D3signAllTheThings

Lithium Overview

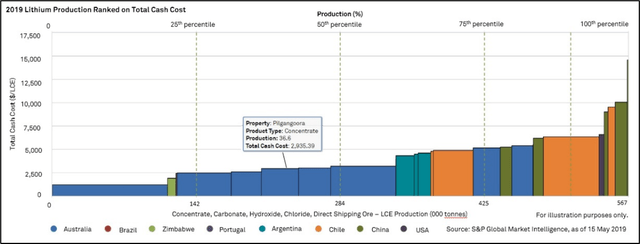

Lithium, a key ingredient in electric vehicle (“EV”) battery make-up, is derived from brine and hard rock deposits. Cost structures, margins, and project economics are highly distinguishable dependent on asset type.

Typically, hard rock operations have a cost structure approximately half that of similar brine set-ups. However, despite higher operating costs, lithium brine operations boast significantly higher margins.

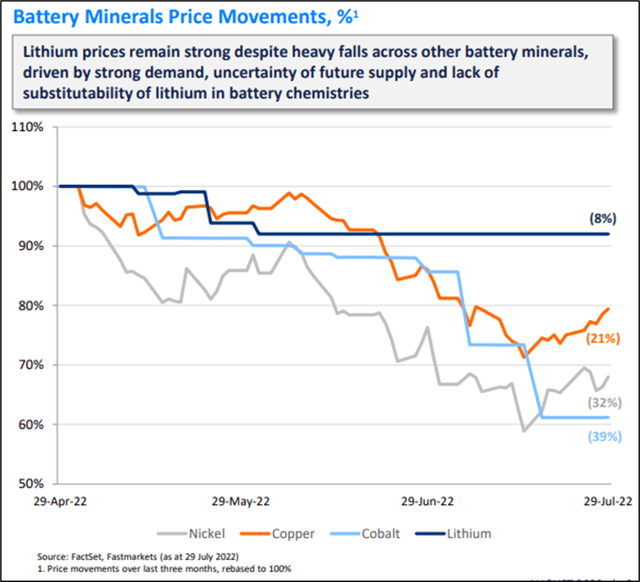

Lithium prices have remained robust due to little substitutability in battery chemistries.

This value differential is encouraging hard rock producers like Liontown Resources Limited (OTCPK:LINRF), to invest in processing plants to grab larger chunks of the lithium value chain.

Big demand, a well financed project, and a strategy which targets value accretive segments of the supply chain are a few of the reasons I have a bullish outlook on the Western Australian junior’s prospects.

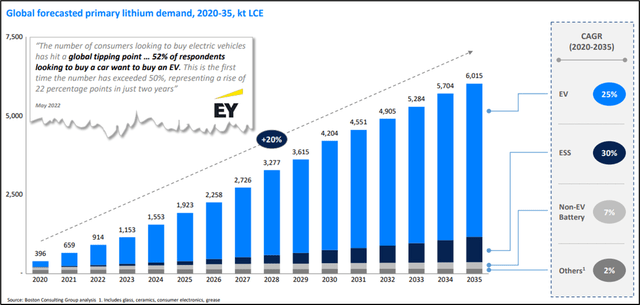

Lithium demand is forecast to go all-out beast mode with eye-watering +20% year-on-year compound annual growth rates.

Hard rock operations often have a conventional mining configuration; ore is extracted before being concentrated by crushing and follows a series of process transformations to produce a concentrate.

Spodumene is the final product in hard rock mining operations. It is marketed and distributed to lithium hydroxide or carbonate conversion plants which finalize conversion into lithium chemical products.

Most of the added value in the lithium supply chain is derived from these complex industrial conversion processes, incentivizing miners to develop downstream refining operations.

S&P Global Market Intelligence

China presently dominates the higher end of the lithium conversion cost curve. Australian hard rock miners such as Liontown Resources and Pilbara Minerals propose conventional low-cost hard rock Spodumene set-ups.

Company Introduction

With a market cap of AUD $4.5B, it may be a little harsh calling Liontown Resources a junior miner. The Perth based lithium player is ardently laying the foundations to its world-class Kathleen Valley Lithium project.

