Melpomenem

Cloud? SaaS? Electronic? No Difference

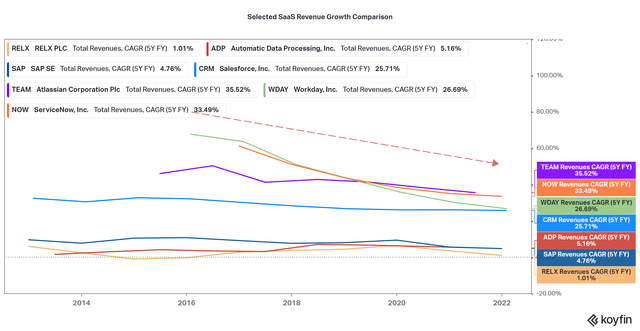

Thanks to the rise of data centers, cloud computing, and millions of different software applications for entities to use, a rise in subscription software services began around the late 2000s. While some companies such Adobe (ADBE), Salesforce (CRM), and Workday (WDAY) have incredible growth rates over the past decade or more, most SaaS companies in fact have extremely slow growth. Is it competition that stifles growth, or are the positives of SaaS (shown in the image below) over-hyped? This article will highlight an example of a leading SaaS player RELX plc (NYSE:RELX), a company that dominates in their respective markets, but has failed to see positive (revenue) growth over the years. In return, I will also give my perspective on why I am not interested in other SaaS names as I believe they will meet a similar fate in due time.

