BeeBright/iStock via Getty Images

The article was coproduced with Nicholas Ward.

Anyone who follows the residential housing market is well aware of the tremendous rally that we’ve seen in recent years in terms of housing prices.

Month after month, we’ve seen double-digit increases in home prices.

This is largely due to incredibly low housing stock. And while it’s true that rising rates have the potential to put a damper on this asset class, looking at analyst reports, it doesn’t appear as though the housing market is going to slow down anytime soon.

Zillow recently published its monthly residential housing report, which highlights data throughout the roughly two-year period that we’ve seen since the start of the COVID-19 pandemic (March of 2020 was when we saw the huge equity sell-off that year). Zillow noted,

“The typical U.S. home value is now $331,533, up 32.4%, or $81,000, compared to February 2020, and is 20.3% higher than last year — another in a long line of new records for annual appreciation.”

To further highlight recent demand trends, Zillow said,

“Extremely strong demand finds that the houses that do get listed are scooped up in just 11 days, six days faster than in February 2021 and a full 25 days faster than in 2020.”

The report noted that inventories fell once again in February, now standing 48% below where they were at the start of the 2020 pandemic period. The Zillow report stated,

“Lack of inventory is driving these historic price hikes. There are roughly 730,000 houses currently for sale in the U.S., compared to 1.4 million in February 2020.”

Due to the relatively strong economy that we’re looking at today, there’s high demand for housing. Low supply combined with high demand has caused home prices to rise by an average of 32% during the last couple of years. And, looking ahead, Zillow predicts that the strong home price appreciation trend will remain in place throughout 2022.

The company believes that home price growth will peak in May of 2022 (the typical height of the Spring buying season) at roughly 22% on a year-over-year basis. And, in its latest report, Zillow is expecting to see housing prices 17% higher than they are today in February of 2023.

In short, according to Zillow’s data, individuals who are waiting to buy because of hopes of a housing crash are going to be sorely disappointed. With all of this in mind, we want to pivot toward one of our favorite areas of REITdom:

The multifamily residential space.

The lack of housing inventory and the rising prices of the homes that are available in the market is forcing many to remain in the rental market. The Zillow report highlights this trend as well, saying,

“Rent prices have reversed from a cooling trend; a one-year lease now would cost nearly $3,400 more than one signed two years ago.”

The report continued,

“Rent prices reversed from a cooling trend in January, shooting up 1.1% from last month and 17% from last year. Typical rent across the U.S. is now $1,883 per month, $283 per month higher than in February 2020. Rent growth was slow in 2020 after the outbreak of the pandemic, but it skyrocketed in 2021.”

We’ve highlighted the importance of investing in companies with strong assets in supply constrained markets and therefore, this macro data bodes well for the multi-family landlords.

This is especially the case for one of our absolute favorite companies in the multi-family REIT space: Essex Property Trust (NYSE:ESS).

ESS recently published its March 2022 Investor Presentation, which highlights the continued strength of its operations and its portfolio. Essex receives a 95/100 quality score on the iREIT IQ scoring system, meaning that this apartment REIT is one of the highest quality companies in our entire coverage spectrum. And therefore, we wanted to take the time to highlight ESS’s recent presentation data because this is a company that deserves a spot on every REIT investor’s watch list.

