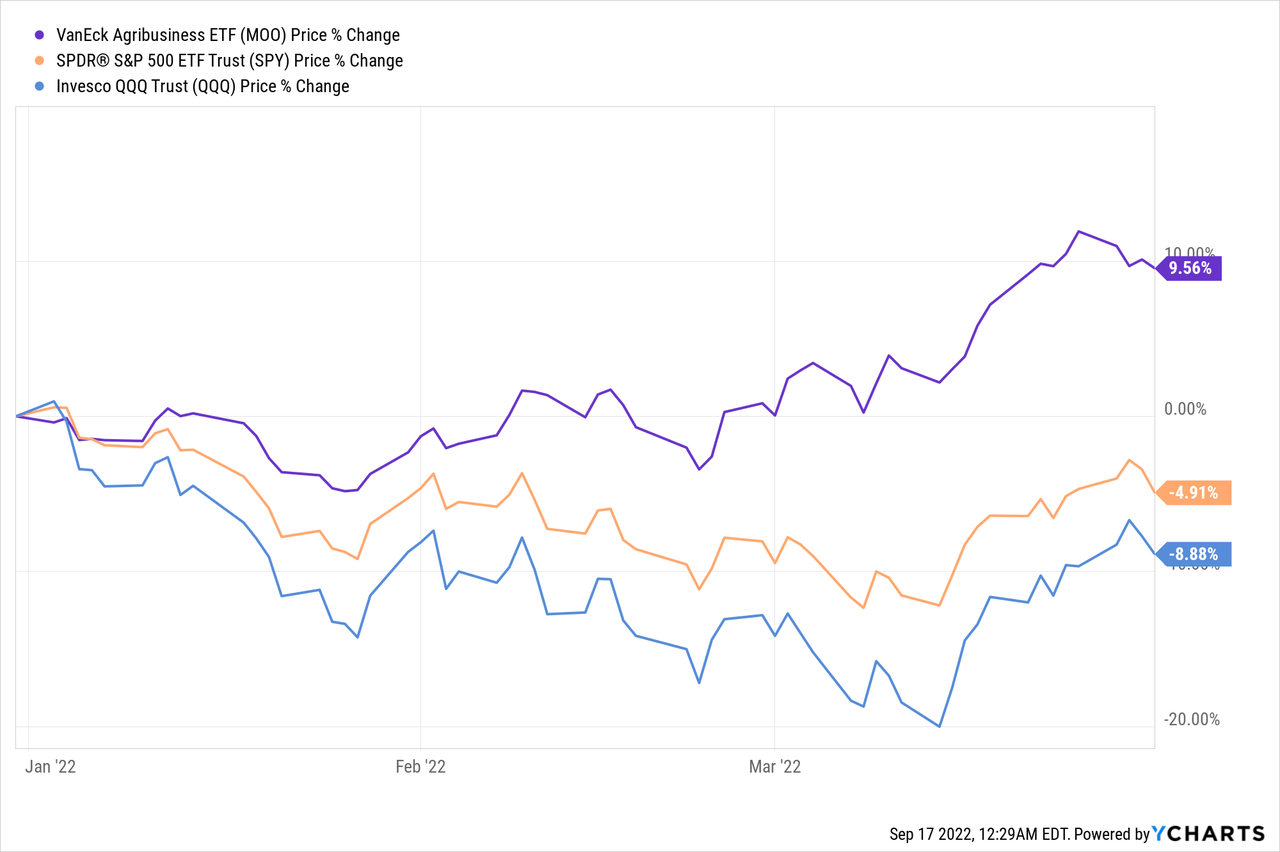

But it helps to remember Q1 of 2022 as per below.

MOO rose 9.52% whilst SPY fell 4.91% and QQQ fell 8.88%.

Food prices and disruption matter more than the wider market.

Quick Comparison of Industry Alternatives.

There are three agriculture industry ETFs as follows.

