Salameh dibaei/iStock via Getty Images

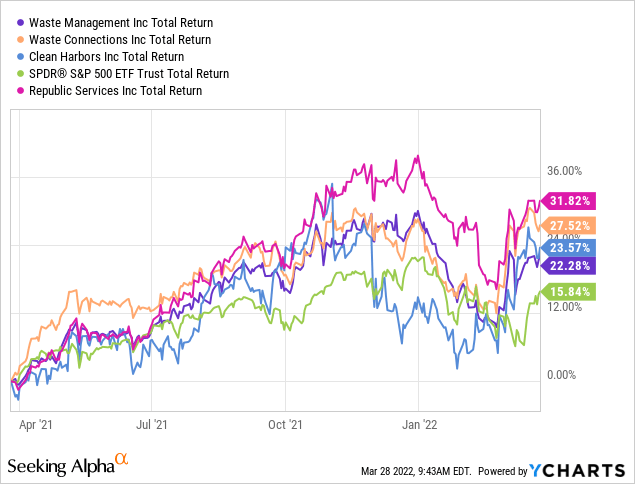

Over the last twelve months, waste services stocks have outperformed the broader S&P 500. Waste Management (NYSE:WM) delivered a 22% return but was bested by Waste Connections at 28% (WCN) and Republic Services (RSG) at 32%. In general, investors have come to appreciate the industry’s relative stability during the pandemic and potential for economies of scale with growth. The industry benefits from having strong barriers to entry, with regulatory permits and the need for an established footprint all but barring new entrants. Waste Management has clear runway to continue to scale through acquisitions of less abler regional players that would benefit from the synergies of a larger operator. The $4.6 billion acquisition of Advanced Disposal back in October 2020 amidst the deepening of the pandemic brought in an additional 3 million new industrial, commercial, and residential customers in the Eastern US. Going forward, the company has $150 million of cost synergies to be realized, and I don’t believe the revenue synergies have been materially considered as well. As it stands, the waste management sector is ripe for M&A, with Clean Harbors (CLH) reported to be a key acquisition target and Republic Services recently acquiring US Ecology for $2.2 billion.

According to Seeking Alpha data, however, just over half of analysts are sour on the stock, with 8 analysts rating it a “hold” and 2 rating it a “sell”. This pessimism has lingered since December 2019 and reflects a worsening outlook on the municipal demand for waste services. At 26x forward earnings, Waste Management doesn’t feel particularly cheap either. However, this falls roughly in the middle of the industry pact: it is in-line with Republic Services’ forward multiple, slightly more expensive than Clean Harbors’ 23x but below Waste Connections’ 32x.

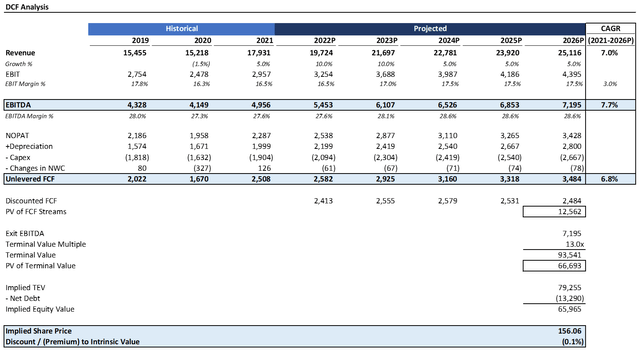

DCF Analysis Indicates Significant Upside

To get a sense of the company’s intrinsic value, I ran a DCF analysis. No DCF analysis can provide a perfect picture of future returns for shareholders; however, they can provide an illustrative “story” of the likelihood of different scenarios. In my DCF analysis, I assumed 10% revenue growth in 2022 staggering to 5% by 2026. I also assumed EBIT margins expanding modestly by 200 bps over the next five years. Capex, increase in net working capital, depreciation, and taxes were flat-lined for simplicity.