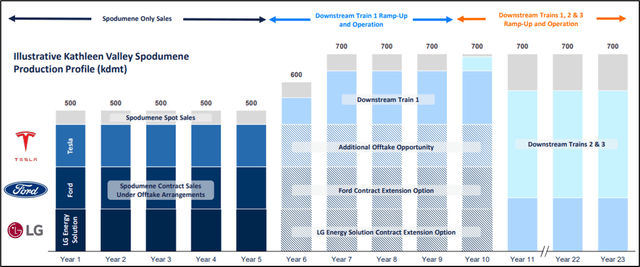

Its high grade 156M ton lithium lease has sparked interest from a who-is-who of tier 1 counterparties, including Tesla (TSLA), LG Energy Solution, and Ford Motor Company (F)

A relatively high lithium price environment has also facilitated project de-risking, with production offtakes secured over the first 5 years.

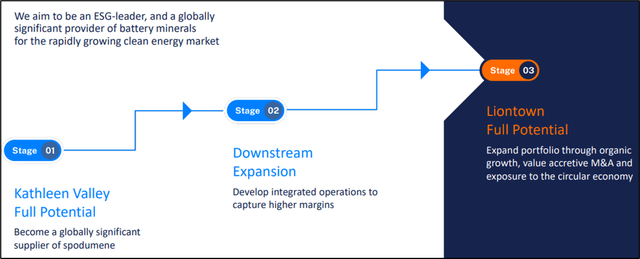

Like many Australian battery pure plays, Liontown Resources is capturing larger swathes of the lithium value chain and increasing margins by strategically planning greater downstream conversion at mine site.

Liontown Resources strategy is underpinned by a move toward higher value-add lithium production.

The Kathleen Valley Project

Project build-out is underway with world-class construction engineering venture, Lycopodium appointed as key contractor for engineering, procurement, commissioning, and installation of associated plant. The lion’s share (pardon the pun) of work packages for mine & plant construction has already been issued.

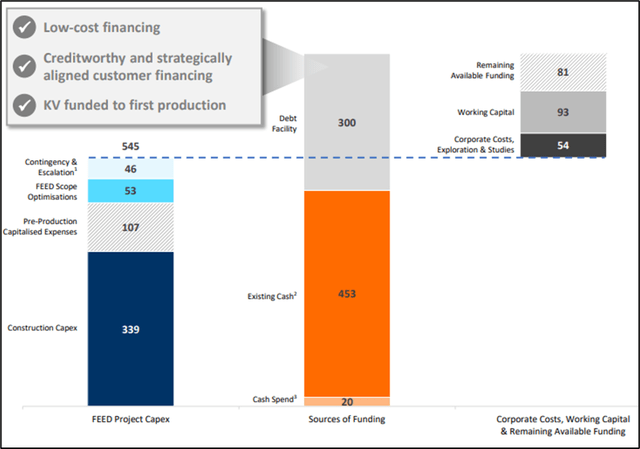

Construction commitments to date tally $147M with ~85% of project costs secured on a fixed price basis. Financing has also been secured with creditworthy and strategically aligned backers bankrolling the project until first production.

Additional funding capacity remains on tap if required. Roughly 40% of the project is expected to be costed on a fixed price basis, assuaging project creep cost over-runs and inflationary fears.

Liontown Resources has opted for a conventional underground long hole open stopping mining method. With the mineral reserve being comparably shallow relative to other underground mines, and more concentrated per vertical meter (100 – 206kt/m and a max depth of 450m). Standard underground mining allows the West Australian lithium junior to take a targeted approach to resource capture in an efficient, cost-effective manner.

The company is likely to develop a contract mining model with current subcontract costs tallying A$56/t ore mined all in. Keep a look out for underground specialists such as Perenti’s Barminco or West Australian outsider Byrnecut to benefit with a future contract award.

The Kathleen Valley Project will be a highly developed underground complex comprised of several declines and developments.

Lycopodium has been awarded contract for Kathleen Valley fixed plant. The firm has an excellent track record of project delivery.

The Kathleen Valley lease is a premier lithium deposit – its 156M tons of 1.4% lithium provides a long-life resource boasting outstanding economic potential. Development risks have been prudently managed, facilitated by Western Australia’s well established mining jurisdiction and natural resources pedigree.

