Feature interview

Courage & Conviction Investing is an individual investor with experience on the buy side that focuses on trying to understand businesses and invest in businesses that are mis-priced, under valued, mis-understood, or simply out of favor. On average, his process is 80% art and 20% science. Small caps are his primary area of focus, but questing for alpha often and does expand this coverage universe, albeit selectively, to include special situation stocks. We discussed using the mosaic theory to form a thesis, mispricings resulting from a lack of analyst coverage and the value in speaking with management.

Seeking Alpha: How have you evolved, as an investor, since we last spoke, back on May 15, 2021?

Courage & Conviction Investing: When we last spoke, back in May 2021, Cathie Wood (ARKK) was still the toast of Wall Street, technology stocks were still very much en vogue and the market seemed poised to continue its ascent. With a very accommodative Federal Reserve, ‘buy the dip’ was the bulls’ anthem and the bond vigilantes had been massacred. Eighteen months ago, visions of the 10YR U.S. Treasury eclipsing 4% would have been considered psychedelic. Back then, there was a lot of anticipation for an auspicious re-opening as people hoped for a return to normalcy. Little do we know, or it is fair to say, that I under appreciated the affect, ultimately, the third and highly generous round of stimulus checks ($1,200 per adult and child that arrived in March 2021) would have on inflation. The combination of three rounds of generous stimulus checks, enhanced unemployment, the Great Resignation movement, and a severely constrained supply chains meant capacity couldn’t keep up with surging demand. In the interest of brevity, as we could discuss this topic for hours, I would refer readers to my recent piece, published on October 11, 2022 (How We Got Here And The Oceanic Forces The Fed Can’t Control), as it explores these topics in greater depth. And to be clear, I think the Fed is making a policy error here and is way too tight, especially in the face of M2, which is flat in 2022.

Meanwhile, let’s face it, if you are a long only investor and don’t hedge or run a long / short book (and I don’t), outside of energy, both upstream and downstream, and a few pockets of mostly commodity stocks, the market has been exceptionally difficult in 2022. Yes, there have been two fierce bear market rallies, but like all bear market rallies, thus far, they’ve all faded. Simply put, this has been the worst year in nearly 100 years for a traditional 60% stocks/ 40% bonds portfolio.

2022 has mostly been about the macro, so think the rapid rise in the Federal Funds Rates, the War in Ukraine, an energy crisis in Europe, China’s housing/ apartment bubble popping, and the highest inflation in forty years. This many negative factors had created a potent brew, leading to what feels akin to a prolonged and nasty hangover, in the form of super negative investor sentiment. Whereas during the March and April 2020 drawdown, although massive, it was so short lived, if you blinked, you missed them. Essentially, in 2022, all of these gale force winds have intensified into a hurricane, resulting in sharp multiple compression. Furthermore, and compounding this multiple compression has been a shift, from irrational exuberance (think of Robert Shiller’s book and now famous phrase), during the halcyon days, stretching from the second half of 2020 to the pinnacle, in February 2022, to the extraordinary bearish sentiment of 2022.

Year-to-date, at least through October 2022, it’s been a Macro fund’s dream (I’m talking about the massive hedge fund strategies, with shops running tens of billions), as long the U.S. dollar, short stocks (mostly technology, consumer discretionary, high leveraged and anything with negative EBITDA), short treasuries, and long energy has been the playbook. Notwithstanding a few fierce bear market rallies, and the July through mid August 2022 move was the best bear market rally, as the 10YR yields moved from its then high of 3.48% to well under 3%, this macro fund playbook has worked masterfully.

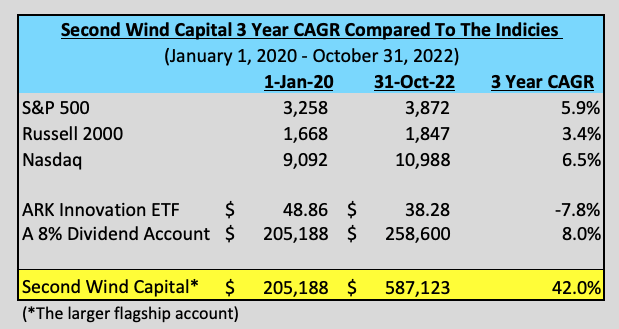

As someone who is just an old school stock picker, and mostly a small cap value investor, tasked with attempting to figure out businesses – meaning: 1) what do they do 2) how do they make money and 3) what are the drivers, it has been really hard in 2022. Yes, from an overall performance perspective, year-to-date through October 2022, I’m about flat, across two accounts, on a dollar weighted basis, but I’m never worked so hard, to just get back to the starting line of flat.