Source: Created by author using data from Yahoo! Finance

Assuming a terminal EBITDA multiple of 13x and a 7% discount rate, the stock is fairly valued. Value is hard to come by in today’s market, so we may have to settle for just “fairly valued”. At a beta of 0.75, the stock is also materially less volatile than the broader market and thus carries significantly less risk. In general, the fluctuations in demand for waste services are more predictable than demand patterns for other industries. Thus, Waste Management is an attractive place to park your money amidst an overvalued and geopolitically challenged stock environment.

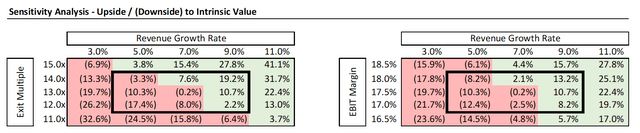

Source: Created by author using data from Yahoo! Finance

Taking a look at the sensitivity analysis, it is a mixed back. A 7% growth clip and a 15x multiple would produce 15% upside, which is fairly aggressive. On the flip side, if the multiple were to contract to 11x and revenue grows at 5%, there would be nearly 25% downside here. I actually don’t think 25% downside is the worst given how limited the volatility is here and how overvalued the broader market is (it’s also offset by the 7% annual returns implicit in the discount rate), but Waste Management is certainly no value play. Waste Management has generally traded in a range of 10-15x over the last decade and a half, so risk/reward is roughly balanced here.

Upside Catalysts

There are several key drivers of value for Waste Management. One that stands out is improved margins. Management is focused on trimming costs and improving the efficiency of its footprint, particularly through the application. Since it’s hard to grow the top-line in waste services, investors are focused on cost containment. To be sure, Waste Management already has the leading footprint that enables cost reduction, and it has pursued a variety of non-core divestitures in waste-to-energy, so the opportunity set here appears relatively narrow. It is more likely, in my mind, that management will pursue acquisitions to generate material synergies in acquired assets versus thinning costs in existing legacy assets. With that said, over the next 4 years, the company is looking to cut 5,000 to 7,000 positions without replacement.

Another major catalyst for the company will be its continued ability to pass on higher prices. The company has been able to cover cost inflation across its business through improved pricing across all lines of its business. In the most recent quarter, this translated into the best collection and disposal yield than the company has generated in over a decade. 2021 churn was at an all-time low of 8.4%.

Lastly, I am also generally optimistic about the company’s potential in environmental tailwinds. With Democrats in control of the White House, climate change is getting taken more seriously. Advances in recycling technology plays right into this theme. Materials Recovery Facilities (MRF) are using AI technology to flex to different waste streams. Waste Management plans on investing $275 million in MRF technology with additional investments throughout the next three years totaling $525 million. Management anticipates these generating incremental operating EBITDA of $180 million.

Downside Catalysts

There are several factors that temper my optimism. Firstly, the universe of opportunities for bolt-ons continue to shrink as the number of interested private equity buyers continues to grow. At the same time, the blue collar labor environment continues to suffer with a shortage of talent. Wage inflation is inevitable. The company is trying to make a shift towards less labor dependency, but it remains a very labor dependent businesses. 40,000 of its 50,000 employees are line employees, and it’s hard to see AI taking over their functions in the next decade. Finally, Waste Management is also particularly challenged by cost pressure in repair & replacement equipment, exacerbated by a challenged supply chain.

Conclusion

It is hard to find any truly undervalued stock in today’s market. While Waste Management is particularly vulnerable to the labor shortage, it still is a solid blue-chip name that’s not so overvalued like the tech stocks out there. It has meaningful upside in environmental demand and has demonstrated solid execution in beating expectations over the past few quarters. For a stock with a beta of 0.75, I would recommend investing in Waste Management not for the value potential but more for the downside insulation. Organic growth has generally been around 7% for the company, so I anticipate Waste Management will be a solid outperformer over the next decade once you bake in a few other synergistic acquisitions.

Be the first to comment