Franck-Boston

Lightning eMotors, Inc. (NYSE:ZEV) is having a tough year, down more than 41% since the start of the year, which is much worse than the performance of the S&P500. The index is down only 11%, meaning that ZEV is far underperforming the market this year.

Furthermore, we believe that ZEV is still showing underwhelming and disappointing results, which is unlikely to cause a quick turnaround in the stock. While the company reported some silver linings and other positive developments in the business, we believe the most important items (backlog, revenue growth, and gross margin) have not shown much improvement.

The most recent earnings results were disappointing, and that causes the outlook for the business and the stock to be quite dark. In simple words, we don’t believe ZEV is a good stock to buy currently. We explain why we don’t see it as a buy in this article.

Stagnant order backlog

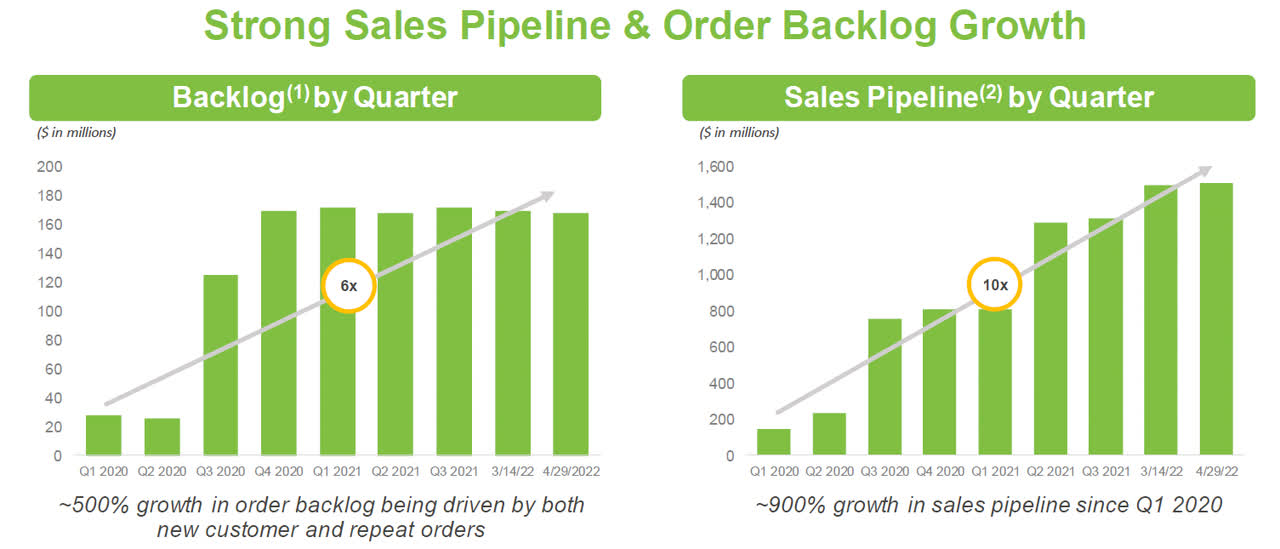

Lightning eMotors reported $169M of orders backlog, which is a relatively large amount that provides Lightning eMotors with a good runway for revenue generation. Having such a strong backlog is one of the attractive aspects of the business, because it shows customers are willing to sign contracts and place orders.

However, one concern is that order backlog has not grown much since Q4-2020. Order backlog has grown strongly soon after ZEV went public, but it has stagnated since then, as shown in the (left) chart below. The sales pipeline has shown better growth, which could potentially convert into backlog in due time. As always, time will tell.

The lack of growth in backlog orders for the past 6 quarters is likely driven by supply chain issues, which are outside of the company’s control and have proven difficult to manage. We give ZEV the benefit of the doubt on this front. Because of ongoing supply chain issues and sizable backlog already on the books, the lack of backlog growth is not hugely concerning (i.e., not a reason to short ZEV), but it is an important item and worth monitoring.

At least there has not been any backlog fallout (i.e., cancellations), which by itself shows that current customers remain committed to purchasing the vehicles. Recall that Lightning eMotors has a variety of customers with some blue-chip names on the list. Additionally, Lightning eMotors receives repeat orders from these customers, which we view positively because repeat orders should generate consistent revenue into the future.

Company Presentation

Although we believe showing growth in backlog orders would be a positive for Lightning eMotors stock, we believe that converting the current backlog to revenues and generating profits on those orders are much more important drivers. On that aspect, Lightning eMotors has not shown great results, which is more concerning than not showing backlog growth.

Disappointing revenue growth

Total revenues came in at just $3.5M, which is down 40% from last year and meaningfully missed analysts’ expectations. With about the same backlog as last year, Lightning eMotors converted a lot less in revenues this quarter, which is not a good sign. The executive team explained that delays were caused by supply chain issues (chassis and other components) and customer financing. The executive team reassured investors that these sales were not lost, only delayed.

However, the guidance provided for Q3 was underwhelming and below analyst expectations. Looking at the full year, the team issued guidance that calls for total revenues between $35M to $45M, which implies 91% revenue growth for the full year. That means the decline in revenue was only a Q2 problem and should be reversed. We would give management the benefit of the doubt on delays.

As much as revenue growth is important, we believe that gross margins are even more important because it is a measure of profitability. On that aspect, Lightning eMotors also disappointed.

Gross margin deterioration

Gross margin keeps on getting worse, which means the business lost more money this year compared to last year. Said another way, Lightning eMotors generated lower sales revenue and lost more money on those sales. Not good.

Gross margin was -38% in Q2-2022, which is meaningfully worse than last year’s -19%. On a year-to-date basis, gross margin stands at -41% compared to -18% last year. To be blunt, these results are terrible.

