niphon

Investment Thesis

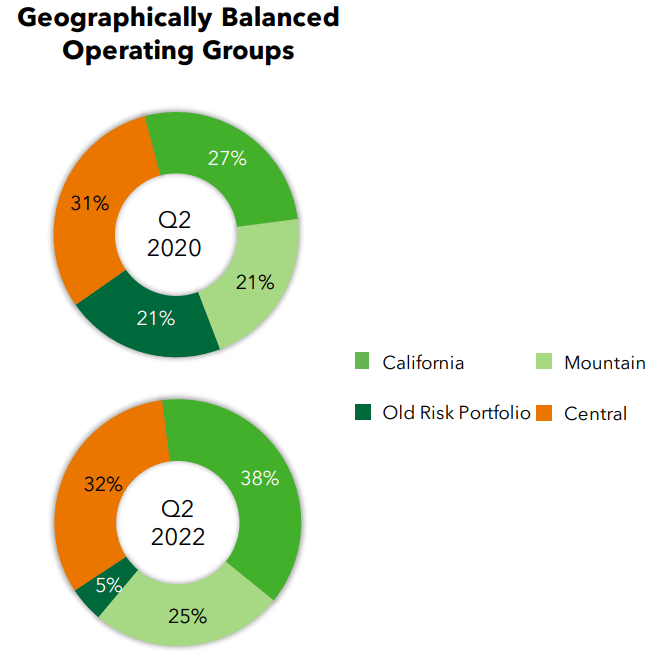

Granite Construction’s (NYSE:GVA) stock has corrected along with the broader markets in the last couple of months. In addition to macroeconomic worries, the company’s poor Q2 results also played a role in this correction. However, looking forward, the company should see improvement in its business in the back half of this year and beyond. The company’s high backlog of committed and awarded projects (CAP) at the end of the second quarter of FY22 should benefit the revenue growth in 2H FY22. Beyond 2022, the funding from the federal infrastructure law should support CAP growth along with strong end markets. Further, in Q4 2021, management announced their new strategic plan to position GVA to deliver growth and profitability. This strategy has four key themes, namely: developing the company’s people; raising the bar; increasing market share; and maximizing Granite’s value add which we have discussed in greater detail in our previous article. This strategic plan should benefit the company’s growth and help improve the margins in the long term. Management has set a strategic target of 14% to 16% gross margin and 9% to 11% adjusted EBITDA margin by the end of 2024 which is achievable as the company winds down its Old Risk Portfolio (ORP) and focuses on bidding projects with higher margins.

Granite Construction’s Revenue Outlook

In Q2 FY22, the revenue was down 8% Y/Y to $768.3 mn (vs. the consensus estimate of $819.76 mn). In the construction segment, the revenue was down 11.4% Y/Y due to the $81 mn decrease in the Central Group and as Old Risk Portfolio (ORP) projects are nearing completion. The revenue in the California Group also declined due to the project start delays from the owner’s side due to contract administration. These declines were partially offset by growth in the Mountain Group. The revenue in the Mountain Group increased 15% Y/Y, with strength in the solar business.

GVA’s Committed & Awarded Project (CAP) (Company’s Presentation)

The Committed & Awarded Project (CAP) at the end of the second quarter was $4.2 bn, up $279 mn from Q1 FY22. The CAP in the second quarter grew across all the groups, led by the California Group with an increase of $149 mn. The CAP in the Central Group increased by $93 mn sequentially, with an average project size of under $20 mn. The ORP (Old Risk Portfolio) projects ended the quarter with a remaining CAP of $195 mn, a decrease of $47 mn from the prior quarter. The burn of the Old Risk Portfolio during Q2 was lower than the company’s expectations due to the increase in project costs. However, the company plans to burn more projects in the second half of FY22 to achieve its goal of exiting the fiscal year with $50 mn in Old Risk Portfolio CAP.

