Stockbyte/Stockbyte via Getty Images

Introduction

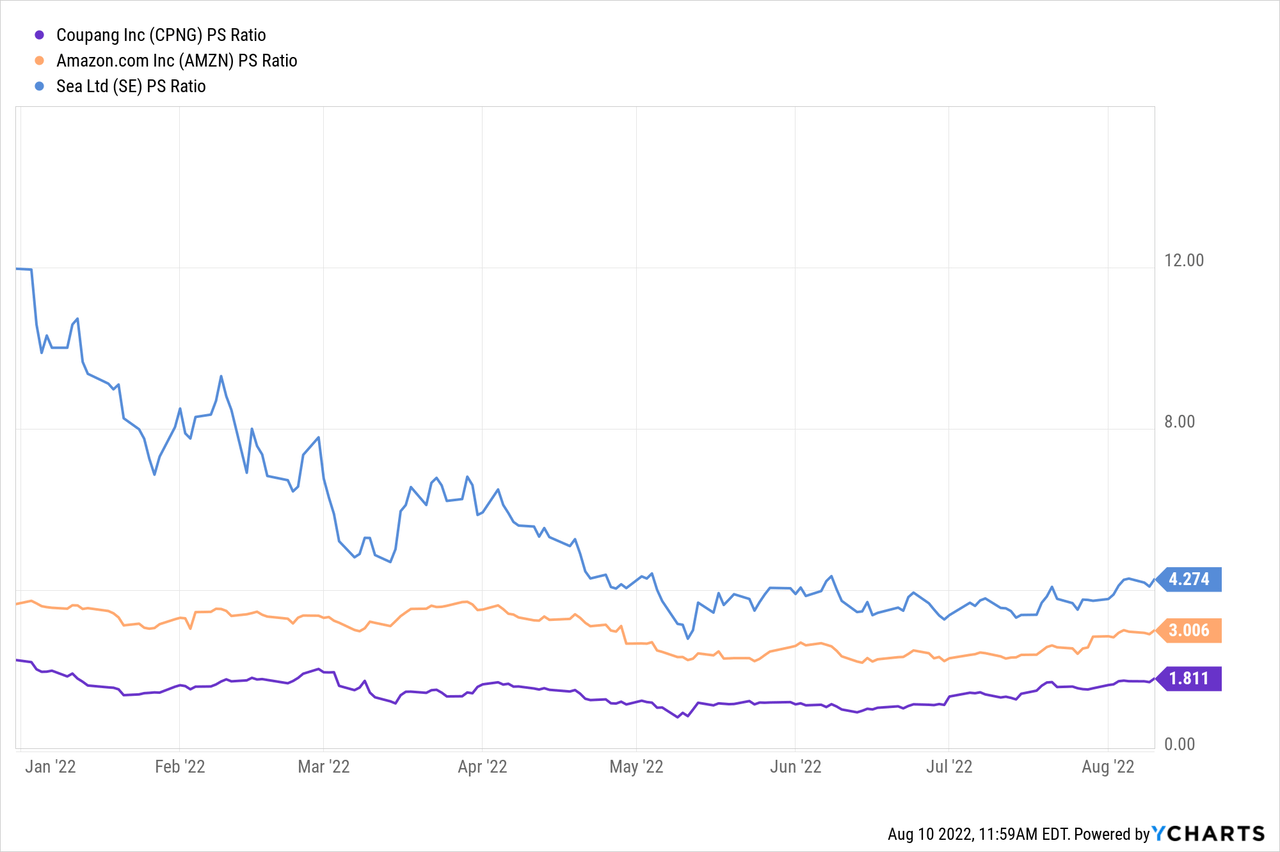

In our previous article, we established our thesis that Coupang (NYSE:CPNG) is operating in a red ocean industry. Therefore, even though CPNG’s valuation (Price-Sales Ratio) is indeed very attractive and CPNG’s cash burn is highly efficient, we refrained from taking any position in CPNG for the time being.

CPNG’s 2022 Q2 quarterly report has just arrived and there is a lot to unpack. This article aims to unpack key insights from the perspective of the perceived red ocean industry.

Market Saturation?

CPNG acknowledged that the broader product e-commerce segment growth is slowing where the segment grew only 6% YoY and 0% QoQ. Hence, our thesis on the “red ocean” product commerce segment is probably on point.

Without organic growth of the broader segment, generally, CPNG’s growth is competitors’ decline. Therefore, CPNG will need to spend more to capture fewer new customers. This is the observation we made in CPNG’s Q2 report.

- CPNG’s 2021 average revenue QoQ growth rate was about 7% QoQ. However, CPNG’s 2022 average revenue QoQ growth is only about 2% on a constant-currency basis.

- CPNG’s number of monthly active users have stagnated for 3 quarters now. Although monthly active users declined 1% QoQ in Q2, it is probably just noise.