SAP Website

RELX: A Bond-like Investment in Risk Management and Media

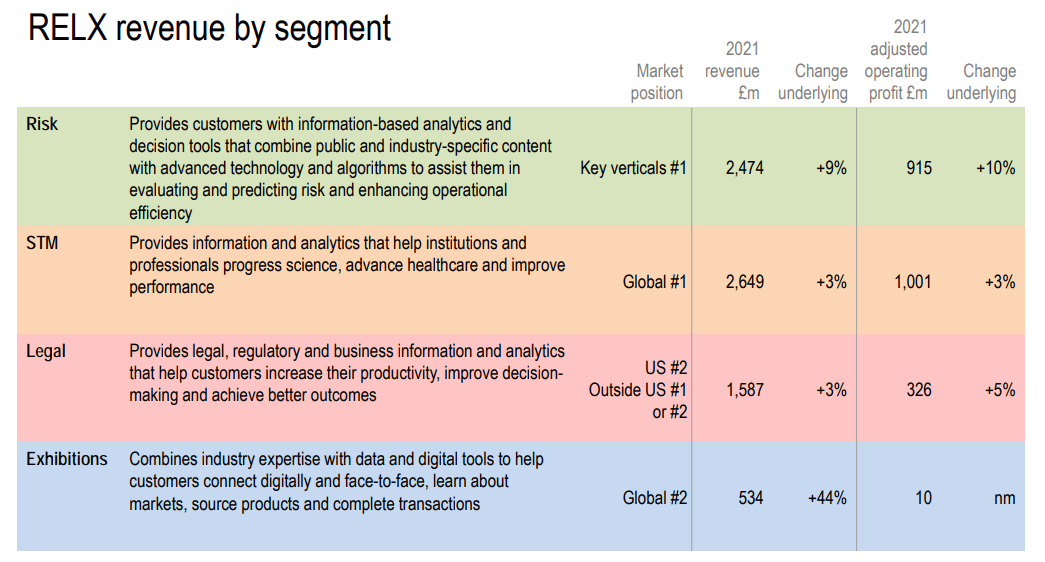

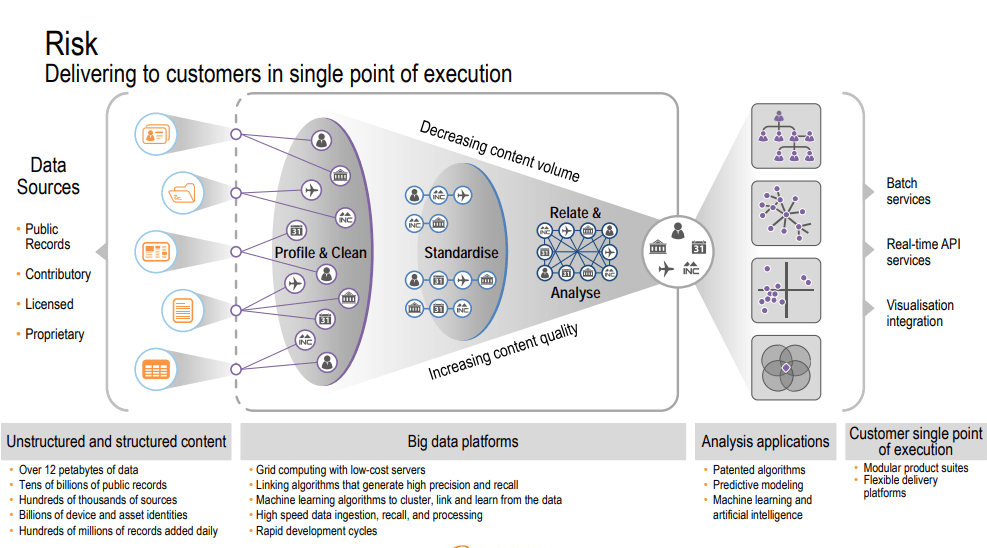

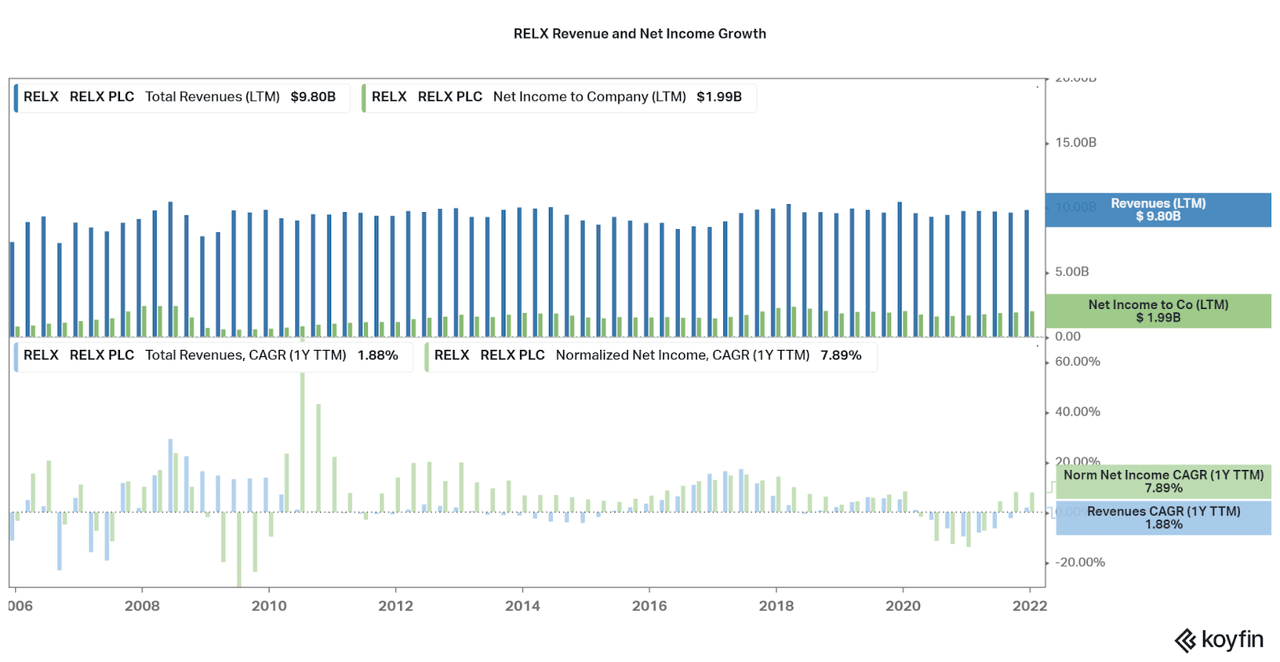

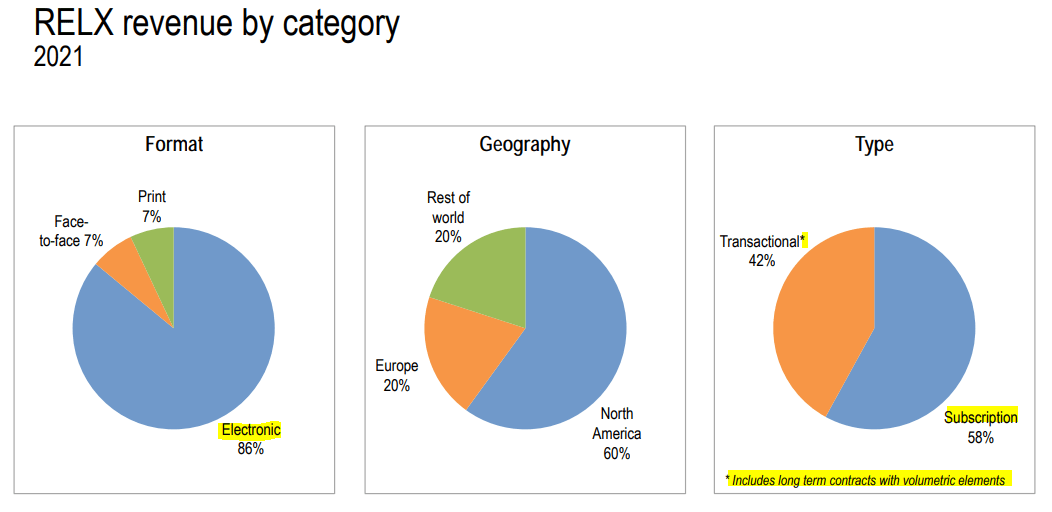

RELX, formerly known as Reed Elsevier is a giant in business analytics and support software, scientific literature publishing, and Legal industry software and database provider. At a $51 billion market cap, this is one of the largest underfollowed companies in the SA ecosystem. This is even as RELX is a #1 or #2 providers in their diverse markets. As you can see in the charts below, RELX is a diversified business, but growth is a little hard to come by. Although, they are performing better than many anticipated thanks to a smooth transition:

In 1995, Forbes magazine (wrongly) predicted Elsevier would be “the first victim of the internet” as it was disrupted and disintermediated by the World Wide Web.

RELX FY 2021 Presentation RELX

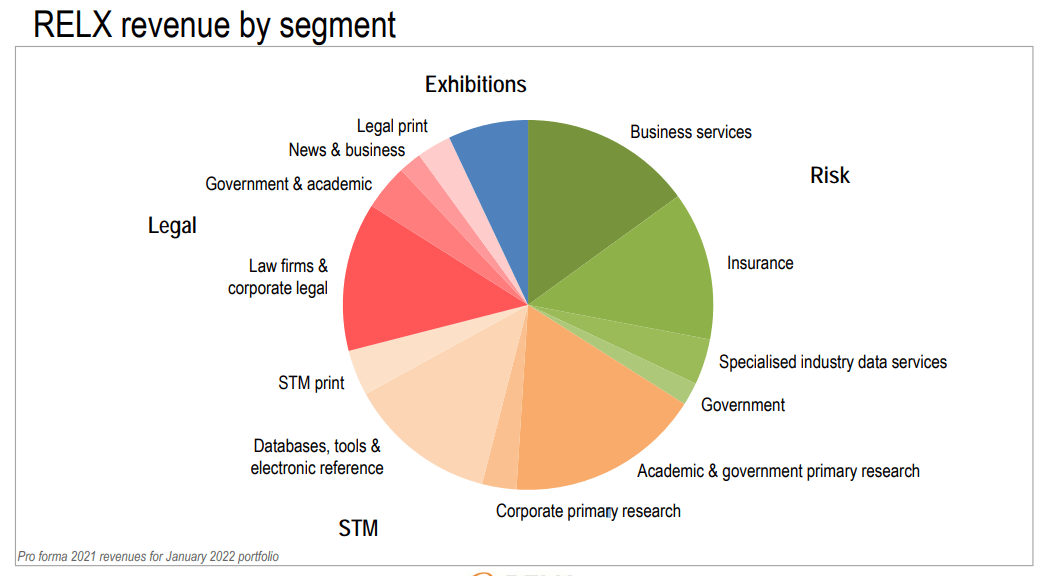

Risk Segment

Risk management is an important way for businesses and organizations to improve their operational efficiency. The main way to do this nowadays is by providing cloud solutions that are easy to access, have unlimited processing power to drive data and analytics, and often have some form of automation or machine learning capabilities. This is the case for major RELX subsidiary LexisNexis that has a huge variety of SaaS, research, and analytics solutions across all markets. They are as follows:

-

LexisNexis: Online data sourcing and analytics service.

-

ICIS: Leading global chemical and energy market research and data provider.

-

Cirium: Leader in aviation and travel data analytics solutions.

-

Proagrica: Farm management software for the agriculture industry.

-

XpertHR, EG, Nextens: Generalized HR, real estate, and tax solutions.

These subsidiaries are leaders in their respective segments, and this should be a reason for the company to see superior growth. Salesforce is a leader in customer relation management, is a larger size, but has a different growth profile compared to RELX. I believe the difference is due to RELX’s maturity, as the company transitioned from legacy software solutions to modern cloud solutions with the same customers. Now, they have reached a plateau in organic growth, with CAGR averages now less than 10% for the past few years (revenues). As I will show later, total revenues across all segments has basically been flat for almost 20 years! Let’s look at the rest of the segments to see if there are particular risk points to consider.

RELX

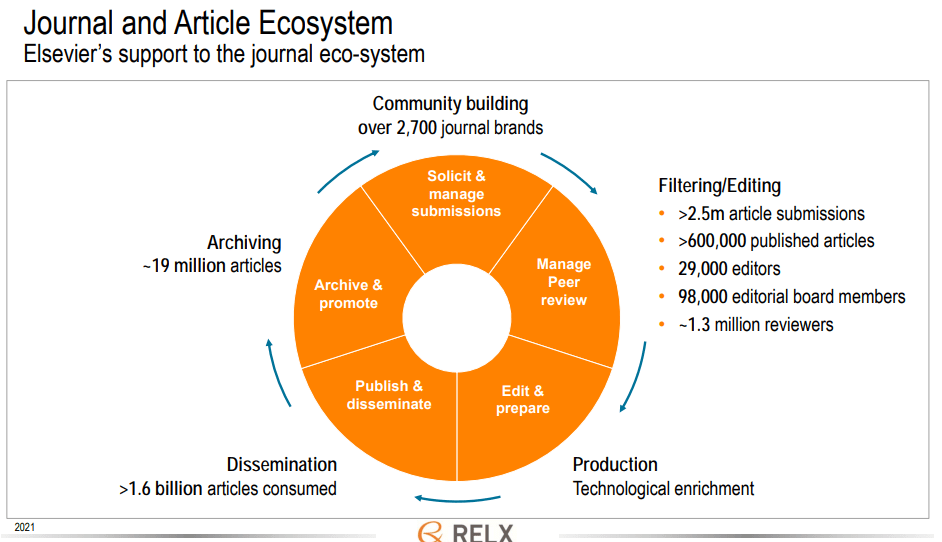

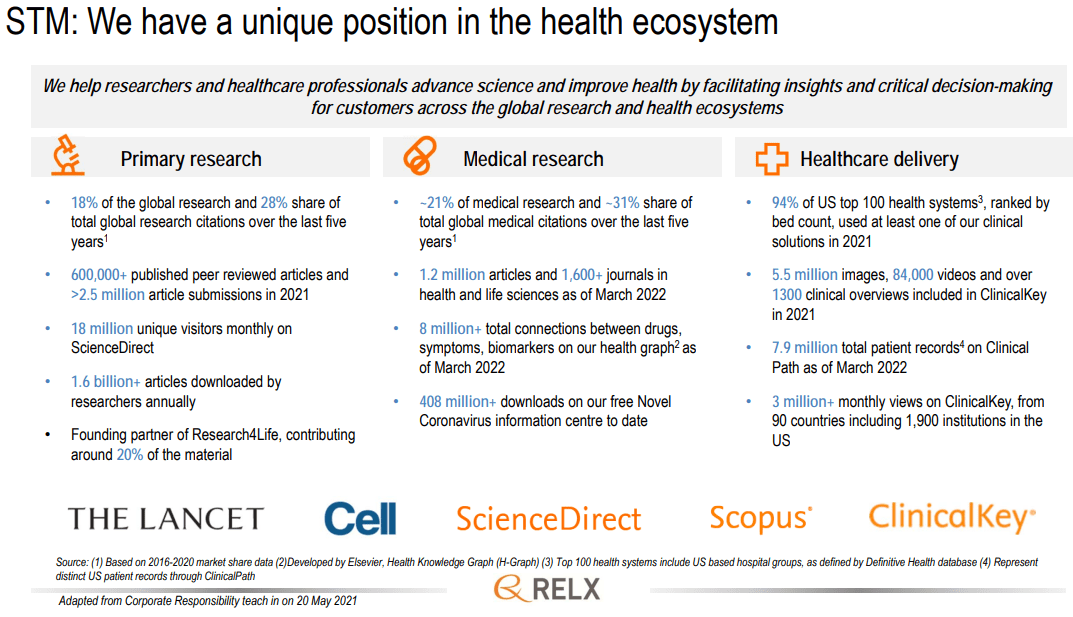

Scientific, Technical, and Medical Segment

This segment is led by academic research publishing giant Elsevier. Anyone like me who has tried to do research outside of your home institution is surely familiar with Elsevier and the lack of open-source research papers. At the same time, a growing movement to drive open-source literature has caused this segment to only average 1-3% revenue and earnings growth per year. While over 74% of revenues are subscription-based, outside competition hampers the overall growth rate. This is disappointing as the number of articles published on Elsevier are increasing at a 7% annual rate, but the company can’t grow pricing with the market. Sure they have a moat, sure they have an almost entirely electronic and subscription platform, but the performance reflects the weak industry.