Suffice to say, I miss the days where figuring out companies and good old fashion stock picking actually mattered as opposed to regularly witnessing 2% daily moves, and an occasional 3% daily move in the S&P 500 (SPY). And speaking of wild volatility, the higher beta Nasdaq Composite (QQQ) has even experienced a few 4% days.

2022 has challenged me and reminded me that you have to be dynamic enough to consider the macro, given the stiffness of the headwinds. Secondly, it has been a great reminder to look out twelve to eighteen months and really stress test your assumptions on what ‘normalized EBITDA’ is each of the companies contained in your portfolio. That said, though, I’m still playing the long game, and think there will, eventually, and your guess is as good as mine when it comes to precise timing, be pots of gold left for stock pickers, amidst all of the wreckage of ships crashed along the shorelines.

SA: Walk us through your investment decision making process. What area of the market do you focus on and what strategies do you employ?

Courage & Conviction Investing: I can’t emphasis enough how much of my process is art vs. science. I truly think is bordering on 80% art and 20% science. Said differently, my process is 80% qualitative and 20% quantitative. On the science side, reading the financial statements, and understanding how they move, for a particular company or industry, is kind of par for the course. It is very much a pre-requisite, just like knowing where to move on the basketball court and knowing the fundamentals of basketball. Let’s face it, you can’t make the D1 basketball team at Duke if don’t know basketball fundamentals and you certainly can’t develop a long term and successful track record of investing if you can’t read the financial statements. That said, though, there is no edge in being able to read financial statements. Stock prices are about the future and how future business result turn out relative to consensus estimates. I just don’t think many people fully grasp this concept and it is one of the biggest sources of how people lose money and get befuddled while doing so.

For me, though, so much of my process is reading and synthesizing the conference calls, sometimes this mean both listening to and reading the call transcripts and going back in time, to prior conference calls to see how consistent management is in term of what they promise, what they can control, and what they deliver. Also, I spend a lot of time thinking about what the company does, how they make money, and the drivers. Thinking about normalized earnings and what you are paying for a business is paramount.

To give you a great example, I have spent a lot of time figuring out TravelCenters of America (TA). Although I have written on this company, extensively and privately to my group (Second Wind Capital), I did share what I thought was a high quality piece – TravelCenters Of America: A Quintessential Turnaround – published on September 30, 2022, albeit with a four week lag. If you go back and slowly read that piece, as there is a lot there, this is great example of my process. And BTW, I still own shares, purchased at $42, on September 2, 2021. Jon and his team are doing exactly what they said they would and frankly have exceeded my expectations. Take a look at the trajectory of TA’s Adj. EBITDA.

TravelCenters of America’s Adj. EBITDA trajectory:

-

FY 2019: $131 million

-

FY 2020: $147 million

-

FY 2021: $220 million

-

TTM 2022 (as of 9/30/22): $320 million

And incidentally, on November 2, 2022, despite posting another great quarter, in Q3 FY 2022, and offering solid commentary on diesel fuel margins in both Q4 FY 2022 and early 2023, the stock got dinged to the tune of down 23%. As of its November 2, 2022 closing price of $49.31, we are talking about a business selling for an Enterprise Value / Adj. EBITDA of only 2.47X. The reason the stock trades so cheap is because the market 1) doesn’t like the elevated Capex spent, in FY 2022, 2) they don’t think fuel margins will stay elevated and 3) they fear diesel volumes could get dinged in a recession. That said, you have to be in the weeds here, to understand the exceptional progress this team has seen. A lot of FY 2022 Capex is one-time and just deferred maintenance. Also, they own 55 sites, arguably worth upwards of $600 million (probably more). This stock is just stupidly cheap and I bought a lot more, at $52.50, on November 2, 2022 drawdown.

SA: As you trade for your personal account – and this is a topic we’ve discussed over the years in this interview series – can you discuss the advantages and disadvantages the individual investor has versus an institution?

Courage & Conviction Investing: As an individual investor, your primary advantage is nimbleness and ability to move undetected when you are initiating or sizing up a position or if you’re exiting a position. In other words, even if you mostly focus on a small cap value strategy, meaning playing in sandboxes with company only sporting $50 million to $500 million market caps, you can easily accumulate and dissolve a position in a business. In other words, your buying or selling doesn’t influence the stock price.

On the institutional side, though, and depending on the assets under management and the mandate, the liquidity and bid / ask spread, in micro caps and many small caps (sub $500 million market caps), simply means that these stocks are off limits.

That said, and I know this is something that I would love to have, there is nothing like have a 5 year investment horizon and the capital to match that strategy. Moreover, if you have the luxury of long term and patient capital, on the front end, the selection and rigorous nature of the due diligence is much more elevated. This is because the express intent of that capital is long term capital appreciation, so the curation of that portfolio is so critical.

As an individual investor, the stakes aren’t nearly as high and the incentive structure is different than running sizeable buy side money.

I actually think being a buy side investor is optimal for the evolution, as analyst.

Let me give you a poignant example. When I launched Second Wind Capital, back in May 2020, my top three ideas, and this was a great point in time to pick stocks, were Kirkland’s (KIRK) at $1.75, Alpha Metallurgical Resources, Inc. (AMR) at $5, and Signet Jewelers Limited (SIG) at $9. Back then, I was long 12,000 shares of KIRK at $1.75, 4,000 shares of AMR, at $5, and 1,600 shares of Signet, at $9. To blow your mind, if you just held these three stocks, from then until now, this is the math:

As of November 3, 2022:

-

12K shares of KIRK x $1.75 equals $21K invested. That is worth $44,880. Let’s forget that KIRK hit $34, back in April 2021.

-

4K shares of AMR x $5 was $20K invested. Those 4,000 shares would be worth $669,520. That is 33.5X your money, and no, that isn’t a typo.

-

1,600 shares of Signet x $9 equals $14,400. Those 1,600 shares would be worth $101,984. Let’s forget that SIG hit $112 (November 2021).

So that $54,400, invested in May 2020, and if held from then until now, would have turned into $816,384, as of November 3, 2022. The rest of the portfolio could have gone to zero and those far returns outpaced my actual results.

Author’s Chart

And my long winded point is, and I learned this the hard way, is that it would be optimal to be able to run long-term and patient institutional buy side capital. That said, the really tricky part is finding the right type of sponsors / capital, backers that are truly philosophically aligned to the strategy, believe in you as an analyst, and willing to play the long game.

SA: Can you discuss how you have used the mosaic theory to form a thesis? Can you give an example? How do you determine if information is relevant or not? How do you translate information into insight?

Courage & Conviction Investing: I would argue so much money has been lost on the assumption that computing ratios, ratios that every single investor and speculator has readily available at their finger tips, is the way to pick stocks. Of course, starting valuation matters. At the highest level, and I’m talking the pinnacle of analysis, the summit all analysts strive to reach, it is figuring out what is priced in -so think future earnings expectations – and then triangulating or reverse engineering where you think future earnings will land. If, your financial model, and it can be a back of the envelope model, as often the trajectory of EBITDA or earnings can be captured in a good, but simple model, is materially different than consensus estimates, then and only then, should you be allocating capital into XYZ security.

The other key element and I have learned this through the school of hard knocks (i.e. I’ve got dinged on what I thought was a well thought out investment thesis) was the importance of a good management team. Sir Warren, and there is only one Sir Warren in the investment world, has shared his hard fought and front line acquired knowledge on this very topic. Good management team, operating decent businesses can create shareholder value. If I look back, almost all of my big misses, were because the management team wasn’t very good. I had these imaginative and grand plans, a great thesis business. Yet, in the end, I wasn’t the CEO or CFO, and I had zero influence whatsoever on the decision making in the C Suite.

In terms of mosaic theory, I think it about trying to really understand the businesses, speaking with the management team (if they will take your call), understanding the valuation and next year’s future earnings expectations, and then finally spending a lot of time thinking about the industry. And, of course, this year, the macro headwinds have stolen everyone’s thunder.

SA: Can you discuss mispricings resulting from a lack of analyst coverage and/or because you believe they are simply wrong in their assumptions? Can you give an example?

Courage & Conviction Investing: One of the big mistakes that I’ve seen, and frankly far too often, is that people think they can outsmart the 50 sell side analysts covering these big technology companies. You need to be an amazing subject matter expert on the underlying technology, the ecosystems it exists and competes in. In addition, you must understand the barbarians at the gate (so think competitors – as competitors are attracted to fast growing market segments with 80%+ gross margins). There are exceptions where there is just so much groupthink, or a balance sheet is super leveraged, such that it is written off, and where a company threads the needle. That said, more often than not, it is unlikely, perhaps outside of times of big market drawdowns or the trough of a commodity cycle, where you can make a big stack. Again, though, thinking that you can consistently outthink the 50 sell siders isn’t a way to create long-term alpha.