We believe that gross margin deterioration is the worst part of the earnings report, and the most concerning item. Gross margin is probably the most important factor that is preventing ZEV stock from rising, and this is the most likely reason why the stock declined following the earnings release.

Gross margin decline shows that Lightning eMotors needs to overcome major challenges to make business profitable. There is no business in the world that can survive (let alone thrive) without generating positive gross margins. Lightning eMotors is no exception. Sooner or later, gross margin will need to reverse and turn positive. The most recent earnings release shows gross margin is trending in the wrong direction.

Gross margin has been getting worse since Lightning eMotors went public, even though gross margin was supposed to be getting better as the business scaled. The results are showing the more Lightning eMotors scales, the worse its gross margin gets. Lightning eMotors has not proven to Mr. Market that it can make a profit in its business, and Mr. Market likes profits. Gross margins must improve and turn positive to secure the long-term survival of the company. Until then, we don’t believe the stock will do well.

A balance sheet for two years

The balance sheet deteriorated further in Q2. As Lightning eMotors continues to lose money quarter after quarter, the balance sheet will most likely continue to deteriorate. However, there is enough cash on the balance sheet to sustain operations for the remaining of 2022, and probably for 2023 (though this is not certain).

Cash burn in the first half of the year was ~$25M, which leaves the company with $125M cash on hand. At a run rate of ~$50M burn per year, the balance sheet has capacity to sustain about 2 years of operations, give or take some months. But that’s it. What happens after that?

Unless the business miraculously turns cash flow positive over the next 12-36 months, Lightning eMotors will eventually need another capital infusion to scale the business and reach profitability. That’s important because a future capital raise will most likely dilute existing shareholders, which is a big risk and undesirable.

Lightning eMotors explicitly states this in their SEC filings, reminding investors that it:

“will require additional capital to fund the growth and scaling of our manufacturing facilities and operations; further develop our products and services, including those for orders in our order backlog; and fund possible acquisitions.”

More importantly, the executive team provided investors with the first clue that it will soon need to raise capital. In the most recent earnings release, the CEO commented that “while we believe we have sufficient cash to fund our operations for the next year, we are exploring ways to raise more capital to fund critical investments.”

Shareholders of Lightning eMotors should expect a capital raise, perhaps within the next 12 months, but surely sometime between now and year-end 2023. There’s just enough cash to survive next year, assuming current trends continue. As the ZEV stock price continues to decline, future capital becomes more expensive, and dilution risk is greater.

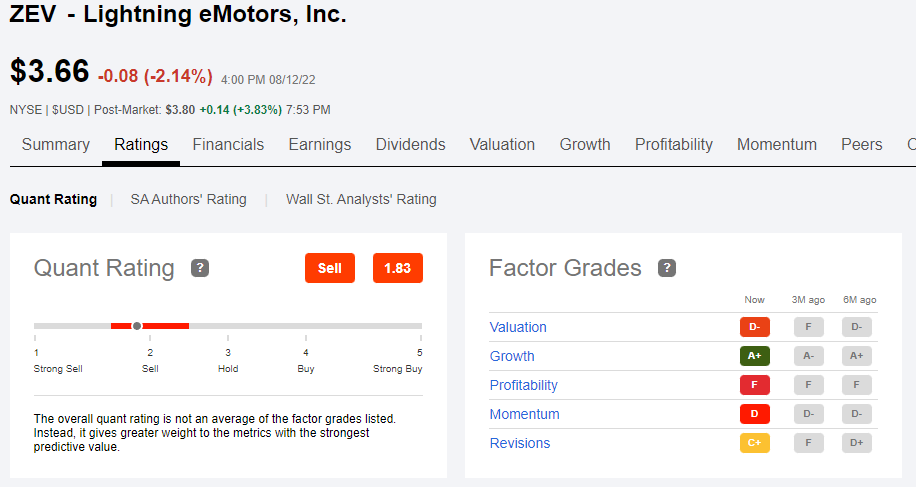

Seeking Alpha quant model dislikes ZEV

In addition to the deterioration in gross margins and balance sheet, coupled with revenue declines and lack of backlog growth. The Seeking Alpha quant model still has a sell rating on Lightning eMotors, with poor scores across the board. The quant model warns investors that ZEV is at risk of performing badly, and we agree.

Seeking Alpha’s quant model shows poor scores for four out of the five major factors, with growth the only positive.

Seeking Alpha

Investor conclusion

Lightning eMotors is an interesting company that is working hard at producing zero emissions vehicles for commercial uses, which is a great mission because it contributes towards a world that is more climate friendly. We remain fond of the company’s mission and products.

However, the business is facing serious challenges, which causes ZEV stock to be a mediocre investment opportunity. Now doesn’t seem like the best time to buy ZEV given all the challenges and poor business fundamentals. We’d like to see improvement in revenue growth and gross margin before becoming more optimistic.

Simply said, while gross margin continues to get worse, the outlook for ZEV will continue to be ugly, and the stock is unlikely to rise. If gross margin turns positive, the stock is likely to respond favorably. But gross margin is deep in negative territory, making it the most important reason for our lack of optimism in ZEV.

Beyond gross margin, converting order backlog into revenue is another important factor, and the recent results have also been disappointing. The decline in revenue growth in Q2 was disappointing, and guidance offered also disappointed. Growing the order backlog is also an important factor to consider, because it will show more confidence from customers to place orders.

Time will tell if Lightning eMotors can overcome these challenges. With serious lack of profitability, coupled with potential dilution from a capital raise on the horizon, Lightning eMotors is a very risky investment at this time. We don’t feel compelled to buy the dip.

Be the first to comment