RELX RELX

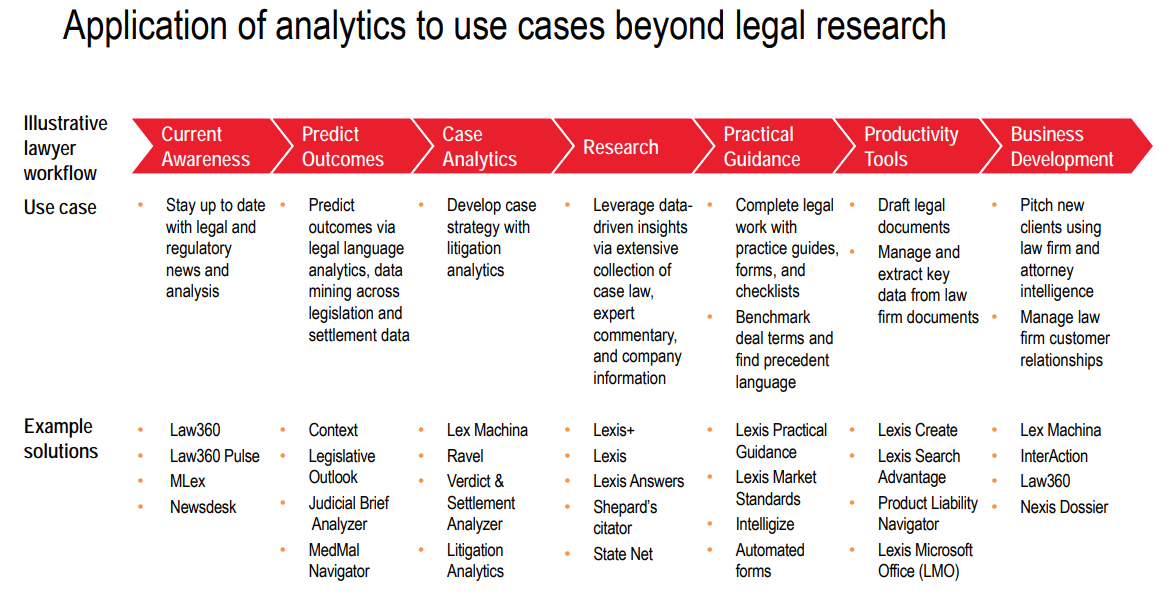

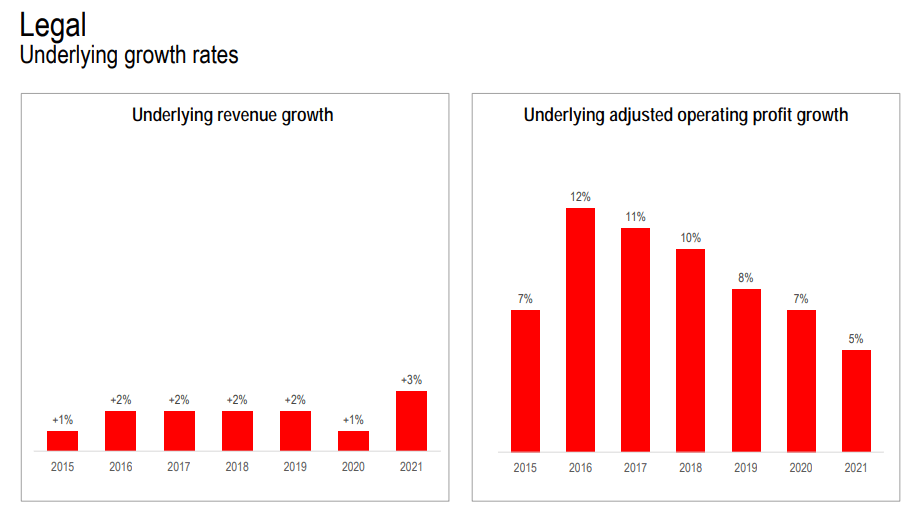

Legal Segment

A unique trait of RELX is their significant exposure to the law industry. People will always complain about how lawyers wring money out of society, but there seems to be a lack of revenue growth in this segment as well. However, I do see that operational improvements led to significant margin improvement over the past 10 or so years, unlike the other segments. As I will discuss next, these minor improvements in profits are the main reason to support RELX, as earnings growth is the main driver behind shareholder returns.

RELX RELX

Cumulatively, RELX has an extremely stable revenue pattern, just without growth. At the same time, the bottom line has been slowly improving at a faster rate than the revenues, but the potential will always be inhibited by the lack of organic growth. However, one must consider the fact that RELX has been continually selling legacy publishing assets and adding on smaller software providers. This a key reason why RELX exhibits this financial pattern. I also wonder what innovation can allow the ball to start rolling down the hill once again.

Koyfin

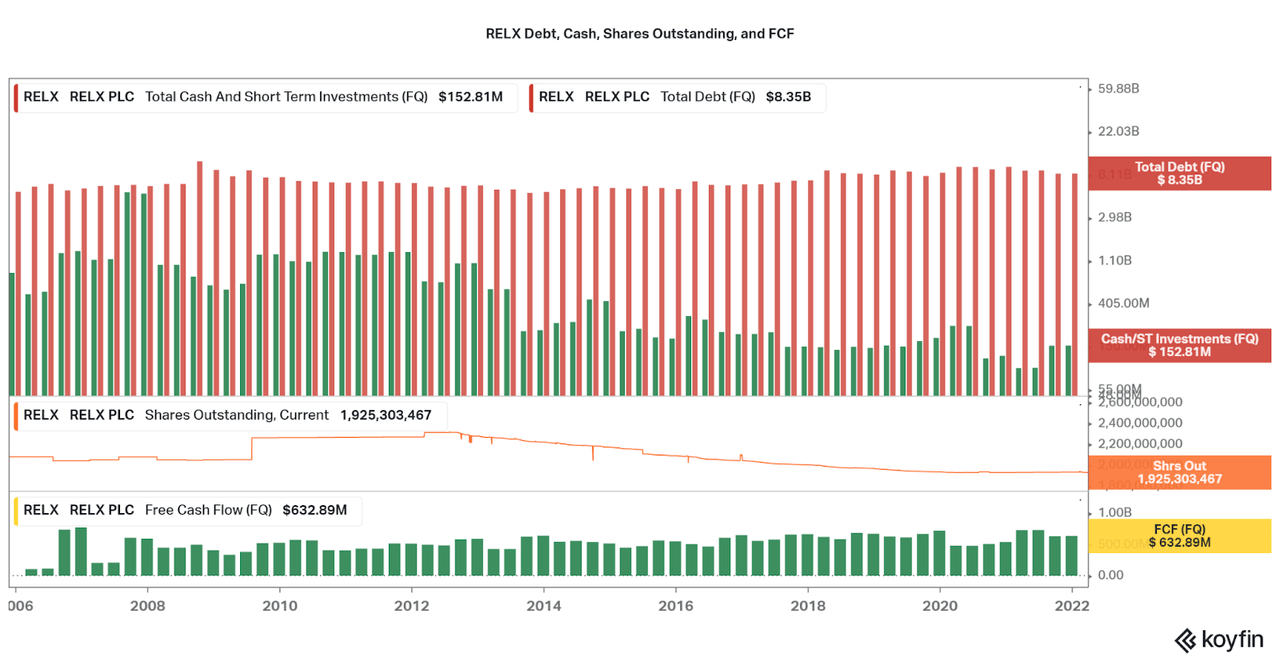

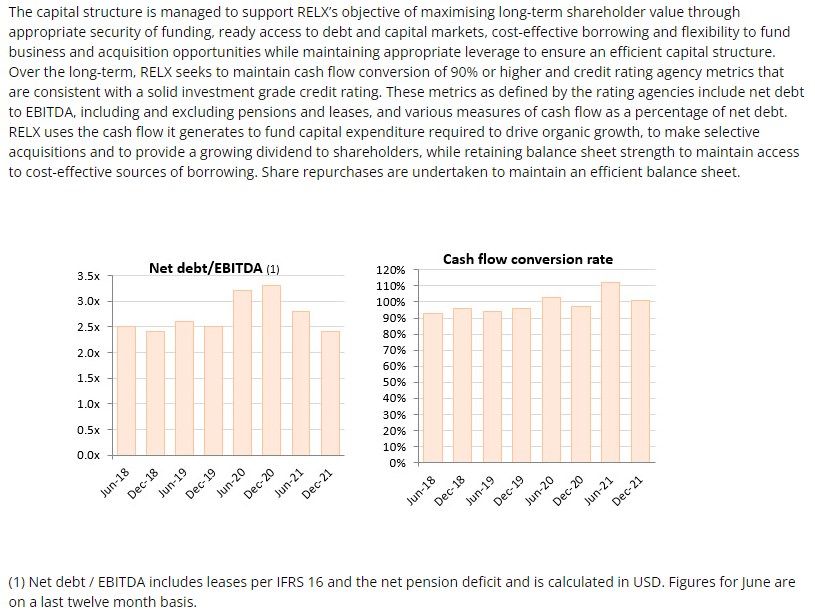

While growth is not a major bullish point for RELX, investors can take solace in the otherwise sound finances. The balance sheet shows that debt is being maintained at the $8-$9 billion mark, while cash has fallen from $2 billion to less than $200 million. This is partly due to significant share repurchases in the first half of the 2010s, although buybacks have not occurred for a few years. At the same time, free cash flows have been stable, and this makes RELX more bond-like than a typical equity. In fact, credit agencies rate RELX in the investment grade setting BBB+/Baa1 position, with a stable outlook. You can read some management comments on the capital structure below.

