benedek/E+ via Getty Images

Investors suffered a third consecutive day of losses in the market, although yesterday was mild relative to the prior two, as apprehension builds in front of what Chairman Powell will say on Friday at the annual Jackson Hole Economic Symposium. Fears of a far more hawkish tone has the futures market now expecting a 75-basis-point rate increase at the Fed’s September 20-21 meeting, whereas it was only 50 basis points one week ago. Additionally, the consensus sees a much lower probability of rate cuts in 2023. I think these fears are misplaced.

Finviz

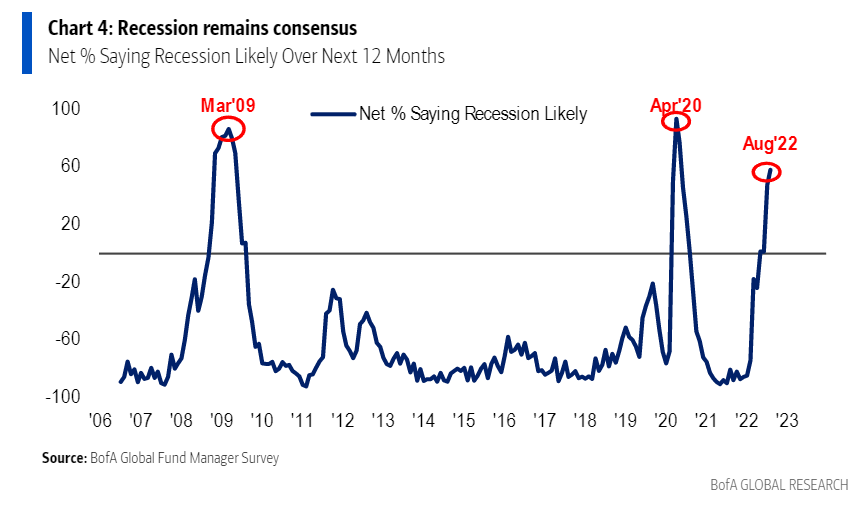

The market was in need of a meaningful pullback last week for two reasons. The first is that it was technically overbought and needed to consolidate gains. The second is that the Fed was growing concerned that the size and speed of the rally would loosen financial conditions. After just two days of losses, the bears came roaring out of their caves in a call for Armageddon. I think they are misinterpreting the recent sell-off as confirmation that Powell will deliver much tighter monetary policy guidance than is expected. This is feeding recession fears again, as the consensus is convinced we will have an economic contraction over the coming 12 months. As a result of this fear trade, the dollar and interest rates are rising, which is exacerbating the selling pressure.