Therefore, the reason why small cap value investors, like myself and others, hunt in jungles where there are very few other hunters, is that there is a far greater opportunity for mis-pricing. When you have three analysts covering a business, the range from low to high, on EBITDA or EPS, can be large, and the market tends to price securities based on consensus, or that average of three estimates. Therefore, the probability of a material mis-pricing is higher when you have only three analysts covering something compared to say twenty or thirty, or even fifty, when we are talking about mega cap tech stocks.

Perhaps, a great example was and probably still is JAKKS Pacific (JAKK). I started covering JAKK, and I like to colloquially, call the stock ‘Captain JAKK’, back in calendar Q2 2021. The stock was then trading in the $8s. Now on the free site, you can read my reports from 2021, so I don’t want completely reinvent the wheel here. However, if you go back and look, the thesis played out here. There was very limited, if any, sell side coverage back then. The company had been in the penalty box, for years, after years of disappointment. As luck would have it, I got in touch with the company, and had a great conversation with Sean McGowan, who back then worked in IR, at JAKKS. Sean had covered the toy industry for decades and he liked that I had done a lot of homework, and we spent well over an hour talking shop. We really got in the weeds, discussed the business, the balance sheet, and what could be, looking out a year. As he worked directly with Stephen Berman, the long-time CEO of JAKKS, I was able to work out, from the subtext, Stephen was on a mission to turn this business around. This was Stephen’s comeback song, so to speak. The other icing on the cake was Larry Rosen, a very smart businessman and entrepreneur, was aggressively buying the stock. Larry still own 16% of the equity, as of his most recent SC 13 filing.

As JAKKS’ EBITDA and business momentum was gathering speed, its balance sheet, although stretched, meant there was a clear pathway to the equity being significantly mis-priced. In a nutshell, sins of the past, and lousy balance sheet kept everyone away. This was viewed, by the good opinion of others, as too toxic and too risky to put to work fresh equity capital here. Also, you can go to Walmart and Target and see the shelves and products. Some other nuances to consider, and I didn’t cover all of them here, is JAKKS’ relationship with Disney is extraordinarily valuable and its costume business, Disguise. The market hasn’t and still doesn’t fully appreciate this value. That said, the big monkey wrench and this threw me off was that usury container rates marred what would have been a spectacular Q4 FY 2021.

Incidentally, after seeing JAKKS’ fantastic Q3 FY 2022 results, and listening to its conference call, I’ve sized JAKK back up, in the $18s.

Here is how I phrased it to my group:

Please show me another business, with a clean balance sheet, trading at less than 2.5X EV/ Adj. EBITDA (and I included the preferred stock), that has grown its revenue, 20% in back to back years, that nearly doubled its EBITDA (from FY 2021 to FY 2022), and has a peer group that trades at roughly 9X (EV/Adj. EBITDA) at Mattel (MAT) and 12X at Hasbro (HAS). Moreover, JAKKS’ FY 2023 outlook is solid, with many upcoming catalysts tied to a big Netflix (NFLX) and Sonic and multiple Disney (DIS) launches.

SA: What role does speaking with management play in your investment decision making process? What can you learn from them that you wouldn’t learn from just reading the Q/K or earnings call transcript?

Courage & Conviction Investing: I would argue that speaking to management is one of the final steps in the investment process. If you do a lot of homework and ask a lot of thoughtful questions, the way management answers your questions and the quality of their responses can provide a great read on how smart and how good they are at operating their businesses.

To give you a recent example, after Q1 FY 2022 and Q2 FY 2022, I spoke with the CFO of Summit Midstream (SMLP), Bill Mault, on two occasions, and for north of an hour, each conversation. Bill could tell I did a ton of work trying to model this business and we had a blast talk about the business, and each basin. The subtext was Bill is really sharp and CEO, Heath Deneke, who was in-line to be the next CEO of Crestwood (CEQP), but must have been passed over, is also very smart. Now, no question, the fundamental backdrop for increasing oil and gas production is excellent, but Summit’s recent $305 million acquisition, in the DJ Basin, at 4X EBITDA, is a signpost that these guys get it and are laser focused on getting its net debt to sub 3.5X, by the end of FY 2024, with the caveat the robust FY 2023 new well activist momentum carry into FY 2024.

Although, as an individual investor, it can be really hard to get the CEO or CFO on the phone, but if you can it should only help you figure out the business and size up the quality of the teams.

SA: What’s one of your highest conviction ideas right now?

Courage & Conviction Investing: From a risk/ reward perspective, and in the low twenties, NCR Corporation is my highest conviction idea. Although the company is fairly complex, and I have written two in-depth pieces, to my marketplace group (Second Wind Capital), I will share a shorter version of my thesis now. NCR Corporation (NCR) is a great way to play the automation of jobs on the lower end of the economic spectrum. Over the past few years, it has been extremely difficult for employers to attract and retain employees. Turnover rates have and remain elevated and workers have been demanding large wage increases. Throughout service economy, I regularly see help wanted signs, and the Great Resignation movement was a reminder, and rightly so, that people want to spend their time and efforts in a job that they view as career as opposed to simply trading time for modest overall compensation.

NCR has a strong presence in banking, retail, point of sales for restaurants, payment solutions, and telecom & technology. If you’ve used an ATM there is a good chance you’ve used NCR’s hardware or software (its AllPoints ATM network). If you’ve shopped at Walmart (WMT), or your local grocery store (among many other places), and used the self-checkout kiosks, there is a very good chance you’ve used NCR’s technology.

Remarkably, the company’s products and software have gotten much better and its business results have too, yet its valuation hasn’t reflected how much better and more valuable the business has become in its equity valuation. Incidentally, in September 2022, NCR was ranked fourth in IDC’s Top 100 FinTech rankings! The only firms ranked higher have much larger enterprise values (Fidelity National Information Services, Inc. (FIS), Fiserv, Inc. (FISV), and SS&C Technologies (SSNC)).

The reason NCR trades so cheaply is because final negotiations to sell the business, to private equity firm, Veritas, broke down, at the very last minute. The dramatic rise in interest rates, combined with perhaps an impasse on a final price might have been the ultimate cause of the failed sale. The market was expecting that Veritas and NCR would, eventually, get the deal across the finish line. When the deal was called off, at least for now, NCR shares cascaded lower and it took at least a month for the fast money sellers to take their ball and go home. Now that the dust has settled, the fundamental based investors have cleaned up the fast money sellers, who have migrated to greener M&A arbitrage pastures.

That said, with or without a deal, and although management is moving ahead with a two company split, as they want to separate the lower growth, but high free cash flow segments of the business from the faster growth SaaS side of the business, I’m very happy to own and recommend NCR shares in the low $20s. Also, in FY 2022, a number of forces have dinged results. These include supply chain issues, largely driven by major semi-conductor shortages. In some instances, NCR had to pay 20X to 50X more for its chips to fulfill hardware orders, which dinged hardware margins. Next, a very strong U.S. dollar has been a major FX headwind, and rapidly rising interest rates have been an EBITDA drag, as NCR has to pay to borrow the actual cash, located in its owned ATM network. Despite very strong KPIs, solid revenue growth, and very healthy EBITDA margins, all of these factors, along with negative working capital associated with maintaining excess levels of inventories to mitigate against supply chain bottlenecks as well as maintain very high levels of customer service have dinged free cash flow. However, excluding FX headwinds, and FX is always fluid, these headwinds appear to be diminishing, as NCR is set to deliver on the low end of its original FY 2022 Adj. EBITDA guidance. Finally, from a valuation standpoint, NCR is only trading an EV/ FY 2022 Adj. EBITDA of 6X. And as NCR’s net debt, roughly $5.3 billion, makes up 62% of its total enterprise value (and a lot of this debt is termed out, and at low fixed rates), the equity is fairly torqued to multiple expansion and improving FY 2023 EBITDA and free cash flow generation. On its Q3 FY 2022 conference call, from Q4 FY 2022 – FY 2023, the company expects to generate $500 million to $800 million of free cash flow. Depending on where that free cash flow figure, ultimately lands, $400 million to $500 million will be earmarked for balance sheet deleveraging, but management stated an openness to using excess free cash flow to buyback shares. Also, they left the door open to an M&A transaction, but at the right price. In closing, in the low twenties, I would argue NCR shares look compelling with or without an M&A deal, as this is a very good business, trading at a low valuation.

***

Thanks to Courage & Conviction Investing for the interview.

Courage & Conviction Investing is long TA, JAKK, KIRK, NCR, NFLX and SMLP

Be the first to comment