In the Material segment, sales increased 12% Y/Y driven by higher sales prices in aggregates and asphalt, partially offset by lower sales volume. The decline in sales volume was due to the shortage of cement and fly ash in various markets. The shortage was due to the supply chain constraints experienced by the companies supplying aggregates, such as Martin Marietta Materials (MLM).

GVA made two strategic announcements in the second quarter within its Materials segment. The company acquired the greenfield aggregate operations in Utah, which align with its strategy to invest in vertically integrated operations. The acquisition strengthens the company’s key home market presence in Salt Lake City and provides GVA with long-term aggregate resources where aggregates are scarce. The company is in the process of developing the Grantsville, Utah facility, which is expected to ramp up its production in 2022 and reach full production in 2023. GVA also completed the purchase of a liquid asphalt terminal in Bakersfield, California, which has 170,000 barrels of liquid asphalt storage capacity. This additional storage capacity should allow GVA to be more flexible in the timing of asphalt purchases and proactively manage the volatility in oil prices. This should also benefit the company to stabilize its supply chain and better achieve the mix specifications to meet the home market demand due to the short-term disruptions. The asphalt terminals should begin full-scale operations in 2023.

In the Construction segment, the revenue in the California Group was down Y/Y but the outlook for 2H FY22 remains strong due to the strong CAP and bidding opportunities. The delayed projects in the second quarter are expected to ramp up in the second half. Overall, the public market environment is stronger and the company has increased its win percentage, leading to a healthy CAP. Additionally, the projects funded from the infrastructure bill are expected to flow in FY23 and should build up on the strong end markets, supporting the CAP growth. The outlook for the Materials segment remains the same as that of the Construction segment. The materials segment is expected to have a strong 2H FY22, benefiting from price increases implemented earlier in 2022. The company’s guidance for FY22 remains unchanged at low single digits. The strong CAP and funding from the infrastructure bill should support the 2024 revenue target of 6% to 8% organic CAGR. In Q4 2021, management announced their new strategic plan to position GVA to deliver growth and profitability. This strategy has four key themes namely: developing the company’s people, raising the bar, increasing market share, and maximizing Granite’s value add which we have discussed in greater detail in our previous article. This strategic plan should benefit the company’s revenue growth by helping it utilize the strong demand opportunity created by the infrastructure bill. So, I am optimistic about the company’s near and long-term growth prospects.

Margins

The company’s gross margin disappointed in Q2 and decreased 160 bps Y/Y to 10.2% due to losses incurred in the ORP projects and lower revenue in the California Group. The adjusted EBITDA margin from continuing operations also declined Y/Y due to the ORP losses incurred in the quarter. Management lowered its adjusted EBITDA margin guidance range from 6% to 8% previously to 5.5% to 6.5% in FY22 due to these ORP losses in the first half and the impact of higher fuel and energy-related costs in the materials segment.

However, I am not too worried about it and have a favorable medium-term view of the margin. The company’s Old Risk Portfolio is near its completion, and I don’t expect headwinds from it will continue beyond the next year. Further, strong demand due to the infrastructure bill and the more selective and conservative approach that management has adopted in their bidding on new projects bodes well for the company’s long-term margin prospects. The company is working towards its strategic target of 14% to 16% gross margin and 9% to 11% adjusted EBITDA margin by the end of 2024. To achieve this, the company is improving its project execution and focusing on bidding on high-margin projects. I believe we can see a significant improvement in the company’s margins over the coming years.

Valuation & Conclusion

The company’s EPS is expected to see a meaningful increase next year as its execution improves and headwinds from the Old Risk Portfolio wane. The stock is trading at 10.06x FY23 consensus EPS estimate of $2.74, which is much lower than its five-year average forward P/E of 19.88x. The strong CAP should support the revenue growth in 2H FY22. Beyond FY22, the funding from the federal infrastructure bill along with strong end markets should support the revenue growth. The company’s margin should improve beyond 2022 with the completion of ORP projects, the improvement in execution and focus on bidding projects at higher margins. Given low valuations and good prospects, I have a buy rating on the stock.

Be the first to comment