TennesseePhotographer

Just over ten months ago, I wrote on Cracker Barrel (NASDAQ:CBRL), noting that while the stock paid an attractive dividend yield, I didn’t see nearly enough margin of safety to justify paying above $130.00 for the stock. Since then, the stock has seen a drawdown of more than 30% to its recent low at $83.00, which isn’t surprising given that it’s seen a much slower earnings recovery than some of its peers, with annual EPS still ~35% below its FY2019 peak. The consolation is that investors have enjoyed generous capital returns in the period, but this didn’t do enough to offset the share-price decline.

Looking ahead to FY2023, there are reasons to be cautiously optimistic, with expected cost savings, an expectation for commodity inflation to ease, and an increase in visits among its younger guests. However, this was partially offset by fewer visits from its 65 and older guests, and the macro backdrop remains unfavorable, with discretionary budgets still pinched due to inflationary pressures. So, while we should see much less margin pressure in FY2023 and investors are collecting an attractive dividend yield (~5.3%), I still don’t see a low-risk buy point in the stock.

Cracker Barrel Menu (Company Website)

Q4 Results

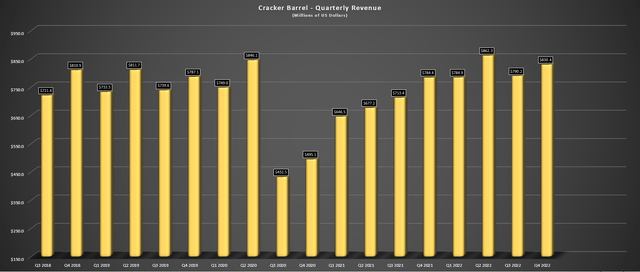

Cracker Barrel released its fiscal Q4 and FY2022 results last week, reporting quarterly revenue of $830.4 million, a 6% increase from the year-ago period. The increase in revenue was driven primarily by menu price increases, with comparable sales up 3.0% in its retail segment and 6.1% in its restaurant segment, balanced against pricing of 7.0% in the period. On a full-year basis, the company reported comparable sales growth of 15.0% in restaurants and 18.2% in retail, a decent performance considering the very difficult macro backdrop, with consumers left with tightened discretionary budgets due to rising gas and grocery prices and higher mortgage costs.

Cracker Barrel – Quarterly Revenue (Company Filings, Author’s Chart)

Digging into the quarter a little closer, Cracker Barrel noted that its sales performance was below expectations in fiscal Q4 and that it saw fewer visits from its 65 and older guests, with inflationary pressures also impacting its lower-income guests, in line with commentary industry-wide from H1 2022. The silver lining was that the company had a record year for retail sales with total sales of $700+ million, and it’s seeing increased visits from younger guests, which has partially offset the decline in its oldest cohort.

Notably, these visits from younger guests appear to be favorable to checks, with higher alcohol/appetizer attach rates and spending in retail, which could be a case of getting breakfast with the family and a treat from the gift shop on the way out after the meal. The company believes that this traffic from younger guests is sticky and is being helped by menu innovation with the recently launched “Build Your Own Homestyle Breakfast”, continued menu innovation, and adding beer/wine to the menu, which it rolled out in late 2020. If this traffic turns out to be sustainable, this could boost average weekly sales, given the higher average checks, assuming traffic normalizes among its older cohorts.

Finally, Cracker Barrel noted that it would be conservative on pricing and mindful of maintaining its value proposition, with 8% effective pricing planned for FY2023. However, the company did note that it will carefully watch its holdout group for price increases and monitor any sign of pushback to higher prices. If there were signs of changing guest behavior, such as check management, the company could elect to pass on some of its price increases for the coming year. Given that the company is anticipating 8.0% commodity inflation and 5% wage inflation in FY2023, an inability to pass on costs to consumers through 8% effective pricing would not be ideal from a margin standpoint.

Costs & Margins

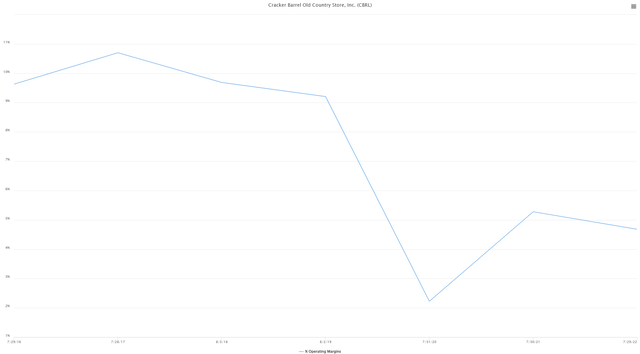

Unfortunately, while there were some encouraging comments surrounding an increase in visits from younger guests and a plan to accelerate unit growth at Maple Street in FY2023, this was largely overshadowed by margin performance. During FY2022, margins took a beating again, falling to just 4.7%, down from 5.3% in FY2021 and ~9.0% in FY2019. In the most recent quarter specifically, CBRL’s cost of goods sold soared by 280 basis points to 32.9%, impacted by commodity inflation and freight. Meanwhile, labor was up 130 basis points, and restaurant operating expenses were also up 70 basis points, hit by higher maintenance costs and utility costs.