Essex’s Portfolio

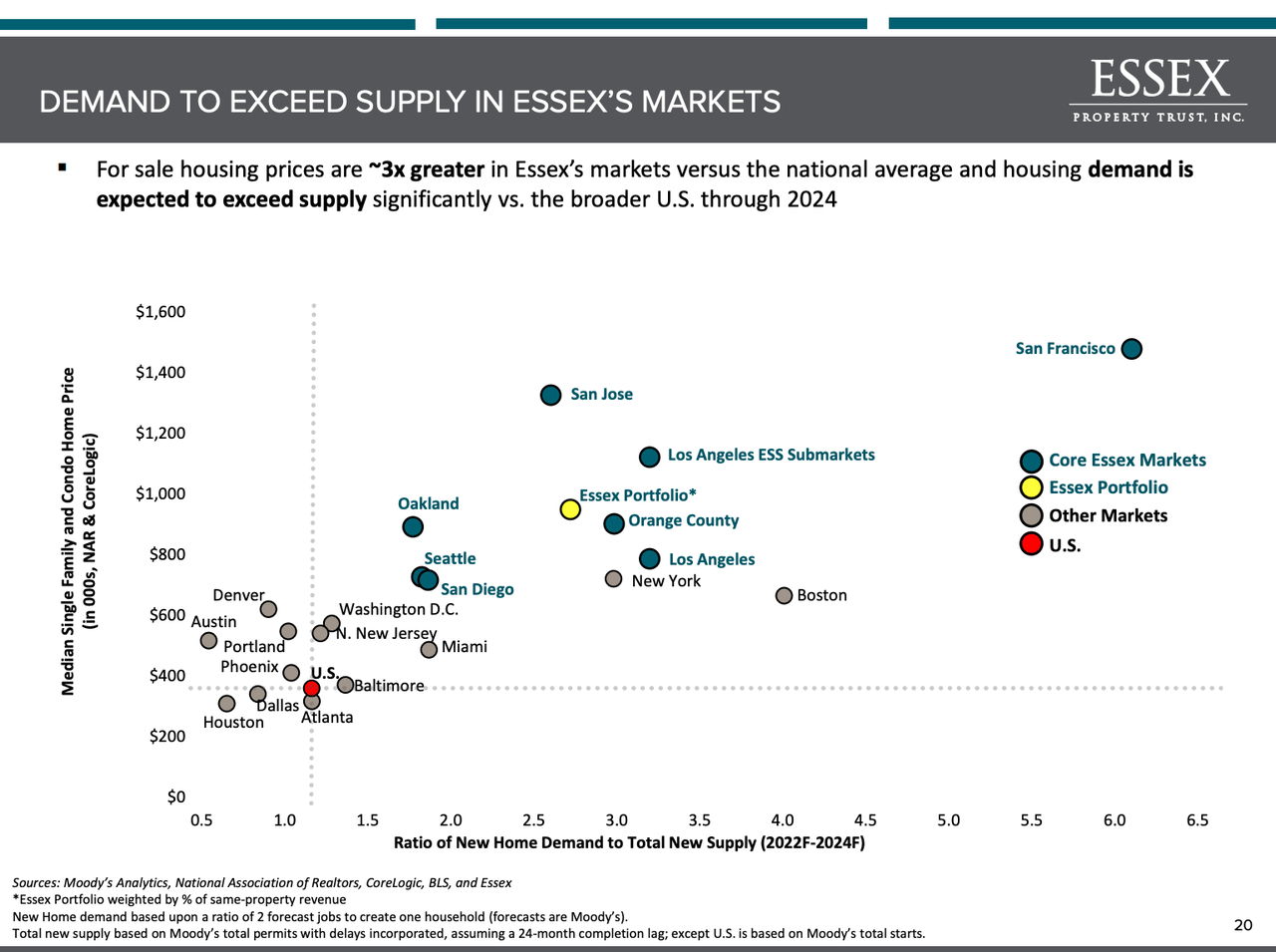

Essex is constantly highlighting the fact that investing in supply constrained markets has been top of mind (this has been the case for years and years) and frankly, it continues to pay off.

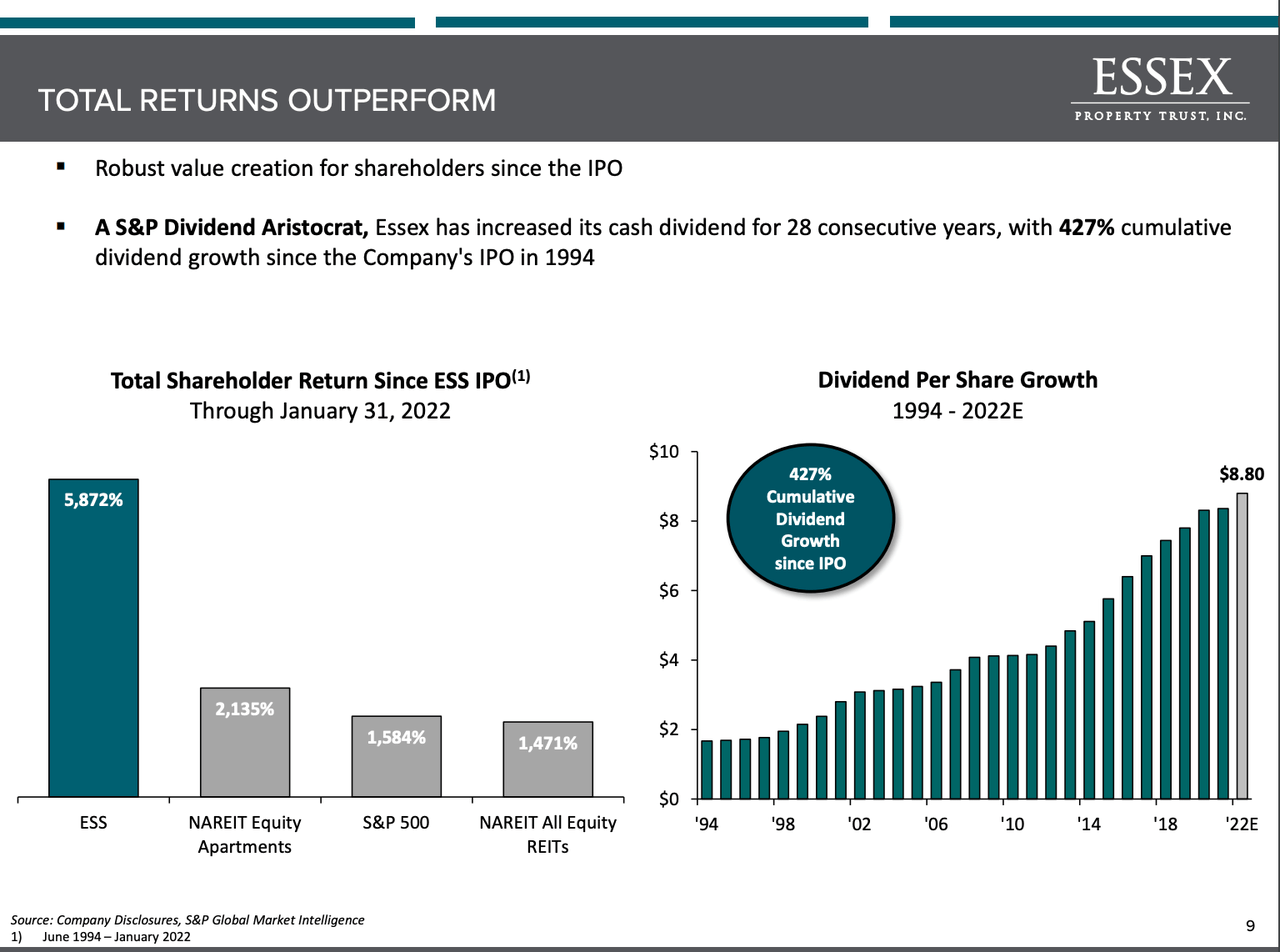

ESS shares have generated a 16.2% CAGR since their IPO in 1994, meaning that this company is one of the top performing stocks (not just REITs) in all of the market during the last several decades.

And, looking at recent data, the supply/demand metrics that have helped management to generate such wealth for shareholders clearly remain in Essex’s favor.

ESS Investor Presentation

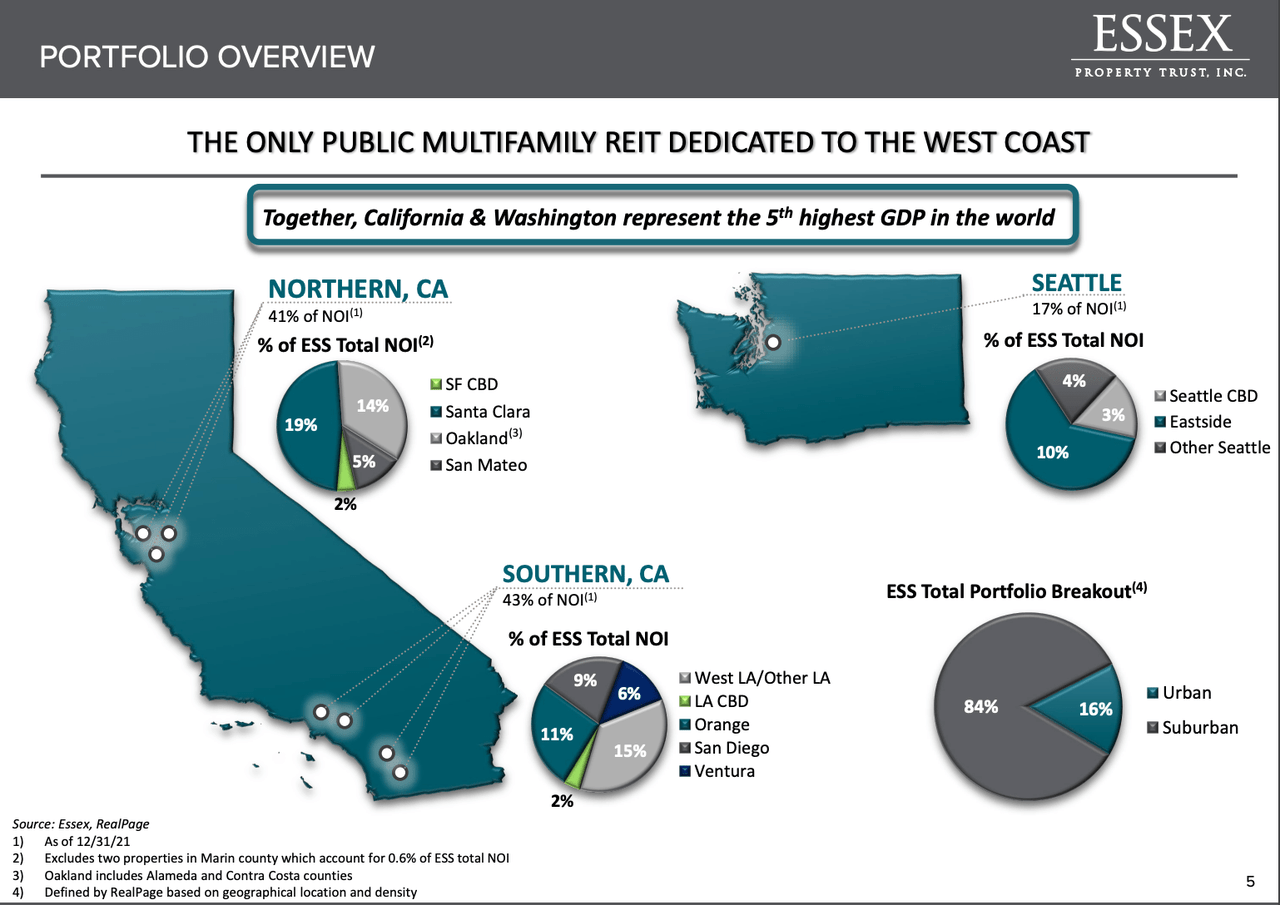

One of the biggest critiques of Essex is its geographic concentration.

Unlike the other blue chip multifamily REITs that we cover, ESS management has built a West-Coast-centric portfolio, encompassing assets along the California coast and in Seattle.

To many, this presents investors with unnecessary risk, relative to other names that offer exposure to properties throughout the entire United States.

ESS Investor Presentation

However, the fact of the matter is this decision by management (to be a West Coast sharpshooter) has proven to be a great one. ESS has essentially ridden the massive demand wave created by the U.S. technology industry, investing in properties and developments in areas where there is low supply, high demand, and a strong job market, largely due to the ongoing success of the largest U.S. tech companies.

Essex’s Operations

Yes, there has been a bit of a Silicon Valley exodus in recent years, with tech firms spreading out across the U.S. and establishing operations in other fast growing tech hubs in areas like Austin, Denver, south Florida, and the Raleigh area.

Yes, U.S. tech stocks have seen their share prices suffer (on a relative basis to the rest of the market) over the last year or so and as rates move higher, many analysts predict that this trend will remain in place.

And yes, California still doesn’t offer the same sort of business-friendly legislative environment that we see across the rest of the sun belt.

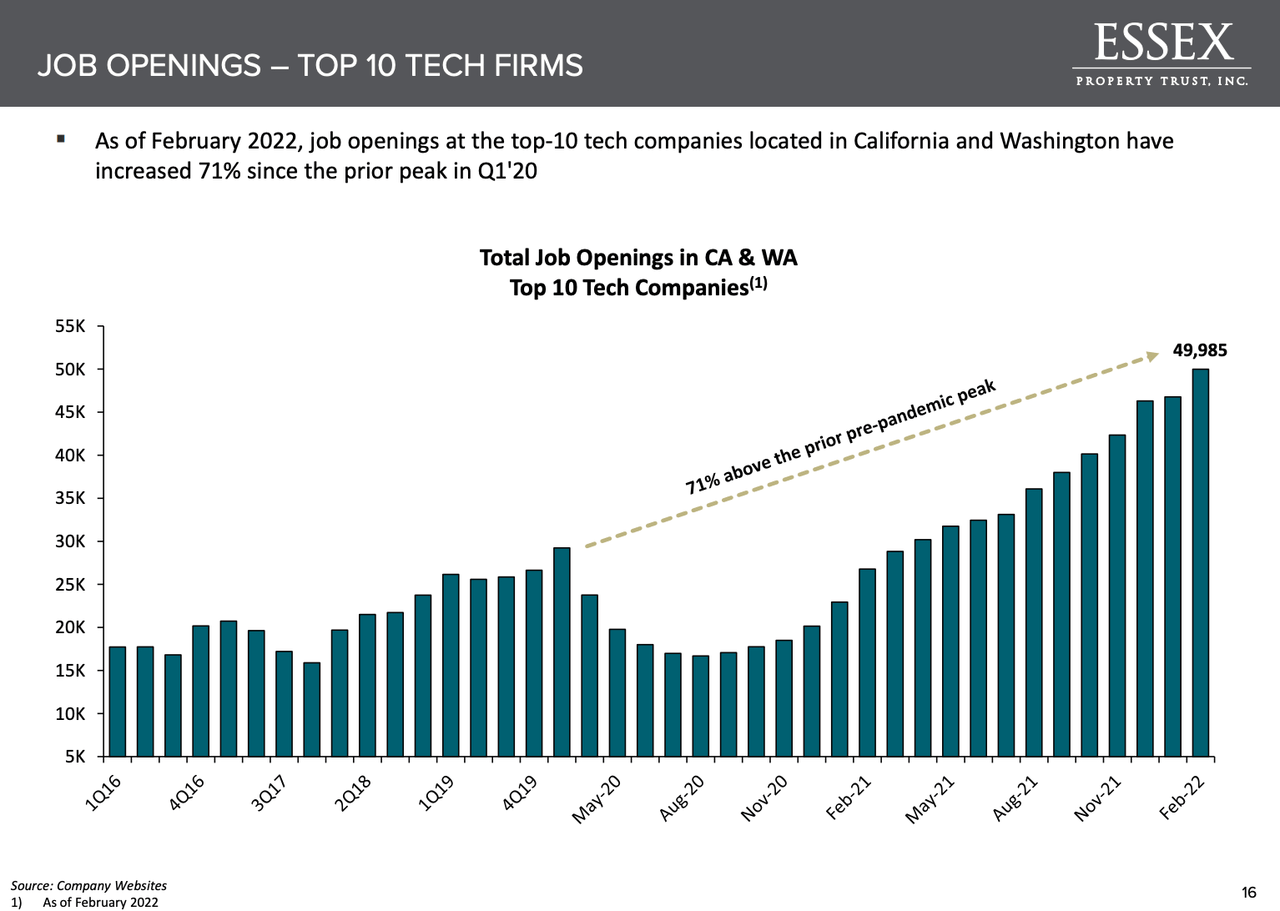

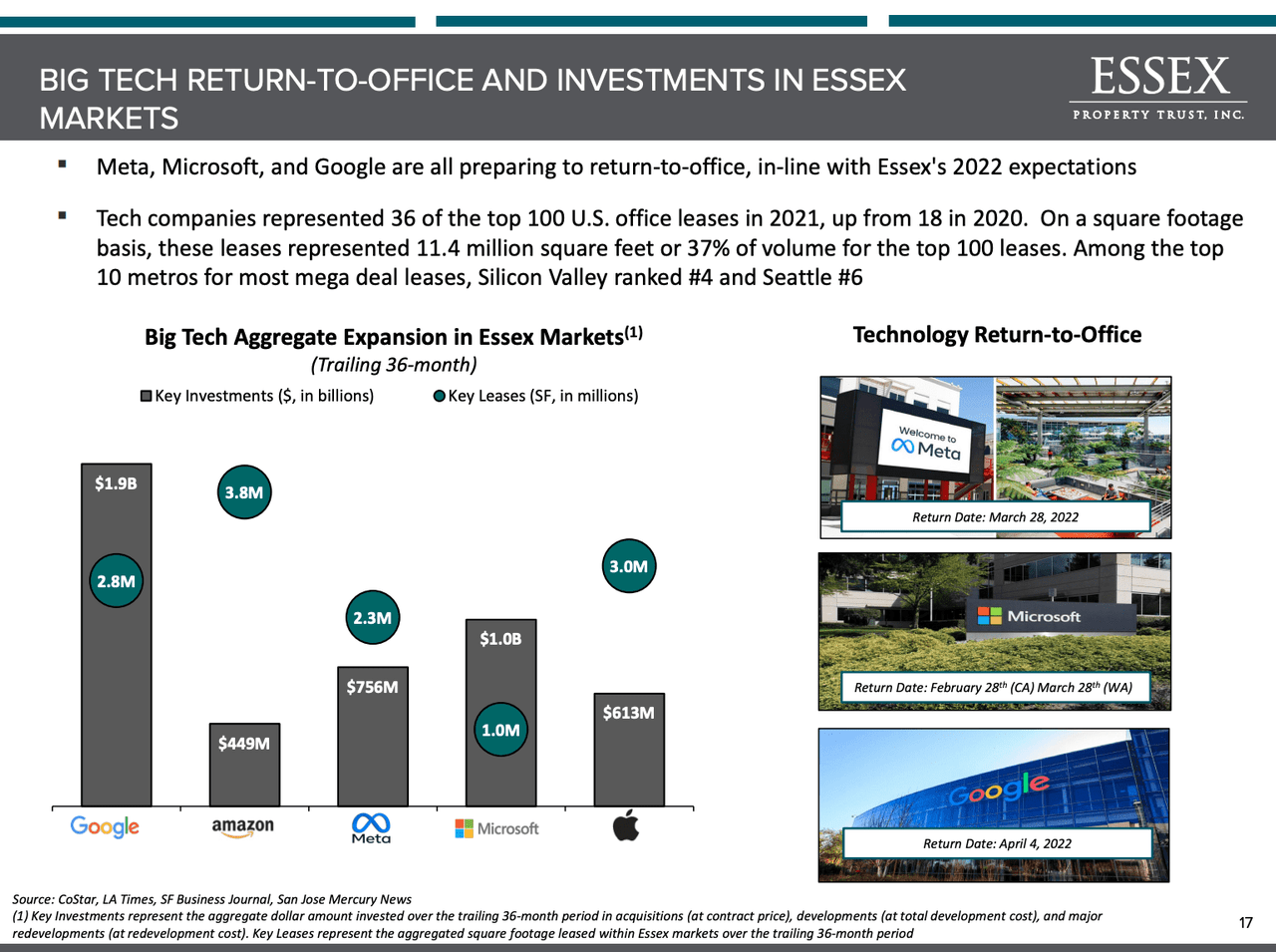

However, the fact is U.S. tech firms are alive and well. Operationally speaking, this sector is still producing some of the most robust growth in all of the market. And, as shown by the slide below, the largest tech firms which have operations in ESS markets are hiring at a historic pace.

