ablokhin

The restaurant business has had a complex recovery since the 2020 crash. After experiencing a massive wave of permanent closures in 2020 and 2021, most are now struggling with rising costs. A recent study suggests over two-thirds of independent restaurants have seen revenue decline despite price increases, causing many to reduce staff and operating hours. Nearly half of restaurant businesses could not pay July rent (one of the highest rates among small business segments) as 84% of people say they eat out less often due to rising prices. Put simply, today is a challenging period to be a restaurant owner, particularly one not focusing on fast food or delivery.

Thus far, Chipotle (NYSE:CMG) stock has weathered the storm and is trading just 10% below its all-time high. The company has continued to grow revenue and has seen its profit margins slowly return toward pre-lockdown levels. On the surface, the company may still appear to be the unique growth opportunity it was years ago. However, when we account for shifting economic fundamentals and factors specific to restaurants, Chipotle’s profitability and sales appear to be headed for a sharp reversal.

Chipotle commands an extremely high “P/E” valuation of 50X, making it among the highest valued restaurant stocks in the industry, excluding those with large recent earnings declines. Compared to the industry average, CMG’s valuation implies trading at a roughly 100% premium or higher. While it is one of the few “healthy” restaurant stocks in the industry, it must maintain high organic growth to be fairly valued today. In my view, given today’s economic headwinds, growing competition, and signs of a diseconomy of scale, it is doubtful Chipotle will maintain its earnings growth rate both in the short-run and the long-run. With this in mind, and considering its recent short-squeeze spike higher, CMG may be an excellent short opportunity today.

Can Chipotle Continue To Be Resilient?

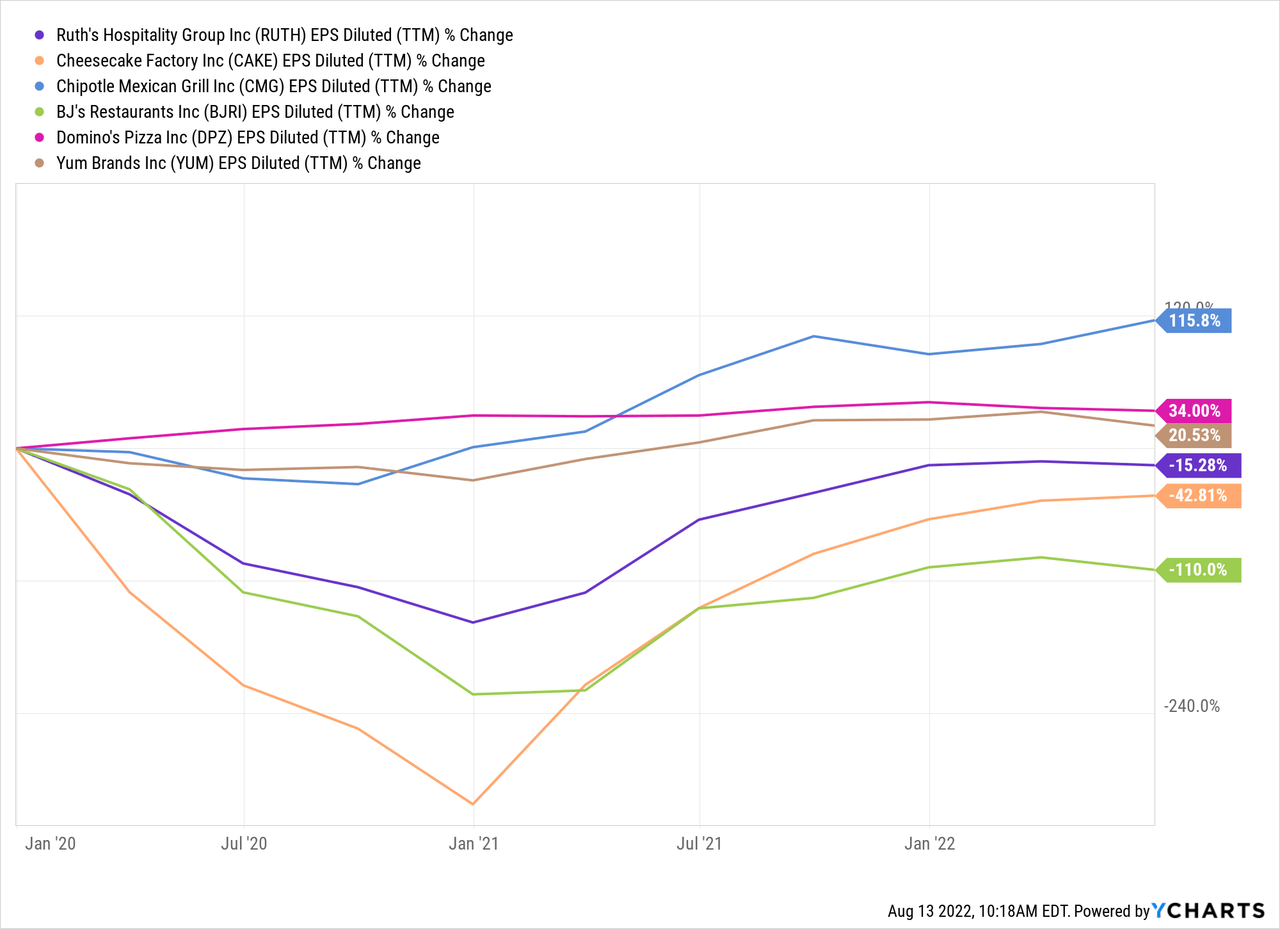

Chipotle’s near-peers, Domino’s Pizza (DPZ), Yum Brands (YUM), McDonald’s (MCD), and Wendy’s (WEN), as well as most other restaurants and fast food stocks, have seen their earnings-per-share dip over the past year. Long-term losses are typically more considerable for dine-in-oriented companies such as BJ’s (BJRI), Cheesecake Factory (CAKE), and Ruth’s Hospitality (RUTH). See the sample’s EPS trends below:

Many people may recognize these trends in their dining habits over the past two and a half years. Initially, dine-in restaurants were hit extremely hard as lockdowns directly halted their business activity. During that period, dine-out companies such as Domino’s, Chipotle, and Yum Brands (which owns many fast food chains) saw nearly flat net-EPS changes as more people ate out. Since then, dine-in restaurants have not fully recovered, while dine-out restaurants mostly have. However, over the past year, Chipotle has been among the few that have maintained its 2021 EPS as its peers struggle with inflation.

Recent surveys show people have a growing preference for healthier options and food delivery, with nearly half of young people aiming to eat healthier this year and a third of all people ordering food delivery once a week or more. Consumer trends favor Chipotle, the largest in its immediate peer group. Of course, while Chipotle may be one of the only “healthier fast-food” stocks, it has a wide variety of private competitors such as Qdoba, Moe’s, Baja Fresh, and Rubio’s. Despite double-digit price hikes, Chipotle has remained slightly more affordable than these companies; however, this month, it decided to raise prices again shortly after that survey was published. The more expensive it is to eat out, the more likely people are to shift their preferences, mainly if they cannot afford to eat out.