Koyfin RELX Website

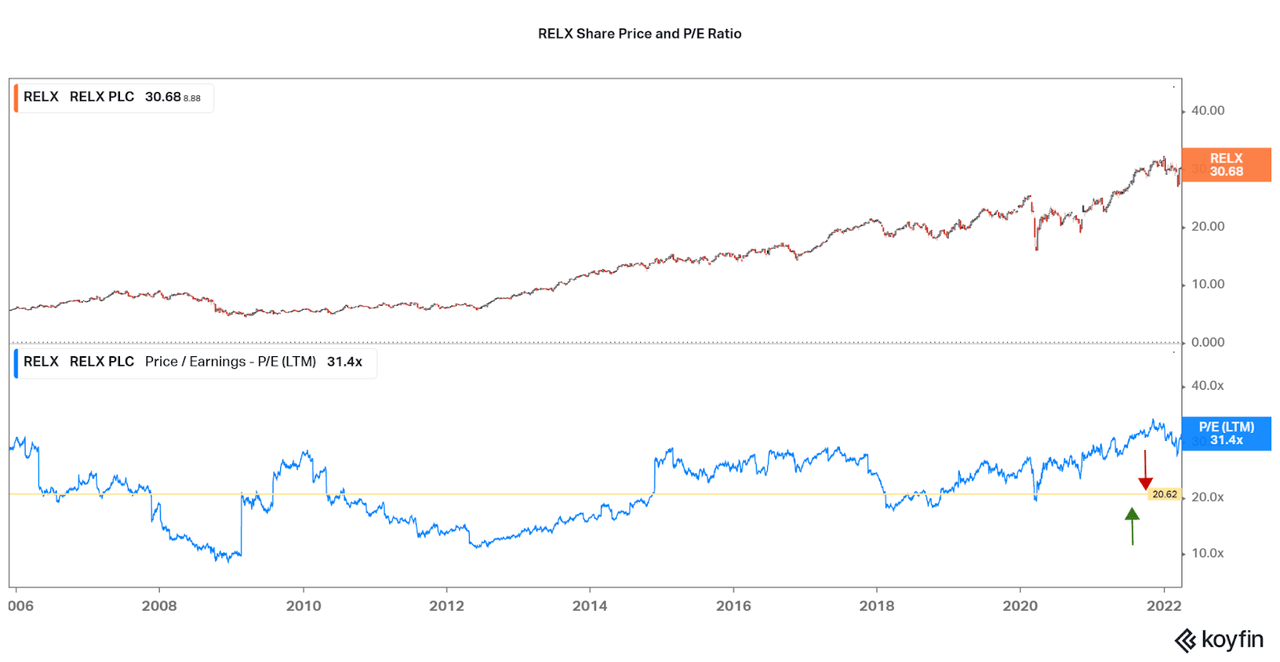

Those who are interested in a stable, hedge-like investment look no further. However, there is one incredible risk point to an investment in RELX: The valuation. At the moment, the company is trading at 30x P/E!! For this growth that is incredible (highlights investors’ favor for safety). However, as soon as speculation is in favor again, the valuation is likely to tank. Historically, the best times to buy were at less than a 20x P/E and I would not attempt to buy until the valuation falls below that level (a fairly common occurrence). Patience is a virtue!

Koyfin

Conclusion

There are a few main takeaways we can learn from studying RELX. First, it is not exceedingly difficult for legacy companies to transition to a SaaS-like business structure. While weaker companies have certainly gone bankrupt due to competition, RELX’s leadership across multiple verticals allows for the company to maintain long-term relationships. Having sticky products that clients rely on no matter what is a key strategy for a company to take.

The current high growth “disruptors” we see climbing up the market are in fact finding organic growth only in underserved or new markets. When a company reaches the edge of the available market, growth rapidly flattens out. However, RELX is an extreme example as stalwarts ADP (ADP), SAP, and Accenture (ACN) continue upward revenue growth. RELX is most similar to Oracle (ORCL) in terms of flat revenues and earnings. Thankfully, only IBM seems to have taken a hit in the modern era, but is falling back on new cloud platforms and has stabilized the downward climb. Just look at how the majority of RELX’s revenues are both electronic and subscription (or long-term contract) based, other big companies are just as similar, if not more SaaS-like.

RELX

As you can see, the old boys continue to maintain their positions as leaders in business solutions and SaaS or cloud versions of most platforms are available. This will put incredible competitive pressure on high growth SaaS providers who have significant solutions overlap with large companies. Examples of companies I believe are about to hit the growth wall include ServiceNow (NOW), Workday, and Atlassian (TEAM), as the competition is immense, the market is reaching saturation (the digital shift is well underway already), and most are facing their first era of financial weakness (thanks to rising interest rates, inflation, possible recession). I would stick with a company that has buying power and diversification, such as Microsoft (MSFT) or Alphabet (GOOG), the largest SaaS providers.

The main takeaway of my conclusions is already well underway as valuations reset and growth of the hyped names slow. I also assume that companies at less than a $10-$20 billion market cap still have some growth in store, as long as they have a vertical to grow into unimpeded. Otherwise, I continue to expect software companies to underperform as they have for the past year. The main indicator will be stalling growth, but also look for valuations to be pressured at the same time. If you do decide to add to companies at this point, make sure they are a small size to leverage high growth, have a moat-like niche (i.e. Cloudflare (NET) or Snowflake (SNOW) [debatable]), and have the financial base to survive weak market conditions.

Thanks for reading. Feel free to share your thoughts below.

Be the first to comment