ESS Investor Presentation

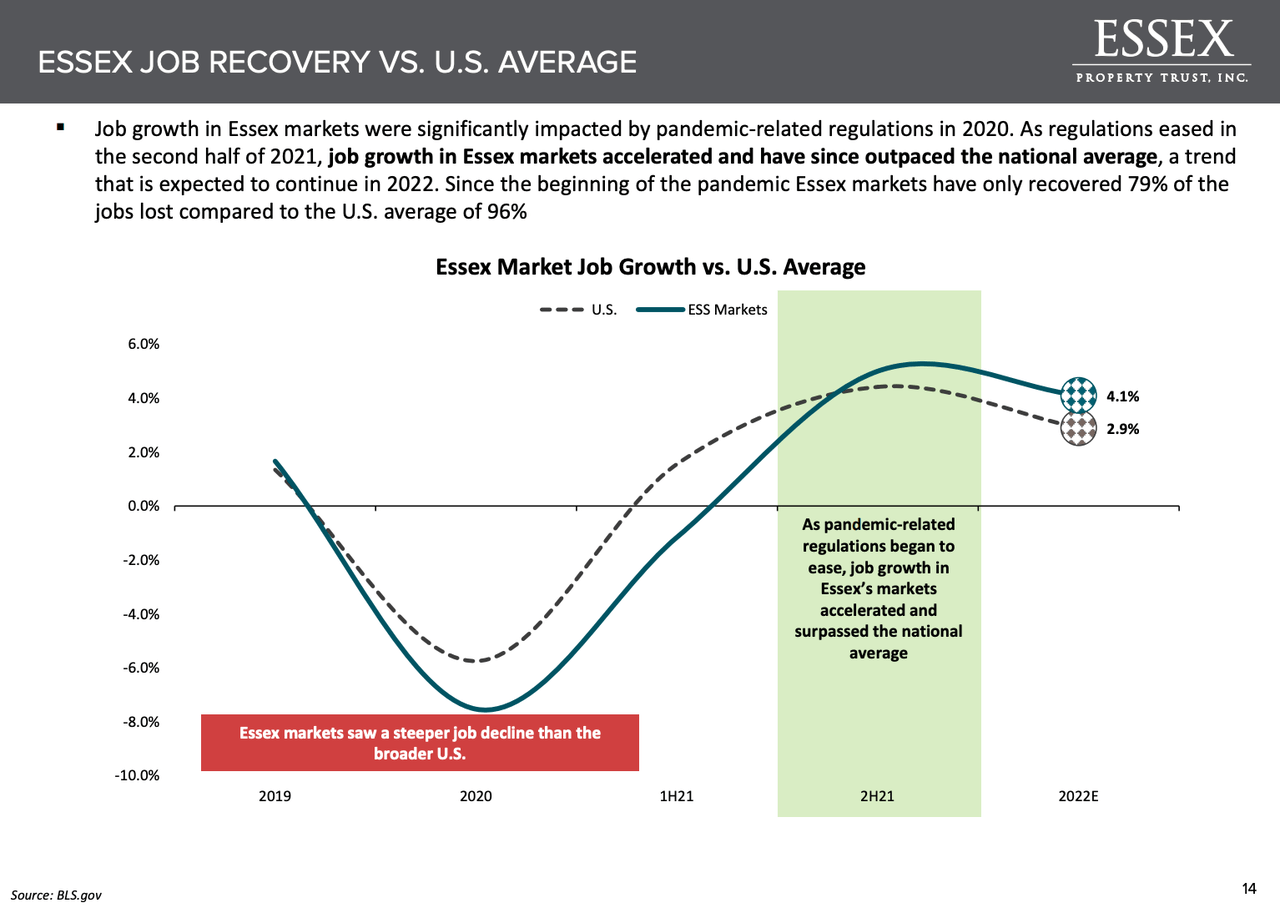

While it’s true that not all of these job offering are in Essex markets (because many of these companies have spread their proverbial wings and now have operations outside of the traditional Silicon Valley setting), Essex clearly states that it has seen a strong rebound within its West Coast job markets.

During 2020, these areas suffered to a greater degree than the U.S. average. However, throughout the second half of 2021 and early 2022, the job markets in Essex’s territories have posted job growth that outpaced the national average.

ESS Investor Presentation

Furthermore, the company shows that the biggest of the big-tech players that have major operations in its markets continue to invest heavily there. It’s clear that the management of large tech firms aren’t willing to totally abandon the work-from-the-office style (in favor of work-from-home, like many believe is the future) and therefore, traditional tech hubs are likely to continue to see strong job growth and housing demand for the foreseeable future.

ESS Investor Presentation

And it’s not only technology that Essex benefits from, but also biotech.

The company notes that it has invested heavily in “Biotech Bay” (San Francisco) and “Biotech Beach” (San Diego), both of which have seen venture capital funding during the trailing twelve months that well surpasses their trailing five-year averages.

ESS highlights the fact that there are 58.5k life-science employees in San Francisco who make an average of $151k/year and 33.7k life-science employees in San Diego, who make an average of $100k/year.

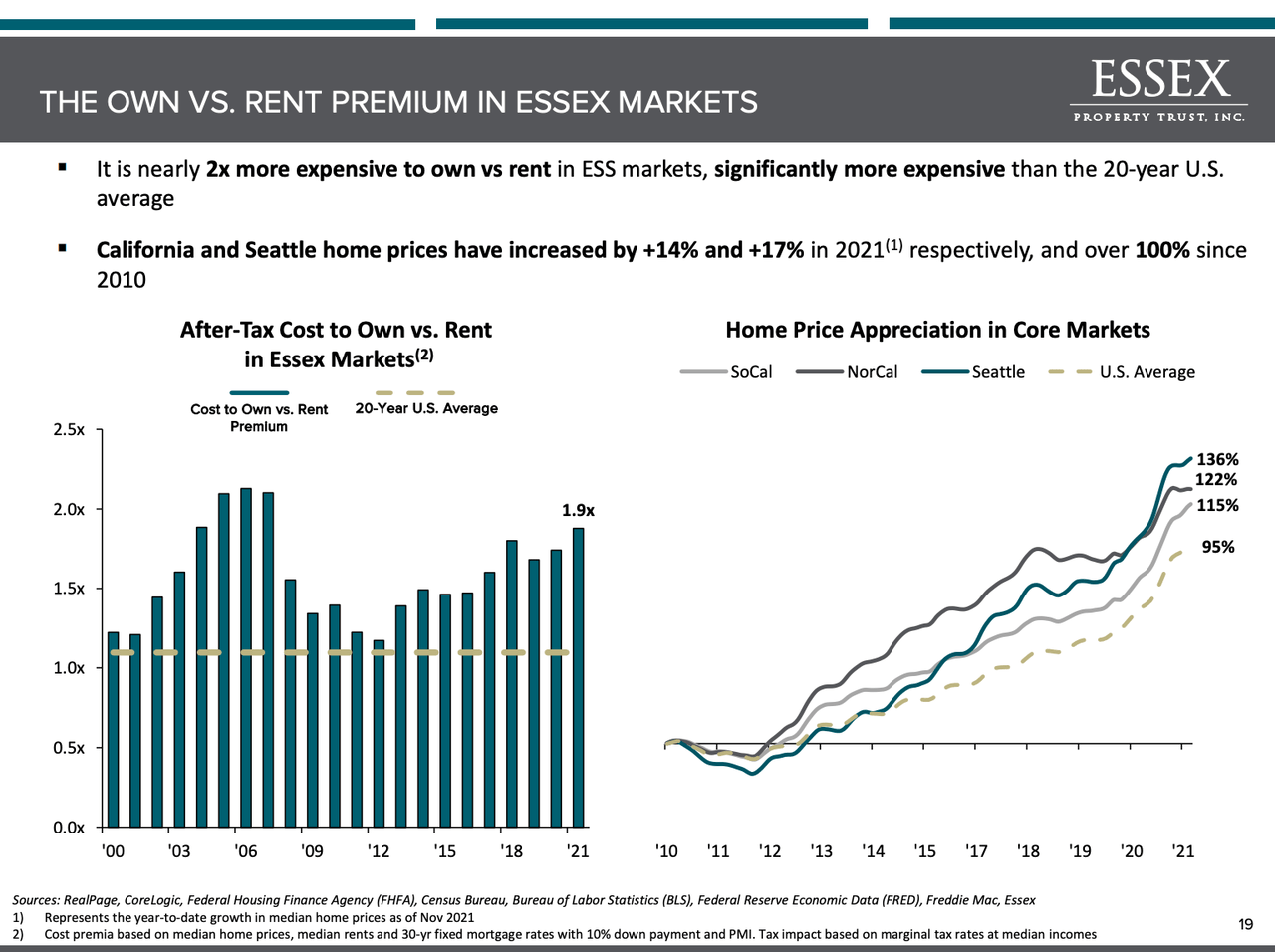

Both of these markets remain incredibly supply constrained, and therefore even for these well-off individuals pulling in six-figure salaries, the calculus, when it comes to the financial benefits of renting vs. buying, is often on the side of renting.