| Ticker | Expense | AUM $M | Daily Vol 3 m av. |

| MOO | 0.52% | $1,489 | 203,000 |

| VEGI | 0.39% | $275 | 98,000 |

| FTAG | 0.70% | $24 | 1,700 |

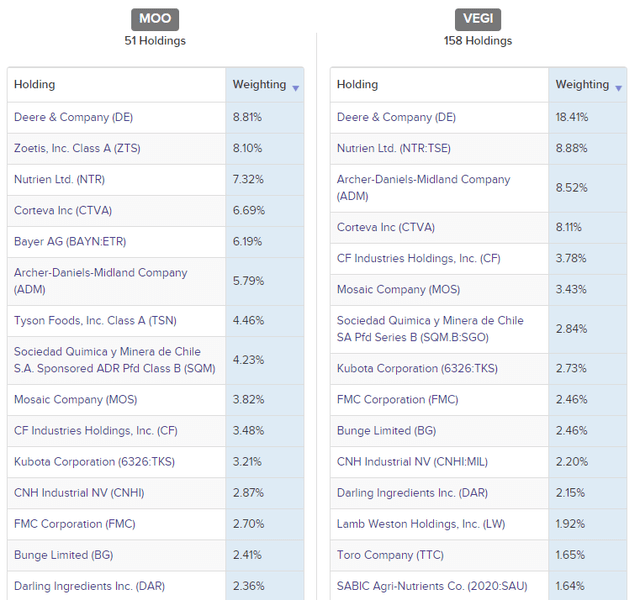

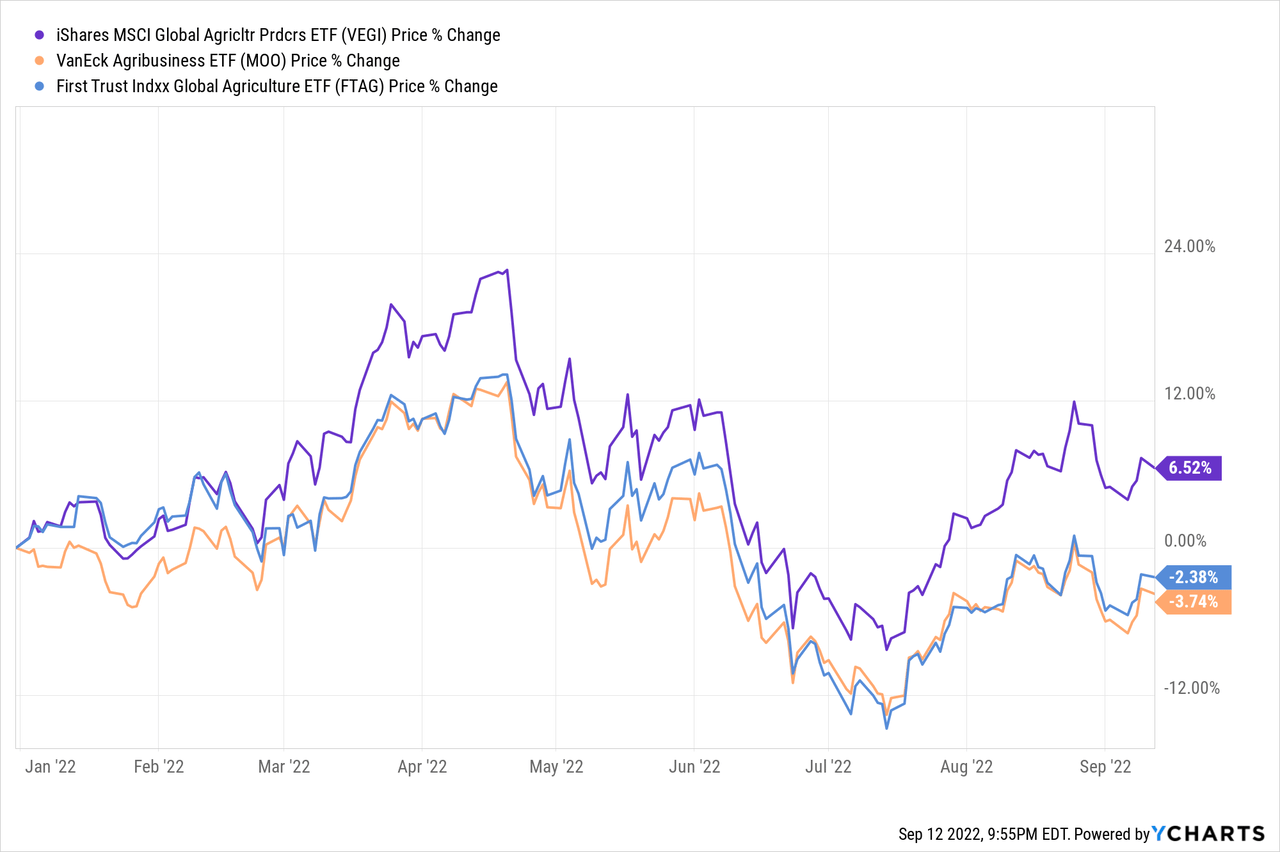

A closest alternative is iShares MSCI Global Agriculture Producers ETF (VEGI).

The main points are:

- The fund holdings and tracking differ – more next.

- AUM is significantly smaller at $275 M vs $1.5 B for MOO.

- VEGI’s liquidity is OK but less than MOO.

- Both have about 50% US vs international holdings.

- It is 13 basis points cheaper than MOO at 0.39% vs 0.52%.

The biggest differences for us however are:

- VEGI has more holdings with 158 vs 51 for MOO.

- Holdings for VEGI seem uncapped so Deere (DE) is 18.41%. This is a big holding for a single stock in a fund.

MOO vs VEGI Holdings (etfdb.com)

The other comparison to MOO is First Trust Indxx Global Agriculture ETF (FTAG) yet is inferior in several ways.

- It is far smaller at $24 M in AUM vs $1.5 B for MOO.

- Liquidity is very low for FTAG with only a handful of trades per day.

- It’s more costly at 0.70% p.a. vs 0.52%.

Usually we prefer the cheaper fund with more holdings, but VEGI’s concentrated Deere & Company holding combined with lower liquidity means it falls to second for us.

Conclusion: An opportunity and a hedge.

If we have learned anything over the last couple of years it is these things:

- Bad things happen.

- Putin will use disruption to achieve political goals, despite the costs.

- Extreme weather is more frequent and predictable (see La Nina).

- International supply chains are more fragile than is often supposed.

- Globalization is noticeably fraying, particularly in inflationary times.

These disruptive and unstable times are uncomfortable, yet they can also present as an opportunity.

Recent equity market falls have further improved the entry price.

That’s why we have recently added VanEck Vectors Agribusiness ETF to our portfolio. Both for its La Nina disruption potential, but also as a hedge for further political disruption of Ukraine’s Black Sea grain exports.

Be the first to comment