Under this situation, CPNG might find that it is easier to continue growth by expanding its products and services. In other words, CPNG may find it easier to grow by offering more services to existing customers rather than winning over competitors’ customers. This is probably what Jung Cue-jin, an analyst at SK Securities meant when suggesting loss-making Coupang continue to expand into new segments such as the recent credit financial industry to enhance profitability.

In reality, CPNG is battling on these 2 fronts: win over competitor’s customers and capture more revenue by offering more services.

CPNG stated that it increased its spending on WOW membership privileges to $500mil. In other words, CPNG is spending $55 on each of its 9mil WOW members quarterly. However, WOW members pay only $11.50 per quarter even after the 72% membership fee hike.

In addition, CPNG is willing to forgo margins by adopting the loss leader strategy. CPNG stated that a study by KPMG found that items sold in its product commerce segment have a 25%-60% price advantage.

On the other hand, CPNG’s latest expansion effort is to enter the credit loan segment, known as Coupang Financials. CPNG is expected to follow NAVER’s playbook by offering loans to its online vendors before offering unsecured loans to offline business operators.

However, the cash burn of this initiative is high and there is a low visibility of profitability over the next few years. For instance, Grab Holdings (GRAB) also has its own payment, buy-now-pay-later, and loan services. In 2022Q2, Grab recorded $1.357bn financial gross merchandise value (GMV), but it only captured $11mil in revenue and made $102mil in losses (Adjusted EBITDA).

If GRAB’s performance is anything to go by, we could see widening losses driven by weakness in CPNG’s eat offerings and Coupang Financials.

CPNG’s Q2 Performance: Top Line

CPNG’s revenue and earnings per share were expected to be $5.22bn and $-0.10 per share respectively, accordingly to consensus estimates.

In 2021, CPNG’s revenue grew by an average of 6.57% QoQ. However, CPNG has de-anchored from its growth trajectory. Given the rate of change in Q1 (Table 1), we expected CPNG’s revenue growth to revert a little back to the 6.57% average to 2%, which brings revenue to $5.22bn in Q2. This aligns with consensus estimates.

Although the actual reported number is -2.3%, CPNG’s QoQ growth is 3% based on a constant-currency basis. In other words, the reported decline is due to KRW depreciation.

Before Q2, developing offerings revenue is growing at 15% QoQ on average (Table 2), higher than the suggested 6.57%, but it only accounts for 4% of CPNG’s total revenue. Hence, developing offerings revenue won’t have much impact on Q2 performance in the near term.

That being said, it is still important for developing offerings revenue to maintain its 15% QoQ growth rate. Any slowdown in growth implies more difficulty in reaching profitability in the future. On the bright side, developing offerings are near breakeven on aggregate (Table 3).

Unfortunately, developing offerings revenue has also de-anchored from its 15% QoQ growth average to decline 10% in Q2. CPNG blamed the broader post-covid slowdown in the online food delivery segment for the decline. Developing offerings revenue include Coupang Eats (restaurant ordering and delivery), Coupang Play (video streaming), its fintech services, and advertisements related to these categories. Unlike Grab, we do not have visibility into the distribution of revenue for each offering under the developing offerings segment.

Nevertheless, CPNG is outperforming the broader e-commerce industry, and the growth story continues.

Table 1. CPNG Historical Revenue and Margins.

| QR | Revenue ($bn) | Change (%) | (Change ($bn) | Net Profit ($bn) | Net Profit Margin | Change NP Margins |

| 2022Q2 | $5 | (2.3) | ($0.12) | |||

| 2022Q1 | 5.12 | 0.79% | 0.04 | -0.209 | -4.1% | -48.8% |

| 2021Q4 | 5.08 | 9.48% | 0.44 | -0.405 | -8.0% | 14.2% |

| 2021Q3 | 4.64 | 3.57% | 0.16 | -0.324 | -7.0% | -39.6% |

| 2021Q2 | 4.48 | 6.67% | 0.28 | -0.518 | -11.6% | 64.6% |

| 2021Q1 | 4.2 | -0.295 | -7.0% |

Source: Author

Table 2. Product Commerce Growth vs Developing Offerings Revenue Growth

| QR | Product Commerce Revenue ($bn) | PCR Change (%) | Developing Offerings Revenue ($bn) | DOR Change (%) |

| 2022Q2 | 4.877 | (1.2) | ||

| 2022Q1 | 4.936 | 2.2 | 0.181 | 0.198675 |

| 2021Q4 | 4.925 | 9.9 | 0.151 | -0.07362 |

| 2021Q3 | 4.482 | 3.4 | 0.163 | 0.124138 |

| 2021Q2 | 4.333 | 5.7 | 0.145 | 0.330275 |

| 2021Q1 | 4.1 | 0.109 |

Source: Author, Form 10Q

Table 3. CPNG Developing Offerings Revenue and Gross Profit

|

QR |

Revenue ($bn) |

Gross Profit ($bn) |

Gross Profit margin (%) |

|

2022Q2 |

0.163 |

– |

– |

|

2022Q1 |

0.181 |

-0.025 |

-0.01% |

|

2021Q4 |

0.151 |

-0.095 |

-0.06% |

|

2021Q3 |

0.163 |

-0.026 |

-0.02% |

|

2021Q2 |

0.145 |

-0.019 |

-0.01% |

|

2021Q1 |

0.109 |

0 |

0.00% |

Source: Author, Form 10Q

CPNG’s Q2 Performance: Bottom Line

CPNG achieved the highest ever gross and net profit margins in Q2 despite revenue decline. CPNG recorded $75mil of losses, the lowest losses in its history. At the same time, CPNG recorded its highest gross profit at $1.15bn despite a decline in revenue. Overall, an outstanding performance.

One driver of CPNG’s improvement on margins is the increase in its WOW membership prices which is expected to increase its annual revenue by $176 mil or $44mil quarterly. Since this fee hike happened in late Q2, its impact will only be reflected from Q3 onwards.

Could this be the start of CPNG’s journey to sustained profitability?

Before taking a victory lap, investors should be aware that CPNG’s improvement in margins could also be attributed to the decline in revenue as CPNG is making losses for every customer they serve. One of the most obvious pieces of evidence is the difference between the WOW membership fees ($11.50 quarterly) and CPNG’s expenses for WOW members ($55 quarterly).

Furthermore, CPNG’s new financial credit initiative is expected to widen CPNG’s losses in the near future.

What is a realistic and achievable terminal profit margin for CPNG? Is it 8%? 10%?

Amazon’s profits weren’t derived from its retail segment. Amazon’s 2021Q4 retail segment sales totaled around $120bn, but operating at a $1.8bn loss. On the other hand, Amazon Web Service (AWS) only made $17.8bn in sales (15% of the retail segment) but grossed $5.3bn in profit.

All in all, investors shouldn’t be too optimistic about CPNG’s profitability just yet. What we need to see is both the top line and bottom grow together.

Will there be an increase in liability or shares outstanding?

This question is important because we’ve seen companies in highly competitive sectors diluting investors by more than 70% in a single year. For instance, the Bitcoin mining sector is highly competitive and mining companies are required to increase mining capacity just to maintain their share in the Bitcoin network or Bitcoin mining yield. Hut 8 Mining (HUT), a crypto mining company, increased its shares outstanding by 85% since 31st Dec 2020 to commit to its HODL strategy and growth targets.

When a business is unprofitable, its growth is either financed through equity (share offerings) or liability (short-term and long-term debts). CPNG made around $1.8bn losses since 2021Q1, while operating and investing cash flow were about -$1.7bn. So how does CPNG finance its growth (investing) and operations?

CPNG’s balance sheet is strong. As of 2022Q2, CPNG has $3.1bn in cash raised from its IPO and burns on average $0.246bn (for investment and operation) quarterly (Table 4). This means this CPNG can continue its aggressive growth for another 13 quarters without needing to raise more capital. As a result, CPNG’s shares outstanding also remained stable.

Moreover, CPNG’s cash burn is also on a downtrend. Hence, it is unlikely for CPNG to dilute shareholders or take on additional debt anytime soon.

Although there were smaller rounds of long-term and short-term debt financing, the resulting increase in cash was offset through repayment.

Table 4: CPNG’s Cash Position and Changes QoQ, Shares Outstanding

| QR | Cash Equivalent ($bn) | Change ($bn) | Shares Outstanding (bn) |

| 2022Q2 | 3.1 | -0.27 | 1.59 |

| 2022Q1 | 3.37 | -0.12 | 1.586 |

| 2021Q4 | 3.49 | -0.44 | 1.58 |

| 2021Q3 | 3.93 | -0.354 | 1.575 |

| 2021Q2 | 4.284 | -0.046 | 1.56 |

| 2021Q1 | 4.33 | 1.558 |

Source: Author

Verdict

Although CPNG is trading lower than Sea Ltd (SE) and Amazon (AMZN), the decline in revenue growth suggests that it is probably fair as CPNG needs to show the capacity to grow its top line by 66% and 230% respectively to justify SE’s and AMZN’s PS ratio.

In this article, we further cemented our thesis that CPNG is operating in a red ocean industry where potential growth and margins are very limited. The broader e-commerce industry is stagnating while CPNG growth (revenue and active users) declined.

Although margins are improving, we show concerns over its sustainability. We attributed its improvement to the decline in revenue. Furthermore, CPNG is still spending big to provide value to its WOW customers and its latest initiative into the credit financing segment will put pressure on margins. In addition, AMZN’s retail segment performance suggests that CPNG’s terminal margin isn’t optimistic.

Therefore, we’ll continue to enjoy the value CPNG provides as a customer for the time being. What we need to see to change our mind is growing revenue and margins in the coming quarter.

Be the first to comment