This is one of the things that continues to make the California/Seattle markets that Essex invests in so unique. In most areas of the country, if you can qualify for a loan, the math points towards buying and owning property as the more fiscally responsible thing to do. But, that’s not the case up and down the Pacific Coast.

ESS Investor Presentation

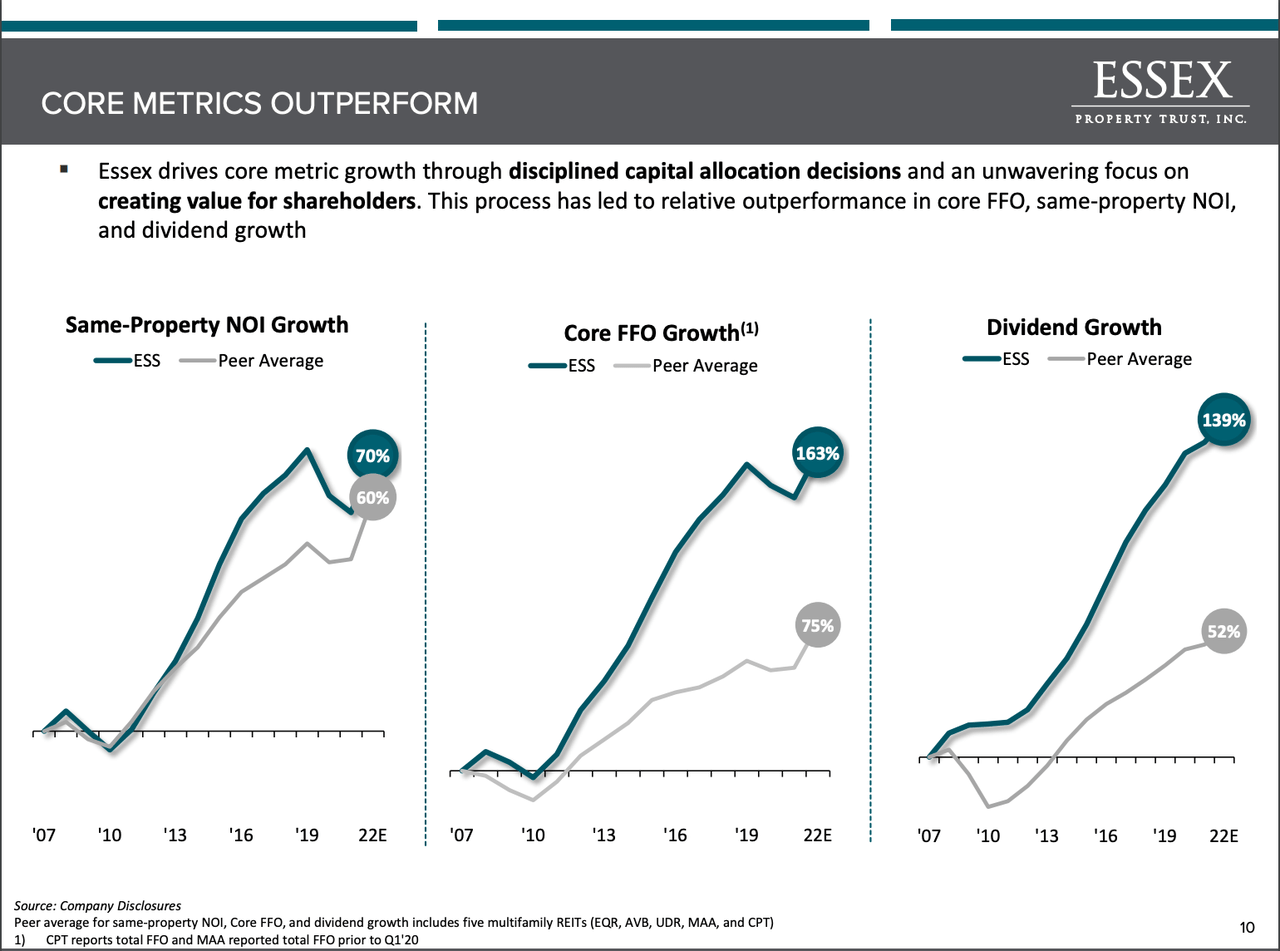

And, at the end of the day, these attractive supply/demand metrics have consistently trickled down to ESS’s bottom-line in a big way. Before we noted the strong total return CAGR that ESS has produced for shareholders.

Well, this is based upon reliably growing fundamentals and in recent years, we’ve continued to watch this company execute on growth initiatives.

