RiverNorthPhotography

This article was co-produced with Chuck Walston.

When it comes to Verizon Communications Inc. (NYSE:VZ), the bears are mauling the bulls. Bears will point to the fact that VZ has a hefty debt load, and the company is grappling with a bulked up T-Mobile (TMUS) and a slimmed down AT&T (T).

Furthermore, every quarter since Q2 2020, Verizon has lost market share in total phones and postpaid phones. During the first nine months of this year alone, Verizon lost 16,000 wireless subscribers. In that same time frame, AT&T added 1.7 million net subscribers, and T-Mobile added 1.1 million.

That largely explains why T-Mobile shares have soared, AT&T’s have surged, and the stock of VZ is down around 26% over the last twelve months.

However, while losses of subs and high debt levels support the bear argument, there are some positives to support the bulls. In some respects, VZ is the better company of the three, and one must wonder if the drop in share price provides an investment opportunity.

Why The Share Price Fell So Far

Shares of Verizon were chugging along rather handsomely, outperforming the markets by a wide margin until Q1 22 results hit in late April.

Net income and EPS dropped year-over-year, dragged down by higher operating expenses. Cash flow from operating activities of $6.8 billion were down $2.9 billion year-over-year. Capex increased more than fourfold, and the firm’s prodigious debt inched up by $1.9 billion.

As is common for the company during each Q1, Verizon lost net postpaid phone customers (36,000), although that marked the lowest first quarter loss since 2018.

All in all, there were few positives in the report. However, I will posit the main cause of the decline in the share price was a disappointing outlook for 2022.

Management guided for reported wireless service revenue growth, adjusted EBITDA growth, and adjusted EPS were all projected to fall at the lower end of the previous range.

Following those earnings, Verizon investors experienced the worst one-day loss since the COVID crash of 2020. In just over a week, the shares fell from the mid-50s to the mid-40s. However, the stock recovered nicely, hitting over $52 within two months.

Then the second shoe fell in the form of Q2 earnings.

A one-two punch in the from a loss of 12,000 net postpaid phone customers, the weakest showing for that metric in a second quarter in a decade, and management’s downgraded guidance, once again floored the share price.

Postpaid revenue, which accounts for over 80% of total service revenue, recorded a 2.2% increase, but that represented a growth rate half that of the previous year.

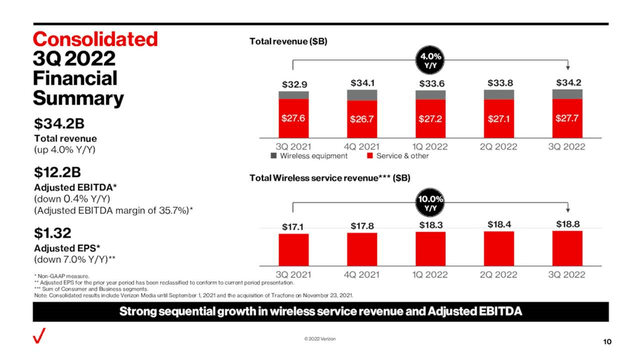

Once again, Verizon’s forecast for wireless service revenue growth dropped from a prior range of 9% to 10% down to 8.5% to 9.5 5%. Service and other revenue growth was changed from flat to flat to minus 1%. Adjusted EBITDA was lowered from a prior growth of 2% to 3% to a minus 1.5 % to flat, and the outlook for adjusted EPS dropped from a range of $5.40 to $5.55 to $5.10 to $5.25.

The share price plummeted. However, unlike the drop that followed Q1 results, there was no subsequent recovery in the stock.

Third quarter results did little to turn the tide. Even though Verizon beat consensus revenue by $410 million and consensus EPS by $0.03. At the same time, the company reported a paltry 8,000 postpaid phone net additions along with a 0.92% retail postpaid phone churn rate.

The result of three consecutive quarters of less than stellar results? Shares of Verizon sank to a 12-year low.

A Bull’s Eye View

It is common for pundits to contrast Verizon’s weak net postpaid phone additions with the robust gains in postpaid phone customers reported by AT&T. For example, in Q3 alone, VZ had a net loss of 189,000 wireless postpaid phone customers versus an increase of 708,000 postpaid phone users by AT&T.

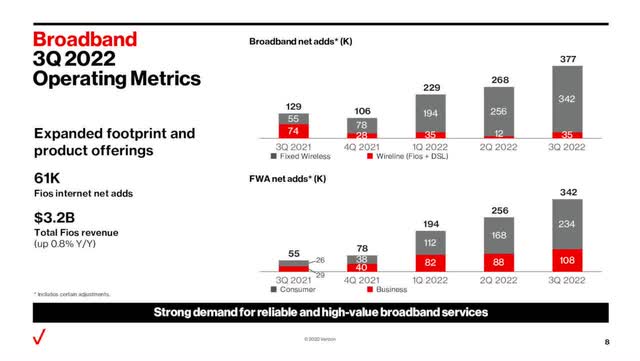

However, this is a bit of a myopic view. Verizon also posted 229k total broadband net additions in Q1, 268,000 net broadband adds in Q2, and 377,000 in Q3, for a year-to-date increase of 874,000 net broadband additions.