Bloomberg

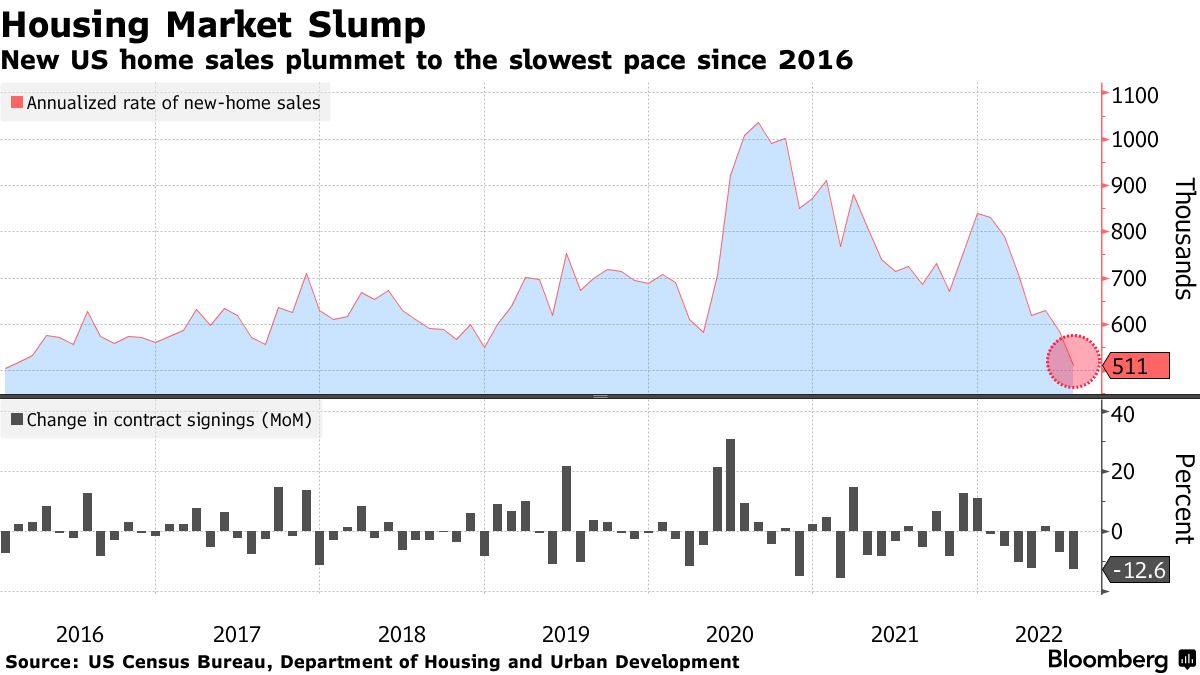

If the consensus call for recession in the next 12-months is correct, Chairman Powell is very unlikely to carry a hawkish tone on Friday. He is more likely to be extremely balanced, if not encouraging about the economic expansion’s ability to sustain itself. Thankfully, a recession still looks very unlikely, but we are seeing a significant slowing in pockets of the economy, which will lead to much lower inflation in the months ahead. That is what the Fed wants to see. The housing market is arguably in its own recession with new homes sales falling for a sixth consecutive month to the slowest pace since 2016, as well as existing homes sales to the lowest levels in more than two years. Home price appreciation has abruptly stalled, and rents should follow. Fortunately, residential investment is a much smaller percentage of the overall economy than it was prior to the bubble in 2008, so at just 3-5% of economic activity, it’s not that relevant. Still, the decline in activity will have a meaningful deflationary impact later this year and in 2023 through lower home prices and rents.

Bloomberg

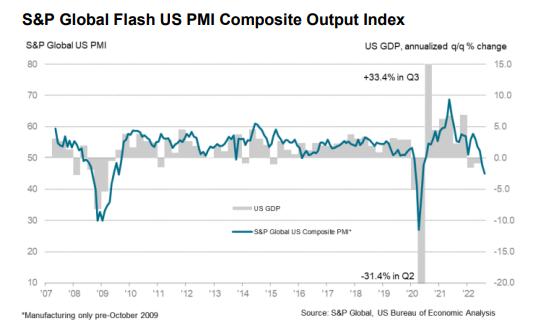

If anything jars Chairman Powell, outside of the downturn in housing, it should be yesterday’s S&P Global PMI report. It shows the service sector falling further into what could be construed as a contraction midway through August with the index declining from 47.3 in July to 44.1 today. While this index has a limited history and runs contrary to what the Institute for Supply Management’s similar monthly survey indicates about economic strength, it has to be taken seriously.

S&P Global

Survey respondents saw a decline in new orders and a slower rise in employment during August. This resulted in the slowest rate of input inflation in seven months, while output charges increased at the slowest pace in 17 months. If the Fed wants to tame demand, this is clear evidence that it is happening. On a positive note and surprisingly, optimism regarding the business outlook rose to a three-month high.

Chairman Powell is well aware that inflation is the most lagging of all the economic indicators. Therefore, today’s rate of inflation does not have as much to do with current monetary policy as today’s leading economic indicators, which tell us about where inflation will be tomorrow. All signs point to a sharp deceleration in the inflation rate. The Fed is on track.

Powell does not need to “pivot” to calm markets. He simply needs to say the Fed will remain data dependent, and that the tighter financial conditions we have seen to date are already having a meaningful impact on the rate of growth in the economy, which should work towards a significant decline in the rate of inflation over the coming 12 months.

Members of the Fed will continue to jawbone markets with the threat of more aggressive tightening when they see signs of speculative investment activity emerge. The recent rebound in meme stocks over the past two weeks was a good example. They do not want markets to loosen financial conditions in any way that might reverse the progress made on the inflation front. I expect we will see softer employment numbers and more progress on headline inflation between now and the Fed’s next meeting in September, which will result in an additional 50-basis-point rate increase in the Fed funds rate. That should provide the major market averages with support well above the June lows.

Be the first to comment