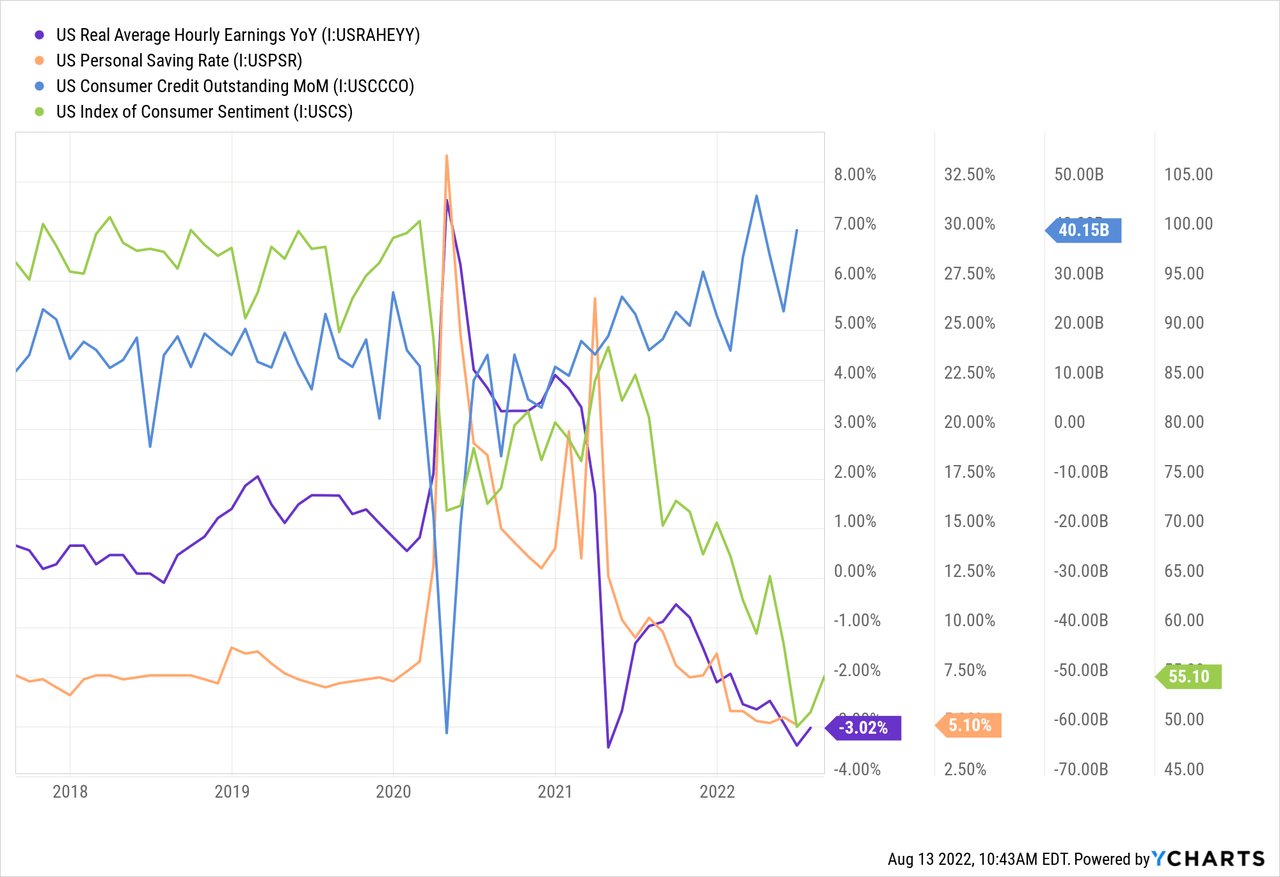

People are eating out less and delivering food far more than they were years ago. This is an increasingly expensive habit that many are unlikely to sustain, given falling savings and real wages. Today, real hourly wages, personal savings, and consumer sentiment are all abysmally low, while consumer credit growth is exceptionally high. See below:

The trend of declining real incomes has directly promoted falling savings and growing consumer debt. For now, consumer spending has been artificially supported by credit card balance growth, but that cannot be sustained, and recent economic trends suggest it is shifting. Fast food companies typically benefit from some anti-cyclicality due to low prices, but I highly doubt this will remain true for those like Chipotle, which costs far more than cooking at home. Many people, particularly younger adults, are not in the habit of cooking at home, but declining affordability may reverse this trend. Once one develops those skills, their demand for eating out may permanently reduce.

Overall, I believe it is clear that Chipotle’s earnings and sales will likely begin to follow the same path as its peers over the coming quarters. The company has benefited from the delivery and health foods trends, but its cyclical exposure grows as its prices rise. As such, I believe Chipotle will see a relatively significant decline in demand over the coming year as consumer preferences shift toward cooking. While this factor may reverse once economic demand recovers (which may take years given falling real wages and growth), there may be permanent changes if the younger generation of adults sees habits shift toward cooking and away from frequent food delivery.

Supply Chain and Labor Woes Are Not Over

As detailed in the company’s last earnings call, Chipotle is still struggling with high labor turnover and rising labor costs. The job quit level has leveled off but remains nearly as high as last year and is over 2X average levels. Like most fast food restaurants, Chipotle has been racing to maintain employment by raising wages. In fact, the company had such extensive employment woes that it had to pay a $20M settlement for allegedly not letting employees use sick leave and other violations.

As long as job quits remain high, Chipotle will likely need to raise wages to maintain employment levels. Thus far, the firm has offset this factor by increasing menu prices, but given the economic state of consumption, higher prices may negatively impact sales. In other words, the company’s would-be profits are starting to be indirectly transferred to its employees as workers demand higher pay while sales slow. Last quarter Chipotle operated at near-record high-profit margins of 11%, which seems unsustainable in the current labor and consumer market.

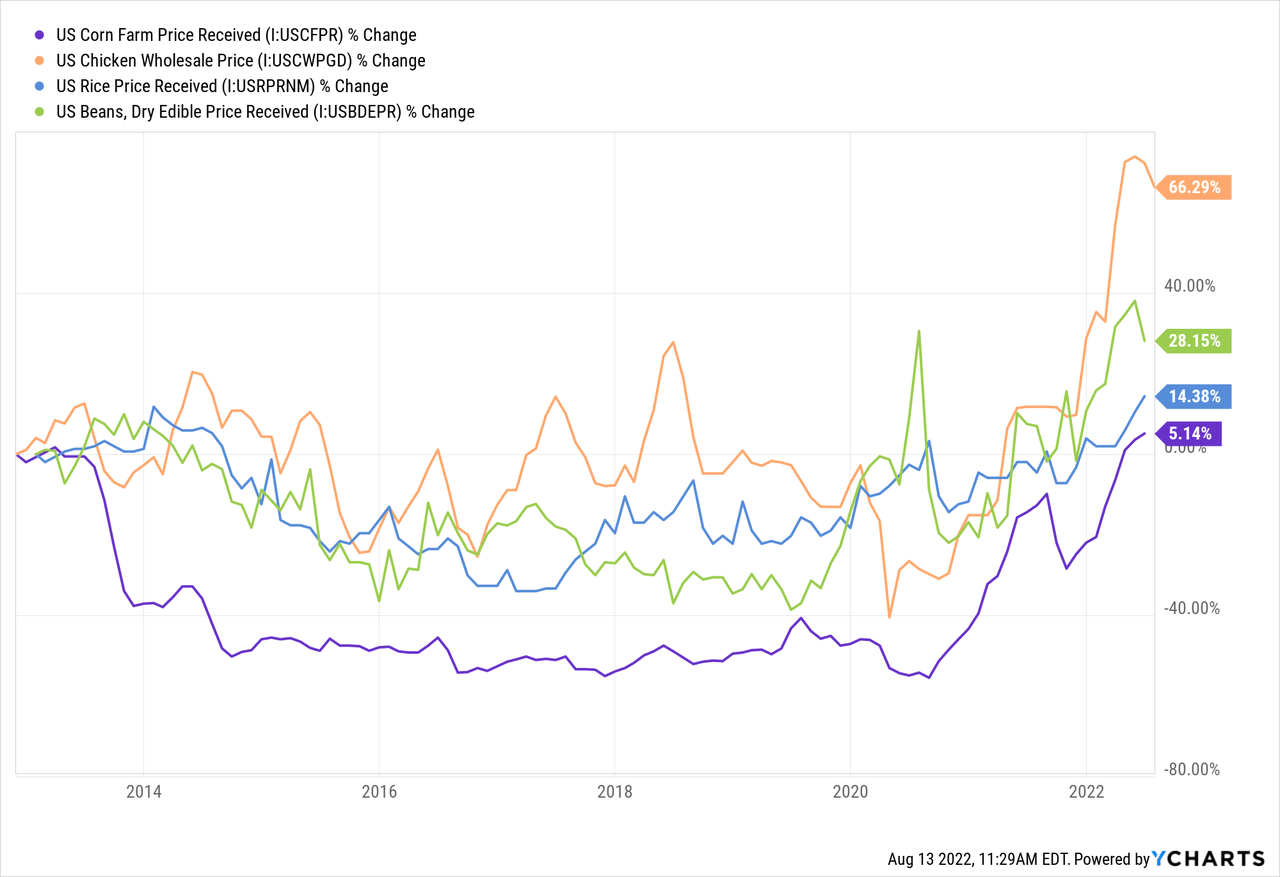

Chipotle is also struggling with growing food costs which now account for around 30% of sales. This trend is showing few signs of slowing, as seen in prices for a few of Chipotle’s essential commodities:

The price of most food commodities is near all-time-high levels today. There have been slight declines in agricultural futures over the past six weeks, but I believe the trend of higher food prices is set to continue. Current food prices primarily reflect supply from the southern hemisphere’s harvest season and the past fall harvest. The upcoming northern hemisphere harvest will reflect the impact of the enormous fertilizer shortage and significant export constraints in Eastern Europe’s breadbasket. The drought in most of the US is also expected to cause another below-average yield for corn. Weather events in Europe are expected to be more problematic for farm yields, indirectly increasing US prices as the U.S is a major agricultural exporter. Food prices may see another large wave higher by year-end if the Northern Hemisphere’s upcoming harvest season is as weak as suggested.

A secondary issue for Chipotle, and virtually all other large chains, is a potential diseconomy of scale that comes with rising commodity prices. Typically, investors and analysts believe larger companies always deliver higher margins due to high-level savings (headquarters, etc.). However, with transportation costs skyrocketing, companies with large supply lines are seeing compounded cost growth. Nearly 90% of Chipotle’s produce is not locally sourced and must be shipped long distances.

This factor potentially contributes to the company’s multiple food-borne illness cases and compounds its fuel overhead costs. While most independent restaurants may not locally source food, they’re likely much more capable of doing so than a more prominent firm like Chipotle. As such, I believe Chipotle may start to lose out to local small businesses over the coming years as restaurant owners benefit from a potential shift in traditional economies of scale.

The Bottom Line

Chipotle is facing pressure from a multitude of sources. It is struggling with rising labor costs, food costs, and transportation costs. Thus far, it has overcome these issues by increasing menu prices. The gap between its menu and grocery prices is becoming large enough that I believe we will begin to see consumer preferences shift toward home cooking. This trend may be larger among younger adults, which drives much of its delivery market. Add on rising delivery fees and staggering declines in consumer stability (falling real wages, savings, credit card growth, etc.), and it seems clear that more people will need to reduce discretionary spending on eating out. Chipotle’s higher prices increase its exposure to this cyclical risk.

While Chipotle’s EPS has been somewhat stable and has grown steadily, I believe it will become much more volatile over the coming year as its top-line sales decline and costs grow. For now, I am in a minority view regarding Chipotle as most analysts focus on its historical resilience over the past two years. However, when considering forward-looking economic data, it becomes clear those historical trends are likely highly unsustainable. While Chipotle’s current 11% profit margins are historically high, they are low enough that all of its EPS could disappear, given a relatively small decline in sales and a continued cost rise.

Even if my expectation regarding Chipotle’s profitability is overly pessimistic, the company is valued at an optimistic forward “P/E” of 50X. At this valuation, the firm is priced as if its sales and income will continue to expand rapidly despite the many growing headwinds. At the very least, I believe the firm deserves a forward “P/E” of 25X, which is closer to its peers and reflects a low-to-no overall growth outlook. This equates to a target share price of roughly $830. I would not be surprised to see the stock fall lower if its EPS declines as much as I expect.

CMG has a short interest of 4.3%, which is slightly high considering its valuation. I believe the stock is a great short opportunity today, given its 32% rally over recent weeks. I think this rapid price increase does not reflect a robust fundamental improvement in outlook but a typical bear market short-squeeze bounce. The stock also has a low borrowing cost of essentially zero and no dividend, so it does not have a high carry risk. Of course, there is a risk this rally extends as FOMO grows and more retail investors race back in. It is also possible that consumer demand will recover and input prices will decline, supporting Chipotle’s growth outlook. That said, I believe both options are unlikely, giving CMG an attractive risk-reward trade-off for short-sellers.

One potential way to leverage this trade with defined risk may be to use put options. In my opinion, those with an expiration date four or more months from now are best as CMG may continue to rally in the short run. Further, while out-of-the-money options have poor liquidity, I expect they will have the best overall risk-reward potential as I believe CMG is headed significantly lower if it re-enters a bearish trend.

Be the first to comment