Not surprisingly, this led to much lower earnings per share in the period, with Cracker Barrel reporting adjusted earnings per share of $1.57 vs. $2.25 in the year-ago period. On a full-year basis, annual EPS was up 19% to $6.09, but this figure was still down 34% from FY2019 levels and has benefited from a ~4% lower share count. Based on the company’s FY2023 outlook of low single-digit unit growth, limited comp sales growth, and the benefit of lower commodity inflation, CBRL is expecting to grow earnings. However, annual EPS will still be well below its prior highs. At the same time, other names are busy reporting earnings, like Restaurant Brands International (QSR) and McDonald’s (MCD), which are more recession-resistant due to their lower average checks.

Cracker Barrel – Operating Margins (TIKR.com)

Fortunately, gas prices have decreased sharply, leading to improved restaurant traffic. The problem is that consumers are getting hit from every angle, impacted by higher utility costs, mortgage costs, and grocery prices. Most importantly, we have a backdrop of a negative wealth effect with housing prices under pressure and investment accounts showing persistently red ink. While this might not impact quick-service restaurants as much, given that they benefit from lower average checks and convenience, this reverse wealth effect could impact casual dining. Given that Cracker Barrel is a family restaurant not shielded from inflationary pressures due to being an operator vs. franchiser, such as Dine Brands (DIN), which has seen earnings hold up much better.

Earnings Trend & Valuation

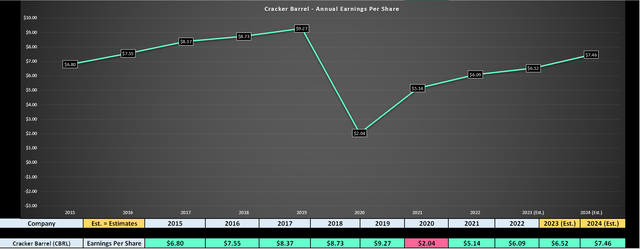

Some investors might argue that Cracker Barrel makes for an excellent investment at current levels, with a ~5.3% dividend yield, additional returns from share buybacks, and the fact that the stock is well off its highs. While these are key attributes that certainly make a stock more attractive for purchase, the earnings trend leaves a lot to be desired, with annual EPS still well below its peak and seeing a very slow recovery. In fact, even if earnings beat current estimates of $6.52 and $7.46 in FY2023 and FY2024, Cracker Barrel will still have one of the worst earnings trends among casual dining names (~20% off FY2019 highs). Let’s see whether this is priced into the stock:

Cracker Barrel – Earnings Trend (FASTGraphs.com)

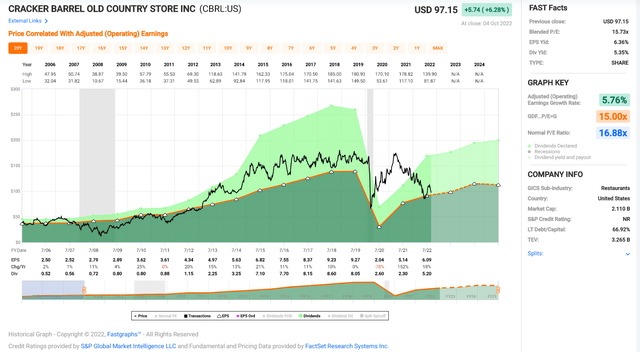

The chart below shows that Cracker Barrel has historically traded at ~16.9 earnings, but this was with steadily growing annual EPS which was consistently hitting new highs over most of this period. The current earnings trend leaves a lot to be desired; the macro outlook is terrible given the recessionary environment, and the industry outlook isn’t much better, with inflation eroding margins for operators, even if it may have peaked in summer 2022. Based on this backdrop, I believe a much more conservative earnings multiple for Cracker Barrel is 15.2, or 10% below its long-term average.

Cracker Barrel Historical Earnings Multiple (FASTGraphs.com)

Based on FY2024 annual EPS estimates of $7.46 and an earnings multiple of 15.2, I see a fair value (18-month price target) for CBRL of $114.00. While this represents a 17% upside from current levels or a ~24% total return in the period, this isn’t nearly enough margin of safety to justify buying an industry laggard. When it comes to industry laggards, I prefer buying at a minimum 30% discount to fair value, which would require CBRL to drop below $85.30 vs. a total return fair value of ~$122.00 (dividends paid over the next 18 months + fair value). So, while the stock is no longer expensive after its violent share-price decline, it’s not overly attractive either.

Summary

Cracker Barrel put together satisfactory results in FY2022 given the challenging environment, and the company expects to see cost savings this year and could benefit from commodity deflation in Q4 2023. However, we could see a couple more tough quarters ahead for the company as consumers remain cash-strapped ahead of the holiday season, and with Cracker Barrel being in one of the less favorable segments of a highly-discretionary industry (casual diner with a non-franchised model), it’s hard to justify paying up for the stock above $98.00. So, while it’s certainly possible that the S&P 500 (SPY) could rally further from current levels, I think there are more attractive bets out there than Cracker Barrel, such as Dine Brands or Restaurant Brands International.

Be the first to comment