courtneyk

Investment Thesis

Atlassian’s (NASDAQ:TEAM) prospects are not enticing. Simply put, I make the case that paying $30 billion for Atlassian is too high.

I maintain my argument, as I did last month as we headed into fiscal Q1 earnings that investors are too caught up in Atlassian’s secular growth story.

I reaffirm my argument that investors were being allured by Atlassian’s proclamation that its SaaS business model provided investors with visibility, predictability, and a lack of negative surprises.

And that even now investors are asked to pay too high a multiple.

What’s Happening Right Now?

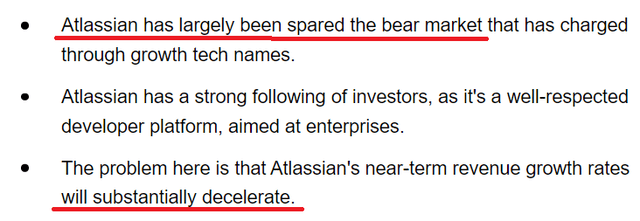

Before going further, let’s get some context. I’ve highlighted the summary of my thesis as we headed into Atlassian’s fiscal Q1 2023 earnings

Since those lines were written a few weeks ago, the stock is down 40% from $230 a share. So what’s happened?

Asides from Atlassian’s slowing growth rates, which is one key consideration, the reality here is that there’s a very large discrepancy between expectations and reality.

Revenue Growth Rates Slow Down

Before digging into Atlassian’s latest guidance, see if you spot a pattern:

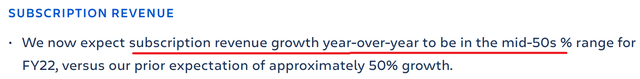

- Fiscal Q3 2022, guidance for fiscal 2022, mid-50% CAGR in cloud revenues:

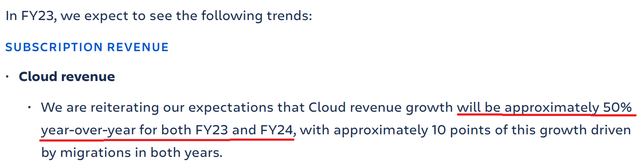

- Fiscal Q4 2022, guidance for fiscal 2023, approximately 50% CAGR in cloud revenues:

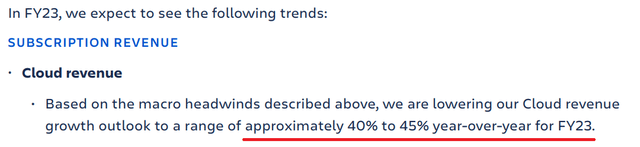

Fiscal Q1 2023, guidance for fiscal 2023, 40-45% cloud revenues:

Not only can you see that in the space of 2 quarters Atlassian’s guided cloud revenue went from approximately 55% CAGR to around 45% CAGR, but more importantly, this growth is coming from the cannibalization of its legacy data center business.

So, altogether, this is how Atlassian’s total revenues look.

Atlassian has guided that Q2 2023 will only see mid 20s% CAGR.

But what’s even more crucial to keep in mind, is that Atlassian’s growth prospects are moving lower in the one area that was seen as its ”growth business unit”, its cloud business.

Atlassian’s Profitability Profile Doesn’t Entice

I’ve noted this already. Atlassian’s legacy business was very profitable. But as Atlassian cannibalizes that business, this will weigh across its profitability profile.

Now consider this, Atlassian’s fiscal Q1 2023 reported a non-GAAP net income of $93 million. But this figure included $174 million of stock-based compensation. So, as investors, one has to consider, what’s really left here for me in terms of owners’ earnings?

TEAM Stock Valuation — How to Value This?

When interest rates were close to 0%, it didn’t matter that companies were unprofitable.

It didn’t matter all that much that companies were adding back stock-based compensation. Management played the game where they pretended stock-based compensation wasn’t a real cost. And we as shareholders were complicit and played along.

In fact, as long as the share price was moving up over time, nobody wanted to ask difficult questions.

But now the time has come, we are forced to ask, what will happen to businesses in this higher rate environment. What will happen to companies if rates stay around 4% for the bulk of 2023?

The Bottom Line

Looking back now, anyone that invested in Atlassian over the past 3 years is now looking at a loss.

But just because the stock is down substantially, does it necessarily mean that it’s undervalued?

Perhaps I’m too inflexible. I believe that companies should be worth their future earnings discounted back to the present at an appropriate rate.

Or perhaps, it could now be that Atlassian’s customers’ need for productivity software comes second to survival?

In my previous article, I said,

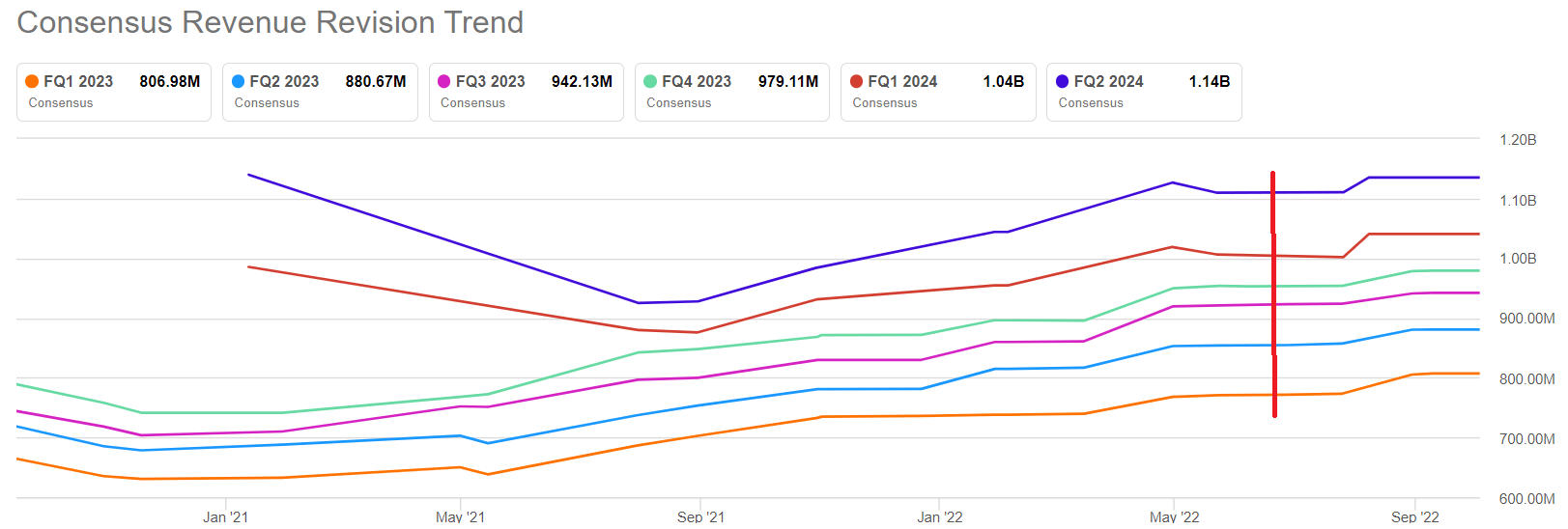

What you see [below], is that even though there’s been consistent evidence since the summer that the global economies are slowing down, analysts have fully disregarded these insights.

TEAM analysts’ revenue estimates

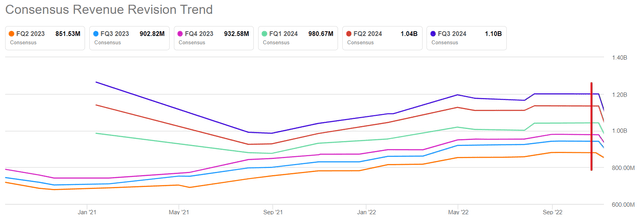

And now what do we see?

TEAM analysts’ revenue estimates

Analysts are starting to recognize that all is not well in SaaS-land.

Be the first to comment