Contrast that with approximately 477,000 broadband connections as of Dec. 31, 2021.

Verizon can now offer the fixed wireless product to over 40 million potential customers with a goal of eventually reaching 64 million homes.

Verizon’s Business segment notched 197,000 postpaid phone net adds in the quarter, the fifth consecutive quarter in which that division added more than 150,000 postpaid phone net adds.

Total revenue and total wireless service revenue were also up quarter-over-quarter and year-over-year.

The 10% jump in wireless service revenue was largely due to the recent acquisition of the TracFone prepaid wireless business. The company also recorded 34,000 TracFone net adds, the first positive number for Tracfone since Q1 of 2021.

Verizon’s Ace In The Hole

Most of Verizon’s poor results on net postpaid phone additions can be attributed to one factor: Verizon raised prices for its plans. Even with that headwind, VZ still leads rivals by a wide margin. The company has about 91.5 million postpaid subscribers. Meanwhile, AT&T has 82.7 million postpaid subs, and T-Mobile has just under 71.1 million.

Why does VZ hold the lead? It likely boils down to network quality. JD Power just ranked VZ as having the highest quality network for the 29th straight year. That assessment is backed by a RootMetrics study.

Aside from placing Verizon at the head of the pack for the 15th straight year, RootMetrics assessed 5G networks for the first time. The study determined that, “Verizon delivered the fastest aggregate median download speed across the US and provided “an unmatched combination of fast speeds plus exceptional reliability, with an expanding 5G network.”

Debt, Dividend, And Valuation

At the close of Q3, VZ has $147.9 billion in debt, a reduction from $151 billion in 2021. Of that, $15 billion is due within one year.

The company had $2.1 billion in cash and equivalents.

Verizon’s debt obligations are leveraged toward variable interest rates. That results in increasing interest on the current debt in this environment. Management suspended stock repurchases to focus on debt payments.

S&P rates Verizon’s debt as BBB+/stable and Moody’s provides a rating of Baa1/stable.

The current yield is 6.92%. The payout ratio is 48.63%, and the five-year dividend growth rate is a bit above 2%.

Verizon trades for $37.90 per share. The average one-year price target of the 21 analysts following the company is $48.60. The average price target of the 8 analysts that rated the stock following the last earnings report is $43.12.

VZ has a forward P/E of 8.00X versus the stock’s 5-year average P/E of 11.51x. Over the last few weeks, the stock has been trading at levels not seen in over a decade.

Is Verizon a Buy, Sell, Or Hold?

It’s apparent that Verizon has lagged competitors in terms of net postpaid phone customers, but that’s largely due to management’s decision to raise plan prices.

It’s also true that debt is up, and net income, EPS and other closely watched metrics are down. However, that’s largely the result of a surge in the capex required to build out the 5G network. It should be noted that the company’s competitors are also loaded with debt and are also devoting enormous sums to capex.

In fact, the ratings agencies rank Verizon’s debt one level above AT&T and two above that of T-Mobile.

By focusing on the postpaid numbers and debt, bears are ignoring a variety of positive stats the company is generating.

Furthermore, when assessing a prospective investment in Verizon, I believe it’s imperative to compare it to AT&T and TMUS. The three are members in an oligopoly, wrestling with the same business environment and competing for the same customers. If, as JD Power proclaims, Verizon has the best network of the three, and the company has the better credit rating, then I believe VZ has the advantage over the long haul.

If I were to identify a long-range problem that might hobble Verizon, I would point to the fact that the U.S. wireless market is saturated, but once again, that also pertains to rivals.

I view the current share valuation as quite attractive considering the company’s long-term prospects. Perhaps of greater importance, I contend that investors seeking a safe robust yield will eventually create an environment in which the stock traces a reversion to the mean.

Consequently, for those seeking a safe, robust yield, I rate VZ as a BUY.

Another Perspective To Consider

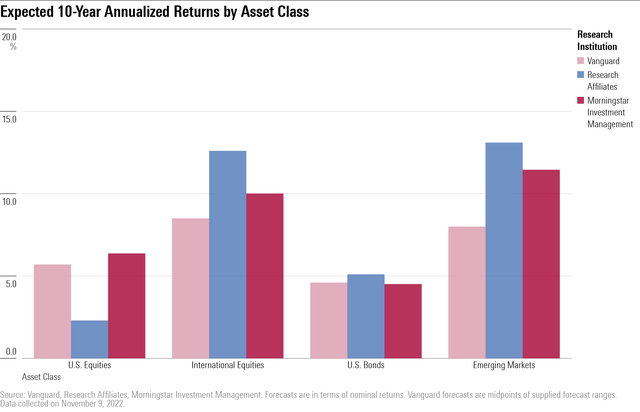

A study by Morningstar, Vanguard and others provides a sobering picture of the markets long term trajectory. Vanguard forecasts annualized nominal returns (before adjusting for inflation) on equities over the next ten years of 4.7% to 6.7%. Research Affiliates is not nearly as sanguine, projecting returns of 2.3% through the next decade, while Morningstar’s estimate lands in the middle at 5.5%.

I do not dismiss these assessments, nor do I embrace them. I simply provide them for your consideration. However, should they prove accurate, an investment in Verizon at this juncture would result in solid returns.

Be the first to comment