ESS Investor Presentation

Essex’s Valuation

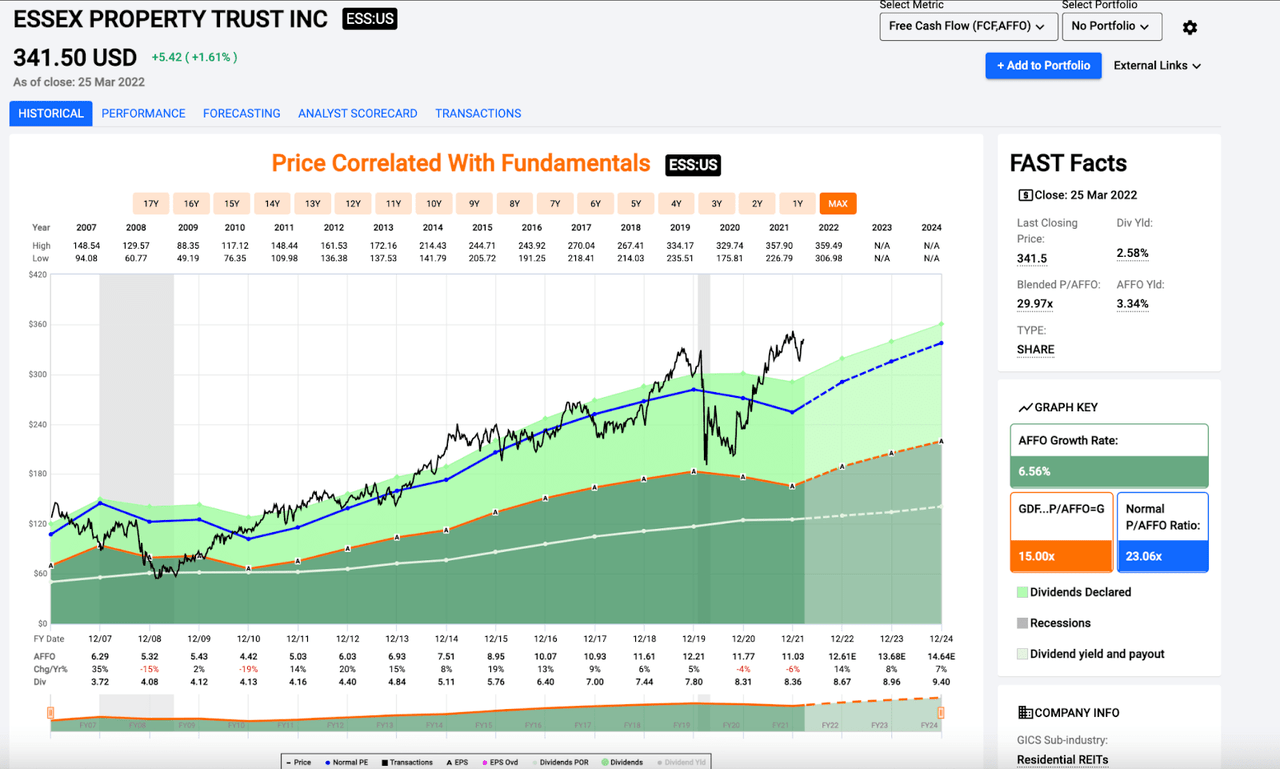

This discussion of fundamentals is the perfect segue into a discussion of ESS’s valuation.

Because of the reliably strong growth that this company has generated over the years, ESS shares have traditionally traded with a high valuation premium attached. And to a certain degree, we totally agree with the market in this regard.

There is little doubt in our minds that Essex deserves a premium valuation. This is definitely a blue chip stock. However, at the stock’s current valuation, we’re not looking to buy.

As you can see on the F.A.S.T. Graph below, ESS currently trades with a blended P/AFFO ratio of 29.97x, which is well above its long-term historical average of approximately 23x.

FAST Graphs

For further comparison’s sake, ESS’s trailing five-year and trailing 10-year average P/AFFO ratios are 22.7x and 24.25x, respectively.

And, looking at the current analyst consensus for forward AFFO growth, we see that at the stock’s current share price of $341.50, ESS is trading with a forward P/AFFO multiple of approximately 27x.

Therefore, even with the stock’s ~12% AFFO growth expectations in 2022, shares are still trading with a premium well above longer-term averages.

It bears noting that ESS is currently trading for approximately 23x the current consensus estimate for 2024 AFFO of $14.64/share. However, that means that investors are banking on ~20 months of growth to justify the current share price (assuming that we do see eventual mean reversion).

Now, for patient investors, this may not be a terrible decision. ESS is expected to produce strong growth in the near term. And, over the very long term, we continue to expect to see Essex generate strong growth for its shareholders.

It’s also important to highlight the fact that Essex is a Dividend Aristocrat, with 28 years of consecutive dividend growth. The company most recently increased its dividend by 5.3% and moving forward, we wouldn’t be surprised to see the stock’s dividend raises continue to accelerate, back up towards the stock’s 10-year dividend growth rate of 7.2%.

Therefore, even though the stock’s dividend yield is relatively low at 2.58%, we do believe that the yield is safe and potentially suitable for someone focused on the growth aspect of dividend growth investing.

ESS Investor Presentation

But, all of these wonderful growth metrics – whether we’re talking about historical figures, present results, or future estimates – don’t overshadow ESS’s current valuation premium.

Conclusion

In short, this is a wonderful company, but at today’s price, Essex does not offer an attractive margin of safety. This is a stock that we’d love to buy into weakness.

And, given that we’ve noticed a bearish trend forming around many of the housing related stocks (for instance, names like Home Depot (HD), which fell by nearly 8.3% last week, Stanley Black & Decker (SWK), which fell by roughly 8.6% last week, and D.R. Horton (DHI), which saw its share price sink by 7.99% last week) we wouldn’t be totally surprised to see this bearish sentiment spread into the single and multifamily REIT spaces as well.

If this happens, ESS will be near the top of our buy list. However, for the time being, we continue to see better bargains throughout REITdom and therefore, ESS maintains is “Trim” rating until we see its valuation fall.

As the title to this article suggests, ESS checks all of the boxes, except one… valuation!

Author’s Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment