adaask

Both Main Street Capital (NYSE:MAIN) and Oaktree Specialty Lending Corporation (NASDAQ:OCSL) are high yield business development companies (i.e., BDCs) that recently reported quarterly earnings. In this article, we will compare them side by side and offer our take on which one is a better buy at the moment.

Oaktree Specialty Lending Vs. Main Street – Quarterly Results

OCSL reported strong Q4 results. Adjusted net investment income increased from $0.17 in Q3 to $0.18 in Q4 due to higher interest rates. NAV per share did decline sequentially to $6.79 due primarily to wider credit spreads reducing the valuation of the portfolio along with write downs in some of the equity investments.

Meanwhile, OCSL hiked its dividend by 5.9% sequentially and 16% year-over-year in conjunction with the earnings release, marking its 10th consecutive quarter of growing its dividend. OCSL also declared a special dividend of $0.14 per share.

The weighted average yield on debt investments increased from 9.9% to 10.6% sequentially. The underwriting track record remained excellent, with no investments on non-accrual status.

MAIN also reported solid Q3 results. Distributable net investment income came in at $0.88, up 15.8% year-over-year. Net asset value per share came in at $25.94, up 2.6% year-to-date and up 2.2% sequentially.

The underwriting remained solid, though not as impressive as OCSL’s, with a non-accrual rate of 0.8% at fair value and 3.7% at cost.

Due to the strong performance for MAIN, management announced a supplemental dividend of $0.10 per share in December as well as an increase to the monthly dividends beginning in 2023. This increase will be 4.7% on a year-over-year basis and 2.3% on a sequential basis.

Oaktree Specialty Lending Vs. Main Street – Balance Sheet

Both boast investment grade credit ratings of Baa3 (Stable) or equivalent with significant liquidity.

OCSL’s balance sheet remains in solid shape as the leverage ratio remained rather conservative with a 1.06x leverage ratio, down from 1.08x at the end of the prior quarter. The company also continued to enjoy significant liquidity, with $524 million in cash and undrawn capacity on its credit facilities.

MAIN’s balance sheet also remains in solid shape, with a 4.26 interest coverage ratio and a 1.0x leverage ratio. The company’s liquidity is $420 million and during the quarter MAIN extended its credit facility’s maturity date to 2027.

Overall, we rate the balance sheet strength of both businesses to be roughly equal at the moment.

Oaktree Specialty Lending Vs. Main Street – Investment Portfolio

The main difference between MAIN’s and OCSL’s portfolios is that OCSL invests a greater percentage of its assets into senior secured debt than MAIN does, whereas MAIN invests a greater percentage of its assets into equity than OCSL does. As a result, MAIN has higher upside and total return potential, while OCSL is more defensively positioned.

On top of that, it appears that OCSL’s underwriting of its debt investments is more conservative than MAIN’s given that it has zero non-accruals whereas MAIN has several.

While MAIN’s more aggressive approach to investing has yielded tremendous results during the economic boom over the past decade plus, OCSL appears to be better positioned for navigating the current economic headwinds. As a result, we give OCSL the edge here.

Oaktree Specialty Lending Vs. Main Street – Track Record

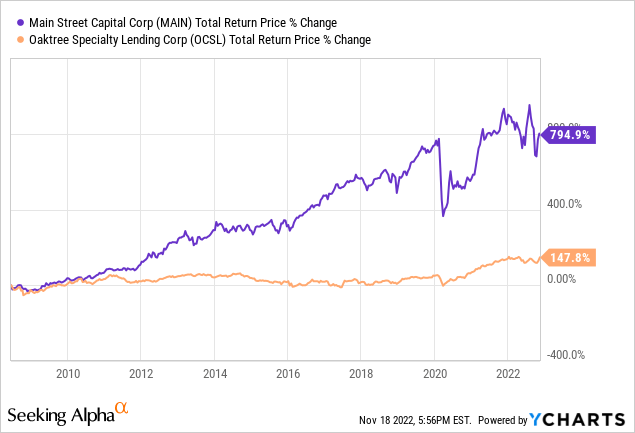

As we just mentioned, MAIN has put together a tremendous track record since the last recession. Meanwhile, OCSL has suffered from mismanagement and has also allocated more capital towards lower-returning loans, which have muted its performance:

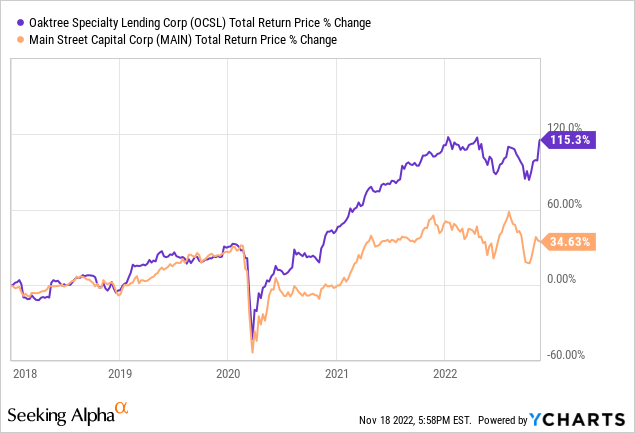

That said, OCSL has only been managed by Oaktree since the end of 2017. Over that period of time, its dividend has grown by leaps and bounds and its total return performance has crushed that of MAIN:

As a result, we view both management teams as having strong credibility and a demonstrated track record of generating attractive returns for shareholders.

Oaktree Specialty Lending Vs. Main Street – Risks And Catalysts

While both employ somewhat similar business models and tend to benefit from rising interest rates and strong economic conditions, MAIN is a bit more sensitive to economic conditions than OCSL is. As a result, if the economy can avoid a severe recession and can return to growth quickly, MAIN will likely benefit more than OCSL will. Meanwhile, if the economy enters a severe recession, MAIN’s superior exposure to equity investments will likely suffer greater losses than OCSL’s stronger focus on senior secured debt and careful underwriting practices.

Given where we are at the moment in the economic cycle, the risk-reward seems to favor OCSL at the moment.

Oaktree Specialty Lending Vs. Main Street – Valuation

OCSL’s valuation is considerably cheaper than MAIN’s across a variety of metrics:

| Valuation Metric | MAIN | OCSL |

| P/E | 10.57x | 8.68x |

| Dividend Yield | 7.36% | 10.28% |

| P/NAV | 1.46x | 1.05x |

Investor Takeaway

MAIN has an impressive track record going for it and its monthly dividend is something that many retirees appreciate. On top of that, it is an internally managed BDC and has a more efficient cost structure than OCSL has, which is externally managed.

That said, OCSL’s management – despite being external – is still exceptional as it benefits from the highly regarded Oaktree platform. This excellence is evidenced by the fact that since Oaktree took over the management of OCSL, the stock has delivered tremendous dividend growth and total return performance, crushing that of MAIN and the BDC sector (BIZD) as a whole. Furthermore, OCSL has no loans on non-accrual whereas MAIN has several, which easily makes up for OCSL’s higher cost structure.

Ultimately, both BDCs are well-managed and offer attractive dividend yields to shareholders. The decision ultimately comes down to a question of valuation and investor outlook on the direction of the economy from here. OCSL wins the valuation competition hands down with its lower P/E ratio and P/NAV ratio along with its significantly higher dividend yield. On top of that, given that the economy is likely going to get worse before it gets better, OCSL has a better risk-reward in the current economic climate.

As a result, we favor OCSL overall at the moment, though we are not necessarily bearish on MAIN either.

Be the first to comment