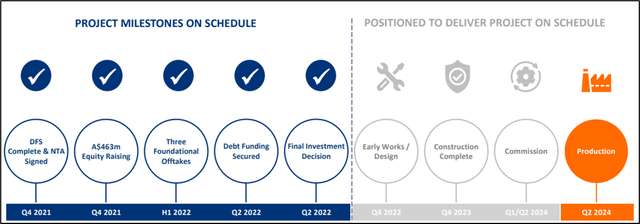

Final investment decision has been completed some time ago, with 500kt of Spodumene production (6%) coming online in 2024, approximately 74t of lithium carbonate equivalent. Only Pilbara Mineral’s (OTCPK:PILBF) prolific Pilgangoora lease, with its 680kt of Spodumene production (5.5%) and 92t of lithium carbonate equivalent, matches Kathleen Valley’s caliber.

Funding secured, not by Tesla Inc (TSLA) but by Ford Motor Company, who figuratively wrote the West Australian miner a A$300M cheque to de-risk project financing. Unlikely that the project runs into any future financing woes.

Project financials tally $339M for construction capex, with another ~200M allocated for pre-production capitalized expenses, front end engineering & design scope modifications, contingency and escalation. Liontown Resources’ cash on hand, which totals $453M, should be enough to get first production over the line.

The Kathleen Valley project remains on track with first production penned in for Q2, 2024.

Initial offtake agreements have been finalized with Tesla, Ford Motor Company, and the Korean battery producer LG Energy Solution saturating available capacity.

For the first 5 years of project life cycle, the venture will principally be limited to lower-value Spodumene spot sales, before further capex investment to boost refining capability. The asset life of a mine is also noteworthy, with the project expected to be running for at least the next 20 years.

As mentioned earlier, Liontown Resources’ strategy is to capture larger parts of the value chain via future capital equipment and transformation capabilities for higher value accretive lithium products.

Project Economics

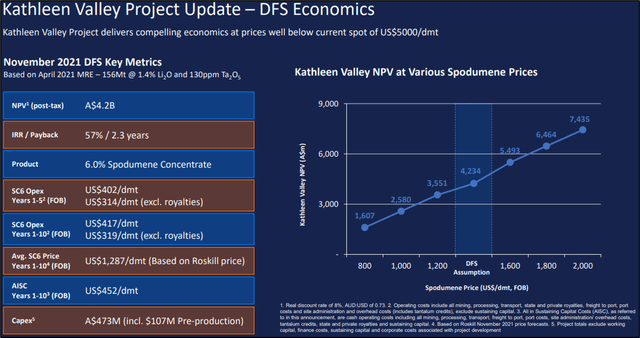

The Kathleen Valley posts project economics attractive enough to whet any investors appetite, even in a tightening credit environment. All-in-sustaining costs come in at $452/dmt with an average sales price almost 3x higher.

Post tax net present value of the project weighs in at A$4.2B with an IRR over 50% and a payback period under 3 years. Even at Spodumene prices well below current market spot rates, the project delivers compelling financials, perhaps explaining why a venture currently posting zero revenues has a market cap in excess of A$4B.

Assuredly, any equity holding in the underlying is a full-blown wager on project success.

The project currently posts extremely attractive project financials.

Valuation

The biggest underpinning risk to any equity holding is the firm’s current valuation. In fact, the sole primary issue is markets have essentially already essentially priced in the NPV of the company’s prized Kathleen Valley lease leaving little wiggle room for additional stock upside.

Analysts do post the equity as a “buy” but forecast price appreciation for the time being is ~20%. Not much granted but the stock has already returned 23% YTD despite a year of volatility and market jitters.

Exposure to ETFs is sizable, with 18 holding Liontown Resources in their wrappers – roughly the equivalent of A $250M. The balance sheet remains rock solid, but questions abound as to whether acquiring the firm at current levels represents best value.

Key Takeaways

For any investor looking for a fledgling lithium project heavily exposed to the advent of the electric car, consider Liontown Resources and its prolific Kathleen Valley lithium play.

While the project remains hard rock, low-cost, low margin, the company boasts the ambition to gravitate to the more lucrative end of the value chain.

With project financing secured, offtake deals agreed, and project construction currently underway, there is little not to like about the West Australian junior Liontown Resources Limited save perhaps a current top-end valuation which prices perfection in terms of project delivery.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment